The first payouts have begun according to onchain data, although the timeline for when coins will be distributed to investors remains unclear.

Defunct Bitcoin exchange Mt. Gox has been causing waves in the market as firms and individuals prepare to receive reimbursements nearly ten years after the platform went under.

The administration overseeing Mt. Gox’s payout plans willdistribute $9 billion in Bitcoin and Bitcoin Cash to users who lost funds when the platform was last hacked in July, 2014.

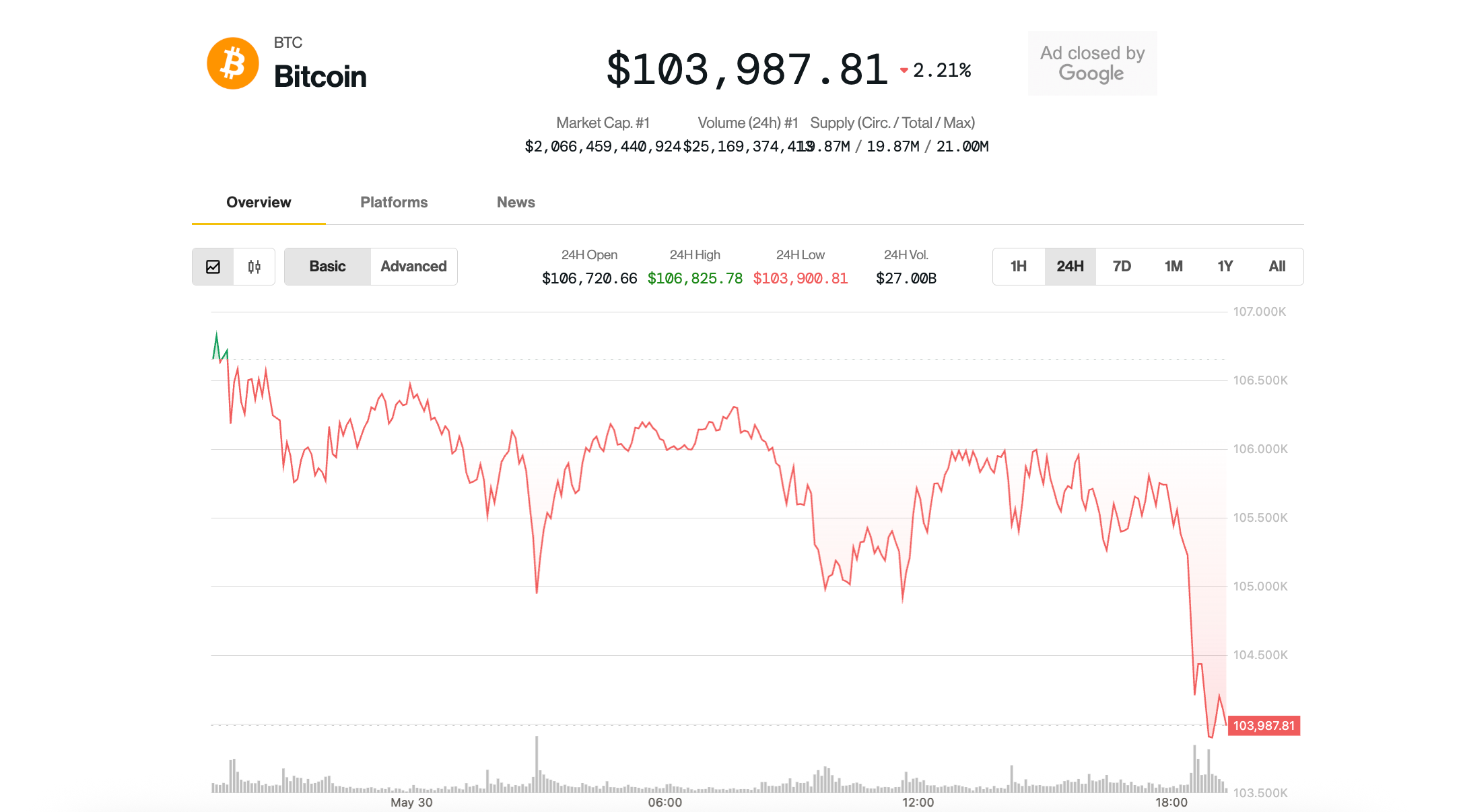

News of Mt. Gox paying out 2014-era coins that were lost in its exchange have been causing prices of tokens to bleed out.

Bitcoin has shed 20% of its value in the past month, trading now for $55,248. Meanwhile, Ethereum has slipped below the $3,000 mark, changing hands for $2,950 and also losing 20% in the past thirty days.

2014-era Coins

Most analysts agree that the sell off plaguing the market was triggered by the Mt. Gox payouts and the likelihood of tens of thousands of coins entering the market.

When the platform went down in July 2014, Bitcoin’s price was $600, meaning that at today’s value, investors are staring down a potential 10,000% profit.

Still, some are happy the crypto market will rid itself from the ever-looming threat.

“The Mt Gox coin return is causing fud today and may result in short-term BTC weakness but over the long term it will be a positive – the fear of Mt Gox coins hitting the market has been an overhang for so long that it’s just another risk being taken off the table for long term BTC success,” said Rennick Palley, Founding Partner at early stage VC firm, Stratos.

Eligible Companies

Five companies are eligible recipients of Mt. Gox-era coins, and are tasked with redistributing the payouts to individuals who lost money in the original bankruptcy: Bitstamp, Bitgo, Kraken, Bitbank and SBI VC Trade.

However, despite a June 24 notice from the trustee in charge of paying out Mt. Gox’s funds, which said funds will begin to flow in early July, details on which companies are receiving the tokens first remains murky; as does how those companies will in turn distribute the crypto they receive .

On July 4, PeckShield alerted that an address linked to Mt. Gox had made a whopping 47,000 BTC ($2.7 billion) transfer to a new address, along with 1,544 bitcoin or $84 million to the aforementioned Bitbank. One day later, Mt. Gox sent an additional 1,200 BTC or $64 million to a new address.

While Bitbank has not confirmed the payouts, data from Arkham Intelligence indicates that the company has begun to move these funds within its wallets. A wallet associated with the Japanese company shows a large number of transfers of Bitcoin over the weekend, ranging between less than 1 BTC to 90 BTC.

While concern that recipients of the funds will sell off those coins is weighing on the market, some analysts say not everyone will sell.

“Although a large portion of the tokens that are repaid will absolutely be sold off, I expect seasoned whales to keep their skin in the game ahead of the upcoming bull run,” said Phillip Alexeev, Chief Growth Officer for CrossFi. He told The Defiant, that investors have managed to live without those funds for many years, and “unless they are absolutely desperate,” can continue waiting until their returns are maximized.

Read More: thedefiant.io

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDS

USDS  Hedera

Hedera  WETH

WETH  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Polkadot

Polkadot  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Pepe

Pepe  Pi Network

Pi Network  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  Aave

Aave  Bittensor

Bittensor  Uniswap

Uniswap  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  OKB

OKB  Aptos

Aptos  Jito Staked SOL

Jito Staked SOL  NEAR Protocol

NEAR Protocol  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Tokenize Xchange

Tokenize Xchange  Ondo

Ondo  Internet Computer

Internet Computer