[ad_1]

Last week DeFi faced another crisis, this time it was with one of the stalwarts of the ecosystem, Curve Finance.

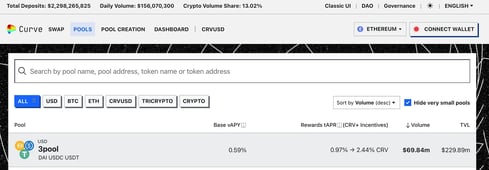

Curve is a leading decentralised exchange, popular with many DeFi users for its liquidity pools which enable depositors to earn a yield on a number of popular tokens. This includes Bitcoin, Ether, and staked Ether tokens such as stETH and RETH. Also stablecoins such as USDC and USDT.

What has made Curve so popular is that in addition to earning a yield on their deposits, liquidity providers can boost their earnings significantly through Curve’s governance token, CRV.

For instance, Curve’s most popular pool, 3pool consists of DAI, USDC and USDT. The base APY on the pool is 0.85%, however, this can be boosted from 0.94% to 2.35% in CRV rewards by locking up their CRV tokens.

The Curve Exploit

It’s only when the Tide goes out you learn who’s been Swimming Naked

The Vyper bug wasn’t the only issue. Curve’s Founder, Michael Egorov had pledged 34% of CRV’s total market cap across a number of DeFi protocols.

This meant that if CRV’s token started plummeting below a certain threshold the CRV collateral would start flooding the market in order to liquidate the position.

As Ryan of Bankless pointed out, the potential CRV selling pressure was plain and simple, leverage going wrong.

But people really should be paying attention to who holds the tokens associated with the DeFi protocols they are using. And what these holders are doing with them.

The net effect is that Curve appears to have survived this time around, but it does highlight clear issues still facing the DeFi ecosystem.

Managing software vulnerabilities

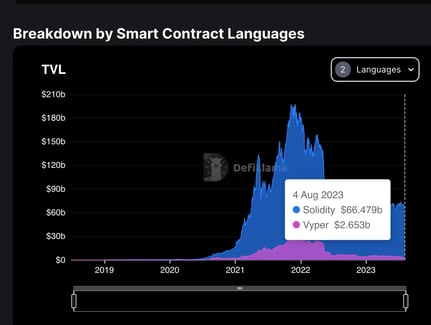

Developers face an endless game of cat and mouse with malicious hackers trying to find vulnerabilities and exploit their code. In the past, this was constrained to corporate systems that sat behind firewalls which often required social engineering or lax security practices to get into.

Public blockchains changed this. In creating decentralised applications, huge honeypots of cryptocurrencies were created for attackers to focus their energies on. Why jump through all of the hoops to exploit institutions, when you have hundreds of millions of dollars available on public blockchain networks?

Anyone who has spent significant time working as or with developers will appreciate just how time-consuming development is. No code is ever perfect or complete. There are always ways in which it can be improved or optimised.

Heartbleed

It’s estimated that 17% of the webs secure web servers were exposed to the vulnerability when it was detected. The exploit enabled an attacker to retrieve encryption keys on servers and impersonate others accessing them.

Parity Multi-sig

It will never be possible to eliminate errors in code. Even with AI techniques, the underlying large language models (LLMs) are trained on code that has been created by fallible humans.

Can we ever reach a point where decentralised finance can truly fulfil its potential?

I do see areas of the ecosystem in which I have great confidence, such as Circle’s USDC. However, they control token issuance and are very transparent in how they operate as a business, including providing audited reports of their reserves.

Also with base network protocols themselves such as Ethereum. While I don’t envisage any events on the horizon that could threaten the solvency of Ether or the security of the entire Ethereum network, there are ways to recover from major events as the DAO hack once demonstrated (although few in the Ethereum community would be supportive of this level of meddling again).

Stacking DeFi

Where I believe the problem lies is in the ability to stack app upon app and create complex positions spread across multiple DeFi apps. This is where someone deposits tokens with Curve, deposits the CRV into Convex for a yield boost and may further lock up their CVX tokens. Curve may be one of the stalwarts of DeFi. However, with each additional DeFi protocol used the risk to users increases significantly.

Within each DeFi protocol, there will be a small number of developers who truly understand how their smart contracts work. When you combine a number of protocols together, that number becomes even smaller.

This means that a very small proportion of users will have any idea of how safe their funds really are, and instead is simply chasing the advertised yields.

Teams do take measures such as engaging auditors to help verify their contract source code. But are those auditors re-engaged with every change? Are those auditors constantly monitoring all dependencies for updates or vulnerabilities? Even if they are, some exploits will still slip through.

Protecting Mainstream Users

I believe that for DeFi applications to go mainstream we will need greater protection for users. This could be in the form of institutions that have enough capital to make good for their users in the event of exploits. Or simply insurance for them.

Perhaps centralised exchanges will end up being the gateway that many use? Seeing how Coinbase’s Base network evolves in this regard will be very interesting, as they will have the ability to provide backstops in the network.

It is incredible the amount of value that has become locked in the DeFi ecosystem during the past few years. However, from a personal perspective, I still don’t feel comfortable putting any meaningful amount of funds into DeFi protocols unless I can monitor what I’m doing with them around the clock.

I have fewer concerns with stablecoins such as USDC and Ether, as there’s far more transparency with how they operate, which doesn’t require digging through smart contract code.

Without some breakthroughs in how user funds can be protected, I do think that many DeFi protocols will remain niche applications for those users who really understand what they’re doing. Especially now as you can deposit funds with normal banks for 4-5% yields which come with government guarantees.

The risk tied with DeFi simply isn’t worth it. I remain as ardent a supporter of blockchain and web3 as I ever have. But parts of DeFi still feel like high-stakes games of poker, and I’m no gambler.

[ad_2]

Read More: blog.web3labs.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Sui

Sui  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Avalanche

Avalanche  Toncoin

Toncoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Shiba Inu

Shiba Inu  WETH

WETH  Wrapped eETH

Wrapped eETH  Litecoin

Litecoin  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Hedera

Hedera  Monero

Monero  Ethena USDe

Ethena USDe  Polkadot

Polkadot  Bitget Token

Bitget Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Uniswap

Uniswap  Pepe

Pepe  Pi Network

Pi Network  Aave

Aave  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Bittensor

Bittensor  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aptos

Aptos  Cronos

Cronos  NEAR Protocol

NEAR Protocol  Internet Computer

Internet Computer  Jito Staked SOL

Jito Staked SOL  sUSDS

sUSDS  Ethereum Classic

Ethereum Classic