[ad_1]

Get the best data-driven crypto insights and analysis every week:

By: Tanay Ved

-

$TRUMP drove a surge in trading, with trusted exchange volumes reaching $20.5B and retail onboarding pushing active wallets to 6.5M (+25%).

-

Stablecoin supply grew to $12B, with USDC making up 81%, boosting liquidity in Solana’s ecosystem.

-

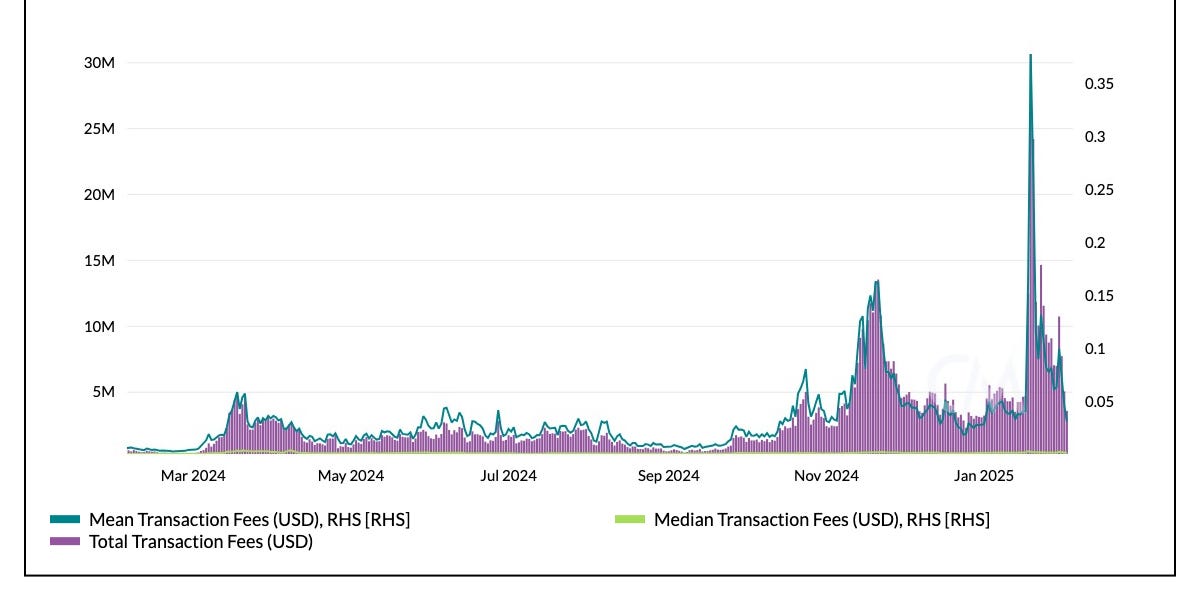

Total fees reached $30.6M, as network congestion increased average fees while median fees remained stable, providing a key stress test for Solana’s infrastructure and applications.

The crypto ecosystem—and Solana in particular—experienced a historic weekend as Donald Trump was sworn in as the 47th U.S. President on January 20th. Just two days before his inauguration, $TRUMP, a meme coin tied to the President, launched on Solana in an unprecedented event that surprised markets and sparked widespread discourse. The surge in retail onboarding pushed Solana’s network activity to new highs, boosted ecosystem liquidity, and, most importantly, provided a real-world stress test for the network.

In this issue of State of the Network, we analyze how Solana fared during this period, examining exchange volumes, adoption trends, stablecoin supply, and transaction fees amid the surge in activity. Additionally, we explore the broader market reaction, including the $2B in crypto liquidations triggered by Trump’s new tariff policies—an unexpected but significant ripple effect of the week’s political developments.

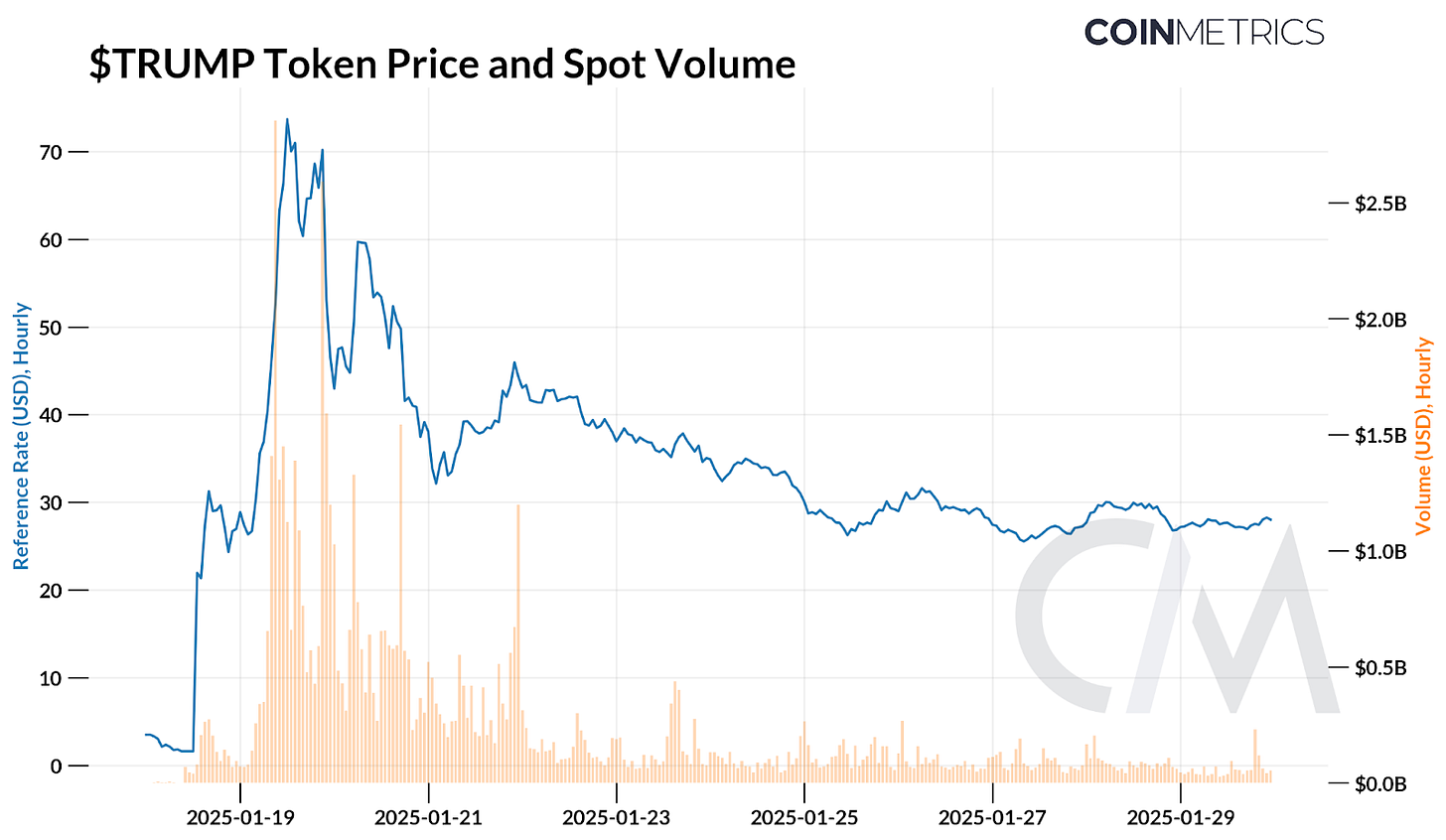

The $TRUMP coin launched just 48 hours before inauguration, catapulting to a ~$8B market cap within its first four hours. Hourly spot volumes hit staggering levels amid elevated trading activity on centralized and decentralized exchanges (DEXs), reaching over $2.5B. Solana (SOL) itself hit a record in spot volumes, reaching $21.7B on January 19th. However, this frenzy was short-lived as attention and liquidity quickly shifted to $MELANIA, a meme coin tied to the First Lady.

Source: Coin Metrics Reference Rates, Intraday

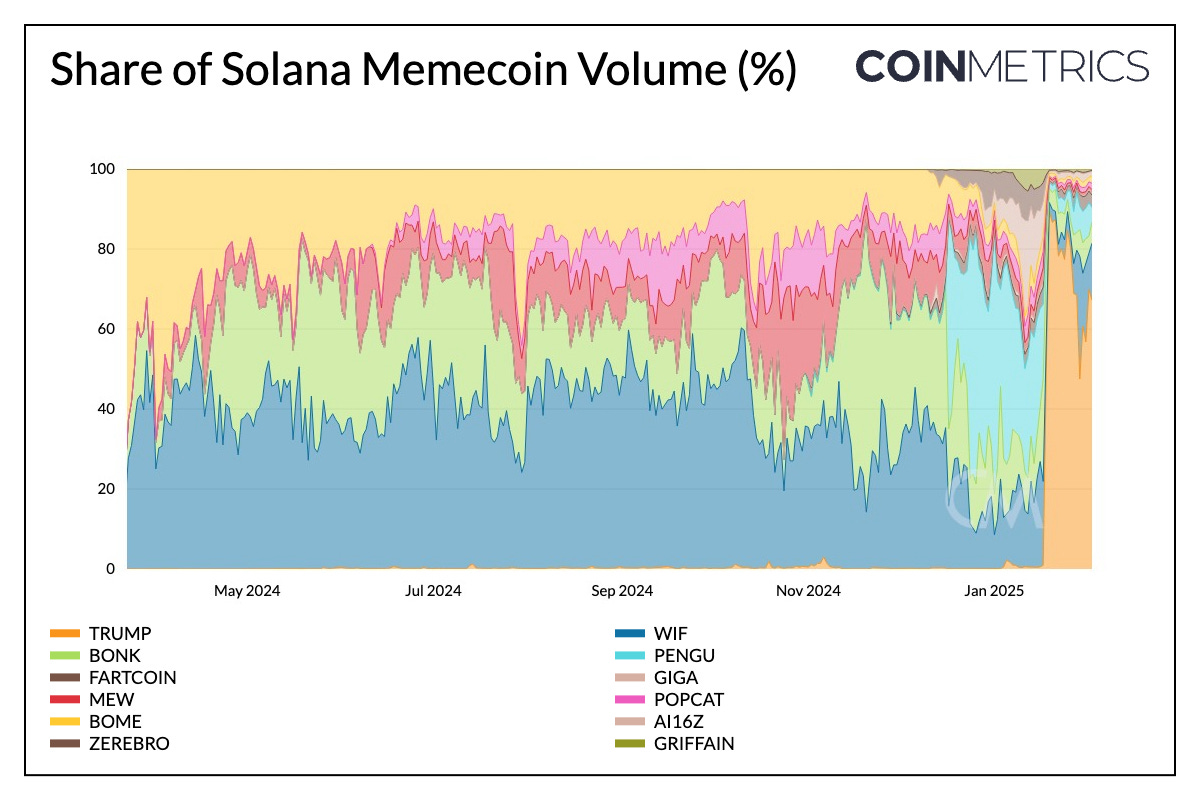

This pattern is emblematic of the memecoin sector, where attention and liquidity rotate rapidly between tokens, often leading to significant drawdowns. While a few large-cap meme coins manage to sustain activity, most remain highly cyclical, with capital and mindshare shifting due to token fatigue and a lack of net new inflows. As seen below, $TRUMP quickly dominated the market, capturing 90% of trading volume among tokens on Solana—including meme coins and AI-agent tokens—pushing daily spot volume to $21B.

Source: Coin Metrics Market Data Feed

Solana has cemented itself as a hotspot for meme coins and a retail consumer base, thanks to its low fees, seamless user experience and applications like Pump.fun and Moonshot, which simplify the discovery, creation, and trading of meme coins. Notably, Moonshot even topped the free finance category in the U.S. Apple App Store during this period.

However, this time, the network faced a significant stress test. Amid the speculative frenzy, Solana saw a surge in adoption and stablecoin supply while processing an immense volume of transactions, all while keeping fees low and relatively predictable.

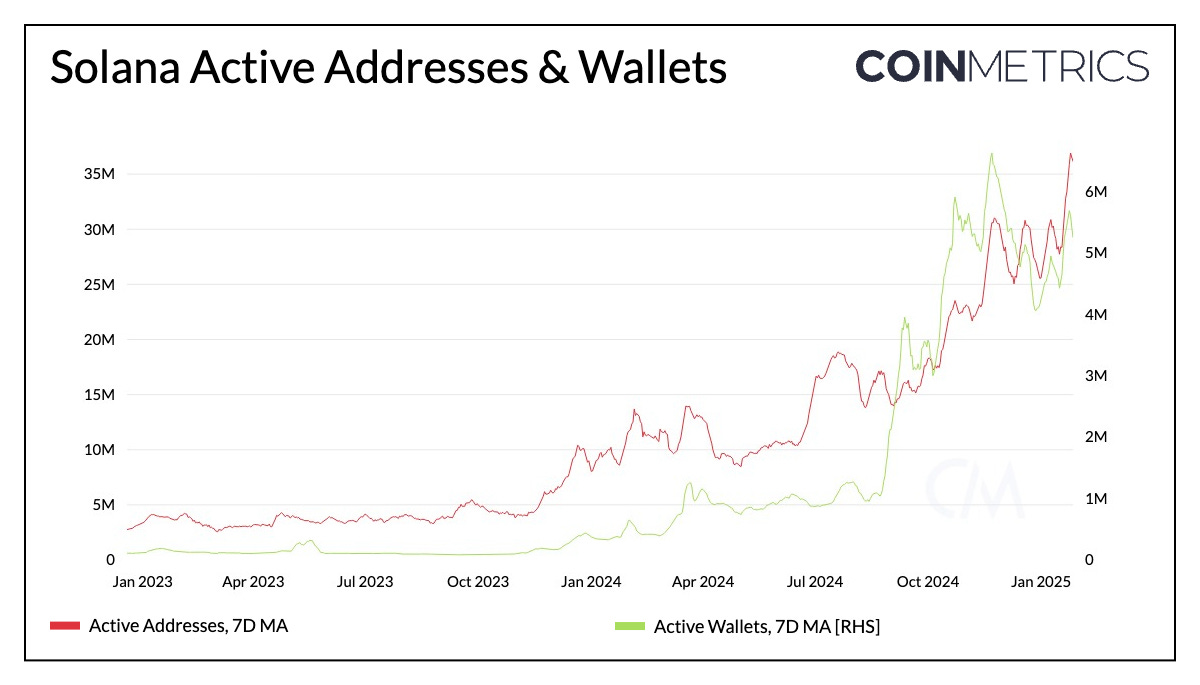

Solana account activity surged during this period. On a 7-day average, SOL active addresses and active wallets rose to 37M and 5.7M, respectively. Since Solana supports both externally owned accounts (EOAs) and program-derived accounts (PDAs), active address counts can appear inflated, as each program generates its own unique address. To better gauge user influx, active wallets provide a more reliable metric. While SOL active addresses jumped 38% to ~40M, active wallets increased by 25% to 6.5M. However, activity has since tapered off, suggesting that while user adoption saw a temporary spike, it lacked sustained momentum.

Source: Coin Metrics Network Data Pro

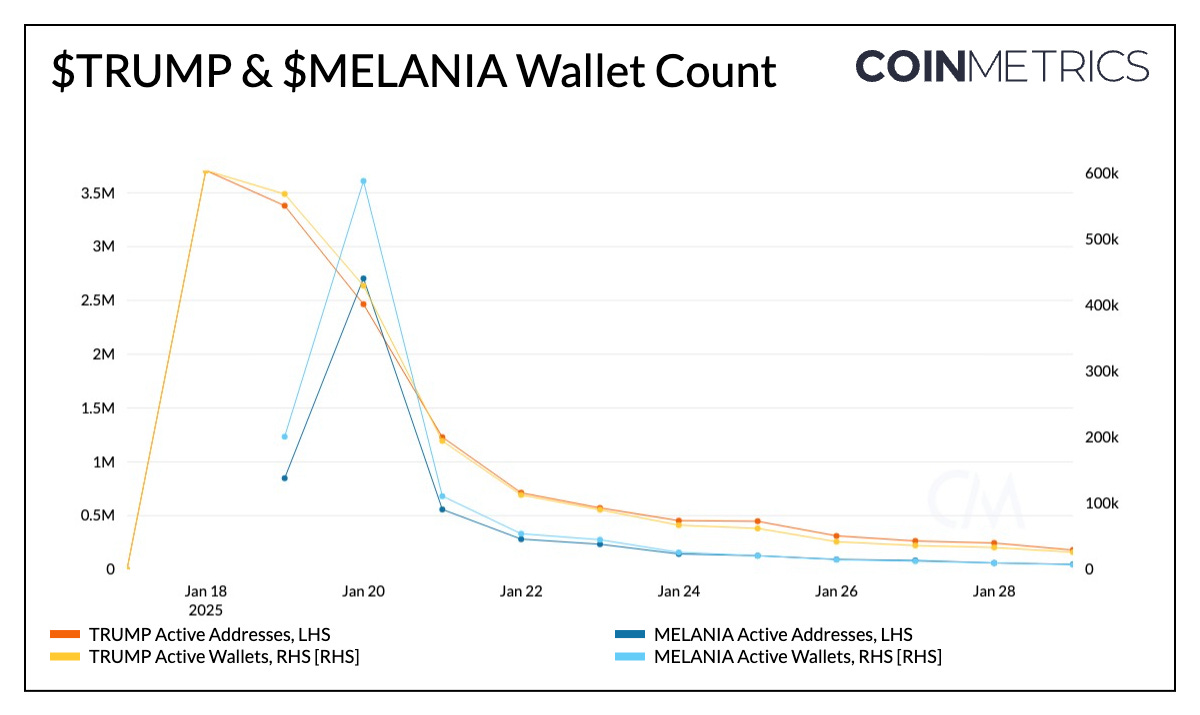

Similarly, $TRUMP saw a surge in account activity, reaching 3.7M active addresses and 604K active wallets on January 18th. However, with the launch of $MELANIA, attention and liquidity rotated, leading to 2.7M active addresses and 588K active wallets on the Solana network.

Source: Coin Metrics Network Data Pro

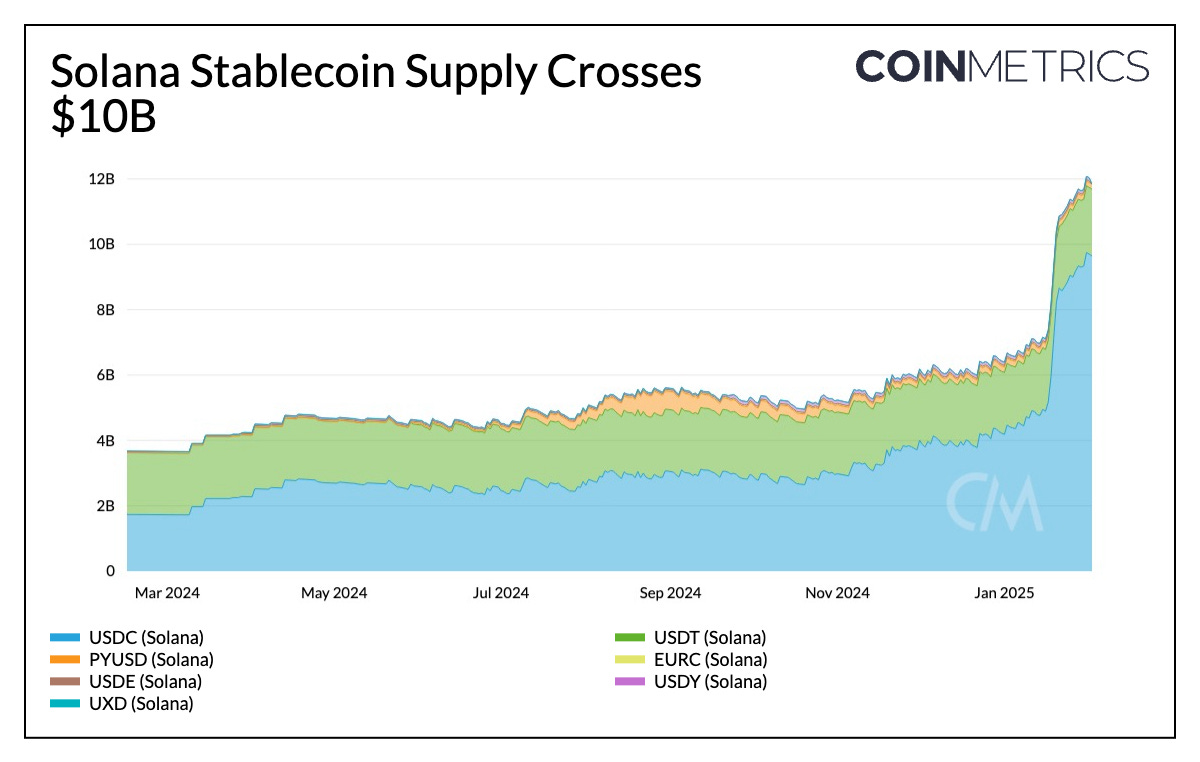

One major side-effect of the weekend’s events was a significant increase in Solana’s stablecoin supply. Over the span of just 5 days, Solana’s stablecoin supply grew from $6.1B to $10.2B, hitting this milestone for the first time. Since then, it has continued to climb higher to $12B, with USDC representing 81% of network share. While Solana’s stablecoin supply still trails behind Ethereum and Tron, this provided a significant boost to liquidity in the ecosystem as traders sought exposure to the newly launched tokens through aggregators like Jupiter and exchanges like Raydium and Meteora.

Source: Coin Metrics Network Data Pro

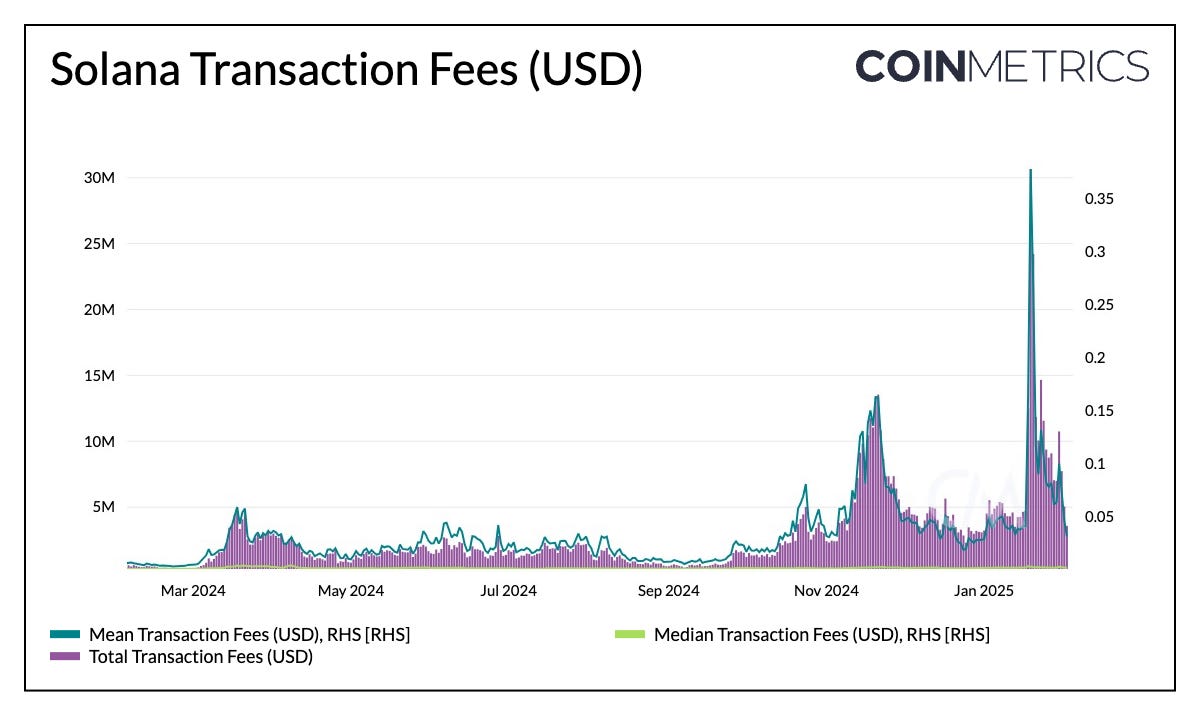

As users flocked to the Solana blockchain to gain exposure to the $TRUMP coin, demand for blockspace surged in tandem. While mean transaction fees spiked by 825% to $0.37 in response to network congestion, median fees remained significantly low at around $0.003. Although transaction demand was high, most users still faced low and predictable costs, while a cohort of users paid higher fees to prioritize transactions. During this period, total fees rose to $30.6M, while priority fees represented 98% of the total, as users raced to increase their likelihood of transaction inclusion by the lead validator.

Source: Coin Metrics Network Data Pro

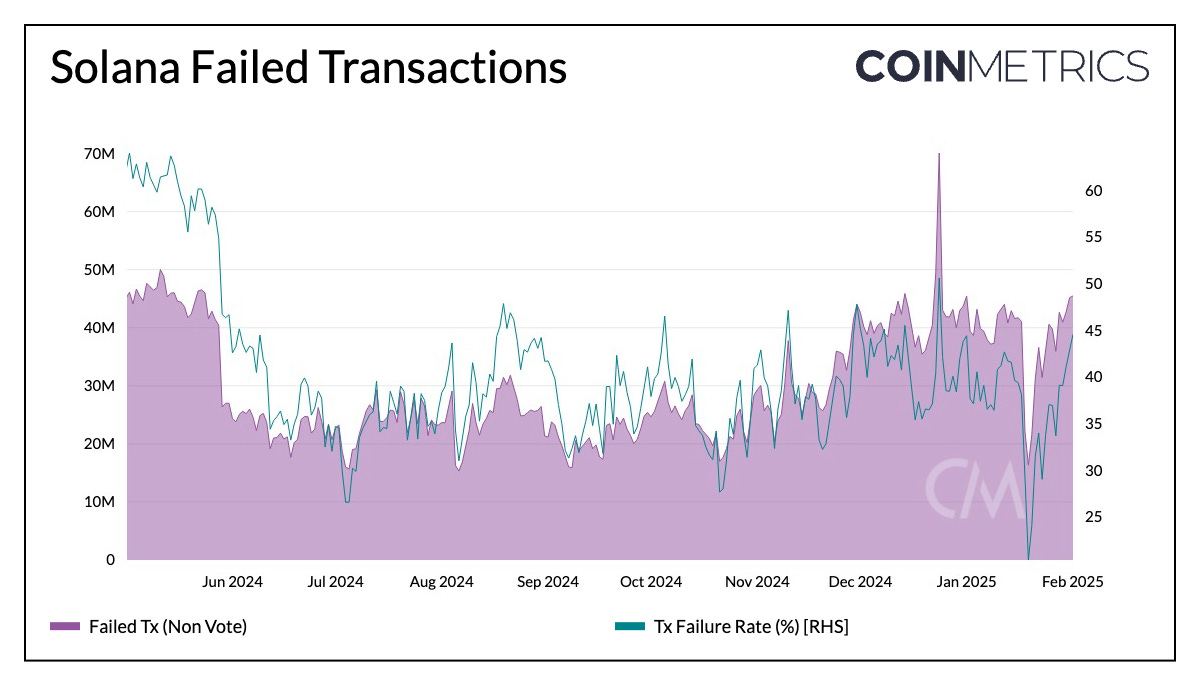

Due to extreme demand on the network, paired with Solana’s low-fee architecture, arbitrage opportunities surged, attracting a flood of bots attempting to exploit price discrepancies. Solana relies on Jito’s block engine and Jito-Solana client infrastructure to optimize transaction processing and facilitate out-of-protocol tips, enhancing validator incentives through maximal extractable value (MEV). However, as congestion increased, Jito’s block engine became overwhelmed, causing degraded performance.

Source: Coin Metrics Network Data Pro

Bots that relied on Jito for transaction submission struggled to adapt, leading to a sharp decline in non-vote transactions. At the same time, users bidding higher priority fees saw increased transaction success rates, which may have temporarily lowered non-vote transaction failure rates before they rebounded as conditions normalized.

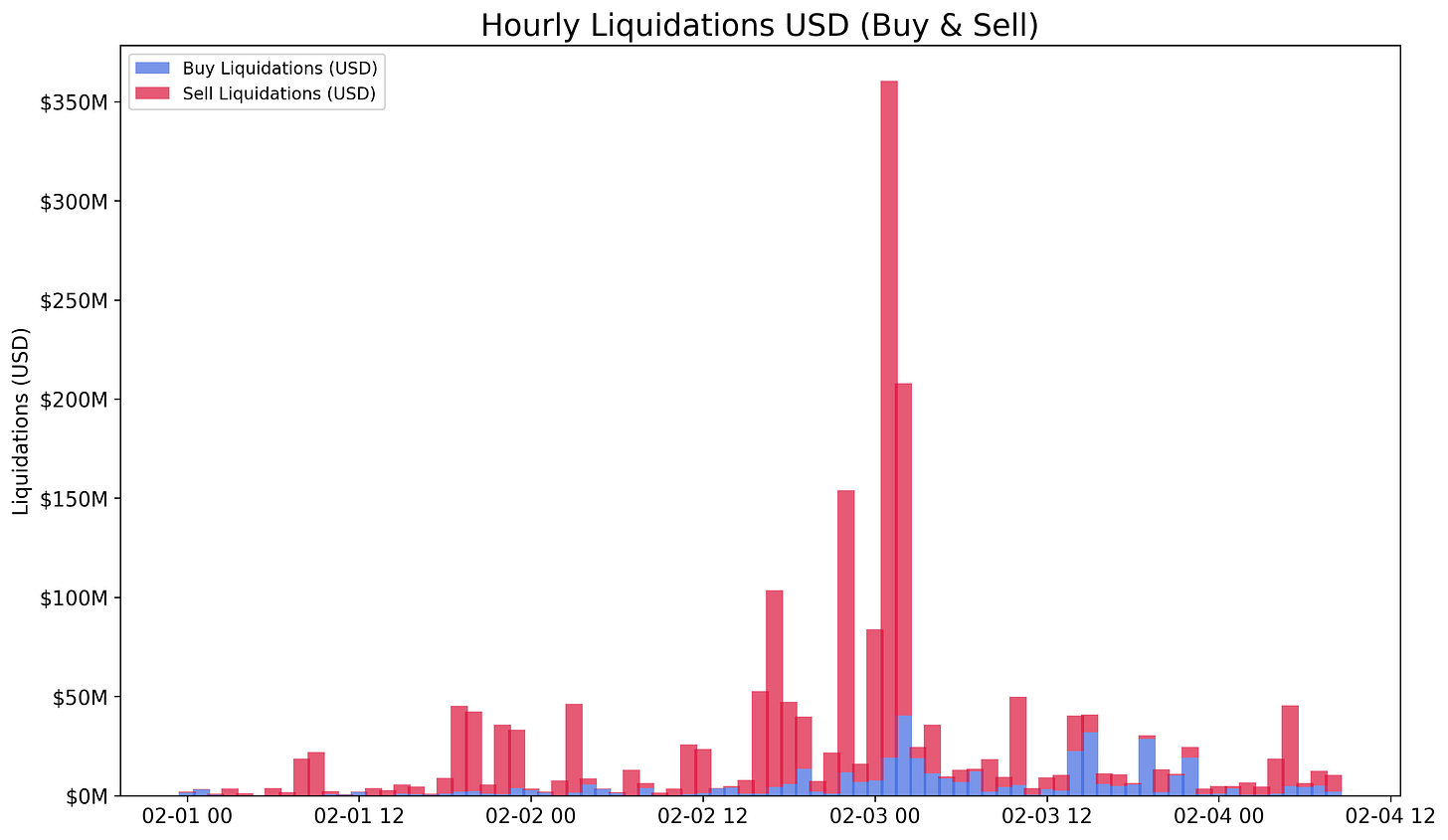

In an adjacent development, President Trump imposed a fresh round of tariffs, this time targeting the United States’ biggest trade partners—with a 25% charge on imports from Canada and Mexico, and 10% from China. The move fueled inflation concerns and triggered volatility across global markets. Crypto was no exception, with its 24/7 nature providing an early gauge of market sentiment. Bitcoin dropped below $100K, reaching ~$92K, while altcoins saw steeper declines, leading to over $2B in liquidations.

Source: Coin Metrics Market Data Feed, Liquidation Metrics

-

Follow Coin Metrics’ State of the Market newsletter which contextualizes the week’s crypto market movements with concise commentary, rich visuals, and timely data.

As always, if you have any feedback or requests please let us know here.

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you’d like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

© 2023 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter.

[ad_2]

Read More: coinmetrics.substack.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Sui

Sui  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Avalanche

Avalanche  Toncoin

Toncoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Shiba Inu

Shiba Inu  WETH

WETH  Wrapped eETH

Wrapped eETH  Litecoin

Litecoin  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Hedera

Hedera  Monero

Monero  Ethena USDe

Ethena USDe  Polkadot

Polkadot  Bitget Token

Bitget Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Uniswap

Uniswap  Pepe

Pepe  Pi Network

Pi Network  Aave

Aave  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  OKB

OKB  Bittensor

Bittensor  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aptos

Aptos  Cronos

Cronos  Internet Computer

Internet Computer  NEAR Protocol

NEAR Protocol  Jito Staked SOL

Jito Staked SOL  sUSDS

sUSDS  Ethereum Classic

Ethereum Classic