The crypto industry is still feeling the effects of several breaches, including the Solana wallet attack, the Acala and Nomad exploits, and the Tornado Cash sanctions. Consequently, it isn’t surprising that the market is still bearish with the dapp activity decreased to the lowest level in the whole year.

However, the latest report by blockchain analytics firm, DappRadar, showed some bright spots as the Ethereum network completed one of the largest test networks, Goerli, in preparation for the upcoming Merge.

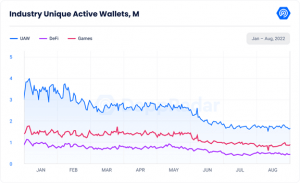

DappRadar’s August 2022 industry report found that Unique Active Wallets (UAW) connected to blockchain dapps dropped by 3.52% on a monthly basis, coming in at 1.67 million. This figure is also a 14.73% decrease when weighed against its counterpart of August 2021.

The decline in other cryptocurrency activities is visible as well. The DappRadar reports makes a note that Solana UAW declined by 53% from the previous month, and the number of transactions dropped by 68%, due to the latest Solana hack that occurred at the beginning of the month.

On the positive side, the decentralized finance (DeFi) industry is experiencing an overall increase in activity as the crypto market recovers slowly. DeFi dapps show signs of recovery with a 3.7% increase in terms of daily average UAW month-over-month (MoM). Still, the DeFi category is far from its peak with under half million daily UAW.

“This growth is driven mainly by the Flow protocol, which has an increase of 577% UAW from last month, due to the support of Flow-based NFTs into Instagram (LINK) and the success of their game, Solitaire Blitz. Also, Optimism has an increase of 33% MoM, driven mainly by the upcoming Ethereum Merge,” the report states.

Even though DeFi shows signs of recovery when analyzing active wallets, the total value locked (TVL), the basis for measuring the efficiency of dApps, is still suffering and presently sits at $74.21 billion. This is an alarming decrease considering that this amount was $250 billion less than eight months ago, the report notes.

In marked contrast, NFTs and games keep signs of evolution and maturity, with 847,230 daily Unique Active Wallets and $698 million in transactions. This is no surprise, as we have seen multiple blockchain games with truly immersive game mechanics that take entertainment to the next level.

Other highlights show new entries as competitors in the NFTs marketplace, with the dominance of OpenSea falling to 56% from the 84% measured in May. However, OpenSea continues to hold its place as the dominant market leader, accounting for $482 million total trading volume. The decline in the total trading volume of OpenSea comes at a time when it is cutting 20% of its workforce, citing the company’s need to adapt to current market conditions.

The DappRadar report depicts the factors that are affecting the blockchain ecosystem, using metrics and data to create an understanding of the latest trends. The report sums up different market scenarios to provide a basic overview of the market with respect to DeFi, NFTs, gaming and everything in between.

Read More: news.google.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Avalanche

Avalanche  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Toncoin

Toncoin  Stellar

Stellar  Shiba Inu

Shiba Inu  Wrapped Bitcoin

Wrapped Bitcoin  Hedera

Hedera  Polkadot

Polkadot  WETH

WETH  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Uniswap

Uniswap  Litecoin

Litecoin  Pepe

Pepe  Hyperliquid

Hyperliquid  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  USDS

USDS  Internet Computer

Internet Computer  Aptos

Aptos  Aave

Aave  Mantle

Mantle  Render

Render  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Ethereum Classic

Ethereum Classic  Bittensor

Bittensor  MANTRA

MANTRA  WhiteBIT Coin

WhiteBIT Coin  Virtuals Protocol

Virtuals Protocol  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Tokenize Xchange

Tokenize Xchange  Monero

Monero  Dai

Dai