[ad_1]

Amid the macro bearish landscape last year, the total value locked in DeFi dried up and the yields were down to their average lows. Consequentially, the DeFi index price, showcasing the state of DeFi on Ethereum, also crashed.

Towards the end of last year, it was hovering around $1.1k, while in early 2023, it dropped down to $1.07k. From thereon, however, there has been an improvement. As shown below, the reading of the same has already notched up to $1.85k, justifying the same.

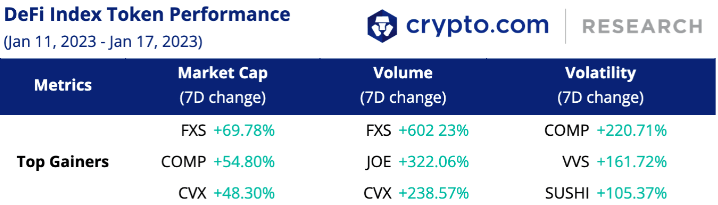

Leaving aside the DeFi trend on Ethereum, the macro state of affairs has also been refined. Evidently, the price of top DeFi tokens has been on the rise. In the period between Jan. 11 to Jan. 17, the top-performing assets from this space fetched their investors with returns in the 48% to 70% bracket. In fact, their volume simultaneously pumped upto 602%, bringing to light the interest influx of market participants.

DeFi market cap balloons up

The impact of the same was clearly visible on the total DeFi market cap. Leaving aside the last couple of days, most of the candles so far this year have been in the green. In fact, there has been an aggregate inflow of ~$10 billion into space since the beginning of this year. From Jan. 1’s lows of $30.3 billion, the worth of all DeFi tokens stood north of $40 billion at press time.

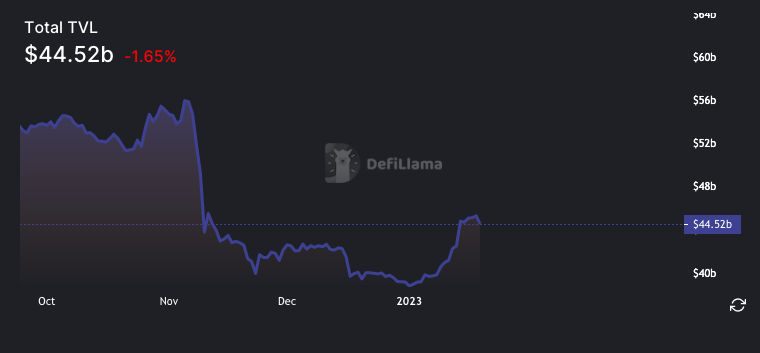

Simultaneously, the total value of assets locked on DeFi protocols has also been on the rise lately. Over the past 18 days, the value of this metric has risen from $38.75 billion to $44.52 billion.

As far as the individual breakdown is concerned, data from DeFiLlama revealed that MakerDAO’s number individually rose by 5% over the past week, while that of Aave, Curve Finance, Convex Finance, and Uniswap noted upticks in the 3%-15% bracket in the same timeframe.

More often than not, the TVL serves as a yardstick to measure the adoption rate and user interest in the DeFi market. Thus, people locking additional assets at this stage on DeFi platforms can be viewed as a sign of growth.

[ad_2]

Read More: news.google.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Sui

Sui  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Avalanche

Avalanche  Toncoin

Toncoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Shiba Inu

Shiba Inu  WETH

WETH  Wrapped eETH

Wrapped eETH  Litecoin

Litecoin  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Hedera

Hedera  Monero

Monero  Ethena USDe

Ethena USDe  Polkadot

Polkadot  Bitget Token

Bitget Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Uniswap

Uniswap  Pepe

Pepe  Pi Network

Pi Network  Aave

Aave  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Bittensor

Bittensor  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aptos

Aptos  Cronos

Cronos  Internet Computer

Internet Computer  NEAR Protocol

NEAR Protocol  Jito Staked SOL

Jito Staked SOL  sUSDS

sUSDS  Ethereum Classic

Ethereum Classic