Portugal’s first property sale in cryptocurrency might have looked unremarkable, but it didn’t feel that way to those who had been working for nearly a year to make it happen.

On May 4, in an office in the northern city of Braga, two men pulled up chairs in front of Apple laptops. João Marques, the seller, passed a crypto wallet address to the buyer, who made a transfer and became the new owner of an apartment in the city worth €110,000 — just under three bitcoin at the time. The president of the Portuguese chamber of notaries, Jorge Silva, watched on — as did Carlos Santos, chief technology officer at the Portuguese real estate company Zome, which brokered the sale.

The whole process took just a few minutes but it was the culmination of many months of discussions between Portuguese tax, financial and notary authorities to agree on how to allow property transactions to happen entirely in cryptocurrency.

Portugal, which does not have capital gains taxes for cryptocurrencies, has been a haven for crypto investors. In mid-April, Silva’s office issued guidance on how notaries should approach crypto transactions without the need to convert to euros before becoming legal. Silva says the move reflects a clear desire on the part of buyers: “Crypto is a reality,” he says, “and now you can do [crypto sales] in a legal way with transparency, complying with everything.”

Portugal is unusual in this respect. In most countries, the absence of resources to assess associated tax implications and risks, as well as the danger of money laundering, means conversion to fiat currency is still necessary at some point in the process.

That uncertainty has not deterred companies such as Zome that have taken the plunge and are attempting to work out what a more established crypto real estate market would look like. Zome began scoping out the possibility of cryptocurrency transactions last summer, says Santos, who sees potential to tap a new client base: “If we provide [crypto investors with] a convenient way, in their language, to allow them to do real estate business in Portugal, then we will attract these guys to us.”

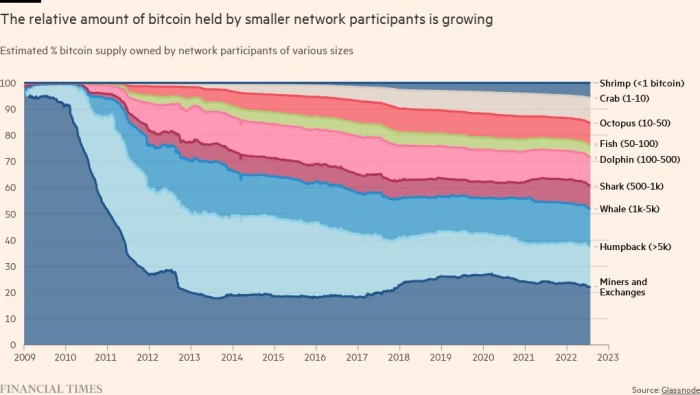

The pool of potential buyers is growing. There are now tens of thousands of bitcoin network participants who hold the equivalent of more than $1mn in their digital wallets. And a survey of US housebuyers commissioned by Redfin in December last year found that 12 per cent of first-time buyers planned to liquidate digital assets for a down payment — up from 5 per cent in the third quarter of 2019.

As trading in cryptocurrencies soared during the pandemic, some investors struck gold and found themselves with the funds to buy property for the first time. Those with established wealth also added crypto to their portfolios. The 2022 Knight Frank Wealth Report, a global survey of more than 600 wealth managers who manage portfolios for individuals worth over $30mn, found nearly one in five clients now invest in cryptocurrencies, tokens and coins.

That reflected the peak of the market. This year, a crash in crypto prices brought on by rising interest rates has spooked investors and wiped around $2tn off the value of all cryptocurrencies. Yet enthusiasm for crypto property deals remains — and not just among buyers who are looking to convert their increasingly volatile assets into safer investments.

Safe as houses

While some Web3-savvy investors have dabbled in buying virtual properties in the metaverse with their crypto funds, many would prefer their digital wealth to translate into their physical lives.

Daniel Browne, a senior real estate associate at British legal firm Kingsley Napley, says he saw interest…

Read More: www.ft.com

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Avalanche

Avalanche  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Stellar

Stellar  Wrapped Bitcoin

Wrapped Bitcoin  Hedera

Hedera  Polkadot

Polkadot  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Uniswap

Uniswap  Pepe

Pepe  Hyperliquid

Hyperliquid  Litecoin

Litecoin  LEO Token

LEO Token  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  Internet Computer

Internet Computer  Ethena USDe

Ethena USDe  USDS

USDS  Aptos

Aptos  Aave

Aave  Render

Render  Mantle

Mantle  Bittensor

Bittensor  POL (ex-MATIC)

POL (ex-MATIC)  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Virtuals Protocol

Virtuals Protocol  WhiteBIT Coin

WhiteBIT Coin  Arbitrum

Arbitrum  MANTRA

MANTRA  Monero

Monero  Tokenize Xchange

Tokenize Xchange