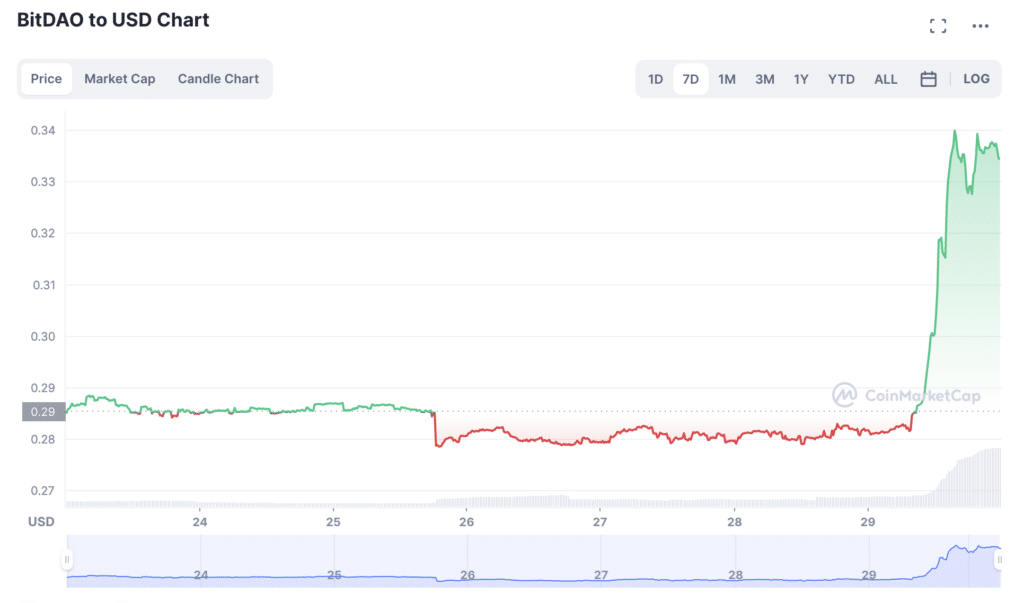

The market reacted with great enthusiasm to BitDAO (BIT) token holders voting to approve BIP-18 proposal to enact a $100 million BIT buyback.

According to data gathered from decentralized governance platform Snapshot, the vote has not yet concluded. As of press time, the holders of 148 million BIT tokens — worth nearly $50 million — voted in favor of the proposal with not one token holder voting against it.

Considering that token holders have a financial incentive to vote in favor of reducing the BIT circulating supply, a change in sentiment is unlikely.

If the vote concludes in favor of the proposal, BitDAO will buy $2 million worth of BIT every day for 50 days starting on the first day of January. Considering this morning’s BIT market cap of under $590 million, this adds up to a significant buyback of about 17% of the token’s total market cap.

Still, the crypto-centric Twitter account Huma points out discrepancies in this data.

It is possible that CoinMarketCap’s data significantly underestimates BIT’s supply. BitDAO’s official website puts the estimate at about $2 billion — this would decrease the buyback percentage to a noteworthy, but not as impressive 5%.

BitDAO is a crypto project that is focused on building decentralized autonomous organizations (DAOs) on the Ethereum blockchain. Specifically, it helps build platforms that enable the creation and management of DAOs. It also focuses on providing tools and resources for developers and users to build and engage with DAOs. Moreover, the project is working on building a decentralized exchange (DEX) that will enable the buying and selling of tokens within DAOs.

BitDAO was earlier exposed to the FTX scandal, as it made a public promise with Alameda Research to keep each other’s tokens for three years, or until November 2, 2024. However, in early November the dramatic drop in its pricing sparked a rapid response from the BitDAO community, who suspected Alameda of dumping the BIT tokens and breaking the mutual no-sale public promise. The BitDAO community asked for a budgetary allocation to monitor and confirm Alameda’s commitment to keeping BIT coins to pinpoint the causes of BIT’s price decline.

Read More: crypto.news

Set the Target Daily Purchase Amount (TDPA) at $2.0M USDT per day starting Jan 1, 2023 for 50 days (total $100M USDT)

Set the Target Daily Purchase Amount (TDPA) at $2.0M USDT per day starting Jan 1, 2023 for 50 days (total $100M USDT)

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Bitcoin Cash

Bitcoin Cash  Stellar

Stellar  LEO Token

LEO Token  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDS

USDS  Hedera

Hedera  WETH

WETH  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Polkadot

Polkadot  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Pepe

Pepe  Pi Network

Pi Network  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  Aave

Aave  Uniswap

Uniswap  Bittensor

Bittensor  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  OKB

OKB  Aptos

Aptos  NEAR Protocol

NEAR Protocol  Jito Staked SOL

Jito Staked SOL  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Ondo

Ondo  Tokenize Xchange

Tokenize Xchange  Ethereum Classic

Ethereum Classic