- The aftereffect of Ethereum’s merge failed to yield a substantial effect on the ETH price.

- The funding rate flatlined as traders offered no push for increased volume.

As the 15 September Ethereum [ETH] Merge approaches its three-month anniversary, traders still remain in hysteria over the impact the event has had.

Recall that there was blazing excitement in the lead-up to the Proof-of-Stake (PoS) transition. This was due to the prospect of a positive price reaction.

This, unfortunately, did not appear as the outcome; in fact, over time, ETH dropped below $1,500. Per current circumstances, ETH refused to produce any spectacular performance as highlighted by Santiment’s latest report.

Here’s Ethereum’s Price Prediction 2023-2024

Incoherence- the order of the day

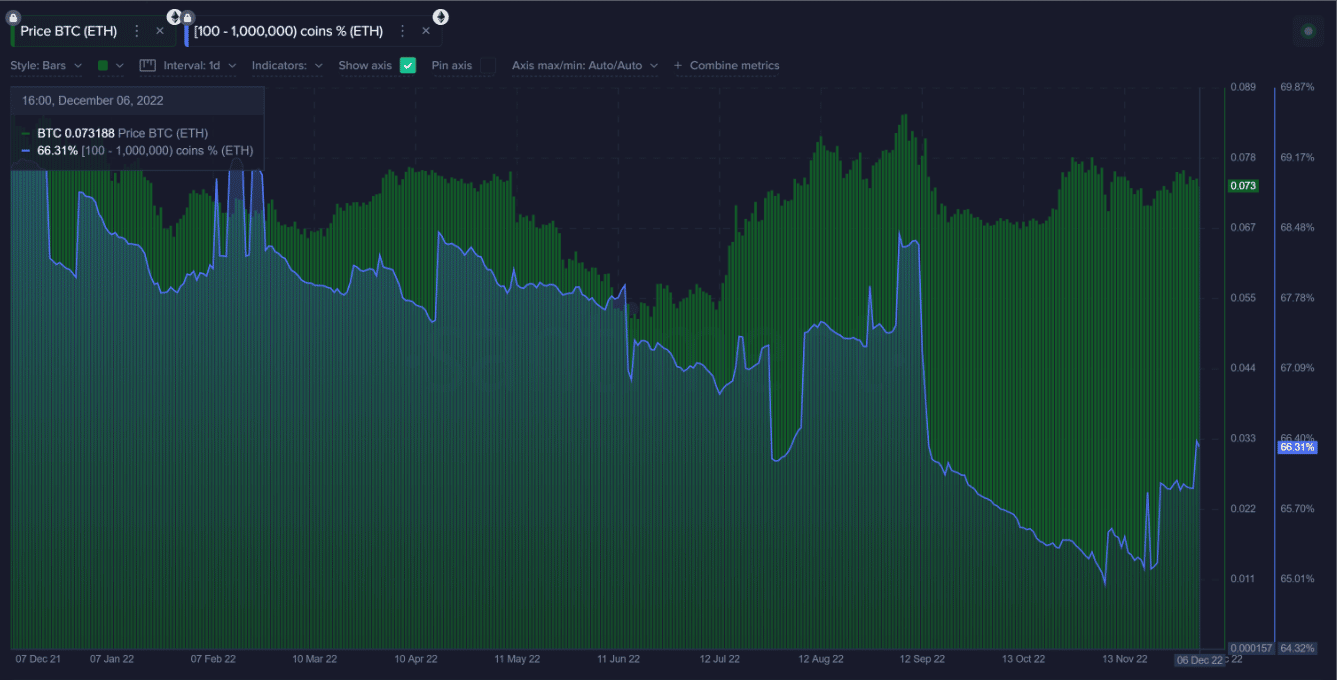

According to Santiment’s on-chain analyst, Brianq, not every part of facet of Ethereum was obsessed with negativity. The analyst noted that whales had been phlegmatic with amassing the second-ranked cryptocurrency in market value weeks after the Merge up to the end of October.

However, since 7 November, these bulging purse investors began stockpiling the asset.

The data above signaled that ETH investors who held between 100 to 1,000,000 coins look to have put back their decision to halt. As such, the renewed interest ensured that these whales floated 2.09% of the overall supply.

The measures taken here paint a cause for a bullish justification. For those considering this metric alone as a rationale for bulls, other metrics suggest that the coast might not be clear yet. So, it could not be time to wager on the recent upward continuation.

In relation to the deeds of market participants, Santiment showed that the funding rate had improved. This was because the Binance funding rate using USDT and BUSD were fair enough as both were at 0.01%.

Still, the status reflected mostly neutrality as Brianq also agreed that the lack of extreme fear and greed contributed to the current condition.

Nonetheless, short liquidations were not exempted as ETH preferred the upside in the last 24 hours. According to Coinglass, total liquidations over the last day was $13.76 million, with shorts taking over $11 million of the wipeout. This implied that the ETH trend as of 8 December did not favor trades that projected a drawback.

Bearing the brunt amid the wait

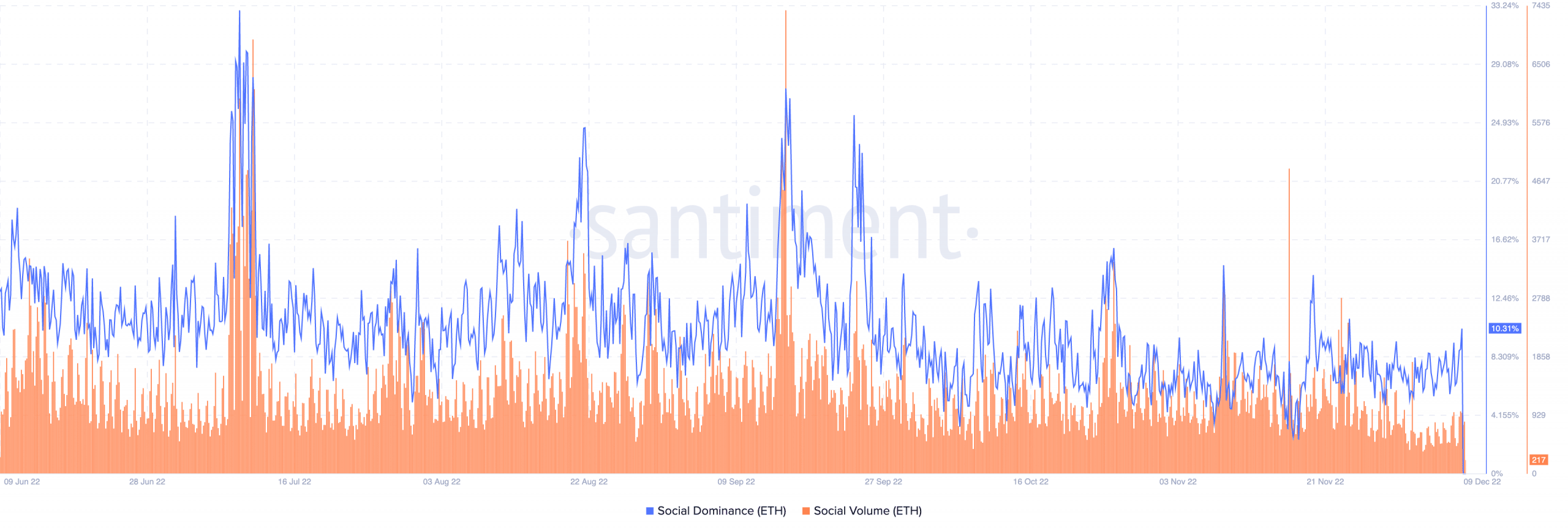

Socially, it was not the best of times for Ethereum shortly after the Merge. This was due to the decline in discussions around the asset. Interestingly, there has been progression lately as ETH’s social dominance rose to 10.31%. Notably, the social volume was suppressed to 193.

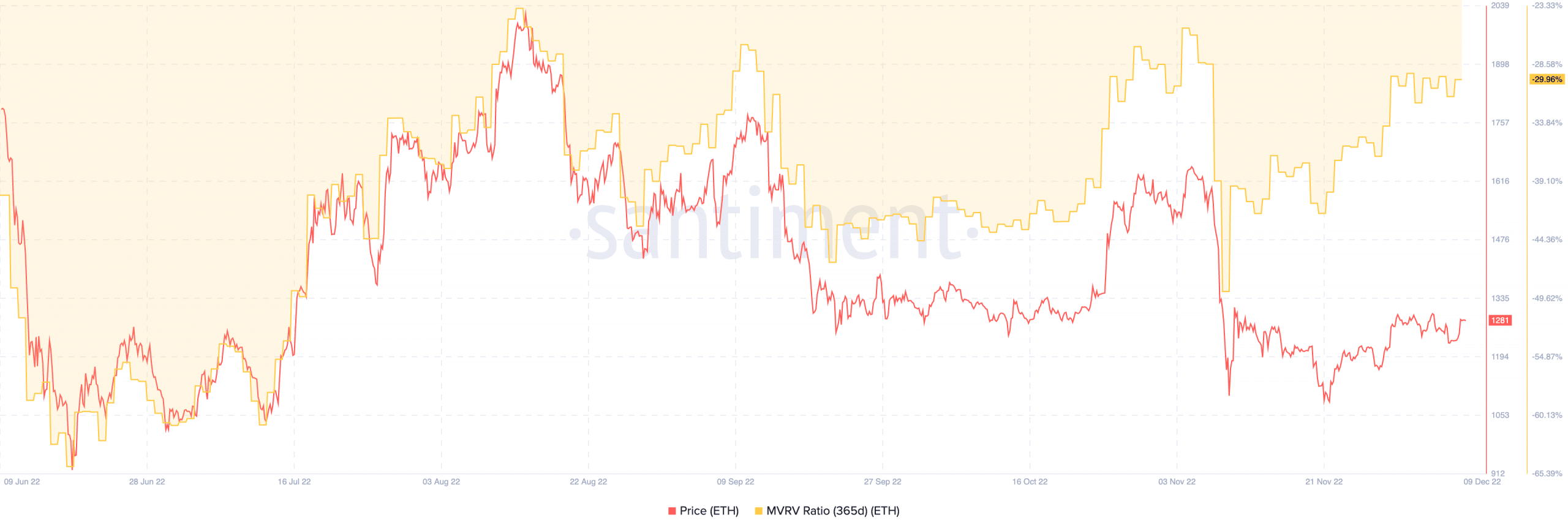

For long-term holders, owning ETH still meant long-standing affliction. This was because of the condition displayed by the 365-day Market Value to Realized Value (MVRV) ratio.

At the time of writing, Ethereum’s MVRV ratio was -29.96. This meant that investors who owned and still held the altcoin possessed returns in the negative.

But with the MVRV ratio choosing an uptrend, ETH’s long-term projection signaled bullish traits. However, in the short term, it was likely that bearishness might prevail. Hence, there could still be a chance to trade below $1,000.

Read More: news.google.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Sui

Sui  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  LEO Token

LEO Token  Bitcoin Cash

Bitcoin Cash  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDS

USDS  Hedera

Hedera  WETH

WETH  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Polkadot

Polkadot  Monero

Monero  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Pepe

Pepe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pi Network

Pi Network  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Uniswap

Uniswap  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Bittensor

Bittensor  OKB

OKB  Cronos

Cronos  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aptos

Aptos  NEAR Protocol

NEAR Protocol  Jito Staked SOL

Jito Staked SOL  Internet Computer

Internet Computer  Ondo

Ondo  Ethereum Classic

Ethereum Classic