[ad_1]

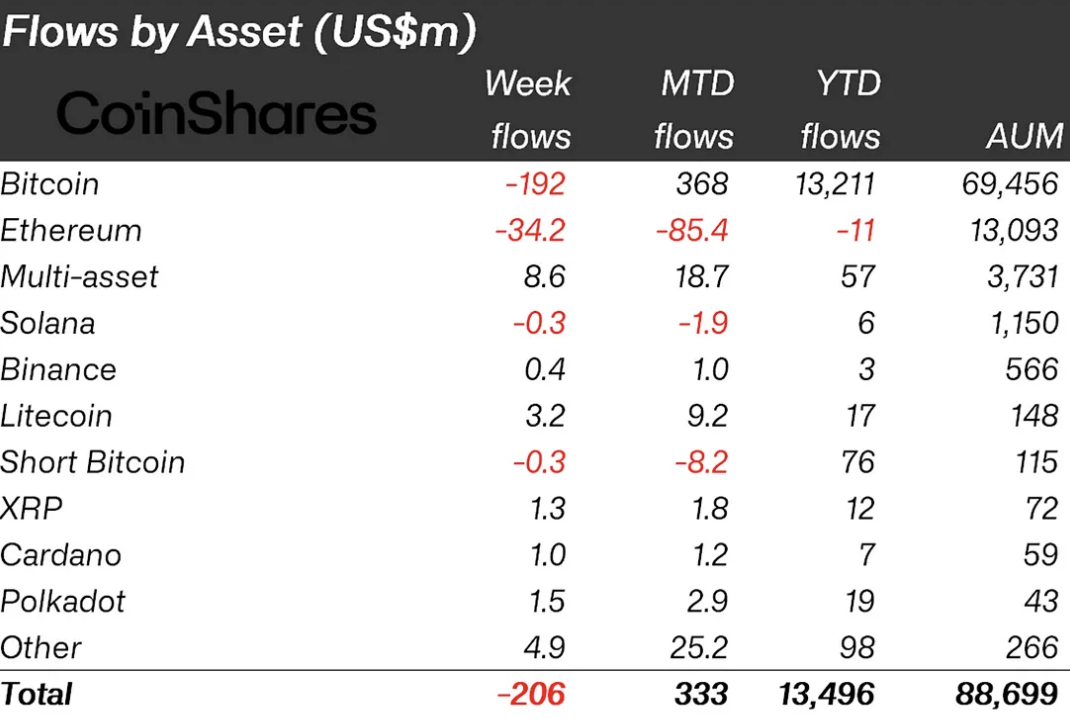

In a recent revelation by CoinShares, Cardano (ADA) has emerged as a frontrunner on the cryptocurrency market, witnessing a staggering 500% surge in fund flows within the past week. The weekly report on fund flows in cryptocurrency-focused investment products revealed that investments tied to Cardano reached a remarkable $1 million mark, marking a significant shift in investor sentiment toward the 10th largest capitalized cryptocurrency.

This surge in investment comes on the heels of a stagnant period, where Cardano-centric investment products experienced a lack of movement in the preceding week, with neither inflows nor outflows recorded. Just two weeks prior, in early April, Cardano ETPs had attracted a relatively modest sum of just over $200,000, making the recent surge all the more striking.

Since the outset of 2024, a total of $7 million has flowed into Cardano-oriented investment products, positioning ADA token as a prominent player among the top altcoins. Despite facing stiff competition from rivals such as Solana (SOL) and Binance Coin (BNB), Cardano has managed to maintain its edge on the market.

The Cardano ETP market boasts a diverse array of investment solutions, including offerings from prominent providers such as 21Shares, WisdomTree, CoinShares and ETC Group. This diversity reflects the growing appeal of Cardano among institutional and retail investors alike.

Meanwhile, the broader digital asset investment landscape has seen consecutive weeks of outflows, totaling $206 million. This trend, coupled with a slight dip in trading volumes for ETPs, suggests a waning appetite among investors.

Speculation regarding the Federal Reserve’s stance on interest rates likely contributes to this subdued sentiment, with expectations of prolonged high rates dampening investor enthusiasm.

[ad_2]

Read More: u.today

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  Sui

Sui  LEO Token

LEO Token  Chainlink

Chainlink  Stellar

Stellar  USDS

USDS  Avalanche

Avalanche  WhiteBIT Coin

WhiteBIT Coin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Litecoin

Litecoin  WETH

WETH  Wrapped eETH

Wrapped eETH  Hedera

Hedera  Monero

Monero  Ethena USDe

Ethena USDe  Polkadot

Polkadot  Bitget Token

Bitget Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Uniswap

Uniswap  Pepe

Pepe  Pi Network

Pi Network  Dai

Dai  Aave

Aave  Ethena Staked USDe

Ethena Staked USDe  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Bittensor

Bittensor  Cronos

Cronos  Aptos

Aptos  sUSDS

sUSDS  Internet Computer

Internet Computer  Jito Staked SOL

Jito Staked SOL  NEAR Protocol

NEAR Protocol  Ethereum Classic

Ethereum Classic