- Ethereum rose to $1,700 on February 17.

- Whale and shark address holding have not slowed down their accumulation.

The price of Ethereum [ETH] reached $1,700 on 17 February after five months. Is this ascent an indicator of things to come? Or will the whale accumulation result in dumping before the Shanghai upgrade?

Read Ethereum’s [ETH] Price Prediction 2023-24

ETH witnesses brief surge

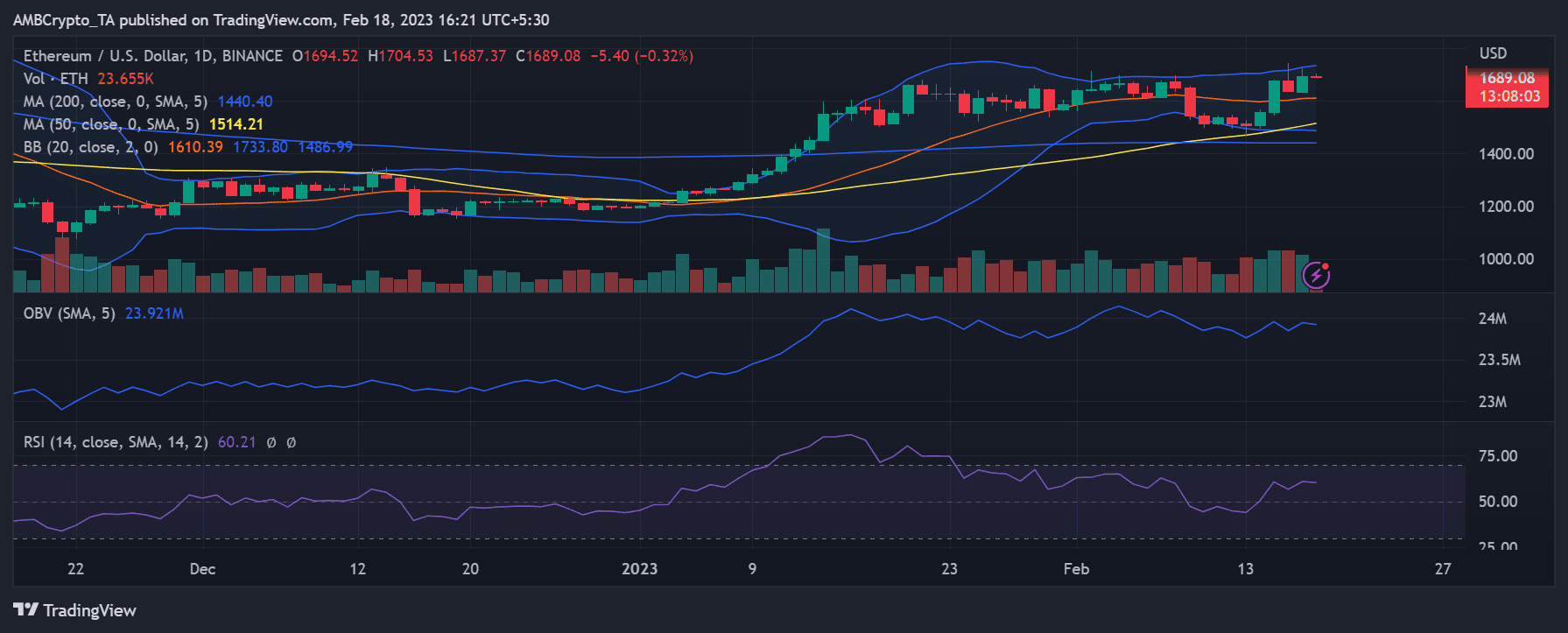

Ethereum gained 3.45% on 17 February, according to a daily period analysis of the cryptocurrency. According to additional research into that trading period, it peaked at $1,721 before ending trade at $1,694.

It was five months since ETH’s price had last reached the $1,700 range during that trading period. Its price was roughly $1,694 at the time of writing.

Furthermore, the Relative Strength Index (RSI) indicated that ETH was in a bull trend because its line was above the 60 mark. The price movement was also noted above both the long and short Moving Averages (blue and yellow lines). Therefore, the asset’s price moving above the (MAs) suggests a good price move and may also point to a possible future uptrend.

Shark and whale hold on

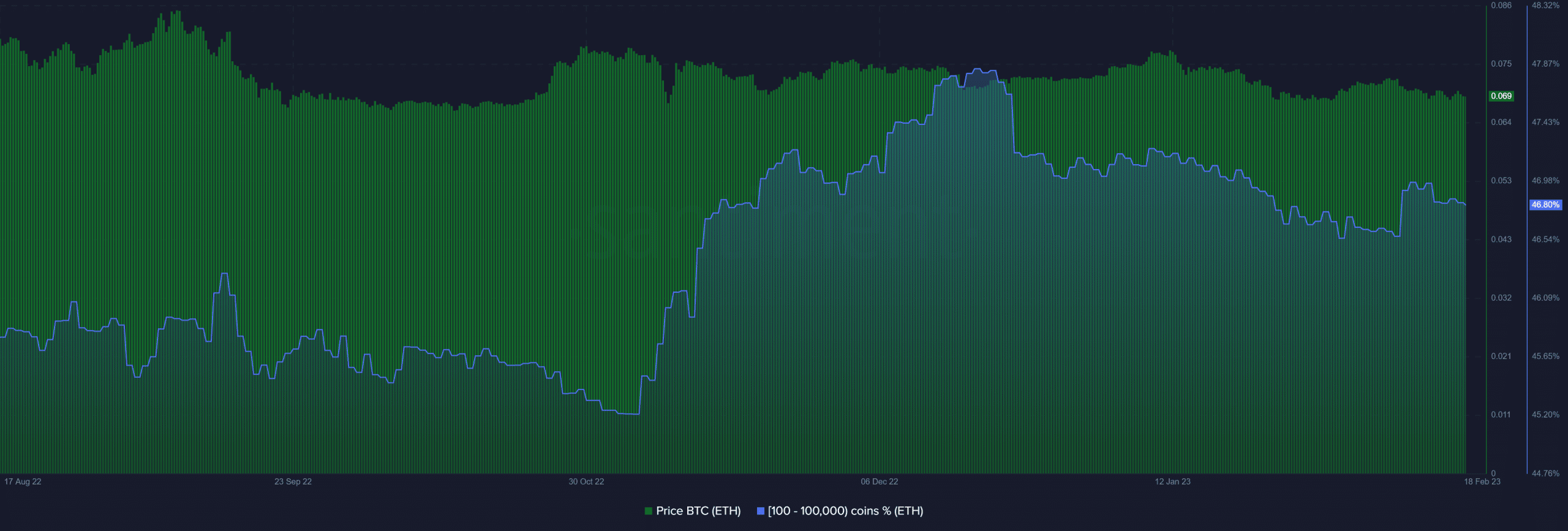

Recent data from Santiment showed that whale and shark addresses were still tightly clutching onto their ETH bags. The graph shows that whale and shark addresses with 100–100,000 ETH still retained close to 47% of the entire supply of ETH. Furthermore, the absence of a sell-off following the most recent price increase suggested that investors anticipated further price increases.

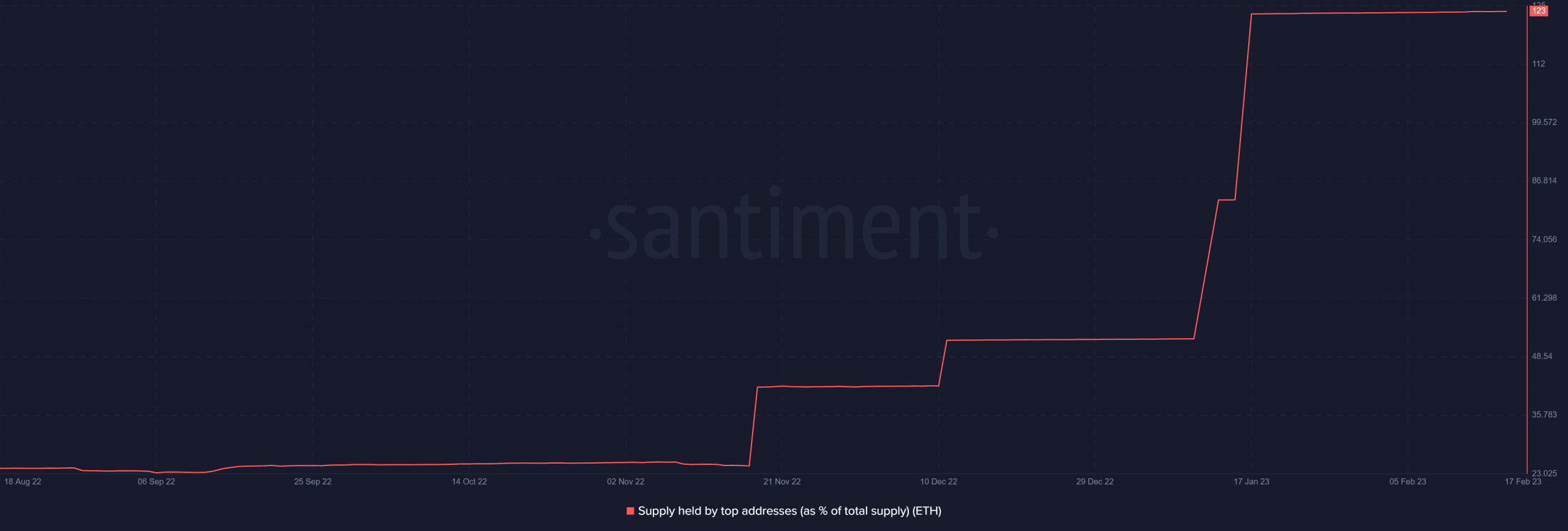

In addition, an examination of the supply owned by the top addresses revealed that the addresses at the top had been on an accumulating binge. For most of January, the graph showing the quantity held by the top addresses as a proportion of the overall supply of Ethereum was rising. It has now leveled off, but at the time of writing, it was at 123.

Volatility incoming?

Ethereum’s Shanghai upgrade will be the next big thing for the cryptocurrency sector. In March, users can withdraw more than $16.5 million worth of Ethereum (ETH) off the blockchain. The Merge was the last significant improvement to the network; however, it had little effect on the price of Ethereum.

Is your portfolio green? Check out the Ethereum Profit Calculator

The Shanghai upgrade will affect the supply and demand of ETH, whereas the Merge was a purely technological development with no apparent economic consequences. However, because of the long-term and short-term nature of the upcoming development, it has the potential to affect the ETH price significantly.

When staked ETHs are released, it is unknown how the shark and whale addresses will respond. But if they, too, decide to sell their assets, ETH’s value will plummet. So, in terms of Ethereum’s price movement, March will be a crucial month.

Read More: ambcrypto.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Wrapped stETH

Wrapped stETH  Hyperliquid

Hyperliquid  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Shiba Inu

Shiba Inu  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Toncoin

Toncoin  Hedera

Hedera  WETH

WETH  Litecoin

Litecoin  USDS

USDS  Polkadot

Polkadot  Wrapped eETH

Wrapped eETH  Monero

Monero  Bitget Token

Bitget Token  Pepe

Pepe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Pi Network

Pi Network  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Uniswap

Uniswap  Aave

Aave  Dai

Dai  Bittensor

Bittensor  NEAR Protocol

NEAR Protocol  Aptos

Aptos  Jito Staked SOL

Jito Staked SOL  OKB

OKB  Tokenize Xchange

Tokenize Xchange  Ondo

Ondo  Cronos

Cronos  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic