When Casey Rodarmor introduced Ordinals in January 2023, the Bitcoin NFT ecosystem entered a renaissance.

This new approach to digital artifacts on Bitcoin opened the floodgates for new collectibles, from rare sats to PFP collections like NodeMonkes, and for new innovations, like dynamic Bitcoin assets via recursive inscriptions.

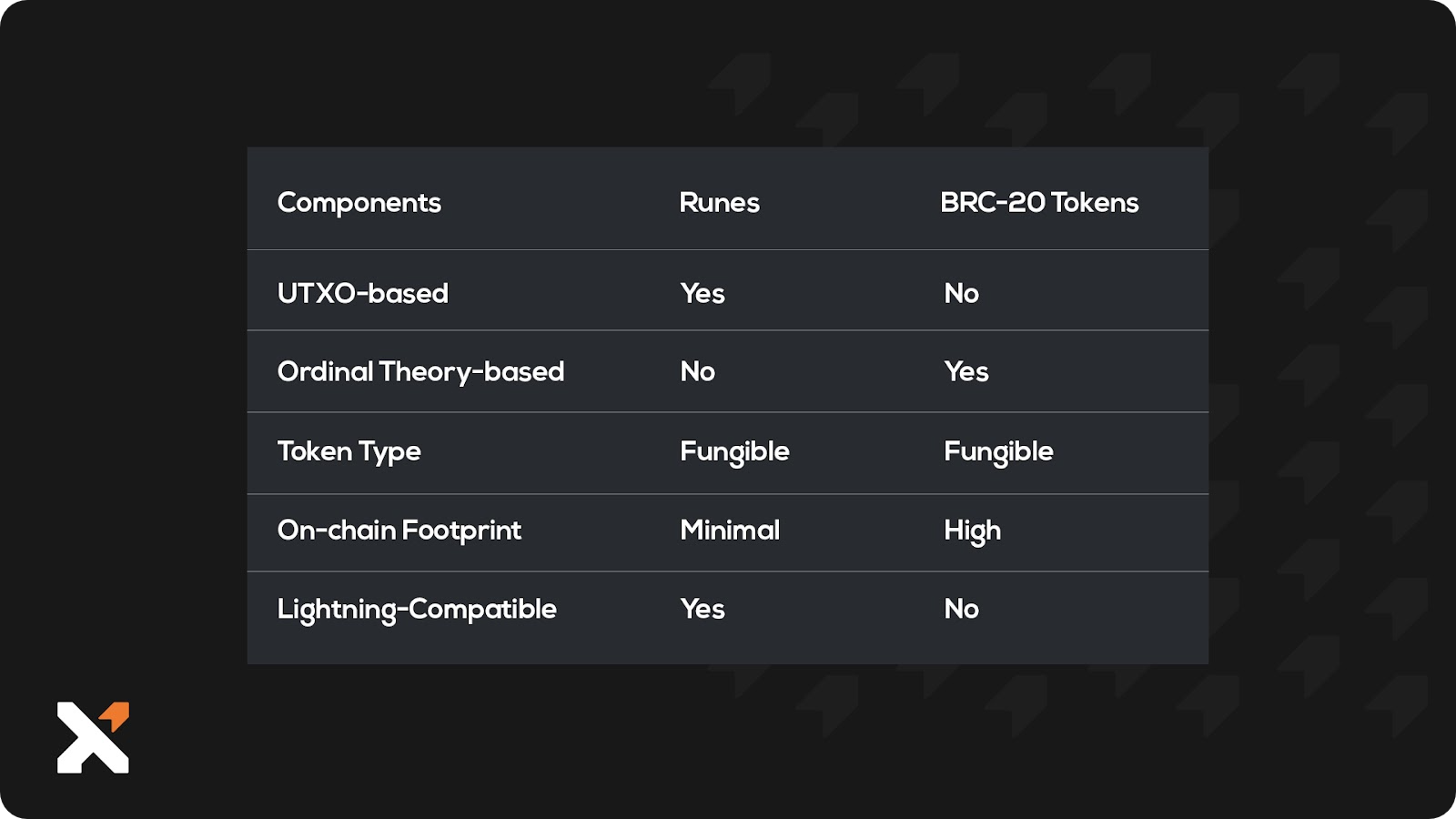

That said, one of the most popular efforts in the Ordinals ecosystem to date has been BRC-20s, an unofficial token standard built on inscriptions designed to roughly approximate Ethereum’s fungible ERC-20s tokens atop the OG blockchain.

Some BRC-20s, like ORDI and SATS, now command ~$1B market caps. This growing demand for Bitcoin-native fungibility is why all eyes are now on Ordinals creator Casey Rodarmor, who is launching Runes, his own take on a fungible token standard, later this month.

In my opinion, Runes are poised to become Bitcoin’s “official” fungible tokens, and their growth this year can be a huge catalyst for Bitcoin NFTs. Let’s get you up to speed on all the basics here accordingly.

How Runes work

“Runes were built for degens and memecoins, but the protocol is simple, efficient, and secure. It is a legitimate competitor to Taproot Assets and RGB.

The protocol is self contained and has no dependencies on ordinals or inscriptions, making it extremely simple.”

Runes are Bitcoin-native digital assets represented as interchangeable tokens. They are introduced into Bitcoin through a process called etching, where each rune is uniquely identified and has specific properties such as name, divisibility, and symbol that, once set, cannot be altered.

Runes transactions are facilitated by runestones, which are special messages stored in Bitcoin transaction outputs. These outputs contain scripts that define the operations to be performed with the runes, such as creating new runes, minting additional units of existing runes, or transferring runes between transactions. This design also allows Runes to be “lifted” and used on the Lightning Network.

Minting of runes is governed by predefined terms set during the etching process, including limitations on the amount and the time window for minting. These features allow for a flexible yet secure way to release tokens on Bitcoin.

Arriving at the halving

In two weeks, on April 19th, Bitcoin will undergo its 4th halving, which will see its block reward drop from 6.25 BTC per block to 3.125 BTC. The Runes protocol will launch in the same block the halving activates.

While the Runes system will be permissionless, its first 10 token releases— Runes #0 through Runes #9—have been hard-coded into the protocol to prevent a frenzy of resourceful people from totally dominating the first launches.

Notably, we already know the details of the genesis rune, UNCOMMON•GOODS, which will offer a free and open minting process beginning at the halving. The mint will run continuously for 4 years, with a limit of 1 mint per transaction and a theoretical maximum of 7,751 mints per block.

This drop mechanic will raise the floor of demand for Bitcoin blockspace for the foreseeable future, and it’s just one mint via the Runes protocol. As such, the arrival of the rest of the Genesis runes and the first community runes will likely usher in a huge new wave of activity and interest around Bitcoin.

A massive catalyst for Ordinals?

The resurgence in Bitcoin NFTs via Ordinals (along with the return of Solana) has made the NFT space much more multipolar than it was during the last crypto bull market.

For example, over the past week, Magic Eden generated +$1.84M in revenue via Ordinals trades, more than what OpenSea and Tensor made across the Ethereum, Solana, and Polygon NFT ecosystems combined in that same span.

Suffice to say, Ordinals are the hottest things in NFTs right now, and the launch of Runes this month will likely make them even hotter.

As people make gains on their first runes, more than a few of them will spend some of their new windfalls on adding choice Bitcoin NFTs to their collections, like NodeMonkes or Bitcoin Puppets. Existing Ordinals projects launching runes for their communities will also prove to be a major draw in the months ahead.

Additionally, the possibility of tracking runes as distinct units will pave the way to new experiments, like creating 10k PFP (profile picture) collections atop fungible Bitcoin tokens.

In other words? Things are going to get weird, the weirdness will be an attraction, and that attraction is going to spill over and feed back into the Ordinals ecosystem. If you feel like you missed the first wave of this latest Bitcoin NFT boom, get ready, because it looks like Runes is about to bring about a second boom.

How to prepare

If you’re interested in participating in the inaugural Runes mints, make sure you have some BTC in a wallet that supports the new protocol before the halving. For example, Xverse has said they’re currently on track to support Runes at launch.

Testnet Runes anyone? ▣👀

We gotchuu covered in 3 easy steps!

1⃣ Settings > Network > Select TESTNET > Save

2⃣Request testnet BTC: https://t.co/9UoRDloyuJ

3⃣Mint Runes in one click https://t.co/KgPZQ5zEC2 pic.twitter.com/l622JXo6xf— Xverse – Bitcoin Wallet for Web3 (@XverseApp) March 18, 2024

It also seems likely that marketplaces like Magic Eden will eventually add support for trading Ordinals with Runes, so keep an eye out for fresh opportunities to make use of your new Bitcoin tokens! It’s the next big frontier here.

Read More: www.bankless.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Avalanche

Avalanche  Sui

Sui  Wrapped stETH

Wrapped stETH  Toncoin

Toncoin  Chainlink

Chainlink  Shiba Inu

Shiba Inu  Stellar

Stellar  Wrapped Bitcoin

Wrapped Bitcoin  Hedera

Hedera  Polkadot

Polkadot  WETH

WETH  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Uniswap

Uniswap  Litecoin

Litecoin  Pepe

Pepe  Hyperliquid

Hyperliquid  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  USDS

USDS  Internet Computer

Internet Computer  Aptos

Aptos  Aave

Aave  Mantle

Mantle  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Render

Render  Ethereum Classic

Ethereum Classic  MANTRA

MANTRA  Bittensor

Bittensor  Monero

Monero  Tokenize Xchange

Tokenize Xchange  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Dai

Dai  Virtuals Protocol

Virtuals Protocol  Arbitrum

Arbitrum