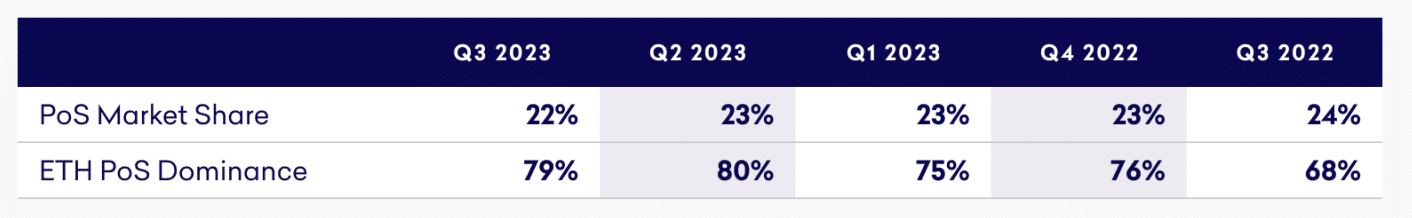

The total market value of cryptocurrencies using the proof-of-stake consensus algorithm decreased by 7% at the end of Q3 to $254 billion.

Such estimates are provided by the Kraken-related platform Staked. According to experts, the market share of such coins decreased by 2% to 22%. Ethereum (ETH) dominance in this segment – by 1%, to 79%.

“The lack of near term catalysts, regulatory uncertainty, and macro challenges left markets in a holding pattern.“

Staked report

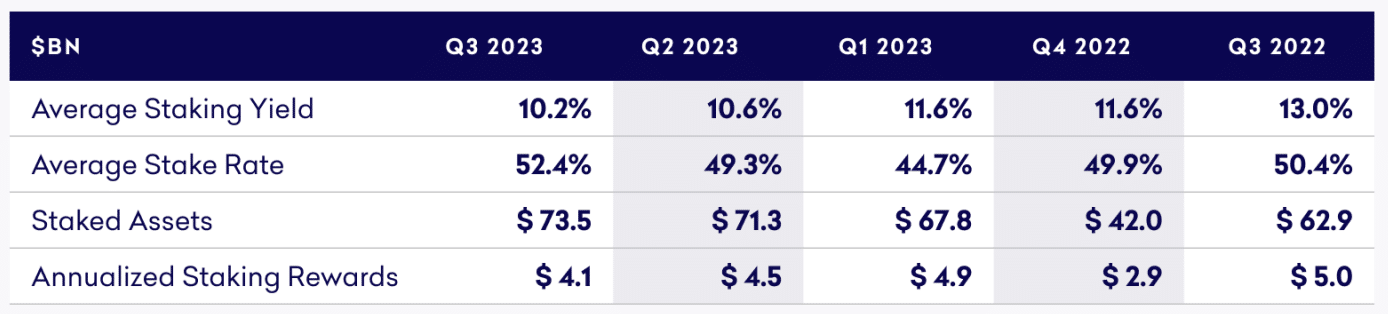

The value of assets locked in staking increased by 3% to $74b. Annualized rewards in value terms decreased by 7%, to $4.1b. The profitability of such operations amounted to 10.2%, which is 0.4% less than in Q2.

The share of blocked coins from their current supply reached a record 52.4% (49.3% in Q2). The leaders in this regard were Aptos (84.1%), Sui (80.5%), Mina (77.6%), Solana (71.9%) and Cosmos (67.6%). The median value among the top 35 coins was 52.6%.

Earlier in October, liquid staking protocol Lido Finance reported problems with configuring some validators. According to Lido Finance, the failure occurred on the Ethereum network, and losses amounted to about 20 ETH (approximately $31,000 at the time of writing).

Read More: crypto.news

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Wrapped stETH

Wrapped stETH  Hyperliquid

Hyperliquid  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  LEO Token

LEO Token  Toncoin

Toncoin  Bitcoin Cash

Bitcoin Cash  Shiba Inu

Shiba Inu  Hedera

Hedera  USDS

USDS  Litecoin

Litecoin  WETH

WETH  Wrapped eETH

Wrapped eETH  Polkadot

Polkadot  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Bitget Token

Bitget Token  Pepe

Pepe  Ethena USDe

Ethena USDe  Pi Network

Pi Network  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  Uniswap

Uniswap  Aave

Aave  Bittensor

Bittensor  NEAR Protocol

NEAR Protocol  Aptos

Aptos  OKB

OKB  Jito Staked SOL

Jito Staked SOL  Ethena Staked USDe

Ethena Staked USDe  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Tokenize Xchange

Tokenize Xchange  Cronos

Cronos  Ondo

Ondo  Internet Computer

Internet Computer