In Brief

The crypto market saw a Bitcoin rally driven by institutional interest and a Federal Reserve rate cut, Ethereum surged 11% with futures spiking, and Toncoin’s ecosystem expanded with a $30M investment and new partnerships.

Bitcoin News & Macro

As the last week of September kicks off, let’s recap what had transpired in the crypto market during week 3. The big news came from the Federal Reserve’s 50 basis point rate cut, which sent a signal to investors: it’s time to seek shelter in hard assets like Bitcoin.

On the institutional front, MicroStrategy kept doubling down, raising $1.01 billion to scoop up more Bitcoin. So, big players still see long-term upside, and they’re willing to put serious money on it. Meanwhile, Coinbase’s cbBTC (its wrapped Bitcoin product) quickly became the third-largest of its kind within a week of launch. So, we’re seeing clear institutional demand for Bitcoin-backed DeFi products.

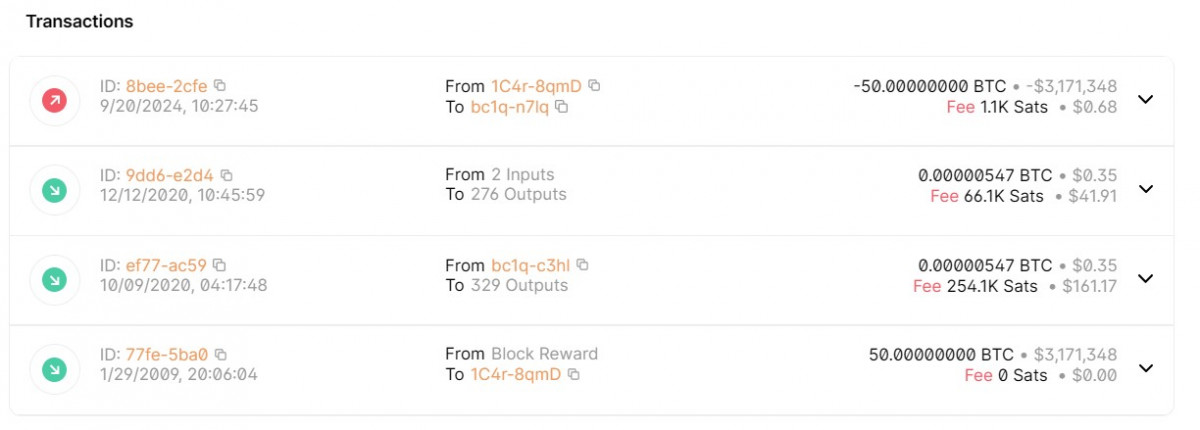

Source: Blockchain.com

Also, this past week, ancient Bitcoin miner wallets, previously dormant for over 15 years, suddenly moved. Naturally, whispers of Satoshi Nakamoto swirled, with some speculating on what this could mean for the market if those coins started trading.

BTC Price Analysis

Now, let’s talk charts, and this is where we have some good news for short-term bulls. The 1D saw a solid breakout from the previous consolidation zone between $58,000 and $62,000, finally pushing past that $62K resistance with some real momentum. This breakout set off a clean rally, with Bitcoin riding above the 20-day EMA, so buyers were firmly in control.

Source: TradingView

But as the price approached $64,000, things started to stall. This level has been a thorn in Bitcoin’s side for a while, acting as a ceiling. We’re seeing a bit of an ascending channel forming, with each push higher testing that upper boundary. The bulls are showing up to defend dips back to the $60K-$61K area, which has turned into a solid support zone now that the 50-day EMA is providing extra backing. It’s clear buyers are stepping in aggressively around here, which keeps the pressure on the upside.

Source: TradingView

Now, let’s zoom into the 4H chart. After busting out of the $58K consolidation zone, Bitcoin saw a series of sharp rallies followed by brief consolidations – classic bullish behavior, if you will. The breakout above $62K was pivotal, with the RSI spiking and showing solid momentum. But again, as the price gets close to $64K, we’re seeing a bit of hesitation. Those upper wicks on the candles tell that sellers are lurking at that level, leading to pullbacks that are quickly bought up around $61K, right near the 50-EMA.

For now, $64,000 is where all eyes are. If it cracks, we could be off to the races. If not, we might see a bit more sideways action before the next decisive move.

Ethereum News & Macro

Ethereum took center stage this past week by making an 11% surge – its biggest rally in Q3. This sparked fresh optimism, seeing that Ethereum futures open interest spiking to a 20-month High.

Source: CoinGlass

Despite this bullish wave, leverage demand remains balanced, signaling that traders are keeping a cautious hand on the wheel.

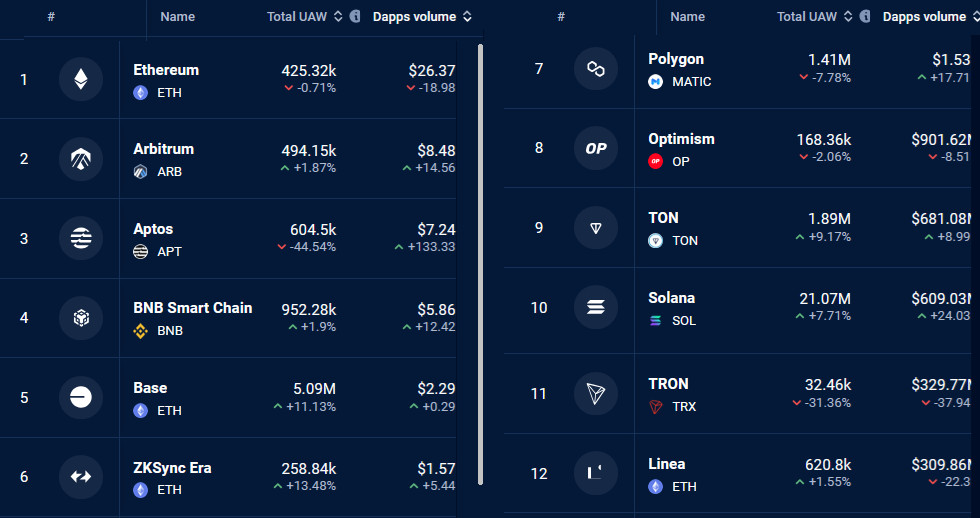

Source: DappRadar

Under the hood, though, Ethereum’s fundamentals are showing cracks. DApp activity dropped 19%, which has some questioning its long-term value. As ETH teeters around the $2,250 support, network utilization is lagging, leaving traders wondering if this dip could mark a local bottom or signal deeper concerns ahead.

Meanwhile, institutions are still placing long bets on Ethereum’s future. A high-profile investor made headlines for flipping a $151 million ETH investment into $214 million over two years, embodying the rewards of a long-term hold strategy. Matt Hougan, Bitwise’s head of research, doubled down on Ethereum as a “contrarian bet” heading into 2025, hinting at a bigger institutional push if market conditions settle.

Hougan wrote in a Sept. 17 blog post:

“From my seat, none of Ethereum’s challenges seem existential, and its opportunities are brimming. I suspect the market may reevaluate Ethereum as we get closer to the November elections and any regulatory clarity that emerges. For now, it looks like a potential contrarian bet through the end of the year.”

On the tech front, Ethereum’s ecosystem took a step forward with lower fees on Layer 2 networks, which is a milestone Vitalik Buterin emphasized at Token2049. Sure, cheaper transactions boost usability, which solidifies the network’s prospects for long-term growth. However, in the short term, broader market volatility continues to keep traders on edge.

ETH Price Analysis

Ethereum’s price action this past week has been all about a strong breakout.

Source: TradingView

On the daily chart, ETH launched off the $2,250 support zone, blowing past its 20-day and 50-day EMAs, and turning previous resistance into new support. That climb past $2,500 showed solid bullish intent, pushing the price into the $2,675 resistance range – an area where sellers have previously stepped in.

Source: TradingView

On the 4-hour chart, the rally looked steady and clean, with ETH riding the 50-EMA higher and the RSI creeping into overbought territory. What’s clear is that this was more about accumulation than wild spikes – buyers have been in control. The push toward $2,675 hit some hesitation as sellers stepped in, but there’s no sharp rejection yet, just a pause.

If ETH can flip that $2,675 level into support, we could see another run at – who knows, maybe $3,000? However, any failure to hold $2,500 could open the door for a sharper correction back to $2,400. All eyes are on how ETH handles this $2,675 zone.

Toncoin News & Macro

Meanwhile, TON had a pretty big week. The biggest splash came on September 17, when TON Foundation teamed up with Curve Finance. The partnership brings Curve’s powerful CFMM technology to TON’s stablecoin swaps, which could make transactions smoother and cut down on price volatility. For DeFi traders and institutions, this upgrade could make TON a much more attractive option, especially as the demand for efficient stablecoin trading heats up.

Souce: Bitget

On September 18, Bitget and Foresight Ventures injected $30 million into the TON ecosystem. That’s a major cash infusion, the goal being to push TON’s governance and development forward. With Bitget’s strong presence in the crypto exchange world, this kind of investment signals growing institutional confidence in TON. More adoption, more development — and possibly more demand for the token, which could translate into price gains.

Next, RedStone went live with its first oracle price feeds on TON. Oracles are the backbone of any decentralized system, providing real-time data that DeFi and GameFi apps rely on to function properly. So, for TON, this is a key infrastructure boost.

Souce: Binance

Finally, BNB Chain is been integrated into Telegram. Since TON is the native blockchain tied to Telegram, any move that expands blockchain utility within the messaging app ecosystem indirectly boosts TON’s standing. As BNB Chain mini-apps and bots flood Telegram, user activity could ramp up across the board, benefiting TON’s utility and demand in the process.

TON Price Analysis

Price-wise, TON has been in a tight consolidation over the past week, bouncing between key support at $5.55 and resistance near $5.80.

Source: TradingView

This sideways move, especially after the recent rebound from September lows around $4.70, suggests a buildup of trader pressure. On the daily chart, the price hovers just above the 20-day EMA, sitting around $5.64, while the 50-day EMA, which is near $5.78, is acting as a soft ceiling. The convergence of these EMAs points to a squeeze, and it’s only a matter of time before we see a decisive move.

Source: TradingView

On the 4-hour chart, the price is stuck in a clear range, with the 50-EMA around $5.58 acting as a strong support level. The RSI is hovering in neutral territory, indicating that there’s no strong bullish or bearish momentum right now – just consolidation. What’s clear, though, is the respect of that $5.80 resistance. Every time the price approaches it, sellers jump in, capping the upside. Meanwhile, buyers are consistently defending the $5.55 level, creating a solid floor.

The longer we stay in this range, the bigger the eventual move could be. A daily close above $5.80 could spark a breakout to $6.00 and beyond, while a failure to hold $5.55 could open the door to a drop toward $5.30 or even $5.00.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

Victoria d’Este

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

Read More: mpost.io

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  LEO Token

LEO Token  Bitcoin Cash

Bitcoin Cash  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  USDS

USDS  WETH

WETH  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Polkadot

Polkadot  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Pepe

Pepe  Pi Network

Pi Network  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Uniswap

Uniswap  Dai

Dai  Bittensor

Bittensor  Ethena Staked USDe

Ethena Staked USDe  Aptos

Aptos  NEAR Protocol

NEAR Protocol  Cronos

Cronos  OKB

OKB  Jito Staked SOL

Jito Staked SOL  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Internet Computer

Internet Computer  Ondo

Ondo  Ethereum Classic

Ethereum Classic