According to FxPro senior market analyst Alex Kuptsikevich, the crypto market has been relatively stagnant, showing a decline in market cap until today’s increase.

Ethereum (ETH) trades at $2,977.88, a 2.6% increase over the past 24 hours. Its market cap has grown by 2.64% to over $357 billion, staying the second-largest cryptocurrency.

Kuptsikevich highlighted Ethereum’s challenges, noting its ongoing consolidation near the lower end of its price range and a “death cross” under its 200-day average, suggesting potential longer-term declines. This contrast between the short-term increase and the analyst’s medium-term concerns shows the complexities of market predictions.

Similarly to Ethereum, Cardano (ADA) has seen a 2.43% rise in its price to $0.4461, with its market cap increasing by 2.42%. Positioned as one of the 10 largest cryptos, ADA’s trading near the lower end of its range suggests a cautious outlook despite the recent uptick, mirroring Ethereum’s consolidation trend.

Litecoin’s (LTC) price has increased by 1.81% to $80.98, and its market cap has risen by 1.82%. As the 19th largest cryptocurrency, LTC continues to test its 200-day average, indicating a potential ongoing struggle to regain stronger bullish momentum. According to Kuptsikevich, Litecoin could face a protracted period of bearish trends if it fails to reclaim higher levels soon.

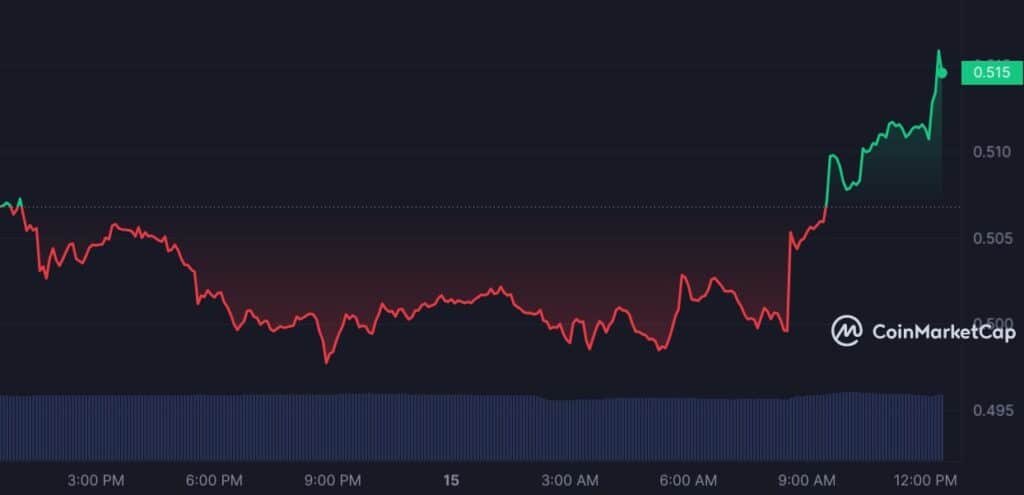

XRP is trading around a historically significant level of $0.50 after losing key support earlier in April.

“XRP broke below an upward support line, transforming it into resistance for subsequent peaks. This sets up a bearish scenario, potentially pulling back to long-term support at $0.25-30,” Kuptsikevich remarked, suggesting a cautious approach for investors.

XRP’s modest price increase of 1.57% to $0.5135 contrasts with a minor 0.56% increase in market cap. The 7th largest crypto, XRP’s break below key support levels earlier in the month points to a challenging road ahead despite some recovery, as indicated by the analyst.

In contrast, Solana (SOL) shows speculative potential, with predictions by Merkle Tree Capital suggesting a rise to $400 by November 2024, driven by meme coin popularity linked to the U.S. election campaign.

Since the Merkle Tree analysis, SOL has shown a notable surge. Its price has increased by 7.54% to $152.76, while its market cap has expanded by 7.53%, making it the fifth largest cryptocurrency.

While the short-term data from CoinMarketCap shows promising gains for these cryptocurrencies from U.S. inflation data, the medium-to-long-term analyses by Kuptsikevich paint a more nuanced picture that could be affected by other external economics.

Read More: crypto.news

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  LEO Token

LEO Token  Avalanche

Avalanche  Chainlink

Chainlink  Stellar

Stellar  Sui

Sui  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Hedera

Hedera  USDS

USDS  Toncoin

Toncoin  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  Polkadot

Polkadot  Hyperliquid

Hyperliquid  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Pi Network

Pi Network  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  WETH

WETH  WhiteBIT Coin

WhiteBIT Coin  Monero

Monero  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Pepe

Pepe  OKB

OKB  Dai

Dai  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Aptos

Aptos  Ondo

Ondo  Gate

Gate  Tokenize Xchange

Tokenize Xchange  NEAR Protocol

NEAR Protocol  sUSDS

sUSDS  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Internet Computer

Internet Computer  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Mantle

Mantle