A profitable trading day is really hard to come by. Especially when an American billionaire investor (Yes, Charlie Munger) has just called for a ban on cryptocurrencies.

Funnily enough, 14 hours (at press time) after his statement to CNBC, the market was nowhere near its doomsday. In fact, Bitcoin [BTC] was trading in the upper circuit following an impressive +8.45% 7-day rally to take traders to the $24,634-mark.

Altcoins, in general, received the lion’s share of the attention though. Ethereum [ETH] crossed its $1,500-psychological level to trade at $1,684 at the time of writing. ETH scalpers had the best time utilizing their skills to drive home unexpected profits. Even so, the market questioned the uptick with an assertion of it being a bull trap.

Read Ethereum’s [ETH] Price Prediction 2023-24

Time for moon or a bit too soon?

You might wonder why this recent uptick is being called a “bull trap” by some analysts. Well, the reasons are quite obvious. Remember that ETH has just broken out above a resistance level of $1,500. Generally, many breakouts are followed by strong moves higher. However, in the case of a bull trap, the direction is quickly reversed.

Some analysts are also of the opinion that the exchange netflow is in its absolute charted territory, and is not giving out hope of a sustained recovery. Usually, when exchange outflow increases by a good margin, traders tend to take that as a precursor of healthy demand.

So the question is what should ETH traders look into to analyze the current happenings of the ecosystem? Interestingly, the answer is ETH PoS metrics.

The PoS bid

These not-so-well-known metrics can help retailers or sharks understand ETH from the networking point of view in order to plan their trading decisions.

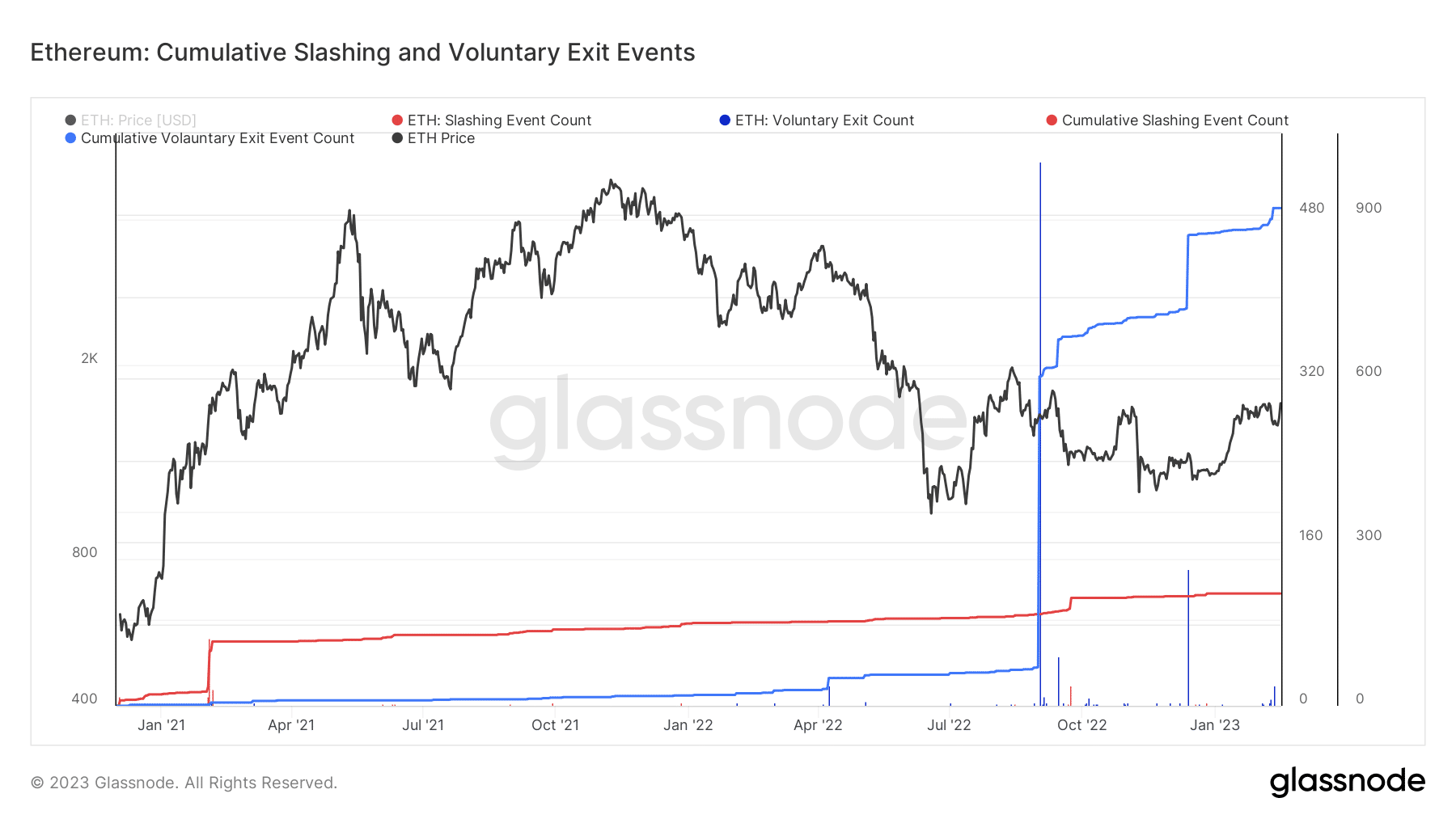

It is in this context one should note that the voluntary exit of ETH stakers has kept on increasing after the Merge. A voluntary exit is an event where a validator opts to cease participating in consensus and enters the exit queue.

The validators no longer propose or attest to blocks, but the ETH stake cannot yet be withdrawn. What’s the good point here? Well, the metric’s increase or decrease has no effect on the price trajectory whatsoever.

On the other hand, the attestation count, which is a ‘yes’ vote to include the latest proposed block at the tip of the blockchain, has been in a healthy state. It goes on to state that the network outage problem can’t be expected from Ethereum, unlike Solana.

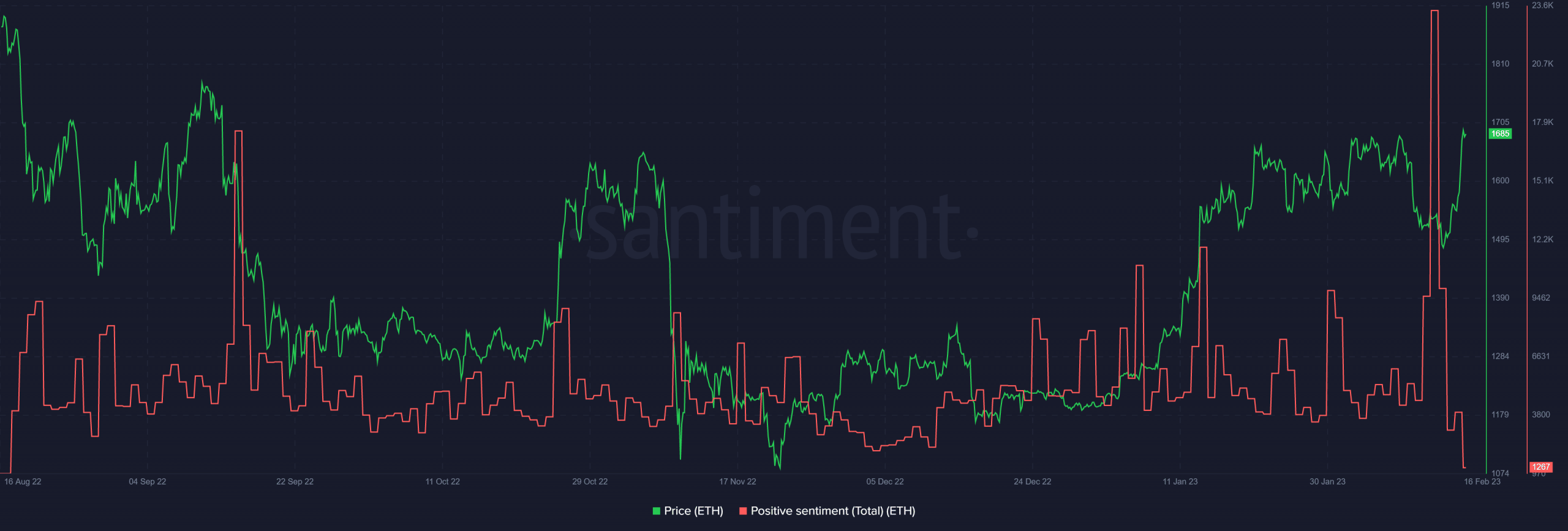

While the networking side of Ethereum looks not in a bad shape, the sentiment around ETH has shifted gears. Consider this – Positive sentiment metric took a freefall after 12 February. Right now, it’s at a level that was last known on 16 August 2022.

It backs up the claims of ETH’s latest uptick being a ‘bull trap.’ Furthermore, the metric revealed that the current sentiment is that of FUD (Fear, Uncertainty, and Doubt), rather than of confidence.

Short sellers can position themselves for the next few days. Evidently, their bet against the prevailing market trend will not go for a toss.

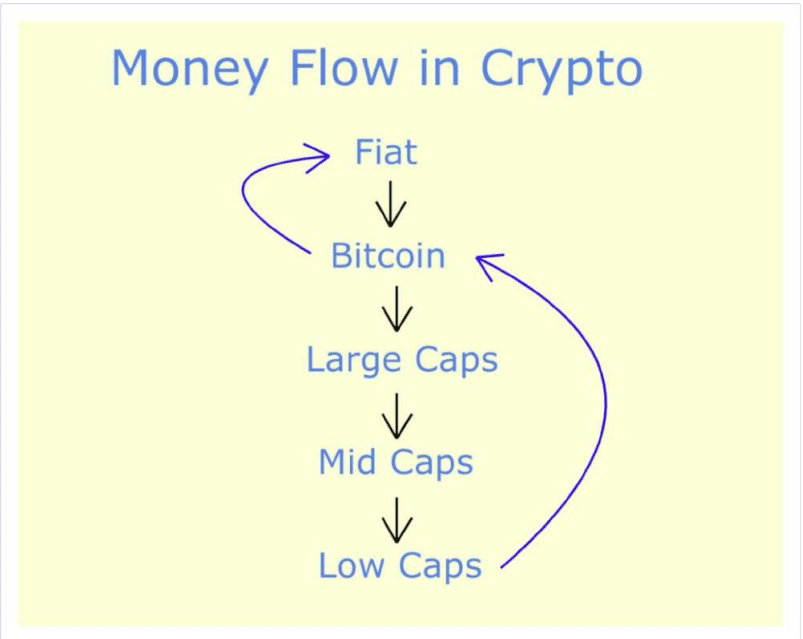

Now, many mid and low-caps like Decentraland, The Sandbox, and Loopring have been enjoying their time in the spotlight.

Alas eventually, altcoins will either correct or push their profits back into Bitcoin, something illustrated by the chart attached below.

Is your portfolio green? Check out the ETH Profit Calculator

That being said, it’s very important for ETH traders (like all other traders) to stick with the strategy that they have been telling themselves

throughout the disappointing bear market. Stop losses should always be respected and taking profits should never be ignored.

And that is exactly the recipe for success in trading.

Read More: ambcrypto.com

![Ethereum [ETH] capitulation soon? Look at these PoS metrics first](https://ambcrypto.com/wp-content/uploads/2023/02/kanchanara-vu13QDlTQyU-unsplash-2-1000x600.jpg)

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  LEO Token

LEO Token  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  Toncoin

Toncoin  Litecoin

Litecoin  Polkadot

Polkadot  USDS

USDS  WETH

WETH  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Wrapped eETH

Wrapped eETH  Bitget Token

Bitget Token  Pepe

Pepe  Pi Network

Pi Network  Ethena USDe

Ethena USDe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  Bittensor

Bittensor  Uniswap

Uniswap  Aave

Aave  NEAR Protocol

NEAR Protocol  Aptos

Aptos  OKB

OKB  Jito Staked SOL

Jito Staked SOL  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Ondo

Ondo  Tokenize Xchange

Tokenize Xchange  Cronos

Cronos  Ethereum Classic

Ethereum Classic