- Cardano ended November with the highest development activity

- ADA started December with the highest staked ratio amongst all Layer 1 tokens

Leading layer 1 blockchain Cardano [ADA] closed November with a development activity count of 572.67, putting it 18% ahead of the next highest-ranked asset, data from Santiment revealed. Polkadot [DOT] and Kusama [KSM] were in second place as they ended the trading month with a development activity count of 486.13 each.

#Cardano is head and shoulders above all other #crypto assets on development activity. Our #github tracking data filters out routine updates like #Slack updates.

For more on @santimentfeed‘s methodology for tracking development activity, read here: https://t.co/vWQCE4a1nv pic.twitter.com/4KQaCUi1ts

— Santiment (@santimentfeed) December 1, 2022

Read Cardano’s [ADA] Price Prediction 2023-2024

Cardano notably experienced a surge in development activity following 21 November’s announcement about launching the network’ algorithmic stablecoin, Djed, in 2023. As a result, the development activity count index went up by 22% between 21 – 30 November. This showcased the determination of GitHub developers towards meeting the launch date.

Furthermore, ADA’s growth in development activity, as of 1 December, led other layer 1 native tokens to remain the asset with the highest staked ratio. According to Staking Rewards, ADA had a staked ratio of 71.17%.

However, even though its staked ratio remained the highest, staking rewards were low. It was just 3.43% as of 1 December. On the other hand, tokens like Cosmos [ATOM] offered rewards as high as 19.25%, even with a lesser staked ratio.

STAKING RATIO BETWEEN LAYER 1 NATIVE ASSET

With 71.17% staking ratio, Cardano became the layer 1 that remained the highest staked ratio among layer 1 native tokens. The reward is only 3.73% but who cares?

#cardano #layer #asset pic.twitter.com/Y3CWSRUwRs— Cardano Daily (@cardano_daily) December 1, 2022

Not all positives for Cardano

While Cardano’s development activity and the quantum of staked ADA rallied, the crypto asset’s market capitalization declined. ADA closed November with a market capitalization of $10.7 billion per data from CoinMarketCap. This represented a 23% drop from the $13.9 billion market capitalization it recorded at the end of October.

The reason for the decline in market capitalization was not far-fetched. This was due to the unexpected collapse of cryptocurrency exchange FTX, which wiped off massive liquidity from the market in just a few days.

On a year-to-date basis, ADA’s market capitalization declined by 69%.

ADA, like many crypto assets, struggled to keep their prices up during the FTX debacle. Additionally, CoinMarketCap revealed that ADA’s price dropped by 24% in November.

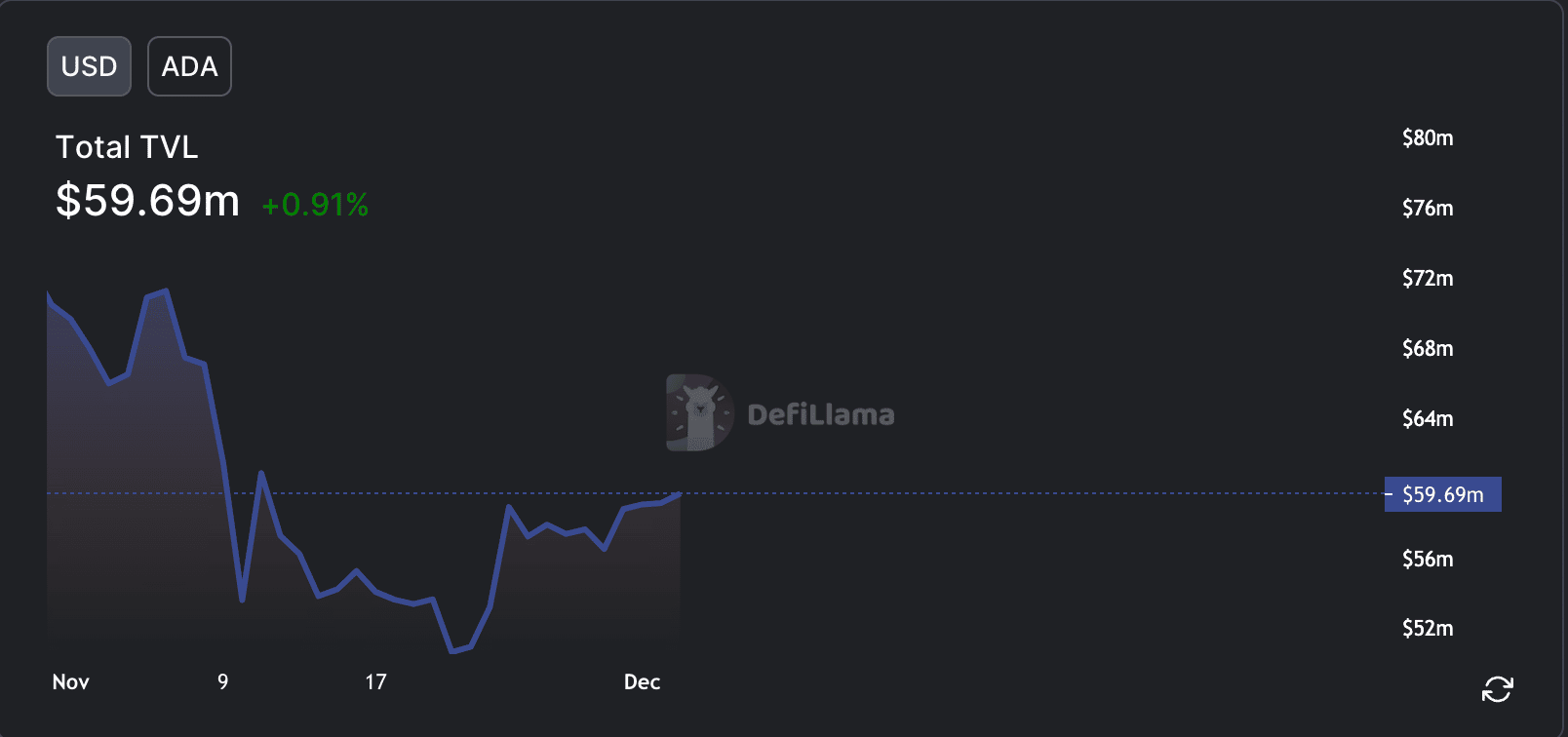

Further, TVL held on the Cardano network also fell within the 30-day period under consideration. At $58.8 million as of 30 November, data from DefiLlama showed that the quantum of Cardano’s TVL fell by 16%. At press time, the network’s TVL stood at $59.69 million.

Read More: ambcrypto.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  LEO Token

LEO Token  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Shiba Inu

Shiba Inu  USDS

USDS  Toncoin

Toncoin  Hedera

Hedera  Sui

Sui  Bitcoin Cash

Bitcoin Cash  Wrapped stETH

Wrapped stETH  Hyperliquid

Hyperliquid  Litecoin

Litecoin  Polkadot

Polkadot  Bitget Token

Bitget Token  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Pi Network

Pi Network  WETH

WETH  WhiteBIT Coin

WhiteBIT Coin  Monero

Monero  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Wrapped eETH

Wrapped eETH  Pepe

Pepe  Dai

Dai  Uniswap

Uniswap  OKB

OKB  Aptos

Aptos  Gate

Gate  Bittensor

Bittensor  NEAR Protocol

NEAR Protocol  Ondo

Ondo  Tokenize Xchange

Tokenize Xchange  Internet Computer

Internet Computer  sUSDS

sUSDS  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Ethereum Classic

Ethereum Classic  Render

Render