[ad_1]

By Omkar Godbole (All times ET unless indicated otherwise)

The crypto market remains directionless, with bitcoin (BTC) languishing below $100,000 before the U.S. jobs report. It’s surprising prices have not yet crossed that threshold, especially after President Donald Trump’s son, Eric, encouraged the family-linked WLFI to invest in BTC in a post on X on Thursday.

Typically, such endorsements during a bull run lead to substantial gains. That that hasn’t materialized is a sign markets are no longer buoyed by talk alone and Trump needs to walk the walk. Early this week, the administration said it’s evaluating the feasibility of a strategic BTC reserve.

Another possibility is that caution ahead of nonfarm payrolls is capping the upside. If that’s the case, a breakout may occur once the data is out, especially if the figure prints weaker than estimated, potentially driving Treasury yields and the dollar index lower.

Crypto newsletter service LondonCryptoClub recommends keeping an eye on revisions in the previous figures. “Bloomberg Intelligence expecting some large downside revisions suggesting the Labour market not as strong in 2024 as first appeared We still think the market (and the Fed themselves) are massively under pricing the rate cuts that will need to come,” the newsletter service’s founders said on X.

At press time, Volmex’s one-day bitcoin implied volatility index stood at an annualized 51%, suggesting a daily price swing of 2.6%, or about $2,600. In other words, the figure could move the spot price by $2,600 in either direction. Notably, some traders are buying put options, bracing for potential downside volatility should the data come in strong.

In other news, the “Strategic Bitcoin Reserve” bill passed the House in the state of Utah and will now move to the Senate. Bloomberg ETF analyst James Seyffart reported that the U.S. SEC has acknowledged Grayscale’s Solana 19b-4 filing. And VanEck predicted a $500 price for SOL, more than double its current value of around $180.

Additionally, FOX reporter Eleanor Terrett shared that U.S. House Financial Services Committee Chairman French Hill and Digital Assets Subcommittee Chairman Bryan Steil have released a stablecoin regulation discussion draft, which proposes a two-year ban on stablecoins backed solely by self-issued digital assets and mandates a Treasury study on their risks.

And finally, Berachain’s BERA token, which debuted yesterday, has already recorded a staggering perpetual trading volume of $4.8 billion, with its price currently sitting at $7.60, a significant drop from yesterday’s peak of $14. Stay alert!

What to Watch

- Crypto:

- Feb. 13: Start of Kraken’s gradual delisting of the USDT, PYUSD, EURT, TUSD, UST stablecoins for EEA clients. The process ends March. 31.

- Feb. 18, 10:00 a.m.: FTX Digital Markets, the Bahamas-based subsidiary of FTX, will start reimbursing creditors.

- Macro

- Feb. 7, 8:30 a.m.: U.S. Bureau of Labor Statistics (BLS) releases January’s Employment Situation report.

- Non Farm Payrolls Est. 170K vs. Prev. 256K

- Unemployment Rate Est. 4.1% vs. Prev. 4.1%

- Feb. 8, 8:30 p.m.: China’s National Bureau of Statistics (NBS) releases January’s Consumer Price Index (CPI) report.

- Inflation Rate MoM Prev. 0%

- Inflation Rate YoY Prev. 0.1%

- PPI YoY Prev. -2.3%

- Feb. 7, 8:30 a.m.: U.S. Bureau of Labor Statistics (BLS) releases January’s Employment Situation report.

- Earnings

- Feb. 10: Canaan (CAN), pre-market, $-0.08

- Feb. 11: HIVE Digital Technologies (HIVE), post-market, $-0.11

- Feb. 11: Exodus Movement (EXOD), post-market, $0.14 (2 ests.)

- Feb. 12: Hut 8 (HUT), pre-market, $0.04

- Feb. 12: IREN (IREN), post-market, $-0.01

- Feb. 12 (TBA): Metaplanet (TYO:3350)

- Feb. 12: Reddit (RDDT), post-market, $0.25

- Feb. 12: Robinhood Markets (HOOD), post-market, $0.41

- Feb. 13: Coinbase Global (COIN), post-market, $1.61

Token Events

- Governance votes & calls

- OsmosisDAO is discussing a change to the use of taker fees collected in OSMO to burn 50% of collected fees.

- Threshold DAO is discussing the creation of a bond program to address its stablecoin’s liquidity challenges.

- Sky DAO is voting on an an executive proposal to lower savings rates, sweep over 400K DAI in PauseProxy into the Surplus Buffer and allocate 3 million DAI for integration boost funding, among other things.

- Yearn DAO is discussing the elimination of the Protocol Guardian Role over concerns surrounding its use to override previous democratic decisions and potential legal risks.

- Feb. 7, 1 p.m.: Sweat Economy (SWEAT) to hold a token holders briefing discussing tokenomics, product roadmap and partnerships.

- Feb. 8, 1:08 p.m.: A dYdX Foundation vote on granting the dYdX Operations subDAO signer market authority over the market map and eliminate revenue sharing for that function is on track to pass.

- Feb. 10, 10:30 a.m.: OKX to hold a listings AMA with Chief Marketing Officer Haider Rafique and Head of Product Marketing Matthew Osofisan.

- Unlocks

- Feb. 9: Movement (MOVE) to unlock 2.17% of circulating supply worth $31.41 million.

- Feb. 10: Aptos (APT) to unlock 1.97% of circulating supply worth $68.99 million.

- Feb. 12: Aethir (ATH) to unlock 10.21% of circulating supply worth $22.72 million.

- Token Launches

- Feb. 7: Avalon Labs (AVL) to be listed on Bybit.

- Feb. 13: EthereumPoW (ETHW) and Polygon (MATIC) to no longer be supported at Deribit.

Conferences

CoinDesk’s Consensus to take place in Hong Kong on Feb. 18-20 and in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

Token Talk

By Shaurya Malwa

- BNB Chain speculators are gambling with a random TST token after an educational video showed its creation.

- TST, or Test Token, was issued on the BNB Chain using the BEP-20 standard. It was not officially launched by Binance, but rather used in a token creation tutorial video by the BNB Chain team.

- The price surged after the video was shared by Binance founder Changpeng Zhao on X because users took it to be an official Binance token even though Zhao no longer has a formal role at the company.

- Zhao deleted his repost of the video later.

- TST skyrocketed to a market cap of around $40 million shortly after Zhao’s post, reaching trading volumes of over $90 million at peak.

Derivatives Positioning

- Perpetual funding rates for BERA are deeply negative, showcasing a strong bias for short positions. SOL, BNB, SHIB and BCH also have negative rates.

- QCP Capital noted demand for BTC puts at $90K and $80K strikes expiring on Feb. 28 in a sign of persistent downside worries.

- Block flows featured a BTC calendar spread betting on prices staying below $120K by the end of April, but eventually rising past $170K the end of December. Plus, an outright long in the $88K Feb expiry put crossed the tape.

- ETH flows featured an outright long in the Feb. 14 expiry call at the $2,800 strike.

Market Movements:

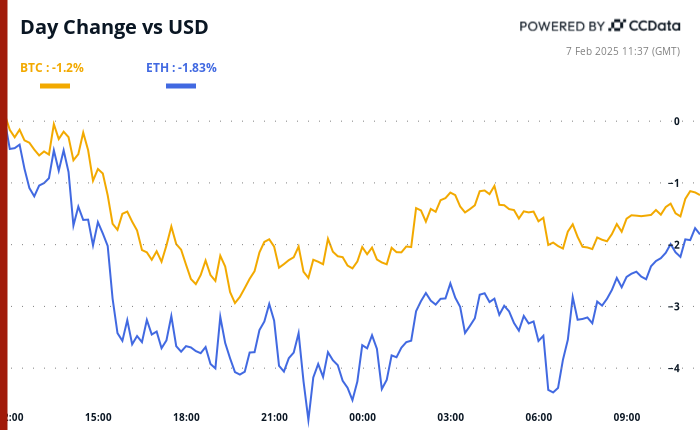

- BTC is up 1.24 % from 4 p.m. ET Thursday to $97,686.16 (24hrs: -1.07%)

- ETH is up 1.61% at $2,757.18 (24hrs: -1.75%)

- CoinDesk 20 is up 1.99% to 3,215.42 (24hrs: -1.83%)

- CESR Composite Staking Rate is down 3 bps to 3.06%

- BTC funding rate is at 0.0052% (5.72% annualized) on Binance

- DXY is up 0.08% at 107.78

- Gold is up 0.37% at $2,866.78/oz

- Silver is up 0.29% to $32.26/oz

- Nikkei 225 closed down 0.72% at 38,787.02

- Hang Seng closed up 1.15% at 21,133.54

- FTSE is down 0.29% at 8,703.92

- Euro Stoxx 50 is down 0.15% at 5,348.71

- DJIA closed -0.28% to 44,747.63

- S&P 500 closed +0.36% at 6,083.57

- Nasdaq closed +0.51% at 19,791.99

- S&P/TSX Composite Index closed -0.14% at 25,534.49

- S&P 40 Latin America closed +1.87% at 2,437.08

- U.S. 10-year Treasury was unchanged at 4.44%

- E-mini S&P 500 futures are unchanged at 6,104.00

- E-mini Nasdaq-100 futures are unchanged at 21,855.75

- E-mini Dow Jones Industrial Average Index futures are unchanged at 21,853.00

Bitcoin Stats:

- BTC Dominance: 61.62 (-0.48%)

- Ethereum to bitcoin ratio: 0.02823 (1.40%)

- Hashrate (seven-day moving average): 808 EH/s

- Hashprice (spot): $57.2

- Total Fees: 5.17 BTC / $514,435

- CME Futures Open Interest: 163,140 BTC

- BTC priced in gold: 33.7 oz

- BTC vs gold market cap: 9.58%

Technical Analysis

- Bitcoin seems to be crossing below the Ichimoku cloud used by traders to gauge momentum and trend strength.

- Crosses below the indicator are taken to represent a bearish shift in trend.

Crypto Equities

- MicroStrategy (MSTR): closed on Thursday at $325.46 (-3.34%), up 0.63% at $327.50 in pre-market.

- Coinbase Global (COIN): closed at $270.37 (-1.73%), up 0.75% at $272.39 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$27.07 (-2.13%)

- MARA Holdings (MARA): closed at $16.80 (-1.35%), up 0.89% at $16.95 in pre-market.

- Riot Platforms (RIOT): closed at $11.61 (-1.11%), up 0.69% at $11.69 in pre-market.

- Core Scientific (CORZ): closed at $12.53 (-1.42%), up 0.32% at $12.57 in pre-market.

- CleanSpark (CLSK): closed at $10.38 (+0.68%), up 6.84% at 11.09 in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $22.76 (+1.34%), down 0.06% at $22.70 in pre-market.

- Semler Scientific (SMLR): closed at $49.92 (-3.61%), up 2.14% at $50.99 in pre-market.

- Exodus Movement (EXOD): closed at $48.01 (-6.52%), unchanged in pre-market.

ETF Flows

Spot BTC ETFs:

- Daily net flow: -$140.2 million

- Cumulative net flows: $40.53 billion

- Total BTC holdings ~ 1.174 million.

Spot ETH ETFs

- Daily net flow: $10.7 million

- Cumulative net flows: $3.18 billion

- Total ETH holdings ~ 3.783 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

- The combined market capitalization of top two stablecoins, USDT and USDC, continues to grow and is fast nearing $200 billion.

- The relentless rise represents an influx of money into the crypto market, hinting at bullish prospects.

While You Were Sleeping

- Bitcoin in a Mire, Gold Eyes 6th Straight Week of Gains as Jobs Data Looms (CoinDesk): With BTC struggling to find its footing amid declining Bitcoin network activity, today’s U.S. jobs data will give some clues on what the Fed may do next.

- Solana’s SOL Could Hit $520 by 2025-End, VanEck Says (CoinDesk): Investment firm VanEck expects the SOL price to reach $520 by year-end. The forecast is based on growing demand for smart-contract platforms and an expanding U.S. M2 money supply.

- Fed’s Waller Says Stablecoins Could Back Dollar’s Reserve Status (Bloomberg): While giving a speech in Washington, Fed Governor Christopher Waller expressed support for stablecoins as long as appropriate “regulatory rails” are in place to “make sure the money is there.”

- Trump’s Memecoin Copycats Spark Fears for Investors (Financial Times): According to an FT analysis, since Donald Trump and his wife launched official memecoins, over 700 copycat tokens have flooded his official Solana wallet, prompting investor warnings.

- India’s Central Bank Cuts Rates for First Time in Nearly 5 Years; Signals Less Restrictive Approach (Reuters): The Reserve Bank of India (RBI) reduced its repo rate by 25 basis points while maintaining a neutral policy stance in an attempt to stimulate a sluggish economy amid lower growth expectations.

- Look to India, Japan for ‘Quality Alpha’ Amid Market Uncertainty, Investor Says (CNBC): According to alternative investment firm PAG, it’s hard to find alpha in China right now due to a lackluster economy and uncertainty over the impact of a trade war with the U.S.

In the Ether

[ad_2]

Read More: www.coindesk.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  Sui

Sui  Chainlink

Chainlink  LEO Token

LEO Token  Avalanche

Avalanche  Stellar

Stellar  USDS

USDS  Toncoin

Toncoin  Shiba Inu

Shiba Inu  WhiteBIT Coin

WhiteBIT Coin  WETH

WETH  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Hedera

Hedera  Monero

Monero  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Polkadot

Polkadot  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Uniswap

Uniswap  Pi Network

Pi Network  Pepe

Pepe  Aave

Aave  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Aptos

Aptos  OKB

OKB  Bittensor

Bittensor  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Jito Staked SOL

Jito Staked SOL  NEAR Protocol

NEAR Protocol  Internet Computer

Internet Computer  Cronos

Cronos  Ethereum Classic

Ethereum Classic  sUSDS

sUSDS