Most altcoins have plummeted by 30% or more in the past week, while Bitcoin trades at $62,000.

It’s been a rough week for global markets as rising tensions between Israel and Iran dominate the headlines.

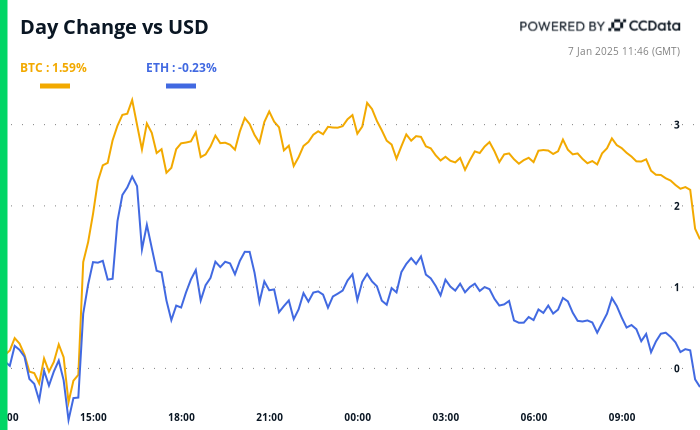

Bitcoin is down 2% today and more than 10% in the last 7 days, currently changing hands for $62,000. The world’s most valuable cryptocurrency is testing the bottom of the trading range that has contained it for the past six weeks.

Meanwhile, most altcoins have been obliterated by 30% or more as Bitcoin’s dominance – BTC’s share of total crypto market capitalization – rose above 57% on Saturday, its highest level since April 2021. Ether and Solana are down 15% and 25%, respectively, since April 9.

Most of the top 100 digital assets have been battered, with leading decentralized exchange Uniswap the week’s biggest loser with a 38% drop. Other major DeFi tokens haven’t fared much better – AAVE, DYDX and RUNE are down more than 30%.

Memecoins weren’t spared either, as sharp selloffs in popular tokens like BONK, WIF, and PEPE drove the sector to shed a third of its value over the weekend.

Buying Opportunity

While the sentiment across Crypto Twitter has turned markedly bearish, some, like renowned trader GiganticRebirth, believe that the ongoing carnage represents a good buying opportunity for sidelined capital.

“Someone once said, liquidations are a forced transfer of wealth from traders who need leverage to wealthy spot buyers. I was enjoying retirement from social media, but don’t want to see my brothers get shaken out when the future is still so bright,” they wrote on X.

After more than $1 billion of leveraged positions were liquidated over the weekend, perpetual funding rates have reset, creating a favourable environment for buyers, according to Lucas Kiely, chief investment officer of digital wealth platformYield App.

“Lots of leverage being washed out has made funding quite cheap, and there’s a relative balance between longs and shorts. Recognizing the lack of support in the market early and buying at the inflection to capture the bounce is the primary strategy that’s paying off for investors at the moment,” he told The Defiant.

Read More: thedefiant.io

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Avalanche

Avalanche  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Stellar

Stellar  Wrapped Bitcoin

Wrapped Bitcoin  Hedera

Hedera  Polkadot

Polkadot  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Uniswap

Uniswap  Pepe

Pepe  Hyperliquid

Hyperliquid  LEO Token

LEO Token  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  Aptos

Aptos  Ethena USDe

Ethena USDe  USDS

USDS  Internet Computer

Internet Computer  Aave

Aave  Render

Render  Mantle

Mantle  Bittensor

Bittensor  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Ethereum Classic

Ethereum Classic  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  WhiteBIT Coin

WhiteBIT Coin  Virtuals Protocol

Virtuals Protocol  Arbitrum

Arbitrum  MANTRA

MANTRA  Tokenize Xchange

Tokenize Xchange  Monero

Monero