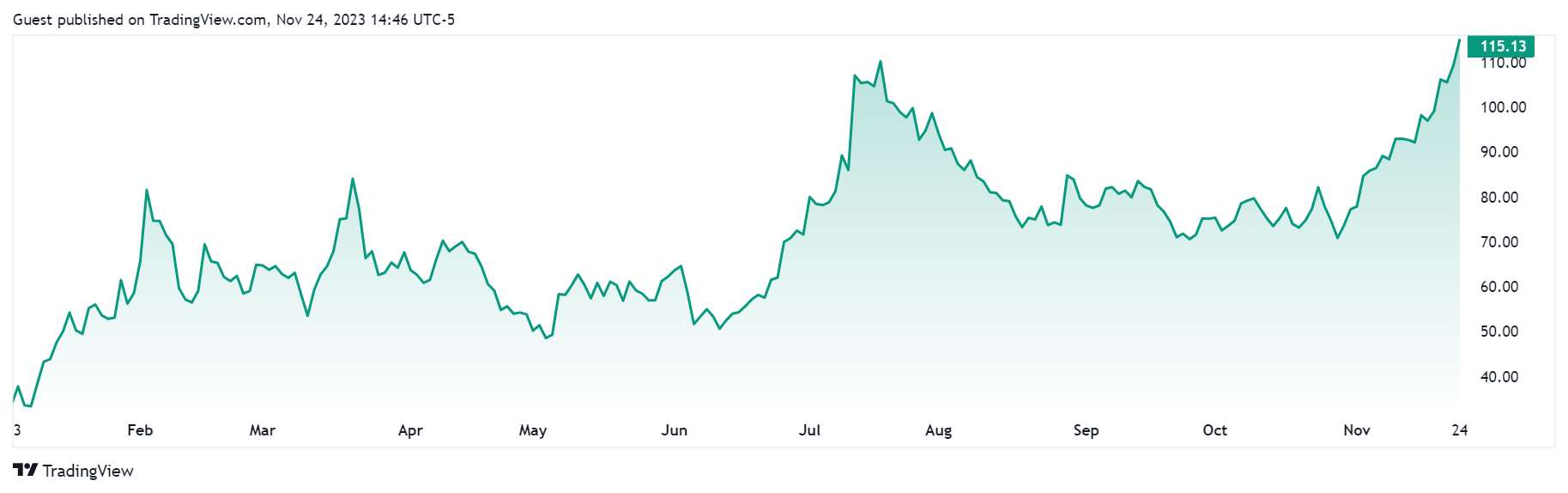

Coinbase’s COIN stock has rallied to its highest point since late April 2022 at $115, representing a 216% growth on the year-to-date metric, according to Tradingview data.

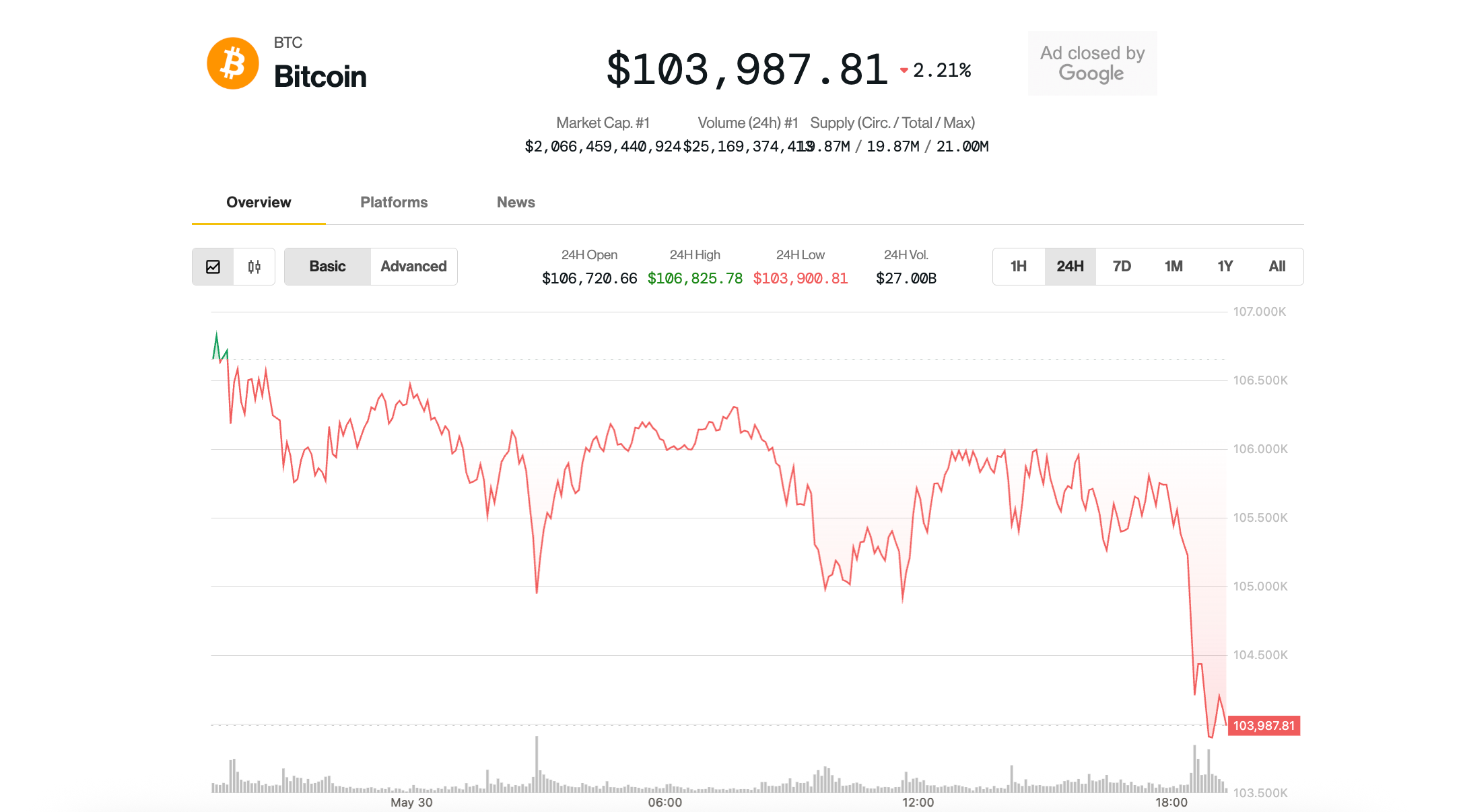

Observers have linked COIN’s price performance to the generally positive trend observed in the crypto space, where flagship digital assets like Bitcoin, Ethereum, and Solana have recorded more than 100% gains during the past year.

Why Coinbase stock is rising

Over the past year, Coinbase has emerged as one of the biggest industry players following the collapse of several crypto firms.

The exchange’s strong reputation has played a huge role in its business as it has recently touted its strong compliance-first approach following the issues of rivals like Binance.

Coinbase CEO Brian Armstrong stated this approach has been proven right, highlighting how the firm embraced “compliance to become a generational company” that can stand the test of time.

Besides that, the company also plays an active role in several spot Bitcoin exchange-traded fund (ETF) applications with the U.S. Securities and Exchange Commission (SEC).

Several applicants, including Fidelity, Invesco, WisdomTree, VanEck, and Ark 21 Shares, have surveillance-sharing agreements (SSAs) with the exchange. Additionally, the firm would be helping asset managers like Franklin Templeton custody of their fund’s BTC.

Meanwhile, the exchange has grown substantially, securing Bermuda’s licensing to launch an international exchange and offering perpetual futures trading to non-U.S. retail customers.

Additionally, it has secured licenses in several European countries, including the Netherlands, Spain, Ireland, Singapore, and Italy, as part of its expansion outside the U.S.

It has also launched several products, including creating an institutional lending service, adding new assets, and unifying its USD and USDC order books.

Read More: cryptoslate.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDS

USDS  Hedera

Hedera  WETH

WETH  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Polkadot

Polkadot  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Pepe

Pepe  Pi Network

Pi Network  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  Aave

Aave  Bittensor

Bittensor  Uniswap

Uniswap  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  OKB

OKB  Aptos

Aptos  Jito Staked SOL

Jito Staked SOL  NEAR Protocol

NEAR Protocol  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Tokenize Xchange

Tokenize Xchange  Ondo

Ondo  Internet Computer

Internet Computer