[ad_1]

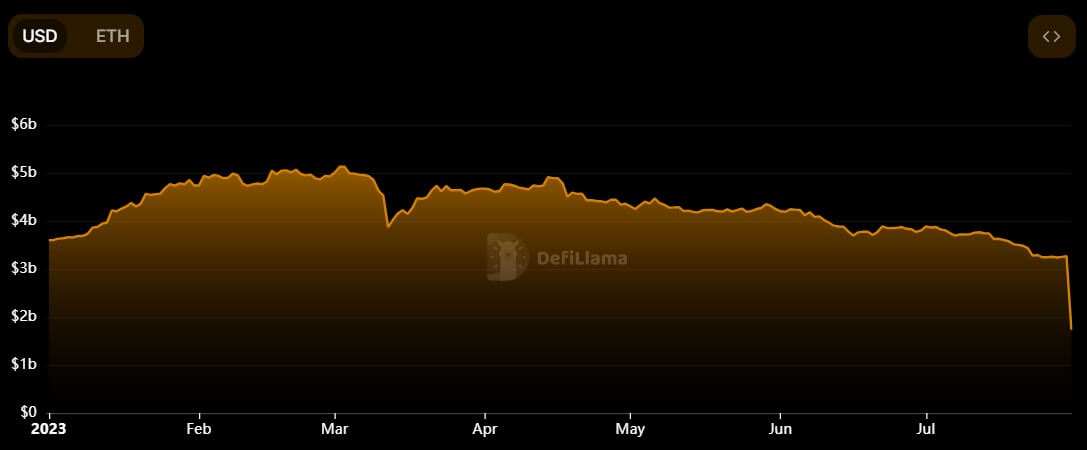

The total value of assets locked on decentralized finance protocol Curve Finance (CRV) plunged nearly 50% in the last 24 hours to $1.731 billion from $3.26 billion recorded on July 30, according to DeFiLlama data.

The exodus can be attributed to an exploit of the protocol, which increased fears of liquidation and bad debt among community members who immediately withdrew their assets from the crypto project.

Vyper vulnerability affects Curve Finance

On July 30, a malfunctioning ‘reentrancy locks vulnerability’ was found on multiple versions of Vyper, a smart contract language for the Ethereum (ETH) virtual machine (EVM). The programming language confirmed the incident, revealing that crypto projects running Vyper 0.2.15, 0.2.16, and 0.3.0 could be impacted.

Following the news, Curve Finance stated that some of its stable pools running Vyper 0.2.15 had exploited the malfunctioning reentrancy lock vulnerability.

A reentrancy attack allows an attacker to drain funds of a vulnerable contract by repeatedly calling the withdraw function before it updates its balance. This attack has been commonly used to exploit several DeFi protocols.

BlockSec, a blockchain security firm, said the reentrancy attack could potentially risk all pools with wrapped Ether (WETH).

While it was unclear how much was stolen from Curve Finance’s stablecoin pools, some estimates suggest that as much as $70 million might have been stolen.

However, a MetaMask developer, Taylor Monahan, noted “lots of whitehat activity + automated MEV bots,” meaning the amount might be lesser.

CRV’s price tank

The exploit has made Curve’s CRV token highly volatile, with its price dumping by around 15% to $0.64707 at the time of writing, according to CryptoSlate’s data.

Meanwhile, CRV’s on-chain value hit lows of $0.109 as liquidity tapered off after the CRV/ETH pool was attacked.

South Korean crypto exchange Upbit suspended deposits and withdrawals for the token, citing vulnerabilities discovered on the DeFi project’s platform. The exchange further warned that CRV’s price was “experiencing significant volatility.”

Bad debt and contagion fears

With hackers holding a significant amount of CRV, there are concerns that the token’s price might fall further if they start selling. This presents a contagion risk because Curve founder Michael Egorov used the token as collateral on several lending protocols, including Aave.

With Egorov having over $100 million in CRV as collateral on Aave, Inverse, and Abracadabra, a liquidation due to a drop in CRV price will affect Curve and all the protocols.

To avoid liquidation, Egorov has been paying down some of the loans. However, this might not prevent bad debt and spillover effects for other lending protocols exposed to Curve.

Meanwhile, Aave Ethereum v2 version has turned off the CRV borrowing function. Wu Blockchain reported that this was probably done to prevent traders from using the Curve vulnerability to panic and the malicious shorting of borrowed CRV to promote serial liquidation.

[ad_2]

Read More: cryptoslate.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Sui

Sui  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Chainlink

Chainlink  Stellar

Stellar  Avalanche

Avalanche  Toncoin

Toncoin  USDS

USDS  WhiteBIT Coin

WhiteBIT Coin  Shiba Inu

Shiba Inu  WETH

WETH  Wrapped eETH

Wrapped eETH  Litecoin

Litecoin  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Hedera

Hedera  Monero

Monero  Ethena USDe

Ethena USDe  Polkadot

Polkadot  Bitget Token

Bitget Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Uniswap

Uniswap  Pepe

Pepe  Pi Network

Pi Network  Aave

Aave  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Bittensor

Bittensor  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aptos

Aptos  Cronos

Cronos  Internet Computer

Internet Computer  NEAR Protocol

NEAR Protocol  Jito Staked SOL

Jito Staked SOL  sUSDS

sUSDS  Ethereum Classic

Ethereum Classic