By Victor Ramirez, Uriel Morone, Kevin Lu, and the Coin Metrics Team

Today we are excited to be releasing a sweeping new report that offers a methodology to translate the existing legal language of securities frameworks into objective, measurable criteria derived from blockchain (“on-chain”) data. Below, we give a high-level introduction to the report followed by a download link to read it in its entirety.

As a response to rampant risk-taking and fraud in the capital markets of 1920’s America, the United States Congress was compelled to enact laws aimed at safeguarding investors from information disparities and fostering transparent markets. This rule-making response not only established the disclosure requirements for publicly issued securities but also led to the creation of the Securities and Exchange Commission (SEC), the chief regulator of American securities markets.

A hundred years later, crypto markets are mirroring the boom and bust cycle of the 1920’s, similarly inciting debate over how markets ought to be regulated. At the heart of this public-private tug-of-war is the crucial task of determining which digital assets fall under the category of securities—a question that has remained foggy for years in the US.

But a recent string of events has brought this long-standing question to the forefront. The SEC’s complaints filed against Coinbase and Binance US in June 2023, in which the commission has alleged that over a dozen assets are offered on the exchanges as unregistered securities, have formally laid out some of the current regulatory body’s arguments. This is all happening against a backdrop of lawmakers in Congress working on a renewed effort to pass a Market Structure Bill, aiming to create clear rules of the road for the digital assets ecosystem.

Then, just in the last two weeks, the New York Southern District Court struck down some of the SEC’s claims against Ripple Labs for allegedly selling XRP as an unregistered security—a landmark decision that preceded a multi-billion dollar move higher in some crypto-asset market valuations. This ruling has not only set a potential precedent but also highlighted the high stakes of this issue.

Sources: Coin Metrics Network Data, SEC Filings

When we talk about high stakes, the numbers speak for themselves. A total of $74 billion, or 6% of the entire $1.1 trillion crypto market, is attributable to assets that the SEC alleges are securities, including XRP, BNB, SOL, and other multi-billion market cap projects. But notably, nearly $500 billion (43%) of the market consists of assets with no clear classification.

A key prong of the discussion is the extent to which crypto assets fit cleanly under existing securities laws. While this is up for debate, a clear novelty of crypto assets versus traditional financial assets is in the data transparency they offer. Public ledgers allow data providers like us to build metrics and analyze the movements of tokens on-chain in real-time. We found that on-chain data can provide objective and measurable supporting evidence that could help determine which assets are securities.

With this in mind, it is possible that on-chain metrics can provide supporting evidence that could help determine which assets are securities. Our new report aims to shed light on this exact subject. Using Coin Metrics’ full suite of data, we outline several key areas of data analysis to translate the legal language of existing frameworks into objective, measurable criteria.

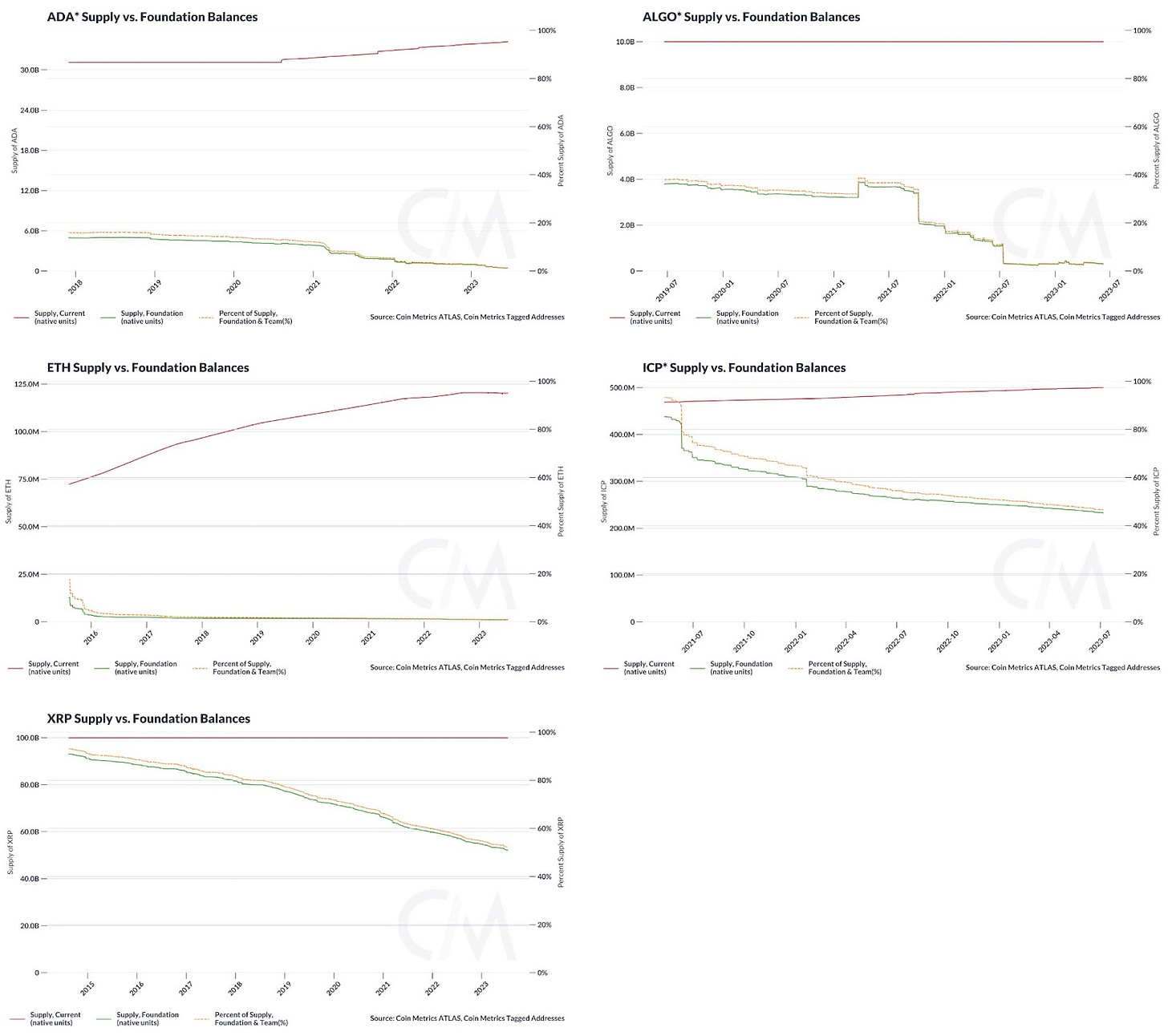

For example, we examine the token balances of teams and foundations for a sampling of crypto projects compared to their total issued supply to try and gauge the “common enterprise” prong of the Howey Test—the eponymous set of criteria emerging from the 1946 case of SEC v W.J. Howey which famously involved investment contracts in Floridian orange groves managed by W.J. Howey’s company, Howey-in-the-Hills Service Inc.

While on-chain metrics may offer valuable insights, they are not a definitive tool for classifying assets as securities. The SEC’s enforcement actions and framework do not point to a single “smoking gun” metric. Instead, a comprehensive legal analysis is required, with data likely serving as just one piece of the puzzle.

Clear rules will allow the industry to be more transparent. With clearer securities regulations, compliance can be more easily measured on-chain, a unique property of blockchains. New securities frameworks which accurately reflect the realities of blockchain technology have the opportunity to allow for clear measurements of compliance. Forging a path to compliance for protocol projects will allow the industry to operate in the US with more clarity. On-chain data may very well have an important role to play in this outstanding multi-billion dollar question.

Read the full report, From Orange Groves to Orange Gold, below.

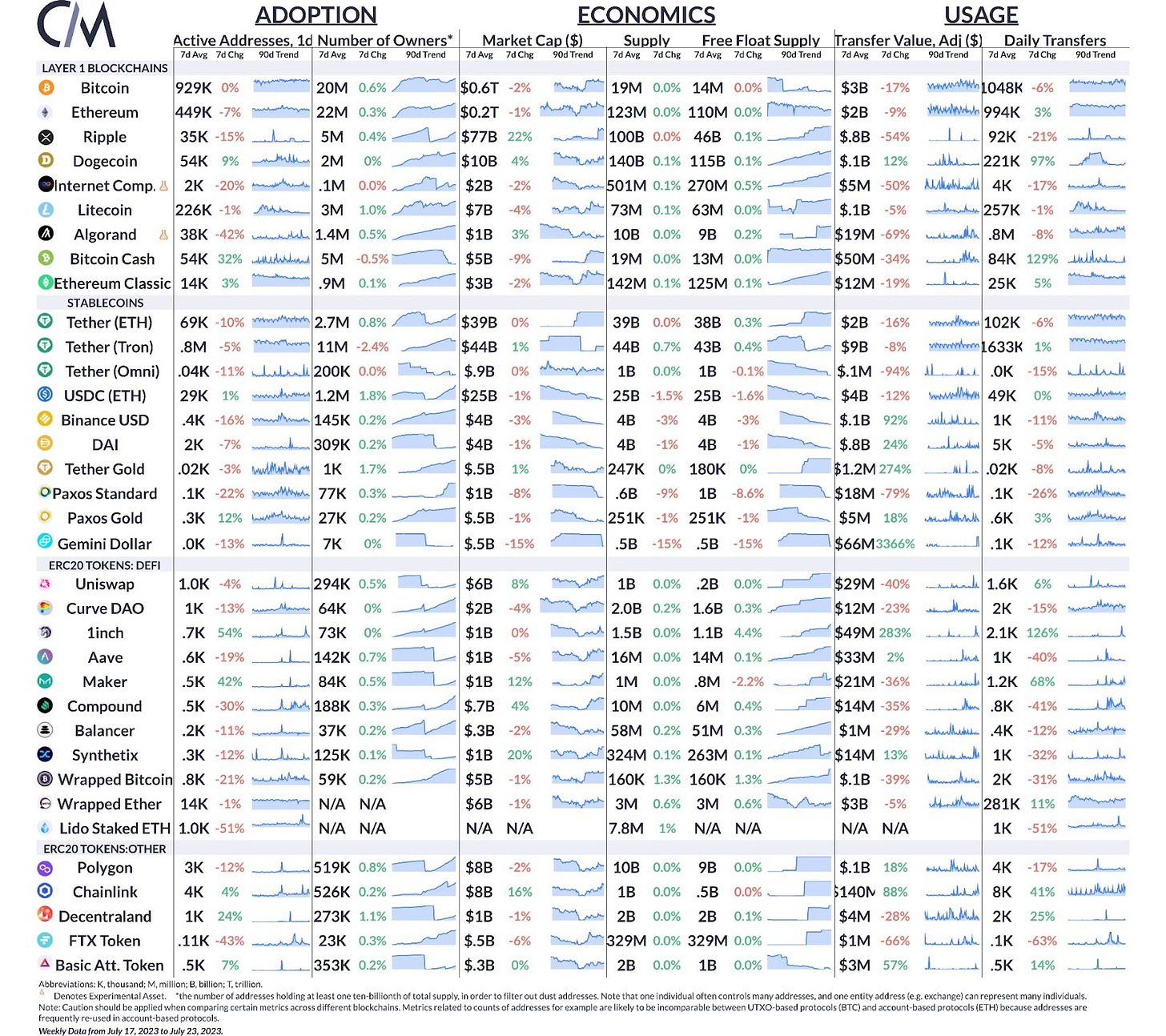

Source: Coin Metrics Network Data Pro

Activity across the major L1 blockchains was flat or down over the week with Bitcoin and Ethereum active addresses unchanged and down 7%, respectively. Stablecoin supply contracted slightly over the week, with USDC supply on Ethereum around 25B. Activity in Chainlink’s LINK token surged, as the platform’s Cross-Chain Interoperability Protocol (CCIP) launched last week.

This week’s updates from the Coin Metrics team:

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you have any feedback or requests please let us know here.

If you’d like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

© 2023 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter.

Read More: coinmetrics.substack.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Sui

Sui  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  LEO Token

LEO Token  Bitcoin Cash

Bitcoin Cash  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDS

USDS  Hedera

Hedera  WETH

WETH  Wrapped eETH

Wrapped eETH  Litecoin

Litecoin  Polkadot

Polkadot  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Pepe

Pepe  Pi Network

Pi Network  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Uniswap

Uniswap  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Bittensor

Bittensor  Aptos

Aptos  Cronos

Cronos  OKB

OKB  NEAR Protocol

NEAR Protocol  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Internet Computer

Internet Computer  Jito Staked SOL

Jito Staked SOL  Ethereum Classic

Ethereum Classic  Ondo

Ondo