In today’s article, we’ll dive into cryptocurrency exchange development. In addition to that, we’ll also introduce Moralis’ API suite, which comprises the industry’s leading interfaces for anyone looking to start a crypto exchange. For a little sneak peek into how you can use Moralis for various crypto exchange features, here’s how easy it is to fetch the price of a token with Moralis’ getTokenPrice() endpoint:

const response = await Moralis.EvmApi.token.getTokenPrice({ "chain": "0x1", "address": "0x7d1afa7b718fb893db30a3abc0cfc608aacfebb0" }); For a more detailed breakdown of Moralis’ APIs and how to call our various endpoints, join us in this article as we break down the process from start to finish!

Also, if you want a complete crypto exchange development tutorial, check out the video below from Moralis’ YouTube channel. In this clip, one of our talented developers walks you through the entire process of creating a decentralized exchange (DEX):

Did you know that you can access Moralis’ tools for free? All you have to do is sign up with Moralis, and you’ll gain immediate access to our industry-leading Web3 APIs!

Overview

We’ll kickstart today’s article by exploring the intricacies of cryptocurrency exchanges. In doing so, you’ll learn what they are and entail. Also, we’ll cover some prominent examples of already existing exchange platforms. From there, we’re going to dive into some essential things you need to be aware of before getting into cryptocurrency exchange development. Next, we’ll briefly cover an example of the crypto exchange development process before we top things off and explore Moralis – the industry’s premier tool if you want to start your own crypto exchange!

So, what is a cryptocurrency exchange? Let’s jump into the first section and answer that question!

What is a Cryptocurrency Exchange?

In the early days – when the blockchain industry remained in its infancy – it was quite challenging to acquire cryptocurrencies. At the time, people generally had to mine crypto or organize private trades in online forums to acquire crypto. Fortunately, this is no longer the case, thanks to cryptocurrency exchanges!

But what is a cryptocurrency exchange? And how do they work?

A cryptocurrency exchange is a digital platform for storing, buying, selling, and swapping cryptocurrencies like Bitcoin, ether, USDT, and BNB. Today, there are hundreds and hundreds of cryptocurrency exchanges, and some prominent examples include Coinbase, Uniswap, PancakeSwap, and Binance.

In addition to the basic functionality of buying, selling, and swapping crypto, some exchanges offer other, more advanced features. A few prominent examples include future and options trading, margin trading, and analytics tools.

Furthermore, there are different types of exchanges, and the two most prominent examples are centralized exchanges (CEXs) and decentralized exchanges (DEXs). CEXs are platforms where you deposit your crypto to an account managed by the platform. Meanwhile, DEXs allow you to make direct peer-to-peer transactions while remaining in full control of your private keys.

Nevertheless, that gives you a brief overview of crypto exchange platforms. In the next section, we’ll look at a few prominent examples!

Examples of Crypto Exchange Platforms

In this section, we’ll explore three examples of industry-leading CEXs and DEXs:

- Coinbase: Coinbase started back in 2012, and it’s a CEX allowing you to store, sell, buy, and trade cryptocurrencies with ease. The Coinbase platform supports over 200 of the most popular cryptocurrencies, including Bitcoin, Ethereum, ETH, BNB, and many others.

In addition to the basic functionality for trading, buying, and selling cryptocurrencies, Coinbase also provides more advanced features. For instance, the platform offers powerful trading charts with multiple technical indicators, spot trading functionality, and much more.

- Uniswap: Uniswap launched in 2018, and it’s one of the industry’s leading DEXs for swapping cryptocurrencies on Ethereum and other major blockchain networks. Since the launch of the platform, Uniswap has managed to process over 160 million transactions, with a total trading volume of more than $1.5 trillion.

Since Uniswap is a DEX, there isn’t a single entity in control of the platform. Uniswap is, instead, managed and governed by a global community of UNI token holders. And UNI is the governance token of the protocol.

- PancakeSwap: PancakeSwap is a BNB Smart Chain-based DEX founded in 2018. The PancakeSwap platform shares many similarities with Uniswap; however, the main difference is that PancakeSwap focuses on BEP-20 tokens rather than ERC-20 tokens.

PancakeSwap also features a native token called CAKE, which has a lot of utility. For instance, by staking CAKE, users receive voting-escrowed CAKE (veCAKE), which provides governance rights to the token holder.

Nevertheless, if you’d like to explore other platforms, check out Moralis’ Web3 Wiki pages for decentralized exchanges and crypto exchanges, where you’ll find 190+ additional examples!

Cryptocurrency Exchange Development: Everything You Need to Know to Start a Crypto Exchange

From this point, let’s dive deeper into the intricacies of cryptocurrency exchange development. However, before we get into the actual step-by-step process of how you can start a crypto exchange, we need to cover a few fundamental aspects.

In doing so, we’ll examine the current market to highlight potential opportunities, explore different revenue streams linked to operating a cryptocurrency exchange, and look at the associated development costs of building a platform.

So, without further ado, let’s briefly look at the current market to highlight the opportunities of getting into crypto exchange development!

Market Opportunities

To highlight the opportunities when it comes to cryptocurrency exchange development, let’s look at a few interesting statistics:

- Market Cap: The collective market capitalization of cryptocurrencies currently stands at over $1.5 trillion, and there are anticipations of even further growth in the coming years.

- Daily Trading Volume: At the time of writing, the daily spot trading volume for cryptocurrencies is just below $100 billion. And at the peak of crypto back in 2021, it exceeded $300 billion at times.

- Exchange Statistics: Binance – one of the biggest cryptocurrency exchanges – currently has a daily trading volume of $15+ billion and almost 13 million weekly visits. Coinbase, on the other hand, has a daily trading volume of about $2 billion and 80k weekly visits.

The size of the crypto market and the volume of transactions processed every day by crypto exchanges clearly highlight the opportunities within the space. As such, with proper execution, cryptocurrency exchange development can prove a very lucrative endeavor!

How Do You Make Money with a Cryptocurrency Exchange?

Now, with an overview of the market opportunities, you might ask yourself, ”How are crypto exchanges making money?”. Well, in this section, we’ll look at three potential revenue stream examples:

- Trading Fees: The biggest source of income for many cryptocurrency exchanges is trading fees. As an owner of an exchange, you can decide to charge a percentage of the transaction value or a flat fee for each trade.

- Listing Fees: Some cryptocurrencies are willing to pay to get their tokens listed on an exchange platform. Consequently, it is possible to generate revenue by charging a fee for new coin listings.

- Staking: Prominent exchanges also allow users to stake their funds in exchange for interest. As such, you can implement features facilitating this service and take a percentage of the interest collected by the user in return.

Nevertheless, these are only three prominent examples of potential revenue streams. There are multiple other features you can use to generate income, including margin trading, token sales, affiliate programs, etc.

The Costs of Cryptocurrency Exchange Platform Development

Pinpointing the exact costs of crypto exchange development is difficult as there are numerous factors to consider. As such, instead of giving you a precise amount, we’ll look at three things that will affect the cost of building a crypto exchange:

- Type of Exchange: The type of platform – whether you want to build a centralized or decentralized exchange – can significantly influence the costs. And this also depends on your team and their proficiency when it comes to Web3 and DeFi dapp development.

- Features: Features can also influence the cryptocurrency exchange development costs. And the more complicated the functionality, the more expensive it will generally be to build the platform.

- Development, Testing, and Maintenance: One of the most significant costs of building a crypto exchange will be salaries during the development stages. However, you’ll also want to keep a solid development team to maintain the exchange and ensure its longevity.

All in all, it’s essential to know that the cost of cryptocurrency exchange development can range from tens of thousands to millions of dollars!

How to Start a Crypto Exchange

With an overview of things to consider when it comes to cryptocurrency exchange development, we’ll now show you how to start a crypto exchange yourself. To do so, we’ll briefly give you an overview of the typical crypto exchange development process:

- Research: The first thing you need to do to start a crypto exchange is research. Find pain points you can solve and identify gaps in the market so you can differentiate yourself from the competition.

- Create a Plan: Create a plan for how you will solve the needs of your users. In doing so, you should define an operational scope, identify key features you wish to implement, build the right team, find Web3 developer tools to help you build faster and smarter, etc.

- Build the Platform: With a plan at hand, you need to undertake all the technical work and build the actual platform. This includes everything from frontend to smart contract and backend development.

- Test and Deploy: Once you have a viable product, you need to put it through rigorous testing. And when everything works as intended, you need to deploy your crypto exchange.

- Maintainance: Finally, once the platform is up and running, you must maintain it to ensure it works in the long run and keeps up with any new regulations.

That gives you an idea of how you can start a crypto exchange. However, it’s worth noting that the steps simply give you an overview and example of what the crypto exchange development process might look like. As such, it might differ depending on what type of platform you’re building, and you can change steps based on your preferences.

Nevertheless, now that you have familiarized yourself with cryptocurrency exchange development, we’ll introduce you to the easiest way to start your own platform: Moralis!

Introducing Moralis – The Easiest Way to Start a Crypto Exchange

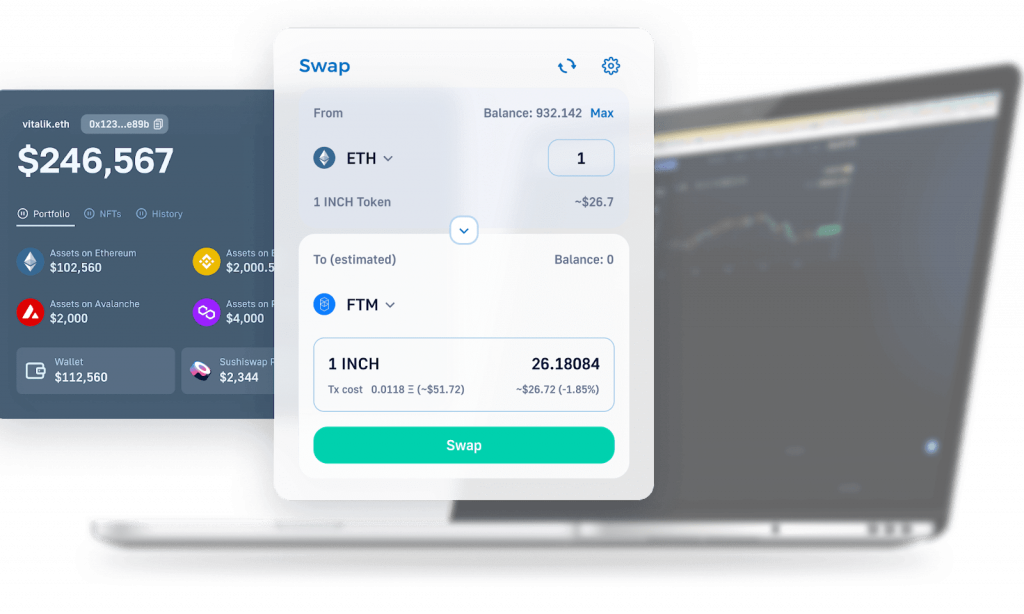

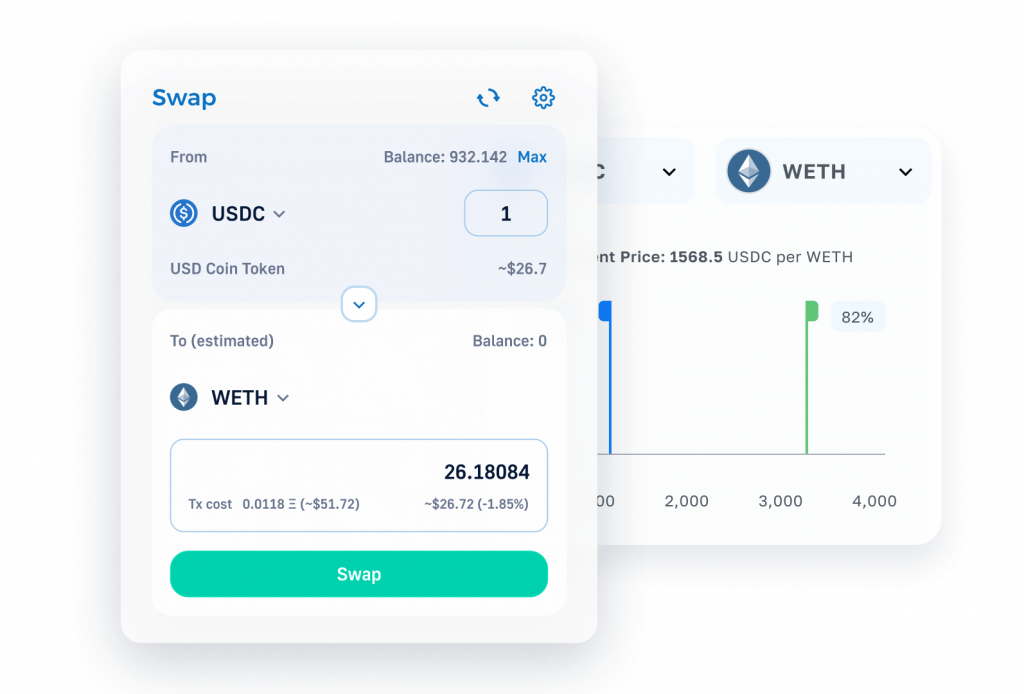

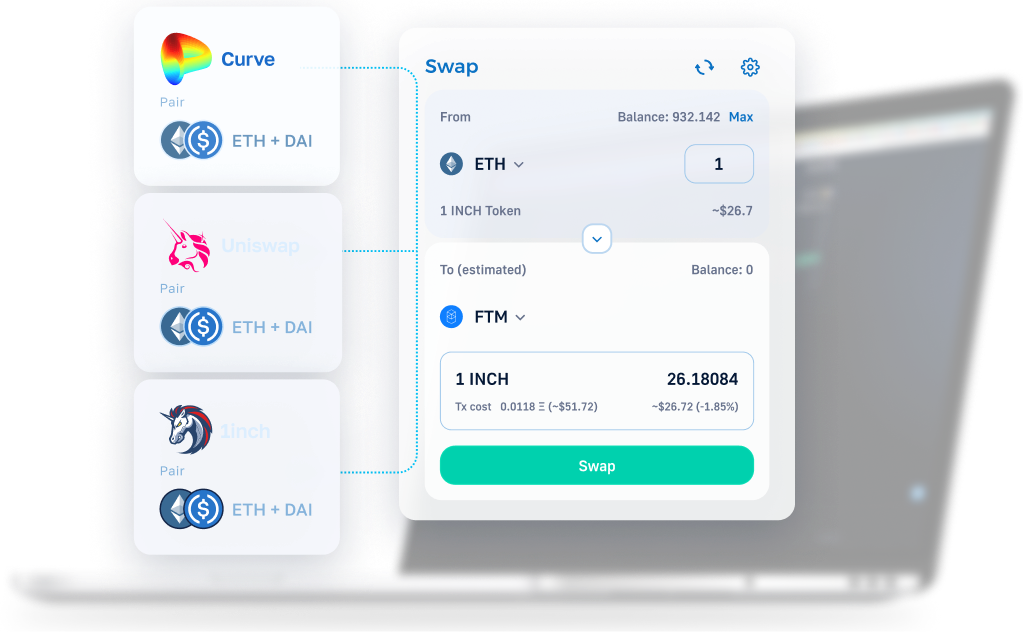

If you’re looking to start a cryptocurrency exchange platform, then you’ll definitely want to leverage Moralis in your development endeavors. Moralis is an industry-leading Web3 API provider, and with our interfaces, you can seamlessly fetch and integrate all the data you need to build platforms like Binance or Uniswap!

In Moralis’ premier suite of Web3 APIs, you’ll find a bunch of interfaces for different use cases that can help you build cryptocurrency exchanges and other platforms. Here are three prominent examples:

- Token API: With the Token API, you can effortlessly get real-time token prices, balances, transfers, and much more with single lines of code. What’s more, the Token API supports every single token across ten+ EVM chains.

- Wallet API: Moralis’ Wallet API supports over 500 million addresses across all the biggest blockchains, including Ethereum, Polygon, BSC, and many others. With only single lines of code, you can use this interface to get wallet balances, transfers, NFTs, etc. As such, this is the perfect tool if you want to integrate wallet functionality into your exchange.

- Streams API: With the Streams API, you can effortlessly set up streams to get real-time notifications sent directly to your project’s backend via webhooks as soon as something important happens on-chain. Consequently, with this feature, you can effortlessly equip your exchange with Web3 notifications to keep your users updated in real-time.

Nonetheless, the Token API, Wallet API, and Streams API are only a few examples of prominent Web3 developer tools. If you want to explore the rest, check out our Web3 API page!

Cryptocurrency Exchange Development Tutorial: How to Get Token Prices Using Moralis’ Token API

An important part of cryptocurrency exchange development is integrating real-time token prices into your platform. And in this section, we’ll show you how easy this becomes when working with Moralis. In fact, all it takes are three simple steps:

- Get a Moralis API Key

- Write a Script Calling the

getTokenPrice()Endpoint - Run the Code

However, crypto prices are only one component needed to start a crypto exchange. Fortunately, you can follow the steps above to integrate other on-chain data with only single lines of code when working with Moralis. All it requires is that you call another endpoint during the second step. Check out Moralis’ official API documentation page if you’d like to explore all your options.

Nevertheless, let’s get going with the tutorial!

Prerequisites

This will be a JavaScript tutorial. As such, if you want to follow along, make sure you have the following ready:

Step 1: Get a Moralis API Key

The first thing you need is an API key. And to get one, you need a Moralis account. As such, start by signing up with Moralis!

Once you have an account, log in to the admin panel, click on the ”Settings” tab, scroll down, and copy your key:

Save it for now, as you’ll need it in the next section!

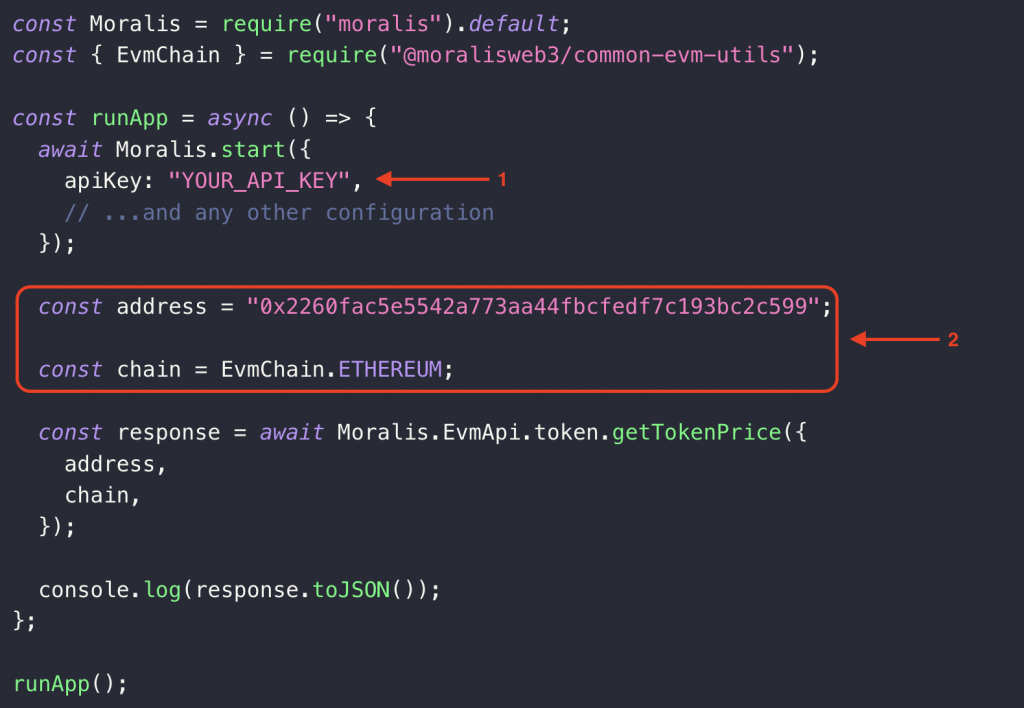

Step 2: Write a Script Calling the getTokenPrice() Endpoint

Set up a new project in your IDE, open a new terminal, and run this command to install the Moralis SDK:

npm install moralis @moralisweb3/common-evm-utils

From there, create a new ”index.js” file and add this code:

const Moralis = require("moralis").default; const { EvmChain } = require("@moralisweb3/common-evm-utils"); const runApp = async () => { await Moralis.start({ apiKey: "YOUR_API_KEY", // ...and any other configuration }); const address = "0x2260fac5e5542a773aa44fbcfedf7c193bc2c599"; const chain = EvmChain.ETHEREUM; const response = await Moralis.EvmApi.token.getTokenPrice({ address, chain, }); console.log(response.toJSON()); }; runApp(); Next, you need to make some minor configurations to the code. First of all, initialize the Moralis SDK by replacing YOUR_API_KEY with the key you copied before. You then additionally need to configure address and chain to fit your query:

That’s it; you’re now ready to run the code!

Step 3: Run the Code

Open a new terminal, cd into your project’s root folder, and run this command to execute the script:

node index.js

In return, you’ll get the cryptocurrency’s price denominated in both the chain’s native token and USD. This is what it might look like:

{ "tokenName": "Wrapped BTC", "tokenSymbol": "WBTC", "tokenLogo": "https://cdn.moralis.io/eth/0x2260fac5e5542a773aa44fbcfedf7c193bc2c599.png", "tokenDecimals": "8", "nativePrice": { "value": "15844922382819160000", "decimals": 18, "name": "Ether", "symbol": "ETH", "address": "0xc02aaa39b223fe8d0a0e5c4f27ead9083c756cc2" }, "usdPrice": 29012.967874240312, "usdPriceFormatted": "29012.967874240312", "24hrPercentChange": "8.125434468247821", "exchangeAddress": "0x1f98431c8ad98523631ae4a59f267346ea31f984", "exchangeName": "Uniswap v3", "tokenAddress": "0x2260fac5e5542a773aa44fbcfedf7c193bc2c599" } Congratulations; you now know how to seamlessly get the price of any cryptocurrency on any chain!

For a full tutorial on how you can build your own crypto exchange, check out the video at the outset of this article!

Summary: Cryptocurrency Exchange Development – How To Start a Crypto Exchange

We kickstarted today’s article by covering the intricacies of crypto exchanges. As such, we learned that they are platforms for buying, storing, and selling cryptocurrencies!

From there, we dove into some important things to consider before getting into cryptocurrency exchange development and building your own platform. For example, we explored the opportunities in the market and explained how exchanges make money. In addition, we covered the development costs of building your own platform.

Next, we briefly outlined an example of what the crypto exchange development process might look like. In doing so, we learned that it typically consists of five steps:

- Research

- Create a Plan

- Build the Platform

- Test and Deploy

- Maintenance

We also introduced Moralis’ Web3 API suite. This suite comprises the ultimate Web3 creator tools for anyone looking to start a crypto exchange!

If you liked this cryptocurrency exchange tutorial, consider reading more guides here on Moralis. For instance, discover what Web3 as a service is, explore a list of exciting smart contract ideas and best free NFT tools, or learn about the difference between Polygon PoS vs Polygon zkEMV.

Also, don’t forget to sign up with Moralis to leverage the industry’s leading Web3 data tools for building a cryptocurrency exchange platform. You can create an account for free, and you’ll get immediate access to all our industry-leading Web3 APIs!

Read More: moralis.io

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  Bitcoin Cash

Bitcoin Cash  Toncoin

Toncoin  Litecoin

Litecoin  Polkadot

Polkadot  WETH

WETH  USDS

USDS  Monero

Monero  Wrapped eETH

Wrapped eETH  Bitget Token

Bitget Token  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Pepe

Pepe  Pi Network

Pi Network  Ethena USDe

Ethena USDe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Uniswap

Uniswap  Bittensor

Bittensor  Dai

Dai  NEAR Protocol

NEAR Protocol  Aptos

Aptos  OKB

OKB  Jito Staked SOL

Jito Staked SOL  Ondo

Ondo  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Official Trump

Official Trump  Cronos

Cronos  Tokenize Xchange

Tokenize Xchange