[ad_1]

- StarkWare has partnered with Chainlink for the integration of Chainlink Price Feeds onto the Starknet testnet.

- LINK has commenced a new bear cycle.

On 6 February, StarkWare, a technology firm specializing in the creation of scalable solutions for blockchain and decentralized applications, announced a collaboration with Chainlink Labs.

The partnership will see the integration of Chainlink Price Feeds onto the Starknet testnet, with the potential for it to be rolled out onto the Starknet mainnet soon.

Read Chainlink’s [LINK] Price Prediction 2023-24

StarkWare offers a suite of zero-knowledge (ZK) proof technology and blockchain infrastructure products, including StarkNet. StarkNet is a permissionless, decentralized Validity-Rollup protocol that functions as a layer-2 scaling solution on the Ethereum mainnet.

EVM-compatible ZK rollups are increasing

Ethereum’s scalability and high transaction costs have long been a concern for users of the blockchain network. To address these issues, Optimistic rollups, such as Arbitrum and Optimism, were introduced as potential solutions.

However, these rollups were only temporary fixes, and the emergence of zkEVMs may soon render them obsolete.

Apart from StarkNet, other platforms that provide zk rollups that are compatible with the Ethereum Virtual Machine (EVM) include Polygon zkEVM, zkSync zkEVM, Scroll zkEVM, and AppliedZKP zkEVM.

While Polygon zkEVM is still in its development phase, it has seen increased usage since it was made available for testing via a public testnet on 11 October.

More growth, & more good news for the Polygon zkEVM testnet.

Transactions surpassed 284k last week

Take a look at all the metrics, and experiment with the future of scaling yourself.

pic.twitter.com/1ounXhZEyO

— Polygon ZK (@0xPolygonZK) February 6, 2023

LINK price stalls, no further uptrend in sight

At press time, LINK exchanged hands at $6.94, per data from CoinMarketCap. In the last week, the alt traded within a tight range as its price oscillated between $6.5 and $7.5.

Having rallied by 25% on a year-to-date basis, price movements on the daily chart revealed that LINK buying momentum has waned significantly since February began.

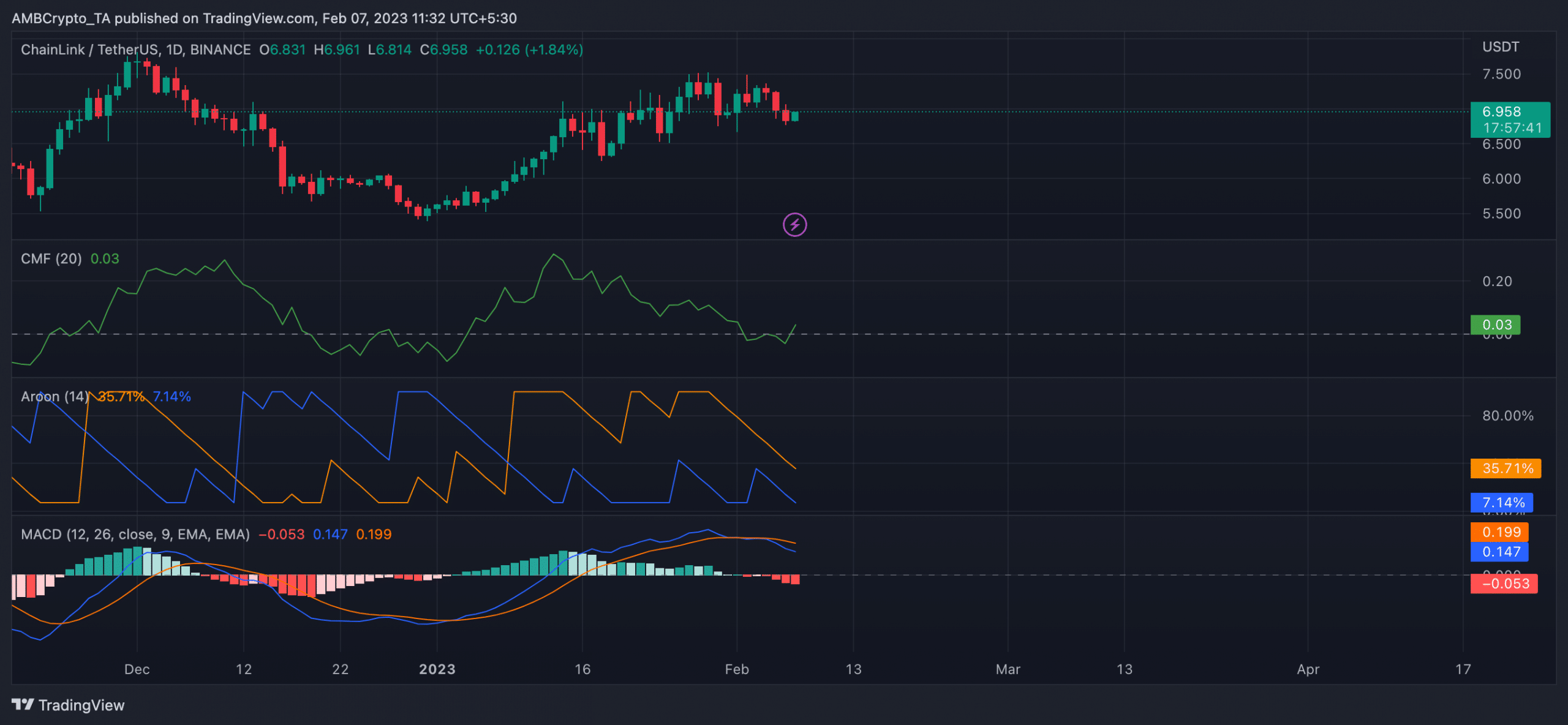

In fact, the new month ushered in the commencement of a new bear cycle as the alt’s moving average convergence/divergence (MACD) line (blue) intersected with the trend line (orange) in a downtrend and has been so positioned since 1 February. Since then, LINK’s price has dropped by 7%.

Is your portfolio green? Check out the Solana Profit Calculator

As of this writing, LINK’s Chaikin Money Flow (CMF) rested slightly above the center line at 0.03. In a downtrend, the LINK market saw less demand that could help drive up its price.

Lastly, a look at the Aroon indicator confirmed the weak nature of the bullish trend in the LINK market. At press time, the Aroon Up Line (blue) was positioned in a downtrend at 7.14%.

If the Aroon Up line is near 100, it suggests that the uptrend is robust and the most recent peak was achieved recently. On the other hand, if the Aroon Up line is close to 0, the uptrend is weak, and the most recent high was attained a long time ago. This is often a precursor to a price drop, so caution is advised.

[ad_2]

Read More: ambcrypto.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  Sui

Sui  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Avalanche

Avalanche  USDS

USDS  Toncoin

Toncoin  WhiteBIT Coin

WhiteBIT Coin  Shiba Inu

Shiba Inu  WETH

WETH  Litecoin

Litecoin  Hedera

Hedera  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Ethena USDe

Ethena USDe  Polkadot

Polkadot  Bitget Token

Bitget Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pi Network

Pi Network  Uniswap

Uniswap  Pepe

Pepe  Aave

Aave  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Aptos

Aptos  OKB

OKB  Bittensor

Bittensor  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  NEAR Protocol

NEAR Protocol  Internet Computer

Internet Computer  Jito Staked SOL

Jito Staked SOL  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Ondo

Ondo