[ad_1]

- Ethereum was the focal point of a possible Visa collaboration to aid auto payments and account abstraction

- While ETH deposits climbed, transaction count decreased

Payment processing network Visa beckoned that it wished to partner with Ethereum [ETH] in the near future, according to its recent research paper. The time of release might come as shocking to many, especially as billions of dollars continue to be wiped out of the crypto market.

However, Visa is not new to the crypto market. The firm was one of the first few traditional platforms that recognized the need for blockchain technology.

Read Ethereum’s [ETH] Price Prediction 2023-2024

What’s with Ethereum and ERC-20?

In January 2022, Visa explored the road to Central Bank Digital Currencies (CBDCs). But for Catherine Gu, Visa’s infrastructure lead and complete integration with the crypto ecosystem was an unavoidable path for the company.

At @Visa , we want to serve as a trusted bridge between the crypto ecosystem and our global network. Excited to share some update today, here is the

pic.twitter.com/OK1sWIaxY3

— Catherine Gu (@catgu_) December 19, 2022

Not minding the turbulent market condition, Gu admitted that the company had done its research. She further noted that Vitalik Buterin’s 2015 public opinion on account abstraction influenced its decisions in choosing Ethereum.

According to the paper, Visa aims to provide a self-custodial wallet with the help of the Proof-of-Stake (PoS) blockchain. It also pointed out that it was pushing for automatic payments via the Ethereum blockchain and ERC-20 smart contract would play a significant role.

For Visa, the crypto ecosystem would be a formidable part of the payment and banking terrain. Defending its position on this what users would benefit, the blog post said,

“Our solution of delegable accounts can be extended to support all kinds of pull payments in general, and moreover third-party account recovery services where multiple parties must consent to initiate an account recovery, third party asset managers with restrictions on the specific Ethereum Request for Comments (ERC) tokens which they can manage, and how they can trade these tokens, and more.”

How many ETH you would get for $10

Picking up the chains

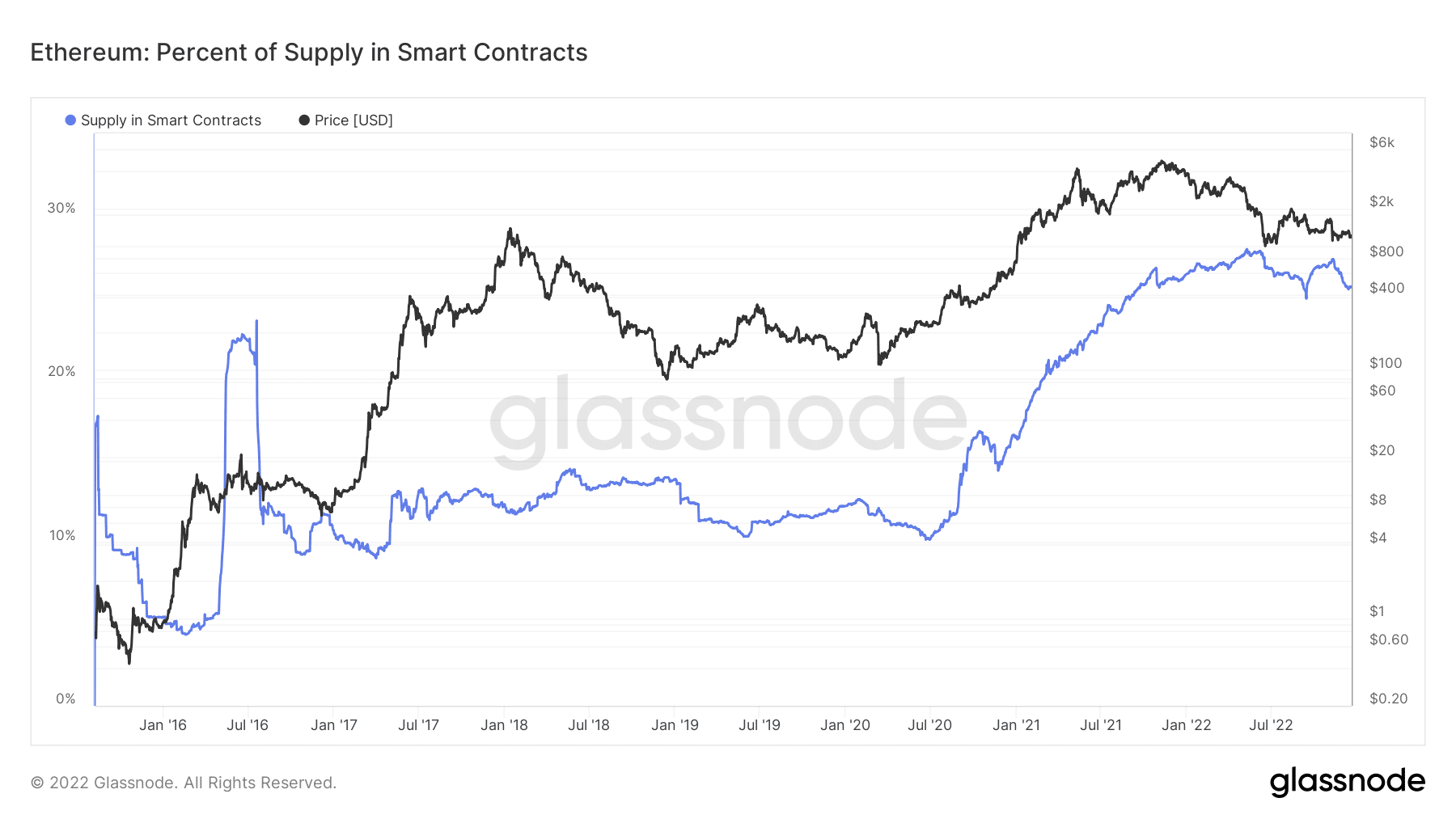

With regards to Ethereum on-chain ranking, Glassnode showed that the supply concentration with regards to smart contracts resisted considerable growth.

Since it decreased to 25.63%, it meant that Ethereum found it challenging to achieve even distribution. Therefore, staking activities have declined especially as the ETH price has been encouraging.

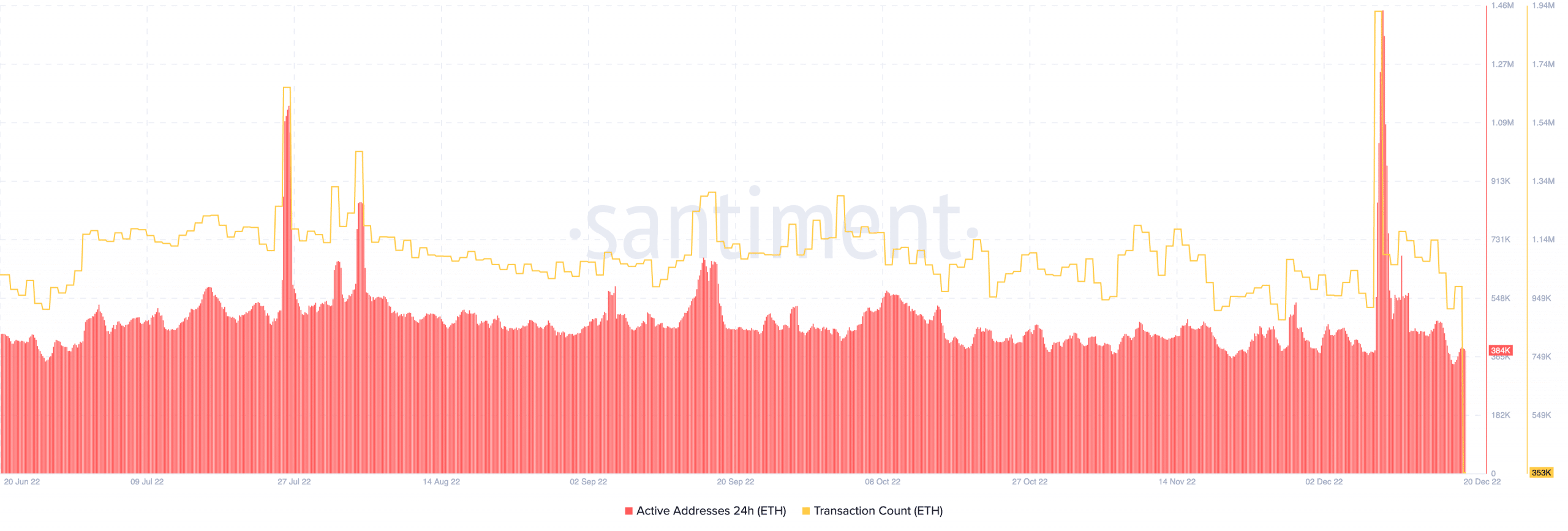

Following the announcement, Ethereum active addresses registered an increase. According to Santiment, addresses active on the network in the last 24 hours had climbed to 384,000.

This indicated an improvement in unique ETH deposits. However, transaction count within the same Ethereum network has been dreadful. At press time, the number of transactions had dipped to 353,000.

This represented a massive fall from 986,000 on 19 December, meaning the altcoin underperformed in the bid to attract holders to trade.

[ad_2]

Read More: ambcrypto.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Sui

Sui  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Avalanche

Avalanche  Stellar

Stellar  WhiteBIT Coin

WhiteBIT Coin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDS

USDS  WETH

WETH  Wrapped eETH

Wrapped eETH  Hedera

Hedera  Litecoin

Litecoin  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Polkadot

Polkadot  Ethena USDe

Ethena USDe  Monero

Monero  Bitget Token

Bitget Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pepe

Pepe  Uniswap

Uniswap  Pi Network

Pi Network  Aave

Aave  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Bittensor

Bittensor  OKB

OKB  Internet Computer

Internet Computer  Aptos

Aptos  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  NEAR Protocol

NEAR Protocol  Cronos

Cronos  Jito Staked SOL

Jito Staked SOL  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange