[ad_1]

Crypto investor Ryan Sean Adams argued on December 4 that Ethereum’s (ETH) current valuation of around $2,200 is almost “hilarious” given the strengthening on-chain activity and the blockchain’s role in the sphere.

Venture Capitalist: Here’s Why Ethereum Is Grossly Undervalued

Adams cited data like the first smart contract platform generating billions annually in “gas” fees, transitioning to becoming deflationary after merging in September 2021, and the over one million validators staking earning over 5% as rewards. Moreover, the venture capitalist pointed out the potential of the United States Securities and Exchange Commission (SEC) approving spot Ethereum ETFs in the long run.

For now, BlackRock and Fidelity, two of the world’s most prominent traditional finance players, have applied to issue these derivative products. Though the SEC has yet to approve any spot crypto ETFs, the agency will authorize one or multiple, likely in early Q1 2024.

Overall, the crypto market expects any spot ETF, including that of Ethereum, to attract billions in institutional capital. Beyond external factors like the SEC and ETFs talk, Adams also pointed out the rising demand for mainnet block space from the multiple layer-2 solutions running off-chain rollups parallel to Ethereum.

ETH Value Draws From On-Chain Activities

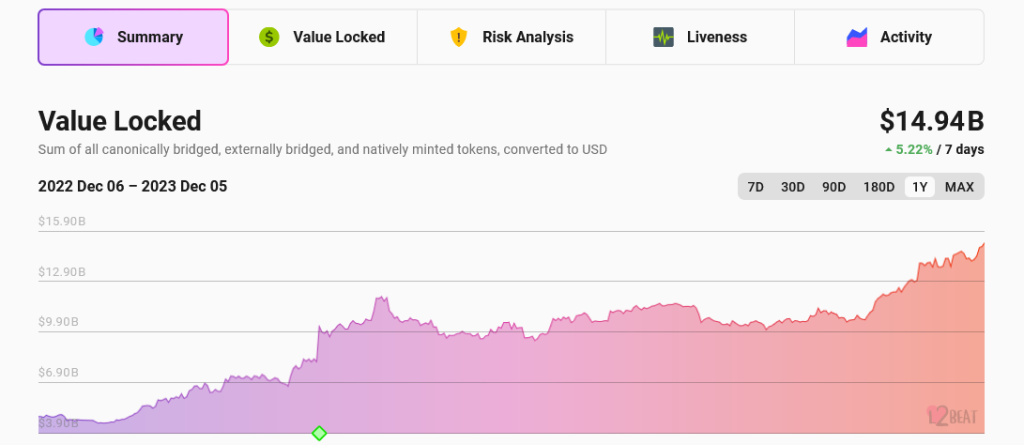

According to L2Beat, Ethereum layer-2 solutions have over $14.9 billion as total value locked (TVL), with the most prominent platforms, including Arbitrum One, OP Mainnet, Starknet, and Base, commanding billions and processing tens of thousands of transactions daily. In the past week, Adams observed that leading layer-2 rollups were the top 10 consumers of Ethereum block space.

Comparing Ethereum using traditional metrics like price-earnings (P/E) ratios that compare favorably to technology companies like Amazon and Zoom, Adams suggested that Ethereum’s upside is almost mathematically unavoidable this cycle.

The venture capitalist, based on the above factors, thinks Ethereum could likely be 10x, pushing the coin to over $22,000 per coin. Even so, the investor can’t precisely gauge how long the markets will “stay irrational,” grossly undervaluing the second most valuable coin.

In response, Uniswap founder Hayden Adams agreed Ethereum fundamentals would fuel appreciation. Even so, the founder thinks Ethereum derives strength not from speculation attributes, as Ryan Sean Adams laid out. The Uniswap founder is confident that demand from active protocols launching on the mainnet and competing for scarce block space will directly pump prices.

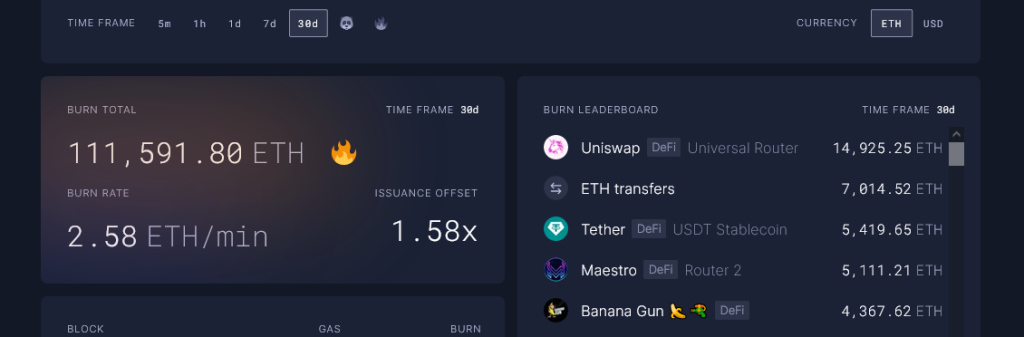

According to Ultra Sound Money, Uniswap helps Ethereum burn the most coins. In the last month alone, Uniswap took over 14,900 ETH out of circulation, helping the network become more deflationary.

Feature image from Canva, chart from TradingView

[ad_2]

Read More: www.newsbtc.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  Sui

Sui  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Avalanche

Avalanche  Toncoin

Toncoin  USDS

USDS  WhiteBIT Coin

WhiteBIT Coin  Shiba Inu

Shiba Inu  WETH

WETH  Wrapped eETH

Wrapped eETH  Litecoin

Litecoin  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Hedera

Hedera  Monero

Monero  Ethena USDe

Ethena USDe  Polkadot

Polkadot  Bitget Token

Bitget Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Uniswap

Uniswap  Pepe

Pepe  Pi Network

Pi Network  Aave

Aave  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  OKB

OKB  Bittensor

Bittensor  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Cronos

Cronos  Aptos

Aptos  Internet Computer

Internet Computer  NEAR Protocol

NEAR Protocol  Jito Staked SOL

Jito Staked SOL  sUSDS

sUSDS  Ethereum Classic

Ethereum Classic