[ad_1]

Get the best data-driven crypto insights and analysis every week:

By: Tanay Ved

Stablecoins are often viewed as crypto’s ‘killer app,’ playing a vital role in bridging traditional finance with the digital asset ecosystem. In this sector, dollar-backed stablecoins have experienced remarkable adoption over the past few years. Stablecoins facilitate 24/7 value exchange, serve as a store of value, medium of exchange and provide a crucial value proposition to dollar-starved economies, especially within emerging markets where people contend with high inflation, currency devaluation or limited access to basic financial services. Amid a landscape that continues to evolve with new issuers, collateral types and expanding utility, Tether (USDT) has established itself as a dominant force.

As the preeminent fiat-collateralized stablecoin, Tether commands over 75% of the $120B+ stablecoin market cap. This prominence, however, has been accompanied by considerable skepticism, particularly around the transparency and nature of its reserves. Recent remarks by Howard Lutnick, the CEO of Cantor Fitzgerald—a firm that manages Tether’s funds—around the legitimacy of its backing may have alleviated some concerns. However, the sheer scale of USDT’s influence warrants a closer examination.

In this week’s issue of Coin Metrics’ State of the Network, we delve into Tether’s remarkable ascent, exploring its primary avenues of growth, adoption, the nature of its usage and reserve holdings to gain a holistic understanding of the stablecoin juggernaut through on-chain data.

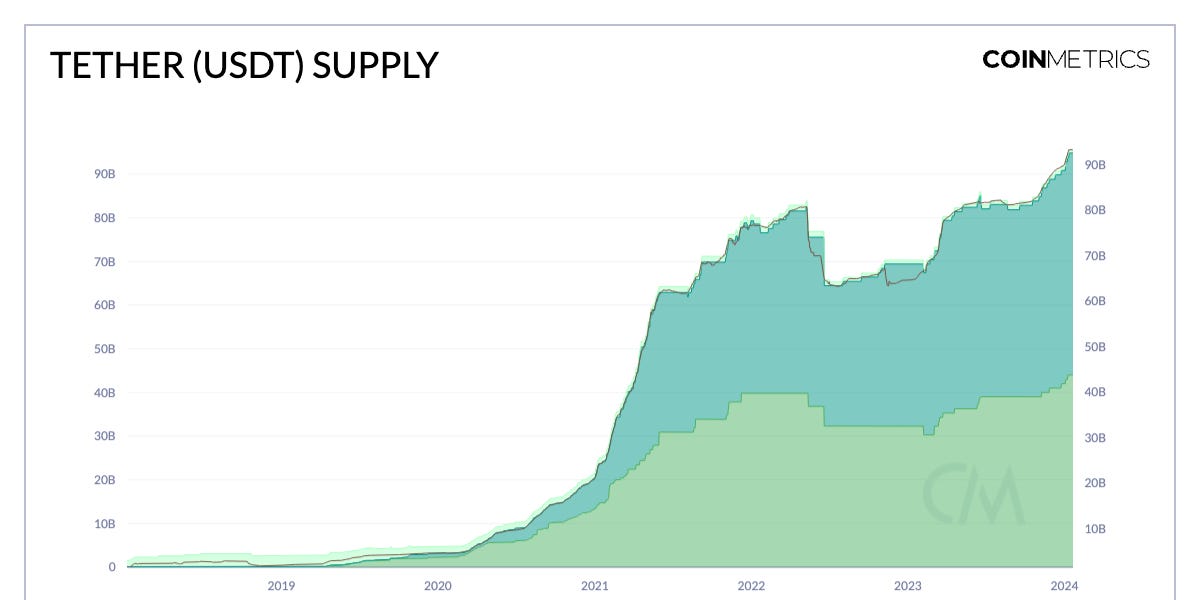

The recent surge in interest surrounding the launch of spot Bitcoin ETFs may have inadvertently diverted attention from Tether’s significant growth. Tether recently achieved a new milestone, surpassing its highest-ever supply, reaching over $95 billion—a 35% increase year-over-year. Analyzing the distribution of this total, $44B—46% of the supply—is minted on the Ethereum blockchain. Conversely, $50.8B, accounting for 53% of supply, is issued on Tron. Meanwhile, issuance on Omni constituted nearly 33% of the total in January 2020, which has dwindled to a mere 1% as a result of Tether’s decision to cease support for the network. As the digital asset ecosystem evolves to embrace multiple chains, Tether’s issuance is expanding on alternative layer-1 networks such as Solana and Avalanche. This expansion enhances USDT’s utility across a variety of on-chain ecosystems.

Source: Coin Metrics Network Data

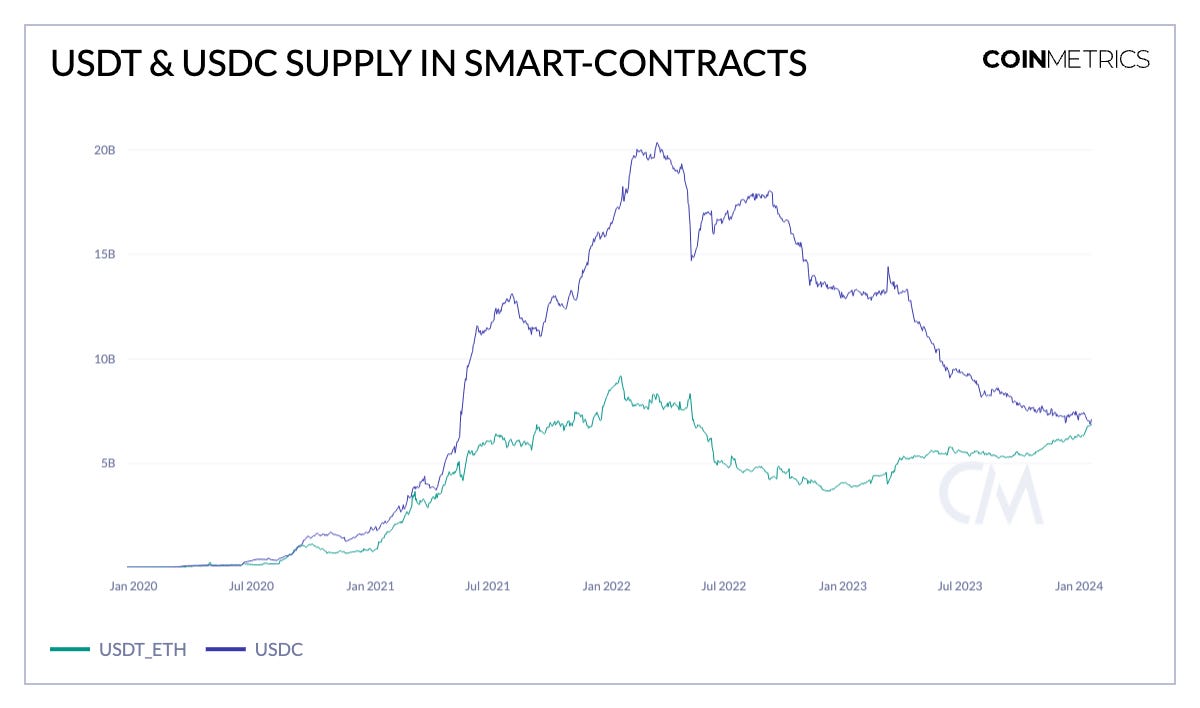

The recent turmoil, notably the collapse of Silicon Valley Bank (SVB) and the repercussions of Operation Choke Point 2.0 may have acted as a catalyst for the surge in offshore stablecoins. Delving deeper into the composition of this surge reveals key growth drivers. A particularly noteworthy trend is the increased prominence of USDT (ETH) in smart contracts, a domain historically dominated by Circle’s USDC since its establishment. The aftermath of the SVB crisis has seemingly shaken market confidence in USDC, inadvertently boosting USDT’s engagement in smart contracts. Since March 2023, USDT’s presence in this sector has soared from $4B to nearly $6.9B. This shift underscores USDT’s growing popularity within decentralized finance (DeFi) applications, a trend vividly captured in the “DeFi Balance Sheets” section of our State of the Market report. Notably, USDT has overtaken USDC in leading money markets, including Aave v2 and Compound, further cementing its position in the DeFi landscape.

USDT’s escalating influence within DeFi, evident across lending platforms and exchanges, highlights its pivotal role in facilitating trustless transactions tied to the dollar, ultimately enabling broader and more efficient access to financial services.

Source: Coin Metrics Network Data

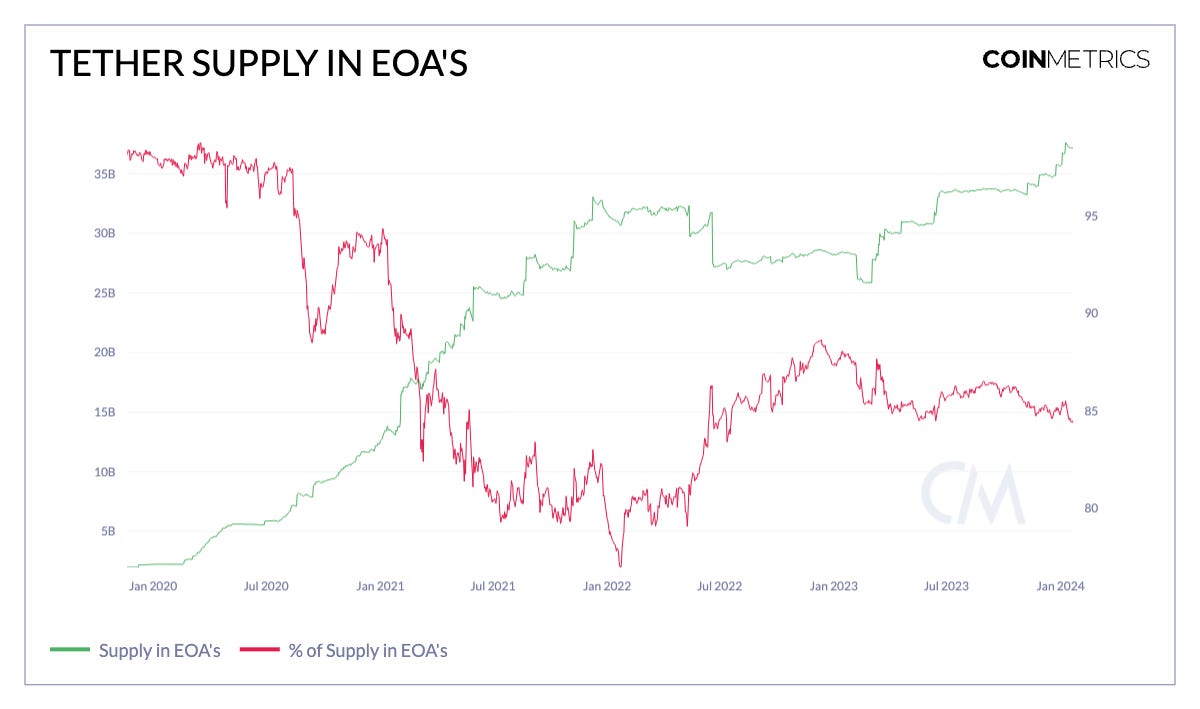

While Tether’s utilization in smart contracts has expanded, it is primarily held by externally owned accounts (EOA’s), or accounts controlled by private keys, akin to accounts owned by individual users. The supply of Tether (ETH) in EOA’s has risen to $37B, comprising 84% of total supply on Ethereum. These trends are reflective of growing adoption of digital dollars not only as a store of value or hedge against volatility, but also for their utility in transactional activities—such as trading or payments.

Source: Coin Metrics Network Data

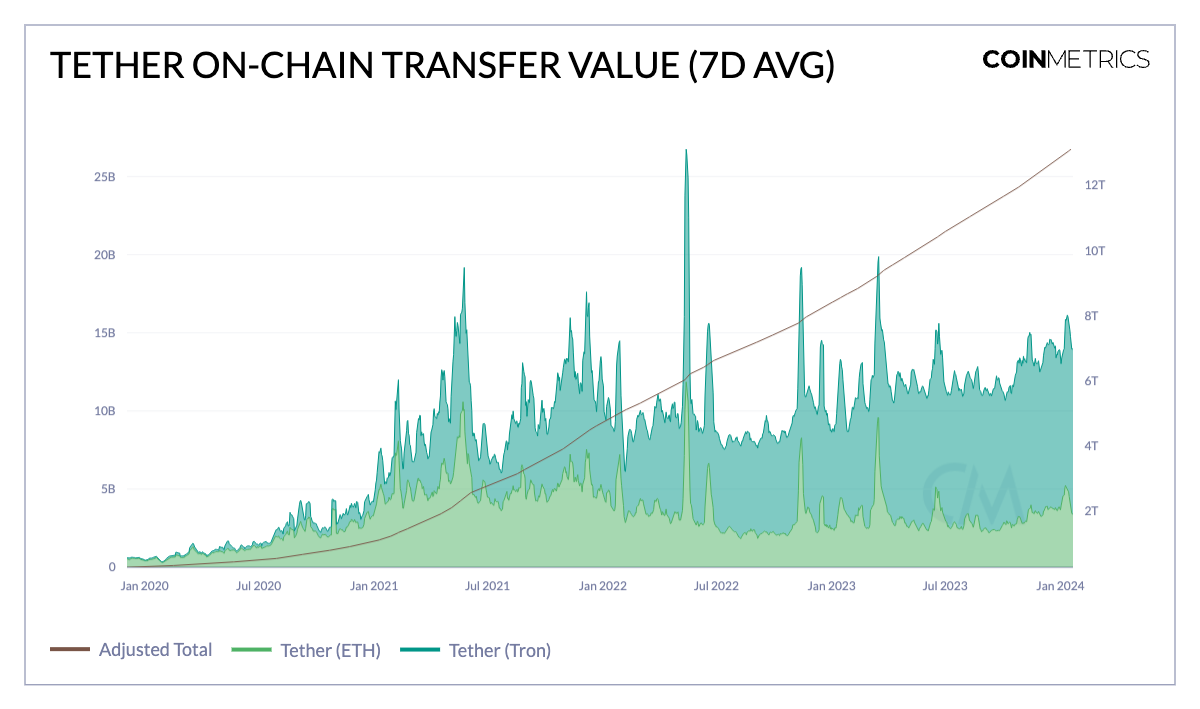

As the largest and most widely adopted stablecoin, Tether has seen substantial usage. This month, the adjusted on-chain transfer value involving distinct USDT addresses on the Ethereum network exceeded $5B. Concurrently, transfer value on the Tron network surpassed $11B. Cumulatively, since its introduction in 2014, Tether has facilitated the transfer of over $13T, emphasizing its growing utilization. This widespread adoption is notably pronounced in emerging markets across Africa, Latin America, South Asia, and other regions. In these locales, Tether often acts as a surrogate for the U.S. dollar. It provides the means to protect savings, seek economic stability and offers access to banking infrastructure, thereby enabling peer-to-peer transactions for various purposes.

Source: Coin Metrics Network Data

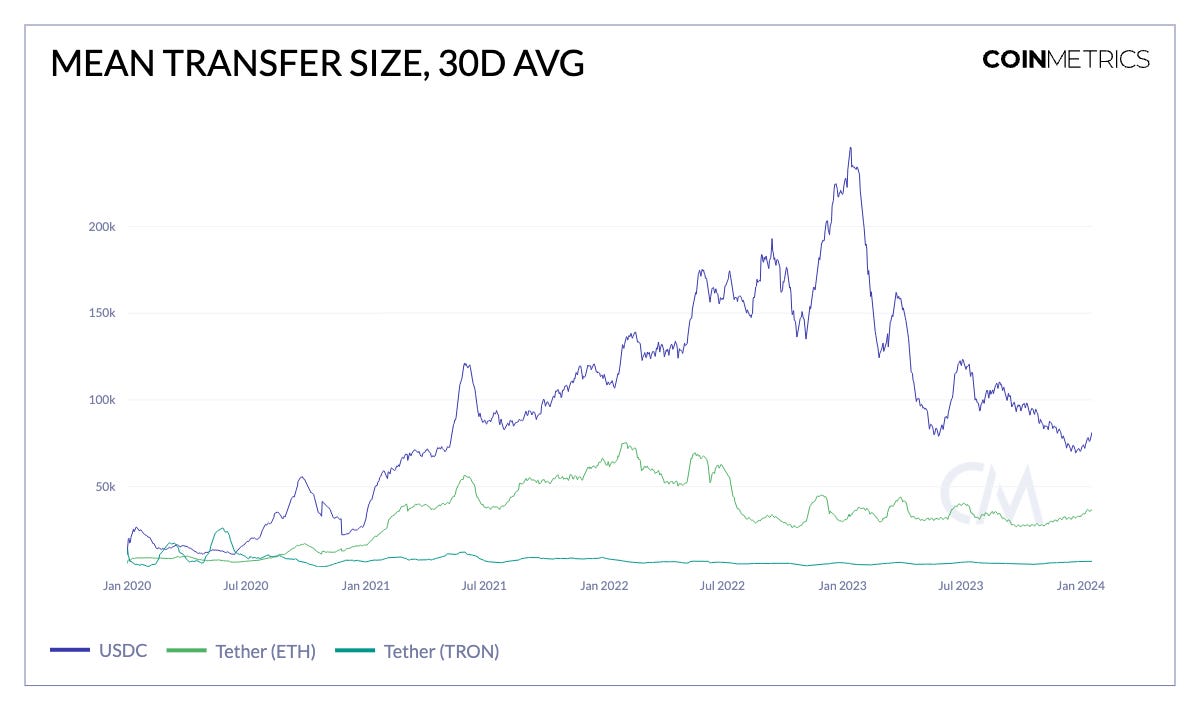

To better understand usage patterns and the demographics served by Tether, examining the nature of “typical” Tether transactions is insightful. The data reveals that average transfer sizes for USDT are generally smaller than those for USDC, which currently averages around $75,000 per transfer. This higher average suggests that USDC is often used for larger-scale transactions, aligning with its status as the primary onshore stablecoin and its widespread use in DeFi applications.

In contrast, USDT on the Ethereum network shows an average transfer size of $35,000, indicating its involvement in substantial financial activities within the DeFi ecosystem, likely influenced by Ethereum’s higher transaction fees. Conversely, USDT on the Tron network presents a distinct scenario. With Tron’s minimal transaction fees, the average transfer size for USDT is around $7,000, facilitating more frequent, lower-value transactions. This makes it a practical option for daily payments and remittances.

More broadly, these patterns not only reflect diverse user demographics and preferences but also underscore the influence of the underlying networks on which these stablecoins operate.

Source: Coin Metrics Network Data

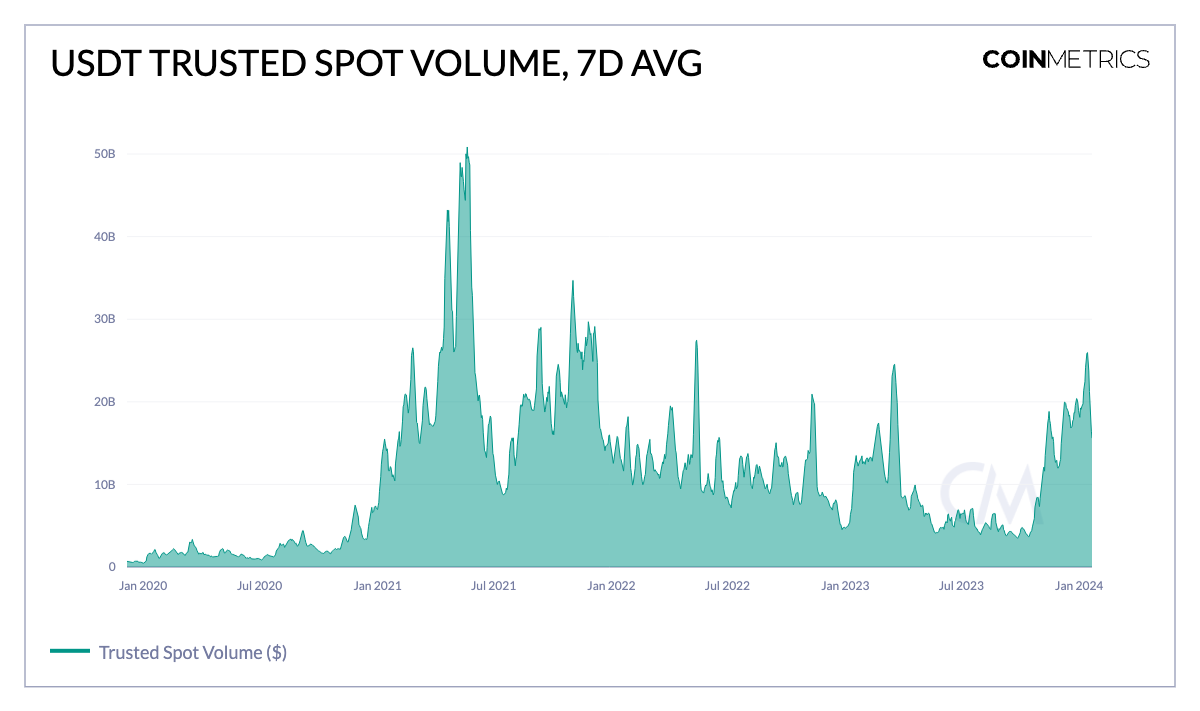

USDT, among other stablecoins, also plays a vital role as a quote asset—facilitating the liquid trading of digital assets on exchanges. With the recent exuberance in digital asset markets leading up to the launch of spot Bitcoin ETFs, USDT has facilitated over $25B in trusted spot volumes, overtaking previous peaks in November 2022 and March 2023. Tether also plays a dominant role in this domain, making up more than 85% of stablecoin denominated trading volume.

Source: Coin Metrics Market Data

The composition and transparency of Tether’s reserves have been contentious topics, often leading to speculation about the adequacy of its financial backing. However, Howard Lutnick’s assertive statement at the World Economic Forum in Davos, affirming that “They have the money,” has helped alleviate some of these concerns, adding a measure of credibility to the discussions about Tether’s reserves. Currently, the only way to verify this is through independent auditor attestation reports, which provide a breakdown of assets held in their reserves on a quarterly basis.

Tether’s reserve composition has undergone several shifts over the years. While forms of debt like commercial paper made up a large portion of reserves in 2021, their latest attestation indicates that reserves are primarily composed of US Treasury bills, reflective of the rising interest rate environment. In May 2023, Tether announced that they would start allocating up to 15% exclusively from realized profits into BTC in an effort to add to USDT’s surplus reserves. This has materialized to 57.5K BTC, amounting to $1.6B worth of bitcoin holdings aligning with their latest attestation in Q3 2023. However, if this bitcoin account were to be conclusively linked to Tether, it’d imply that Tether recently purchased another 8.9K BTC, bringing their current total to 66.4K BTC. This inference is bolstered by the observation that credits to this account seem to be linked to Bitfinex, an exchange closely associated with Tether.

Although the quarterly attestations offer insights into Tether’s holdings, an official, more frequent audit providing detailed transparency would be a welcome development for both users and skeptics.

Tether’s impressive ascent is a testament to its tangible utility, particularly in developing economies where economic instability makes access to a stable, reliable currency scarce. Despite valid concerns around centralization and transparency, the diverse benefits Tether offers should not be overlooked. As one of the gateways to broader digital asset adoption, Tether has helped buoy the entire stablecoin market forward. While it stands as the largest stablecoin today, it will be interesting to see if it continues to reign supreme against the backdrop of an evolving landscape. Circle’s plans to go public, along with the rise of crypto-collateralized and interest-bearing stablecoins make the dynamic nature of the stablecoin landscape an intriguing one to follow.

To follow the data used in this piece and explore our other on-chain metrics check out our charting tool, formula builder, correlation tool, and mobile apps.

Source: Coin Metrics Network Data Pro

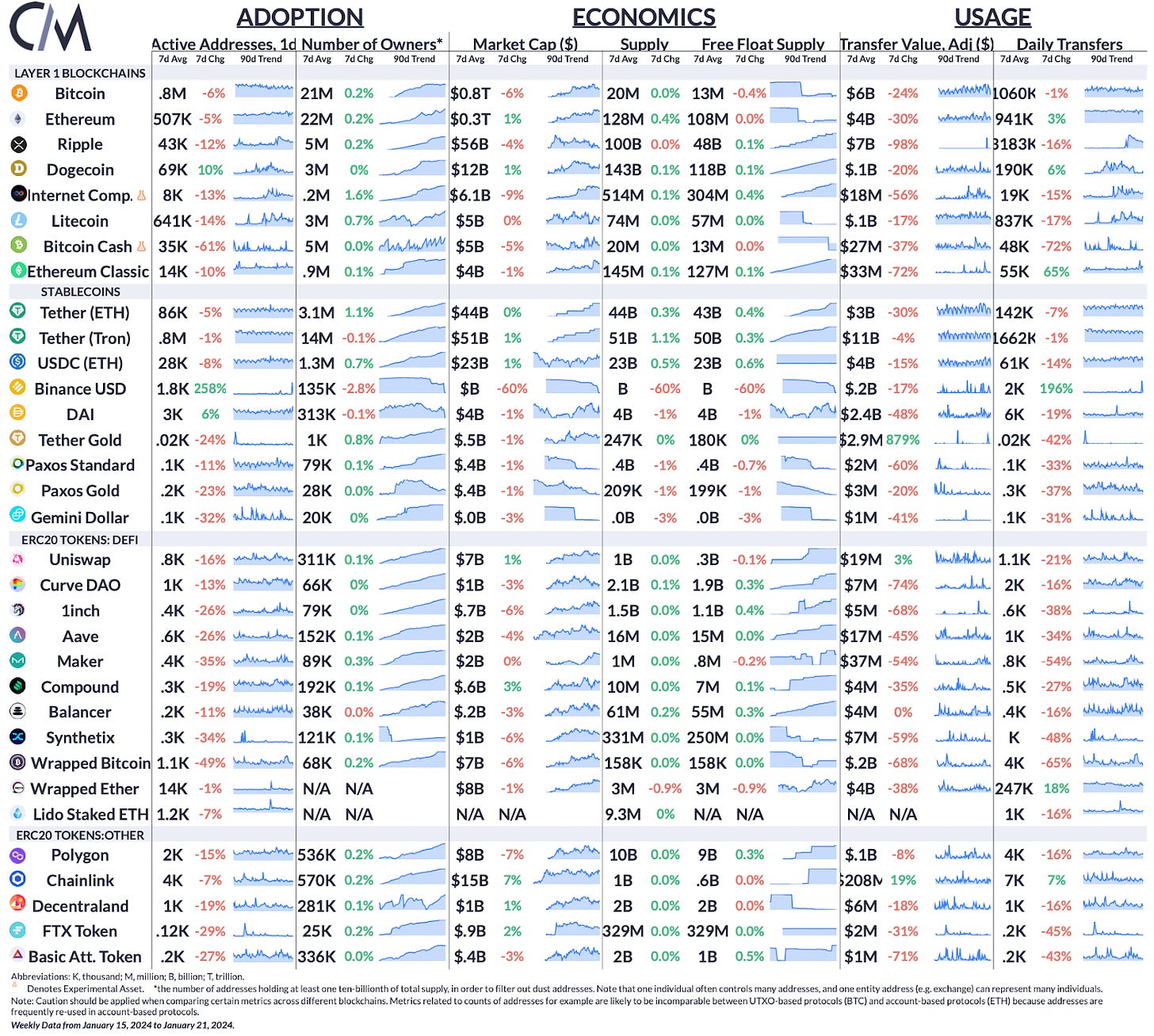

Bitcoin and Ethereum saw a decline in active addresses by 6% and 5% respectively. Concurrently, Bitcoin’s market capitalization dropped by 6%, contributing to an overall downturn in digital asset markets following the launch of spot Bitcoin ETFs.

This week’s updates from the Coin Metrics team:

-

Follow Coin Metrics’ State of the Market newsletter which contextualizes the week’s crypto market movements with concise commentary from the Coin Metrics team, rich visuals, and timely data.

As always, if you have any feedback or requests please let us know here.

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you’d like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

© 2024 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter.

[ad_2]

Read More: coinmetrics.substack.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Sui

Sui  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Stellar

Stellar  Avalanche

Avalanche  USDS

USDS  Toncoin

Toncoin  WhiteBIT Coin

WhiteBIT Coin  Shiba Inu

Shiba Inu  Hedera

Hedera  Litecoin

Litecoin  WETH

WETH  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Ethena USDe

Ethena USDe  Polkadot

Polkadot  Bitget Token

Bitget Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Uniswap

Uniswap  Pepe

Pepe  Pi Network

Pi Network  Aave

Aave  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Aptos

Aptos  Bittensor

Bittensor  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  sUSDS

sUSDS  NEAR Protocol

NEAR Protocol  Internet Computer

Internet Computer  Cronos

Cronos  Jito Staked SOL

Jito Staked SOL  Ethereum Classic

Ethereum Classic