Bitcoin and Ethereum have seen a surge of over 6% in their respective values ahead of the release of Manufacturing and Services PMI figures. As investors await the results of these economic indicators, both cryptocurrencies have experienced upward momentum in their prices.

Bitcoin, the world’s largest cryptocurrency, has managed to stop its downward rally and drew some fresh bids around above the $28k level, registering a 2.63% gain in the past 24 hours, while Ethereum has also regained the $1,800 mark.

Other popular altcoins like Dogecoin, Ripple, Solana, and Litecoin have also experienced significant gains on the day.

Although, the BTC lost some of its gains yesterday as the Federal Reserve raised the interest rate, which tends to make investing in Bitcoin less attractive.

This is because rising interest rates might make the US currency more appealing, encouraging consumers to sell Bitcoin and other cryptocurrencies in favor of the dollar.

Interestingly, the losses in BTC prices were short-lived and temporary, as renewed interest in digital-asset futures and options prompted a recovery in cryptocurrency values.

Renewed Interest in Cryptocurrency Futures and Options Drives Surge in Bitcoin Prices

There have been reports showing renewed interest in cryptocurrency futures and options, resulting in a rise in digital asset values and an increase in derivative trading volumes.

As a result, the number of open Bitcoin options contracts has hit an all-time high. This has led to an “incredible surge” in Bitcoin open interest, which some investors interpret as a sign of potential new entrants.

Derivatives trading platform Deribit has observed a rise in interest, which is partly attributed to instability in traditional financial institutions. This renewed interest in the digital asset market has led to the largest token, Bitcoin, rising approximately 70% since the beginning of the year.

This news has had a positive influence on Bitcoin prices, which are expected to rise further as open contracts and interest increase.

Furthermore, the higher trading volumes in derivative trading compared to spot trading suggest that investors are more interested in speculating on Bitcoin values than holding them as a long-term investments. As a result of this news, BTC prices are likely to rise in the short term, especially if more new participants enter the market.

Bitcoin Rebounds Despite Regulatory Concerns and Interest Rate Hike

Despite concerns about regulatory changes and a recent interest rate hike by the US Federal Reserve, Bitcoin has experienced a 3.8 percent increase in value over the past 24 hours. This has resulted in an overall upward trend in the cryptocurrency market.

Bitcoin’s value has surged by 22% in just one month and more than 65% since the beginning of the year. The fact that Bitcoin has been able to withstand government pressures and financial instability is a testament to its resilience and power in the crypto market.

This is significant news for Bitcoin investors as it indicates that the cryptocurrency may continue to rise and stabilize. Moreover, the current bullish trend in the cryptocurrency market may attract new investors to enter the industry.

Bitcoin Price

The current Bitcoin price is $28,327, and the 24-hour trading volume is $23.4 billion. Bitcoin has increased by 2.5% in the previous 24 hours. As of Friday, the BTC/USD pair is consolidating around the $28,000 mark, having surpassed the $27,750 resistance level. If this upward trend persists, Bitcoin’s value has the potential to reach anywhere between $29,250 and $30,700.

In the event that Bitcoin falls below the support levels of $26,700 or $25,200, the next level of support can be found at $23,150.

Ethereum Price

The current price of Ethereum is $1,812, with a 24-hour trading volume of $11 billion. In the previous 24 hours, Ethereum has gained 3.60%.

At present, Ethereum is facing difficulty in surpassing the $1,800 resistance level and is trading steadily near the support zone of $1,700.

If the ETH/USD pair successfully breaches the $1,800 level, it is anticipated to encounter resistance at the $1,900 mark.

The ETH/USD pair is predicted to discover support levels at either $1,700 or $1,620.

Cryptocurrencies to Watch in 2023

You can check out Cryptonews’ Industry Talk team’s carefully selected list of the top 15 altcoins to keep an eye on in 2023. This list is updated regularly with new ICO projects and altcoins, so make sure to check back frequently for the latest updates.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

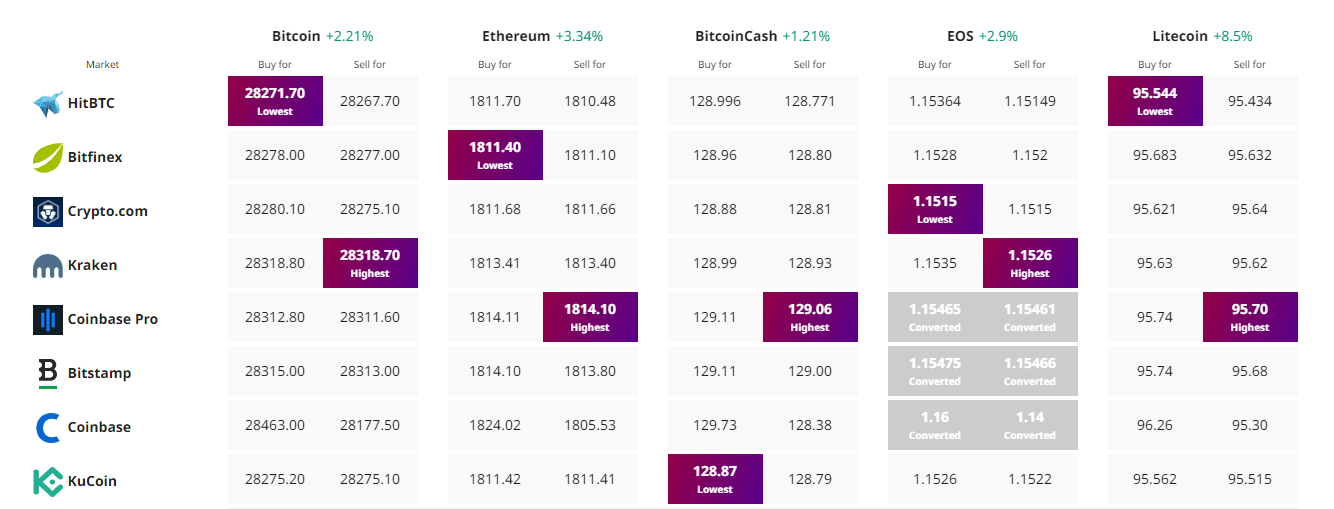

Find The Best Price to Buy/Sell Cryptocurrency

Read More: cryptonews.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Toncoin

Toncoin  LEO Token

LEO Token  Chainlink

Chainlink  Stellar

Stellar  USDS

USDS  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Sui

Sui  Shiba Inu

Shiba Inu  Hedera

Hedera  Litecoin

Litecoin  MANTRA

MANTRA  Polkadot

Polkadot  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  WETH

WETH  Pi Network

Pi Network  Wrapped eETH

Wrapped eETH  WhiteBIT Coin

WhiteBIT Coin  Monero

Monero  Hyperliquid

Hyperliquid  Uniswap

Uniswap  Aptos

Aptos  Dai

Dai  Pepe

Pepe  sUSDS

sUSDS  NEAR Protocol

NEAR Protocol  OKB

OKB  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Tokenize Xchange

Tokenize Xchange  Gate

Gate  Cronos

Cronos  Ondo

Ondo  Mantle

Mantle  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic