[ad_1]

- SOL’s market cap increased by over 130% in Q1.

- Sentiment around the token turned bearish last week.

Like most cryptos, the first quarter of 2024 ended on a positive note for Solana [SOL], as it performed well on multiple fronts. Therefore, here’s a closer look at SOL’s Q1 performance and what you should expect in Q2.

Solana’s Q1 stats

Coin98 Analytics, a data analytics platform, recently posted a tweet highlighting Solana’s network stats during Q1. As per the tweet, SOL displayed remarkable performance in terms of captured value.

SOL’s fees and revenue increased 7 times compared to the previous quarter and 27 times compared to the same period last year.

However, it was surprising to see that despite the massive surge in revenue, the blockchain’s total earnings dropped by 131% in the last quarter. The reason behind this was a 141% rise in Solana’s expenses in Q1.

Nonetheless, the blockchain’s network activity remained robust. This was the case as its daily active addresses surged by 214% and exceeded 591k.

AMBCrypto then checked Artemis’ data to find out how things were looking in Q2. We found that both its feeds and revenue declined during the last week.

A similar declining trend was also noted in terms of daily active addresses. Nonetheless, SOL’s daily transactions increased last week, reflecting a rise in usage.

Solana investors took profit

Coin98’s tweet also mentioned how SOL’s price increased during Q1, thanks to the bullish market condition. As per the report, SOL’s circulating market capitalization exceeded $53 billion as it surged by over 130% in Q1.

However, the growth momentum slowed down in Q2 as bears jumped in.

According to CoinMarketCap, SOL’s price dropped by more than 5% in the last seven days. At the time of writing, SOL was trading at $173.25 with a market cap of over $77 billion. To see how the drop in the token’s price affected market sentiments, AMBCrypto took a look at Santiment’s data.

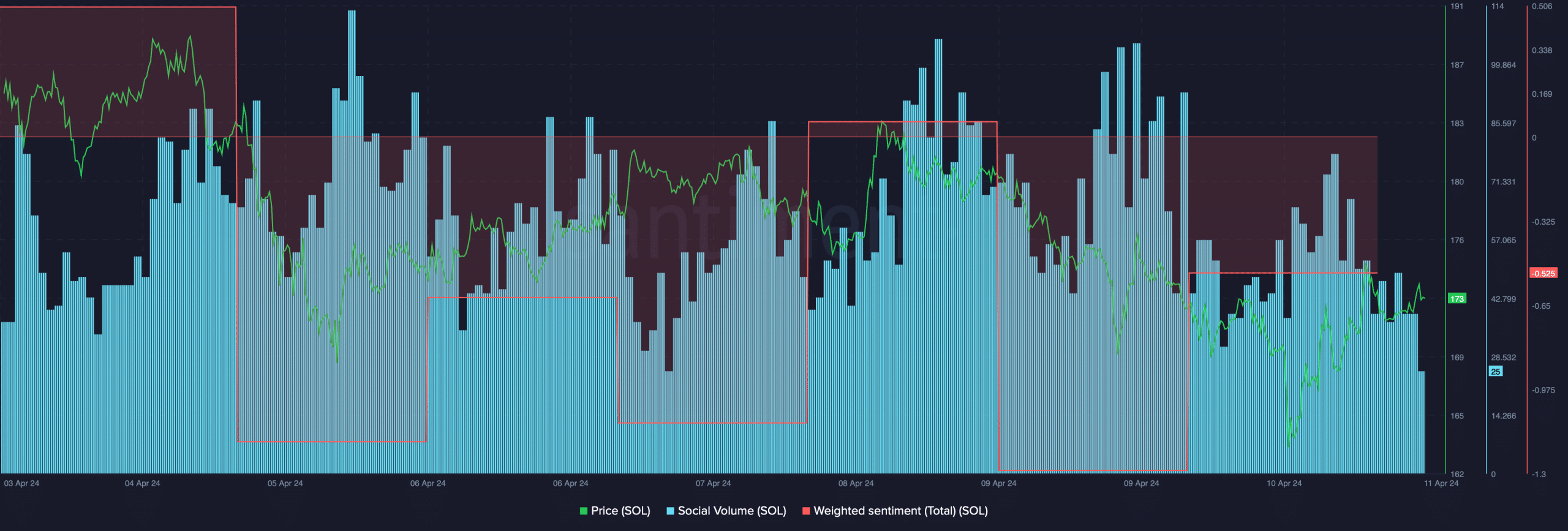

Our analysis revealed that Solana’s social volume remained high last week, which reflected its popularity in the crypto space. However, investors’ confidence in SOL dwindled because of the price action.

The token’s weighted sentiment remained in the negative zone, meaning that bearish sentiment around SOL was dominant in the market.

Realistic or not, here’s SOL’s market cap in BTC’s terms

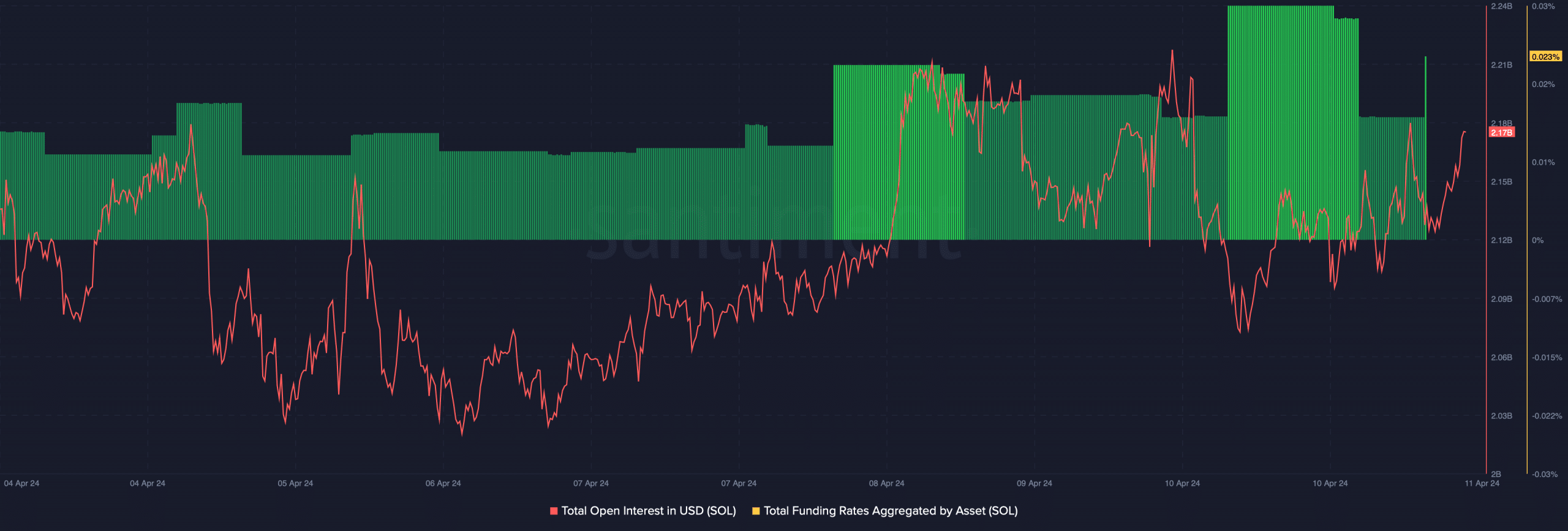

Things in the derivatives market also looked pretty bearish on SOL. Its open interest increased while its price dropped, indicating that the declining price trend might continue further.

Additionally, its funding rate was also high. This suggested that futures investors were buying SOL activity at its low price.

[ad_2]

Read More: ambcrypto.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  Sui

Sui  LEO Token

LEO Token  Chainlink

Chainlink  USDS

USDS  Stellar

Stellar  Avalanche

Avalanche  Toncoin

Toncoin  WhiteBIT Coin

WhiteBIT Coin  Shiba Inu

Shiba Inu  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Litecoin

Litecoin  WETH

WETH  Wrapped eETH

Wrapped eETH  Hedera

Hedera  Ethena USDe

Ethena USDe  Monero

Monero  Polkadot

Polkadot  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Bitget Token

Bitget Token  Pi Network

Pi Network  Pepe

Pepe  Uniswap

Uniswap  Dai

Dai  Aave

Aave  Ethena Staked USDe

Ethena Staked USDe  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Bittensor

Bittensor  Aptos

Aptos  sUSDS

sUSDS  Cronos

Cronos  Internet Computer

Internet Computer  Jito Staked SOL

Jito Staked SOL  NEAR Protocol

NEAR Protocol  Ethereum Classic

Ethereum Classic