- CHZ’s bear run has been met with disappointment

- The chance of CHZ retracing its direction to the greens was minimal and could last for a while

Several investors tipped Chiliz [CHZ] to put up an excellent performance as the FIFA world cup began, owing to its popularity as a blockchain-based sports project. However, that has not been the case, as CHZ shredded 29.09% in the last seven days.

Read AMBCrypto’s Price Prediction for Chiliz 2023-2024

According to CoinMarketCap, the token only registered modest gains between 22 and 23 November since the event began. These gains looked negligible as CHZ’s value decreased by 5.15% in the last 24 hours.

Buy the rumor, sell the news?

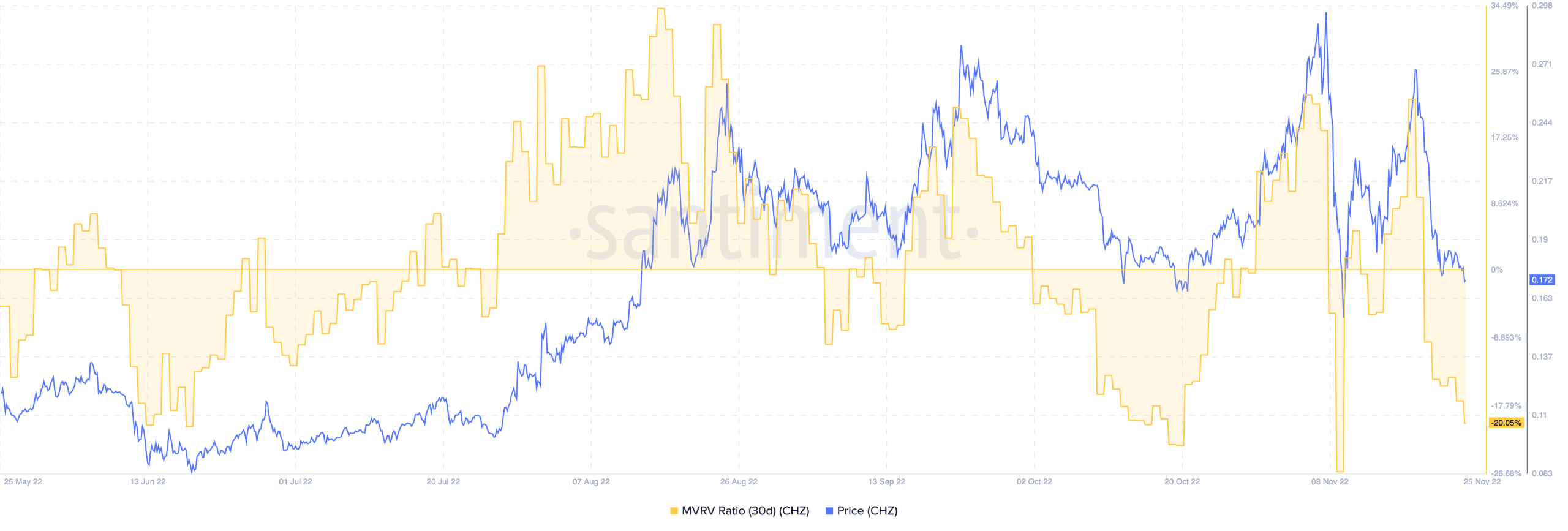

Considering this position, it might be inferred that the opposite effect of anticipation could be related to buying the rumor and selling the news situation. In the lead-up to the event, Santiment revealed that the Market Value to Realized Value (MVRV) ratio went as high as 21.97%. This implied that CHZ investors could gather some profits from upticks.

With the price trading at $0.172, and the MVRV ratio dropping to 20.05%, Chiliz might find it challenging to edge closer to doubling the aforementioned value.

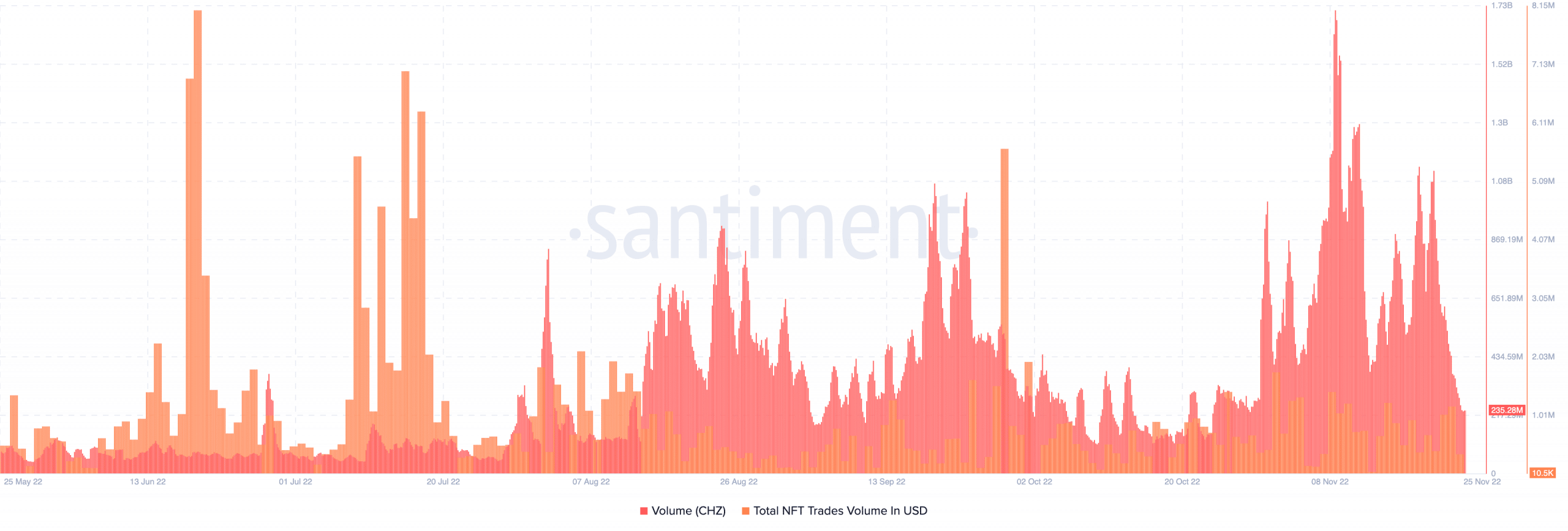

Likewise, the CHZ volume was in a comparable spot with the MVRV ratio. According to Santiment, the token’s volume had lost 24.32% of its value from the previous day. This meant that the number of transactions that had passed through the Chiliz network had substantially decreased.

More unfortunate events seemed to have spread around the Chiliz ecosystem. At press time, engagements on the NFT side could not make up for the price and volume dump. This position inferred that traders had overlooked owning non-fungible collectibles linked to Chiliz. Hence, the overall interest in the token was at an unexpectedly low rate.

Hold on to CHZ till the end, or sell?

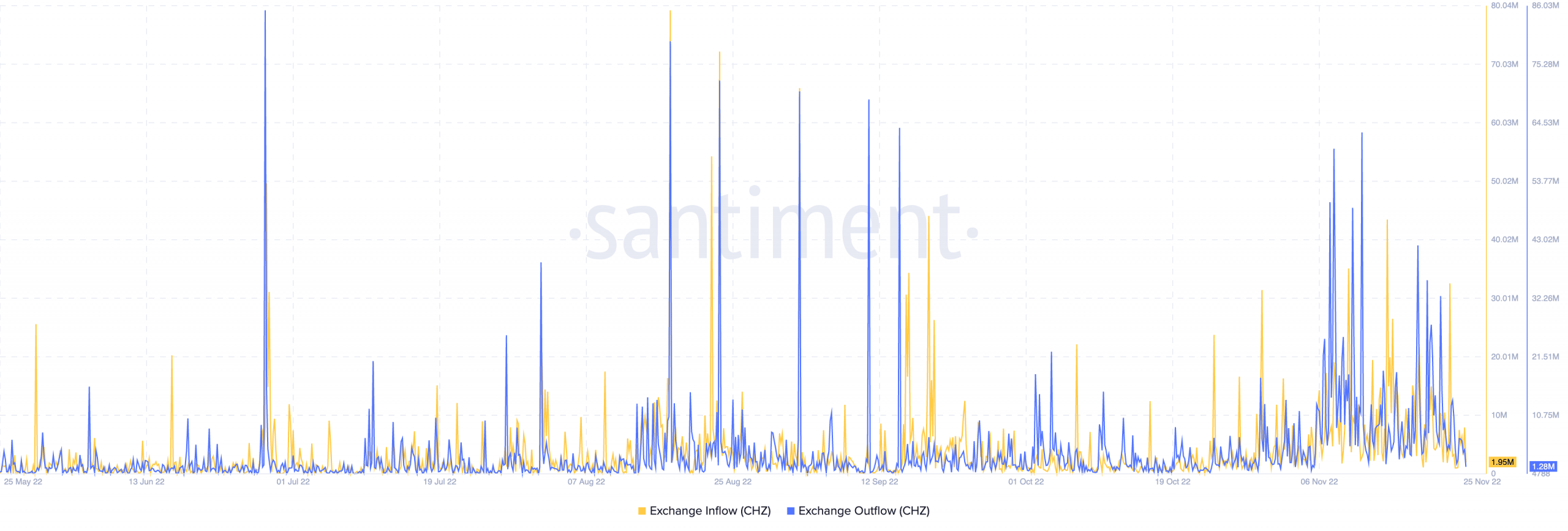

In addition, there was a 57,000 difference between the exchange inflows and outflows. With the exchange inflow at 620,000, it meant that there was a high possibility of selling pressure. However, the slight difference between the in and out supply could imply a chance of neutralizing the sell-offs.

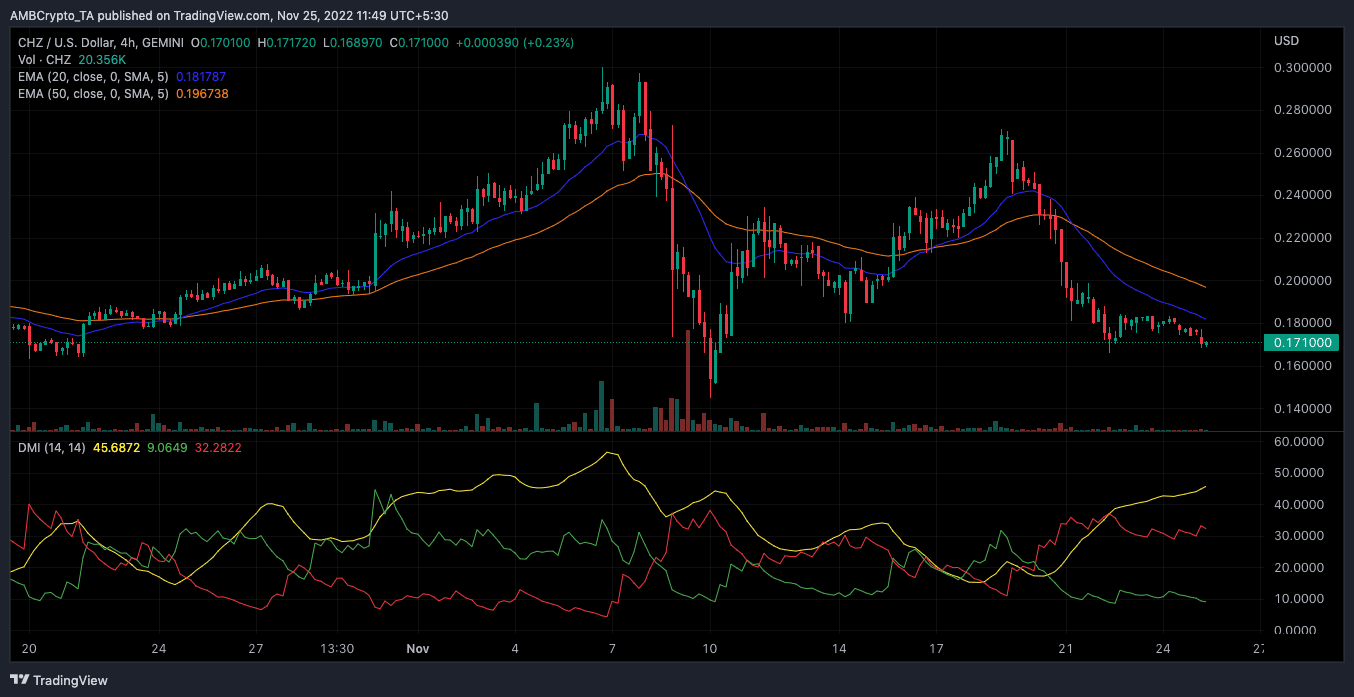

As per indications on the four-hour chart, CHZ’s chances of respite were minimal due to the status of the Directional Movement Index (DMI). Based on the DMI, CHZ was likely to remain in the red. This was because the Average Directional Index (yellow) at 45.68 supported the continued control of a price decline.

A glance at the Exponential Moving Average (EMA) also indicated that the CHZ looked destined for more fall. This was because the 50 EMA (orange) was positioned above the 20 EMA (blue). Hence, the decrease was unlikely to halt in the short term.

Read More: ambcrypto.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Avalanche

Avalanche  Shiba Inu

Shiba Inu  TRON

TRON  Toncoin

Toncoin  Stellar

Stellar  Wrapped stETH

Wrapped stETH  Polkadot

Polkadot  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Sui

Sui  Pepe

Pepe  NEAR Protocol

NEAR Protocol  Litecoin

Litecoin  LEO Token

LEO Token  Uniswap

Uniswap  Hedera

Hedera  Wrapped eETH

Wrapped eETH  Aptos

Aptos  Internet Computer

Internet Computer  USDS

USDS  Cronos

Cronos  Ethereum Classic

Ethereum Classic  POL (ex-MATIC)

POL (ex-MATIC)  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Bittensor

Bittensor  Render

Render  Ethena USDe

Ethena USDe  Filecoin

Filecoin  Algorand

Algorand  Arbitrum

Arbitrum  Stacks

Stacks  Dai

Dai  Celestia

Celestia  Bonk

Bonk  Immutable

Immutable  Cosmos Hub

Cosmos Hub