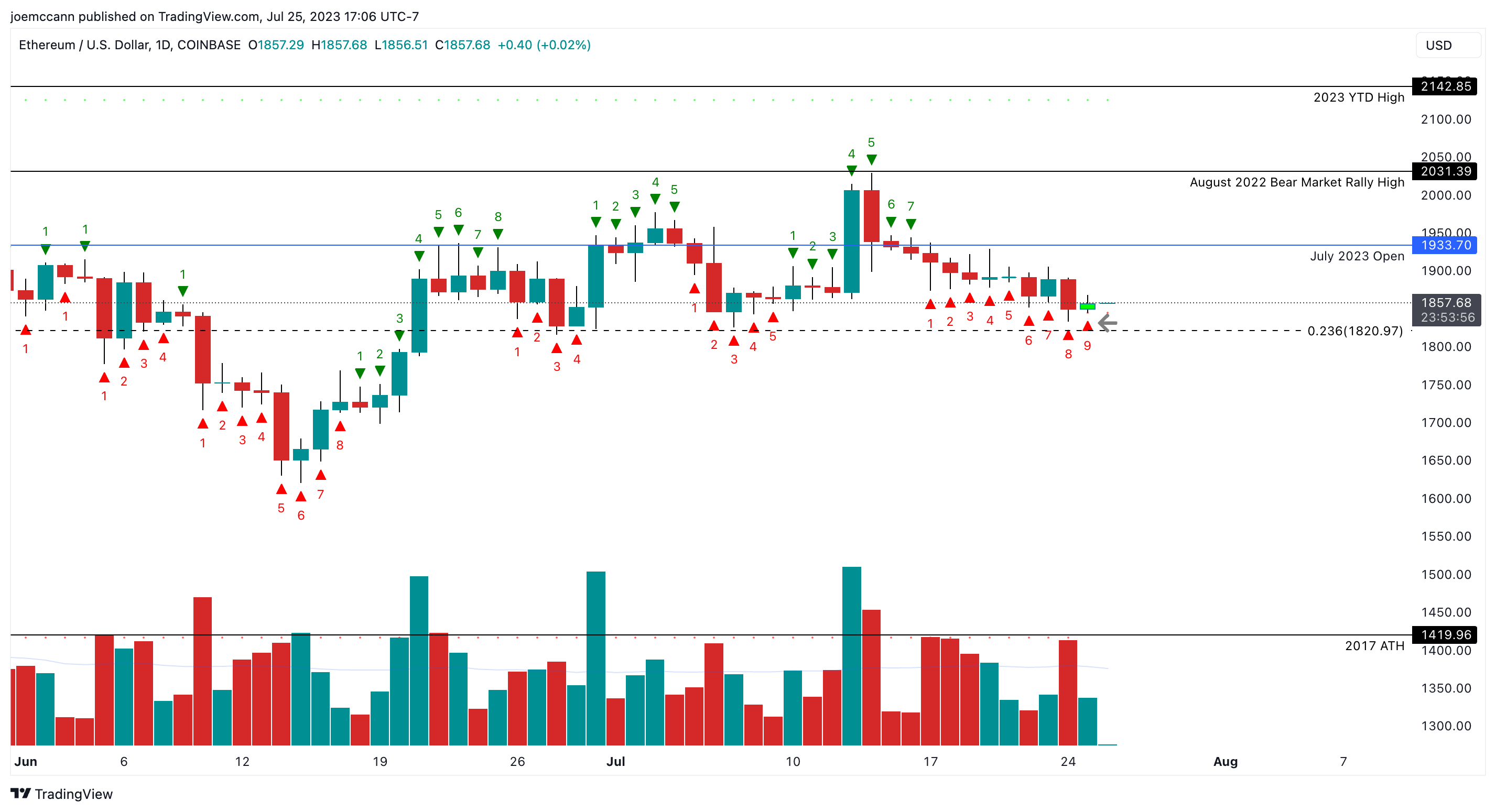

After Ethereum (ETH) once again failed to break the $2,000 level in the 1-day chart, the price has been on a downward slide in recent days. However, this could now change, as a historically accurate trend indicator shows.

Crypto traders and analysts constantly seek reliable indicators to navigate the turbulent market. One such indicator gaining attention is the Tom Demark 9 (TD9), which has flashed a buy signal for Ethereum (ETH) on the daily chart. Renowned analyst Joe McCann shared his insights via Twitter, revealing an intriguing success rate of 78% for ETH’s historical TD9 buy signals.

Ethereum (ETH) Buy Signal

Joe McCann’s tweet brought the spotlight on ETHUSD’s TD9 buy signal, which occurred after the asset dropped 8.7% from its recent high. The TD9 indicator, an indicator that also measures whether an asset is overbought or oversold, similar to the RSI, aims to identify potential trend reversals. According to McCann, historical data showcases the TD9 buy signal’s remarkable accuracy for ETH, with a win rate of nearly 78%.

Possible price targets include the July open at $1,933, the August 2022 bear market rally high at $2,031, and the year-to-date 2021 high at $2,142, according to the analyst.

Digging deeper into the data, McCann highlights the impressive performance of ETH following TD9 buy signals. The statistics reveal that, on average, the asset surged by over 2.6% in the seven days following the signal, with a median return of almost 5%. These figures alone could pique the interest of traders looking for an edge in the crypto market.

To provide a more nuanced picture, McCann narrowed the data to examine the year 2019, a period he deems analogous to the 2023 crypto market cycle. The results are even more captivating, showing a remarkable win rate of nearly 90% for TD9 buy signals during this period.

However, if we trim the data back to starting in 2019 (a year very similar to 2023 in terms of crypto market cycles), ETH has a win rate of nearly 90% with the average return over +7%.

But, as with any indicator, there are exceptions and occasional inaccuracies. McCann’s data shows several instances where the TD9 buy signal failed to predict ETH’s price movement accurately.

Noteworthy is March 13, 2018, when the ETH price slid massively after the buy signal. The ETH price plummeted by 19.3% within seven days and by as much as 34.8% within the next 14 days. The signal was similarly bad on May 8, 2018, after which ETH fell by 22.1% in the following seven days and 26.7% in the following 14 days.

On the other hand, the TD9 buy signal has predicted some massive rallies. For example, on December 10, 2018, following the signal, ETH initially rose by 3.7% in the first seven days, but then came a fabulous 53.0% rise in 14 days and 64.5% in 30 days. The most recent TD9 buy signal on March 11, 20223 delivered a price increase of 18.8% in the first seven days and 29.9% after 30 days.

In general, it can be seen that the accuracy of the TD9 indicator decreases over time. While the indicator has a success rate of 78% in the first seven days with an average 7-day forward return of +2.65% and a median return of almost 5%, the success rate falls in the subsequent period of time. After 14 days, the TD9 indicator has a success rate of only 55.5% (mean 3.8%, median 5.7%), after 30 days of 63.0% (mean 6.9%, median 3.8%) since 2018.

Federal Reserve Meeting Looms

While the TD9 buy signal paints a positive picture for ETH, the crypto market remains vulnerable to external factors, including the upcoming FOMC meeting today. There is a 98.9% probability that there will be a 25 basis point rate hike. But the big question is whether this will be the last hike in this cycle. McCann writes:

July 26th is the latest meeting of the Federal Reserve and Jerome Powell is expected to hike rates another 25 bps. Will Jerome Powell ruin the party for the ETH bulls at the press conference?

At press time, the Ether (ETH) price stood at $1,859.

Featured image from iStock, chart from TradingView.com

Read More: www.newsbtc.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Stellar

Stellar  Shiba Inu

Shiba Inu  LEO Token

LEO Token  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  Toncoin

Toncoin  Litecoin

Litecoin  USDS

USDS  Polkadot

Polkadot  WETH

WETH  Monero

Monero  Bitget Token

Bitget Token  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Wrapped eETH

Wrapped eETH  Pepe

Pepe  Pi Network

Pi Network  Ethena USDe

Ethena USDe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  Bittensor

Bittensor  Uniswap

Uniswap  Aave

Aave  NEAR Protocol

NEAR Protocol  OKB

OKB  Aptos

Aptos  Jito Staked SOL

Jito Staked SOL  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Ondo

Ondo  Cronos

Cronos  Tokenize Xchange

Tokenize Xchange  Internet Computer

Internet Computer