The rapid rise of cryptocurrencies in recent years has led to a billion-dollar industry with top companies and trading platforms integrating trading strategies toward getting maximum returns on their investment.

The complex nature of trading strategies has brought about new terminologies and concepts, and MEV is regarded as one of the new novel concepts in the crypto industry.

What is MEV?

MEV, or maximum extractable value, is the extra monetary value users can get from a block production in addition to staking rewards or gas fees. When transactions in the block are included, excluded, or rearranged in favor of more profitable ones, MEV is generated.

Because transaction placement and speed are critical in trading, MEV employs various strategies that mimic front running on Wall Street, such as sandwich attacks and back running. These strategies are most commonly found on blockchains such as Ethereum, where smart contracts play an important role in transaction processing.

Typical settlement mechanisms on the blockchain allow orders to be organized in batches and exposed before settling, allowing any agent to propose a series of trades. If these arbitrageurs use the standard transaction channel for their transactions, they risk being exploited.

For example, Ethereum’s original architecture called for all pending transactions to be kept in the mempool, where the public could view them before being submitted to a peer-to-peer validator network for processing. Knowledgeable users could evaluate the pending transactions and execute their deal ahead by submitting the same trades with themselves listed as beneficiaries and a higher fee.

What are the negative impacts of MEV?

MEV front running and sandwich attacks inflate asset values and increase network congestion and gas fees. Prioritizing trades over other transactions increases the amount of gas required for the transaction and slows down the network. Sandwich attacks are also harmful to the network because they increase slippage and cause problems with transaction execution.

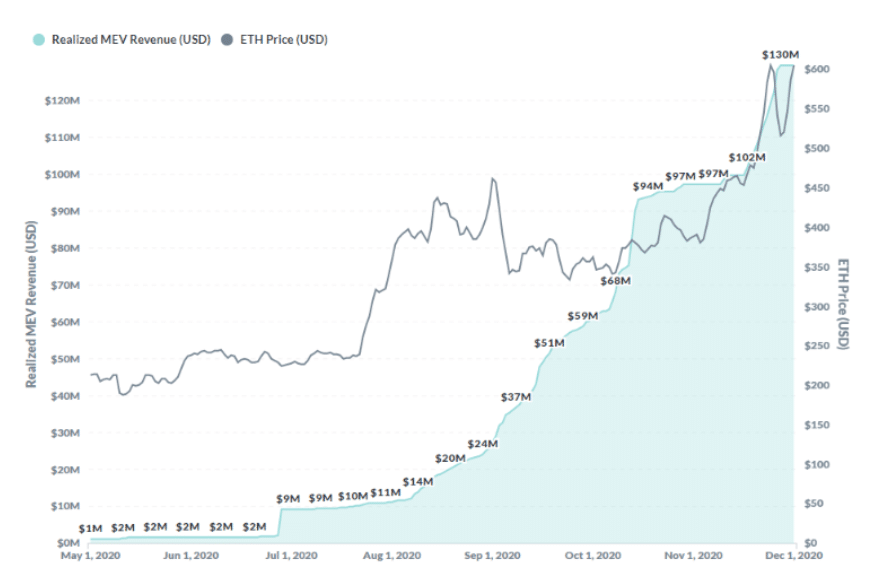

Source: Paradigm Research Feb 5, 2021.

What is MEV Relayer?

An MEV relay is a trusted mediator between block producers and block builders, which helps solve some of the inherent problems of MEV. Essentially, it’s a separate piece of open-source software run by validators that queries and outsources block-building to a network of builders.

This open-source middleware gives access to a competitive block-building market. The consensus layer client of a validator proposes the most profitable block received from the MEV relayer to the Ethereum network for attestation and block inclusion.

Relayers increase block rewards while also preventing arbitrage and bad actors from extracting and manipulating transactions, separating the role of proposers from block builders and having a net positive effect for end-users transacting on chain.

Why should I use an MEV Relayer?

The primary reason anyone participating in staking or running a validator should run an MEV relayer is to increase their yield. MEV Boost can increase your rewards 3-4x over vanilla blocks.

It is equally important to mention that public MEV relayers have been developed to support the sustainable and democratized distribution of block reward, reducing the negative impacts of MEV mentioned above. Relayers can also censor blocks, this topic is currently under much discussion within the various blockchain communities.

Who are the main MEV services?

It’s important to note that many MEV relayers are not mutually exclusive, bundles can and are often sent through multiple routers.

Flashbots: Flashbots is a research and development organization founded to mitigate the negative externalities posed to stateful blockchains, beginning with Ethereum.

Blocknative: Blocknative provides solutions for real-time blockchain transaction management, optimization, and maximizing block rewards for public blockchain networks.

BloxRoute: The bloXroute MEV service allows traders to submit MEV bundles and participate in merged bundles with other traders with three services: Max Profit, Ethical and Regulated.

Eden Network: Eden is a priority transaction network that protects traders from frontrunning, aligns block producer incentives, and redistributes miner extractable value.

Manifold Finance: Manifold Finance functions as an intermediary between Ethereum users and validators. It consolidates all Ethereum transactions in the best possible way to create a block that delivers the highest return on investment for all stakeholders.

How can you use MEV?

If you are technical enough to run your own Ethereum validator and meet the minimum requirements, you can install and run the relayers above. However, most people are staking Ethereum with a staking service such as Allnodes, which offers 1 click staking and allows you to maintain control over your keys.

When choosing a staking service, it’s important to see if the increase in MEV-boosted block rewards is being sent to you. Services like Allnodes do not take a cut of MEV-related rewards, so 100% of the yield is directed back to the end user (staker).

The other important decision is which MEV relayer to choose. Some services will not give you a choice, whereas Allnodes provides the user with an option directly in the UI on which MEV they want to use.

“We run over 15k Ethereum nodes, so we decided the best option is to allow our users to choose what MEV relayer they want to deploy directly in the UI with a simple click. It’s a no-brainer to support the sustainable and democratized distribution of block production while also getting more rewards for staking”

-Robert Ellison – Head of Growth at Allnodes

We recommend visiting a site like https://www.rated.network/relays to decide which MEV relayer you want to use.

Allnodes give users a choice of MEV

Allnodes is a non-custodial platform that allows you to host nodes, stake, and monitor blockchain addresses in a few clicks. Their primary goal as Ethereum validators is to maximize rewards for their customers safely and effectively while at the same time securing the network. As such, they are committed to best practices for MEV, with all rewards returning to the end user.

As an Ethereum validator on Allnodes, your revenue from staking will increase substantially with MEV. Furthermore, the additional revenue distribution is automatic and won’t require technical know-how on your part. You can start hosting your own Eth node here if you have the required minimum of 32 Eth or if you have the minimum of 16 Eth and would like to use Rocketpool.

Disclaimer: This is a paid post and should not be treated as news/advice.

Read More: ambcrypto.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

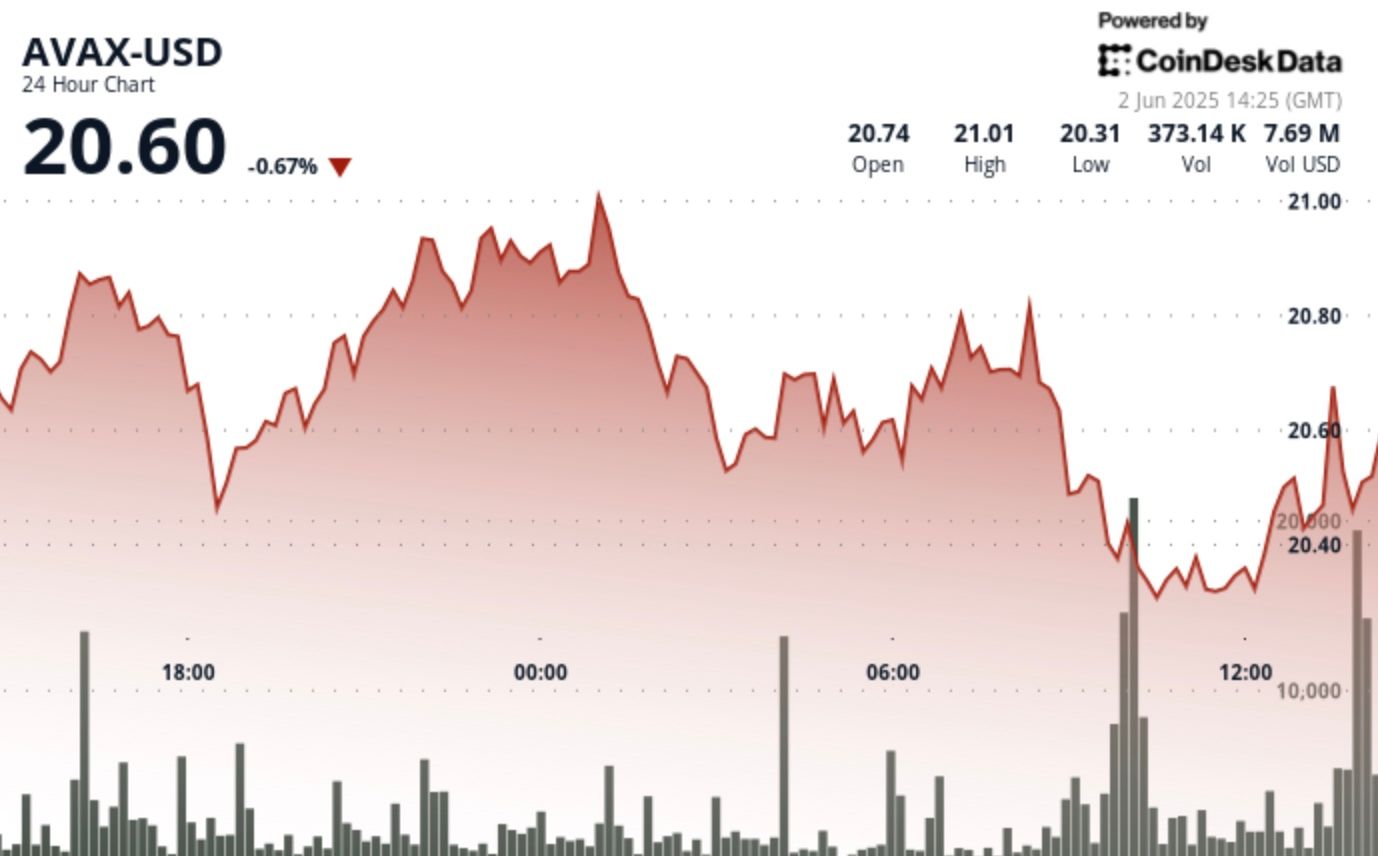

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Toncoin

Toncoin  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Shiba Inu

Shiba Inu  Hedera

Hedera  USDS

USDS  WETH

WETH  Litecoin

Litecoin  Monero

Monero  Wrapped eETH

Wrapped eETH  Polkadot

Polkadot  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Pepe

Pepe  Pi Network

Pi Network  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  Aave

Aave  Uniswap

Uniswap  Bittensor

Bittensor  Ethena Staked USDe

Ethena Staked USDe  Cronos

Cronos  Aptos

Aptos  OKB

OKB  NEAR Protocol

NEAR Protocol  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Jito Staked SOL

Jito Staked SOL  Internet Computer

Internet Computer  Ondo

Ondo  Ethereum Classic

Ethereum Classic