- Solana’s high TPS might have attracted more users as its active addresses increased.

- SOL’s price action remained bullish as it increased by 20% last week.

Solana [SOL] has created quite some buzz in the crypto space, not just for its price but also for its network stats. In fact, the blockchain has outperformed other top players like Polygon [MATIC] on a key front.

Solana tops the table

The latest data from CoinGecko revealed that Solana ranked number one on the list of blockchains by transactions per second (TPS).

This achievement showed the efficiency and dependability of the blockchain as it processed the maximum number of transactions in a set timeframe.

Apart from SOL, Sui, Binance Smart Chain, and Polygon also made it to the top four on the same list. However, it was interesting to note that while Polygon’s TPS stood at 190, Solana had a major lead as its TPS was 1053. Ethereum was lower down on the list with a TPS of just 22.

AMBCryto’s look at Solana Explorer revealed that, at press time, SOL’s TPS was 2303.

AMBCrypto then checked Artemis’ data to see whether Solana’s high TPS had any impact on its network activity. We found that SOL’s daily active addresses have increased over the past three months. The number spiked in mid-March as it exceeded 2.4 million.

However, despite an increase in daily active addresses, the blockchain’s daily transaction count remained somewhat similar to that at the beginning of February.

Notably, SOL’s daily transactions did witness a major uptick on the 11th of April, but the trend didn’t last.

Things in terms of captured value also didn’t look good for the blockchain. SOL’s fees registered a massive drop after spiking on the 18th of March.

Thanks to the drop in fees, the blockchain’s revenue also followed a similar declining trend over the last several weeks. Nonetheless, SOL’s performance on the DeFi front remained on par as its TVL continued to grow.

Solana investors are rejoicing

In the meantime, SOL’s price action gained bullish momentum. According to CoinMaerketCap, SOL was up by more than 20% in the last seven days.

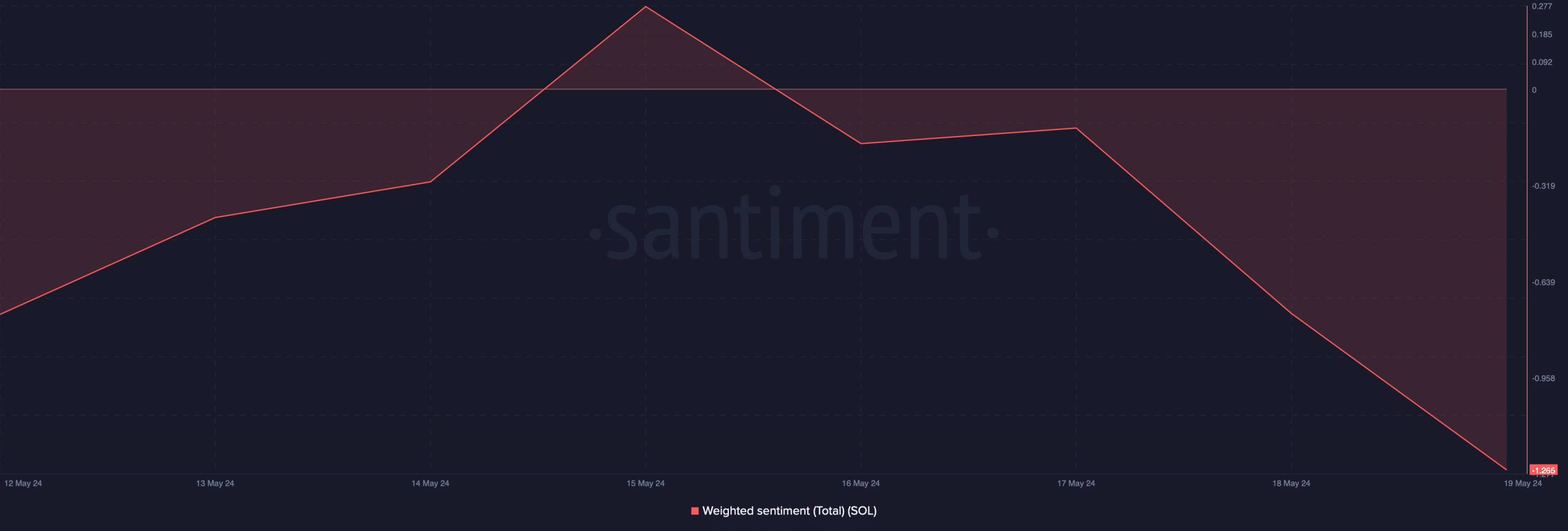

At press time, it was trading at $178.08 with a market capitalization of over $79.9 billion. Surprisingly, the price uptick didn’t help stir up bullish sentiment in the market, as its weighted sentiment remained in the negative zone.

Is your portfolio green? Check out the SOL Profit Calculator

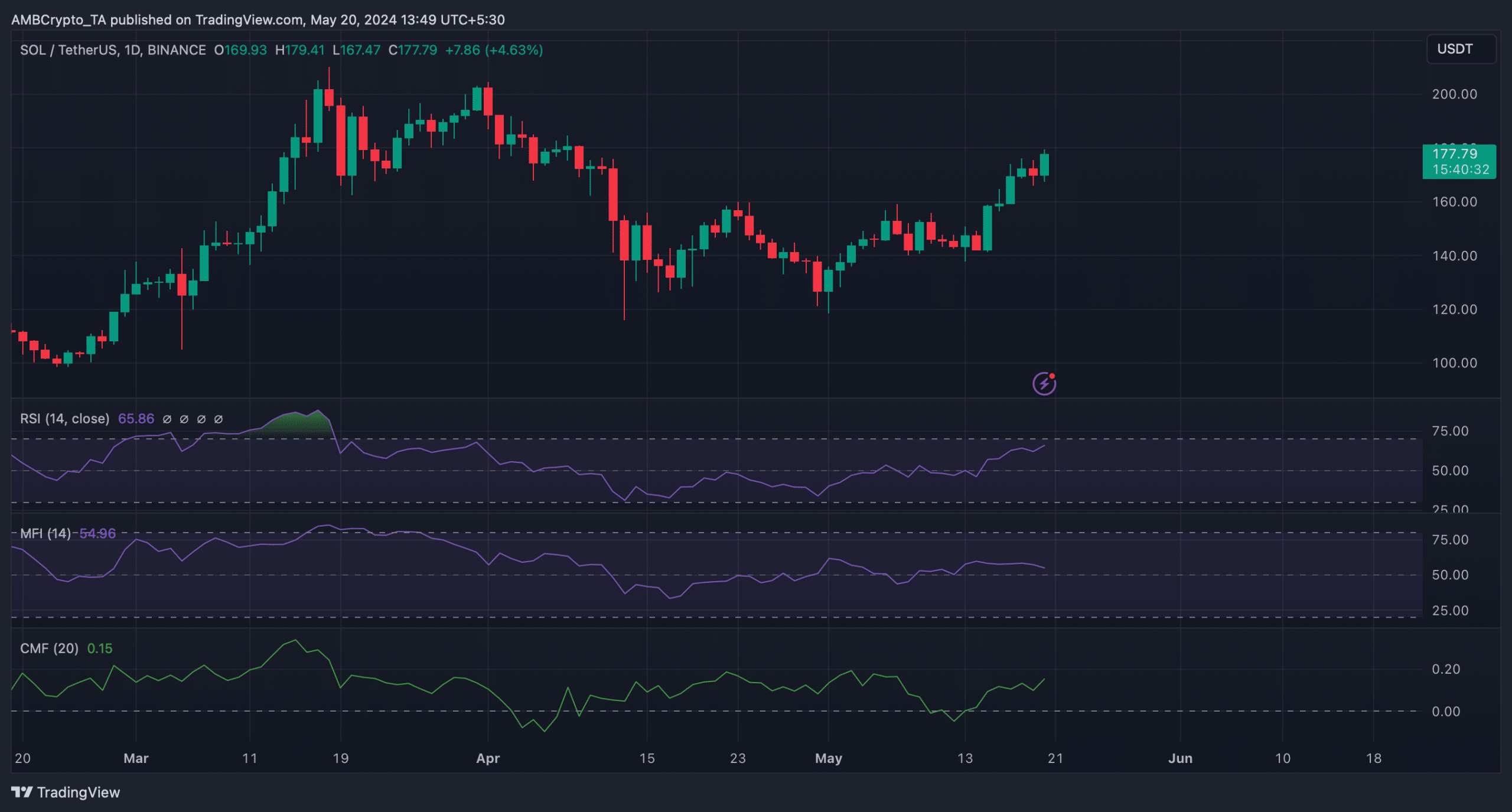

Bearish sentiment around SOL might not be enough to stop the bulls. AMBCrypto’s analysis of SOL’s daily chart revealed that its Relative Strength Index (RSI) registered a massive uptick.

Its Chaikin Money Flow (CMF) also looked bullish, as it had a value of 0.15 at press time. The concerning indicator was the Money Flow Index (MFI), as it indicated that SOL’s price might witness a correction.

Read More: ambcrypto.com

Swell

Swell  COCO COIN

COCO COIN  Nineteen.ai

Nineteen.ai  Based Fartcoin

Based Fartcoin  Gnosis xDai Bridged WETH (Gnosis Chain)

Gnosis xDai Bridged WETH (Gnosis Chain)  node.sys

node.sys  IMO

IMO  Dimitra

Dimitra  Sendcoin

Sendcoin  Basenji

Basenji  Spectral

Spectral  Cocoro

Cocoro  Reef

Reef  WATCoin

WATCoin  Quickswap [OLD]

Quickswap [OLD]  Realio Network Token

Realio Network Token  Dragonchain

Dragonchain  Definitive

Definitive  Quickswap

Quickswap  PiP

PiP  Indigo Protocol

Indigo Protocol  Stafi

Stafi  Perpetual Protocol

Perpetual Protocol  Propchain

Propchain  RETARDIO

RETARDIO  Cortex

Cortex  GoGoPool ggAVAX

GoGoPool ggAVAX  Klever

Klever  ThetaDrop

ThetaDrop  moonpig

moonpig  Luna by Virtuals

Luna by Virtuals  GammaSwap

GammaSwap  Cross The Ages

Cross The Ages  YU

YU  Eggs Finance

Eggs Finance  TROLL

TROLL  MakerDAO Optimism Bridged DAI (Optimism)

MakerDAO Optimism Bridged DAI (Optimism)  PIXL

PIXL  RARI

RARI  pippin

pippin  Numbers Protocol

Numbers Protocol  Bridged Tether (Avalanche)

Bridged Tether (Avalanche)  Sleepless AI

Sleepless AI  Gochujangcoin

Gochujangcoin  Aki Network

Aki Network  Paris Saint-Germain Fan Token

Paris Saint-Germain Fan Token  cBAT

cBAT  michi

michi