- Osmosis outperforms other DEXes in terms of development activity

- Despite this, Cosmos’ TVL continues to decline, along with its trading volume

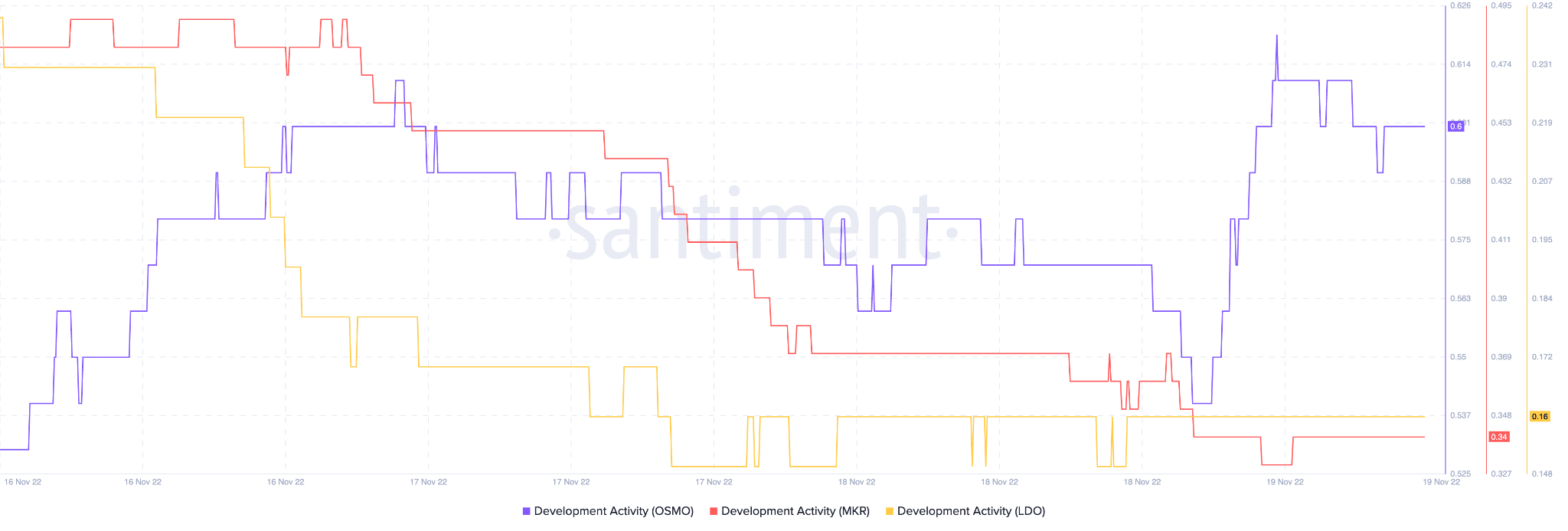

Osmosis, a DeFi project on the Cosmos blockchain, could be imperative for the latter’s growth in the DeFi space. This was because Osmosis managed to take a lead among DeFi protocols, such as MakerDAO and Lido in terms of development activity over the last few days.

Read Cosmos’ [ATOM] price prediction 2022-2023

As can be seen from the image below, Osmosis’ GitHub witnessed a spike, which suggested that its developers were actively contributing towards its GitHub. This growing activity could help Osmosis expand even further and have a positive impact on Cosmos’ DeFi efforts.

Not all good news for Cosmos

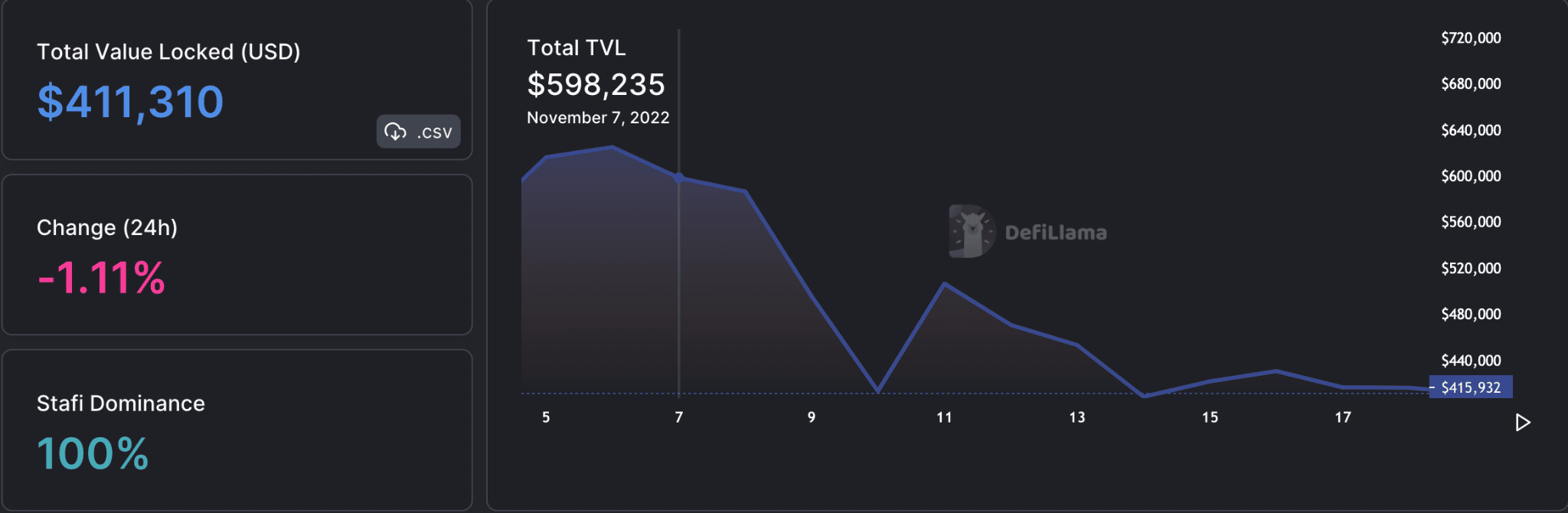

Unfortunately, at the time of writing, Cosmos was unable to perform well in the DeFi sector. Furthermore, as can be seen from the image below, it can be observed that the blockchain’s total value locked (TVL) depreciated substantially over the past few weeks.

As of 19 November,Cosmos’ total value locked stood at $411,310, having depreciated by 1.11% between 18 and 19 November.

However, even though Cosmos did not grow in the DeFi space, stakers continued to show an interest in it. The number of stakers on the Cosmos network grew by 0.15% over the last seven days. They were generating a reward rate of 19.25% at the time of press, according to data provided by Staking Rewards.

Despite the increase in the number of stakers, the overall fees generated by Cosmos depreciated by 30.6% in the last seven days, according to Token Terminal.

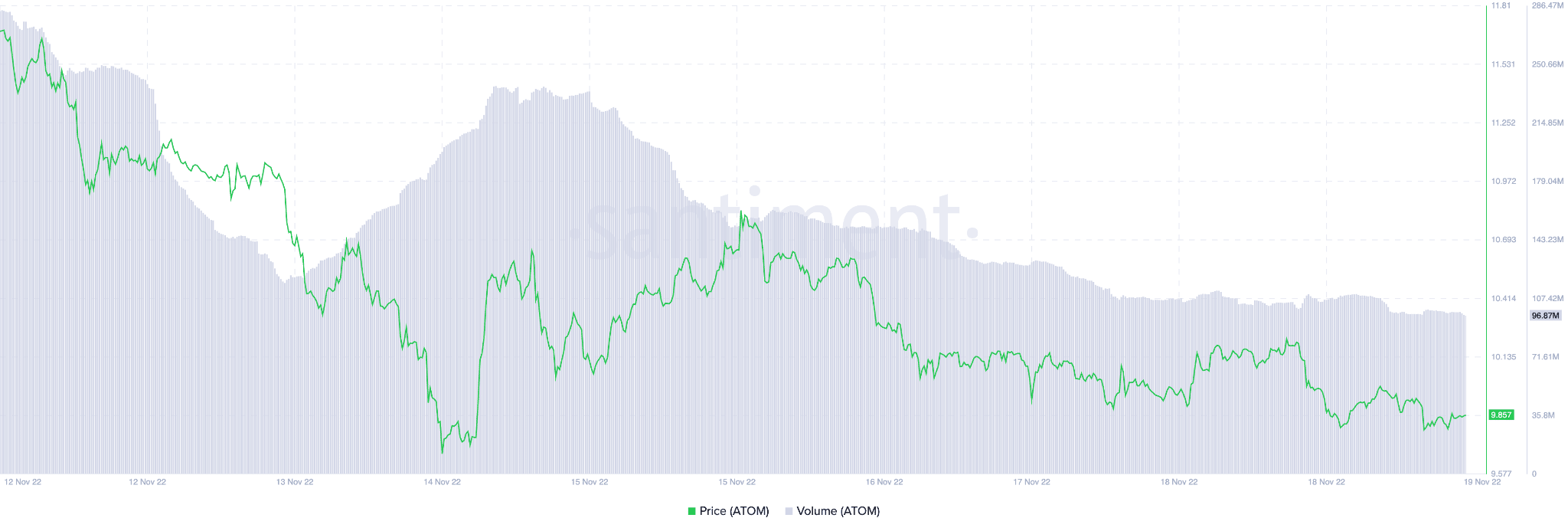

Cosmos’ volume continued to depreciate as well, plummeting all the way from 283 million to 98 million over the course of a week. Its market cap followed suit and declined along with the volume.

These negative factors, coupled with the overall FUD surrounding the crypto market, had a detrimental impact on ATOM’s price.

At the time of writing, ATOM was trading at $9.98. Its price had appreciated by 1.75% in the last 24 hours, according to CoinMarketCap.

Read More: ambcrypto.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Hyperliquid

Hyperliquid  Stellar

Stellar  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  Bitcoin Cash

Bitcoin Cash  Toncoin

Toncoin  Litecoin

Litecoin  Polkadot

Polkadot  WETH

WETH  USDS

USDS  Monero

Monero  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Bitget Token

Bitget Token  Pepe

Pepe  Pi Network

Pi Network  Ethena USDe

Ethena USDe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Uniswap

Uniswap  Dai

Dai  Aave

Aave  NEAR Protocol

NEAR Protocol  Aptos

Aptos  OKB

OKB  Ondo

Ondo  Jito Staked SOL

Jito Staked SOL  Tokenize Xchange

Tokenize Xchange  Cronos

Cronos  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Ethereum Classic

Ethereum Classic