[ad_1]

Dear Bankless Nation,

If you thought the crypto company blowups were over, this week offered an alternative take. Big exchanges and lenders are running out of banking options and regulators are still swarming.

For our weekly recap, we dig into:

-

The Silvergate shoe drops

-

Crypto descends on Denver

-

Solana suffers another outage

-

Oasis counterhacks its hacker

-

‘Everything other than Bitcoin’

– Bankless Team

Here’s a recap of the biggest crypto news from the first week of March.

Crypto companies are not licensed as financial lenders so they need licensed banks to serve the on- and off-ramping needs of their customers.

One of the largest crypto-friendly banks, Silvergate, saw its shares tank 55% on Thursday. This comes amid market concerns of its financial sustainability following FTX’s collapse last November. Silvergate has also been facing a DoJ probe over its FTX and Alameda dealings since early February. The bank previously reported a ~$1B loss for Q4 2022 and cut its staff by 40%.

As a result, Silvergate’s clients are jumping ship en masse. Coinbase, Circle, Paxos, Crypto.com, Bitstamp, Cboe Digital Markets, Galaxy Gemini and LedgerX have announced that they are each cutting ties with Silvergate.

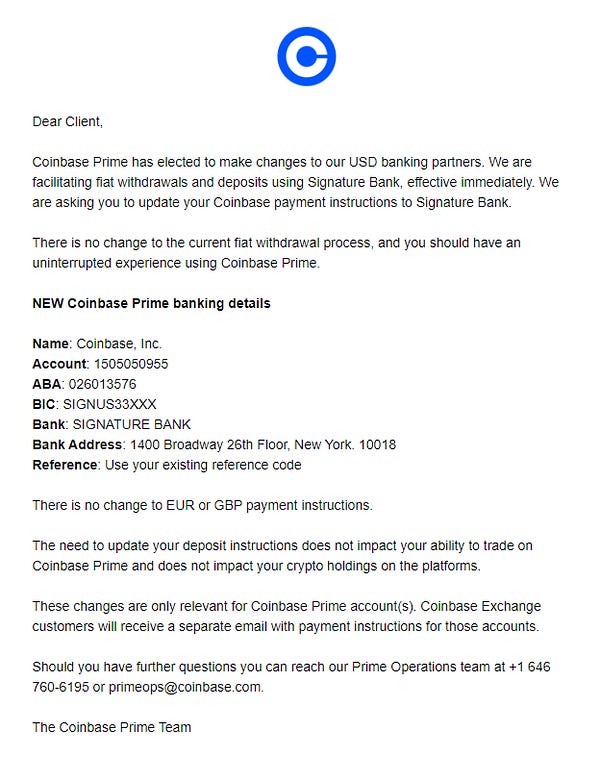

This week, Coinbase announced that it was switching to another crypto-friendly bank, Signature, to service Coinbase Prime account holders.

Kraken on the other hand, is pulling back from using Signature bank to service retail clients. On January 22, Binance also reduced its exposure to retail clients through Signature, setting a new policy that served only customers transacting more than $100K.

On Friday, Silvergate announced it was suspending crypto payments.

“Effective immediately Silvergate Bank has made a risk-based decision to discontinue the Silvergate Exchange Network (SEN). All other deposit-related services remain operational,” Silvergate wrote in a statement given to media outlets.

It’s ETH Denver week.

Here’s a summary of product launches this week thus far:

Solana goes out… again.

After the network suffered a “significant performance degradation,” the network entered a safe mode that paused processing of transactions. Solana was then restarted by validators and came back up after 19 hours.

Developers still don’t know the reason why the network went down.

Separately, Solana is shutting down its retail stores in NYC and Miami.

Jito Labs, a MEV-focused research lab, states that over 30% of all Solana’s transactions are MEV spam attempts.

The Wormhole bridge succumbed to an attack in February 2022 that saw 120K wETH ($321M) stolen. Since then, the hacker has constantly shuffled the stolen crypto through different Ethereum dapps.

According to an official Oasis blog post, whitehat hackers reached out to the Oasis team on February 16 demonstrating how to take the funds back from the hacker thanks to a “previously unknown vulnerability in the design of the admin multisig access”. Oasis is a DeFi aggregator that spun off as its own entity from Maker DAO in mid-2021.

Five days later, Oasis received an order from the High Court of England and Wales last week to retrieve those stolen assets.

So Oasis employed its multisig and conducted a “counter exploit” via an upgradable “proxy” smart contract, retrieving $225M back from the hacker and sent it to an “authorized third party” that is likely to be Jump Crypto, the trading firm that restored the funds last year. See Dan Smith’s article for a technical breakdown.

The good news: Some funds are restored. The bad news: Oasis had a multisig-enabled backdoor to upgrade its code all along, and regulators can lean on protocols to use them when they want to.

What precedent does this set for DeFi?

Much to the joy of Bitcoiners and the chagrin of everyone else, Gary Gensler declared last week that everything in crypto is a security safe for Bitcoin.

The immediate response from Twitter was that Gensler’s opinion is just that: opinion. That crypto tokens are securities is a legal matter yet to be settled in American courts.

Nor is Gensler’s opinion reflective of lawmakers in Congress. The Digital Assets Subcommittee, a body in Congress, is scrutinizing the SEC’s increasing aggressiveness and style of “regulation by enforcement” against the crypto sector.

Brian Armstrong writes on CNBC this week:

U.K., Japan, and EU have all made significant progress to close gaps in existing EU financial services legislation by establishing a harmonized set of rules for crypto-assets… Yet while we see other jurisdictions progress, the U.S. seems more focused on turf battles between regulators. No other country in the world has spent as much time and energy trying to convince its citizens that crypto assets are securities. The U.S. is missing the forest for the trees.

To be continued…

Kraken, the secure, transparent, reliable digital asset exchange, makes it easy to instantly buy 200+ cryptocurrencies with fast, flexible funding options. Your account is covered with industry-leading security and award-winning Client Engagement, available 24/7.

Listen to podcast episode | Apple | Spotify | YouTube | RSS Feed

Go Bankless. $22 / mo. Includes archive access, Inner Circle & Badge—(pay w/ crypto)

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.

[ad_2]

Read More: newsletter.banklesshq.com

Visit Kraken.com to learn more

Visit Kraken.com to learn more

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  Sui

Sui  Chainlink

Chainlink  LEO Token

LEO Token  Avalanche

Avalanche  Stellar

Stellar  USDS

USDS  Toncoin

Toncoin  WhiteBIT Coin

WhiteBIT Coin  Shiba Inu

Shiba Inu  WETH

WETH  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Hedera

Hedera  Monero

Monero  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Polkadot

Polkadot  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pi Network

Pi Network  Uniswap

Uniswap  Aave

Aave  Pepe

Pepe  Dai

Dai  Aptos

Aptos  Ethena Staked USDe

Ethena Staked USDe  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Bittensor

Bittensor  Jito Staked SOL

Jito Staked SOL  NEAR Protocol

NEAR Protocol  Internet Computer

Internet Computer  Cronos

Cronos  Ethereum Classic

Ethereum Classic  sUSDS

sUSDS