[ad_1]

- Increasing Open Interest and negative Funding Rate placed BNB in place to hit $630.

- BNB might continue to outperform SOL despite the negative sentiment around it.

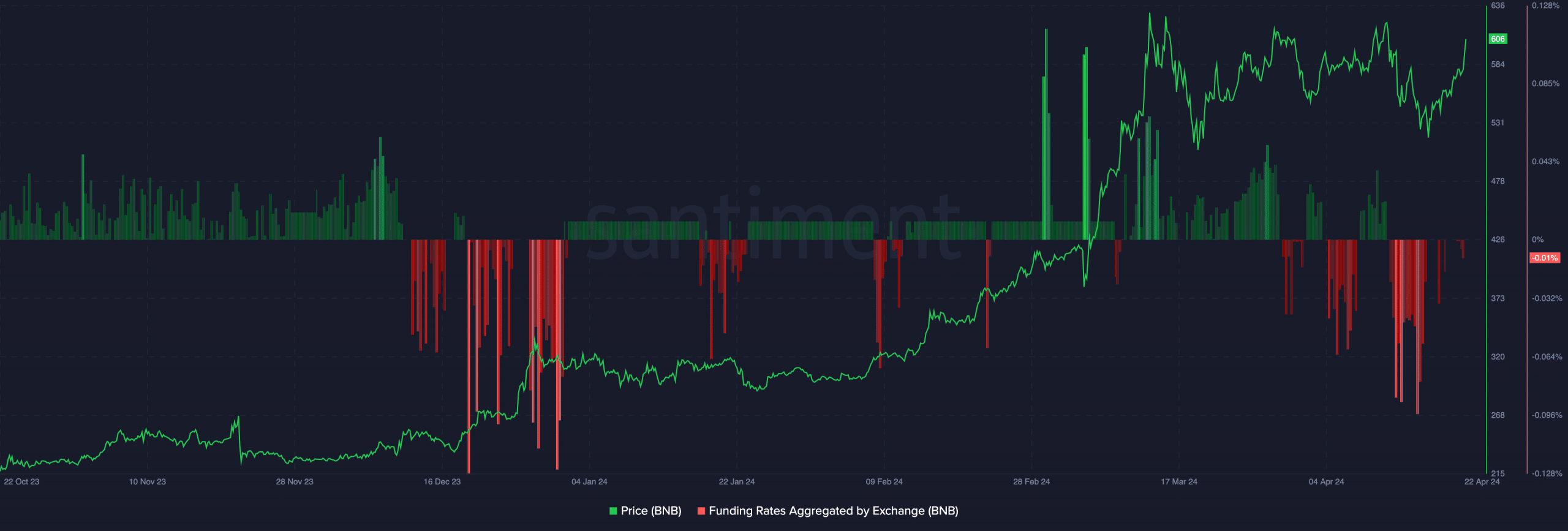

According to AMBCrypto’s analysis, Binance Coin’s [BNB] Funding Rate turned negative on the 22nd of April, implying that short positions dominated the derivative market.

For context, a short is a trader betting on a price decrease to make gains. Funding Rate, on the other hand, is the cost of holding an open perp position.

If positive, longs pay shorts to keep their positions open. But since it was negative, it implied otherwise for BNB. Despite their dominance in the market, shorts were being rewarded for their positions.

BNB is king, sets eyes on another rally

This was because of BNB’s price action. In the last 24 hours, BNB’s price has increased by 4.33%, with the price crossing the much-talked-about $600.

Typically, negative funding alongside a rising price means shorts are not getting rewarded. For the price, this position could be bullish.

Should this remain the case over the next few days, the price of the coin might rise as high as $630. For some time, BNB has been the top performer out of all the cryptocurrencies in the top 10.

On a Year-To-Date (YTD) basis, the value of the coin has increased by 92.12%, beating the likes of Solana [SOL] at its own game. But will the price continue to rise in the short term?

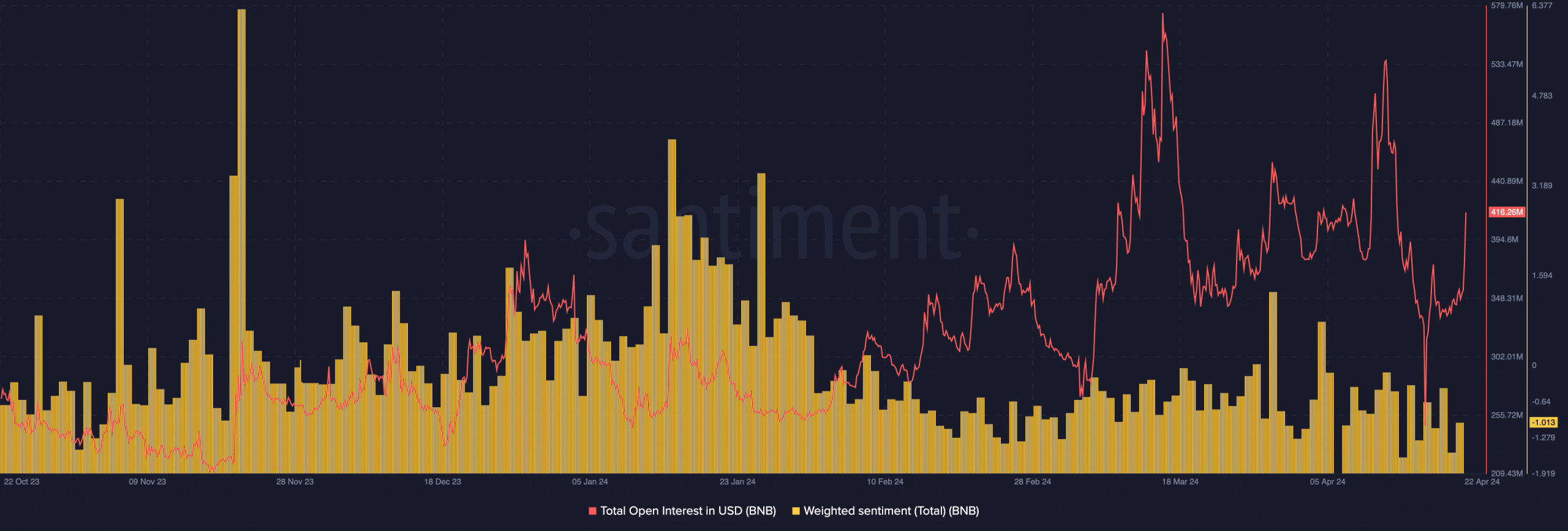

To assess the potential, AMBCrypto looked at BNB’s Open Interest (OI). On-chain data from Santiment showed that the OI increased by 17.89% in the last 24 hours.

This placed the metric at $416.26 million, indicating that many traders were opening more contracts related to the cryptocurrency. Beyond that, OI influences price action.

Despite the coin at your peril

If the OI continues to increase likewise the price, then the uptrend might continue, and longs might keep having an edge over shorts.

On the other hand, if the OI drops while the price rises the upswing might become weak, and a decline could be imminent. But for the time being, that might not be the case.

Furthermore, the Weighted Sentiment around the coin was negative in light of the bullish bias. The negative reading of the metric suggests that comments about BNB were mostly bleak.

Generally, this sentiment is supposed to drag down demand for the coin. But one thing AMBCrypto noticed was that anytime the metric was in the red zone, BNB defied the odds and went on a “hated rally.”

Realistic or not, here’s BNB’s market cap in SOL’s terms

However, traders might need to watch out for BNB momentum in the short term. Should the coin get overbought, the price might retrace and a fall below $600 could be possible.

But as it stands, bears might not be able to halt the coin’s northward move.

[ad_2]

Read More: ambcrypto.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  Sui

Sui  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Avalanche

Avalanche  Toncoin

Toncoin  USDS

USDS  WhiteBIT Coin

WhiteBIT Coin  Shiba Inu

Shiba Inu  WETH

WETH  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Hedera

Hedera  Monero

Monero  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Polkadot

Polkadot  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pi Network

Pi Network  Uniswap

Uniswap  Pepe

Pepe  Aave

Aave  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Aptos

Aptos  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Bittensor

Bittensor  Internet Computer

Internet Computer  NEAR Protocol

NEAR Protocol  Jito Staked SOL

Jito Staked SOL  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Ondo

Ondo