[ad_1]

BTC Rollercoaster

BTC Rollercoaster

Bitcoin had a rollercoaster of a week, dipping into Wednesday’s FOMC meeting before shooting up, only to come down again!

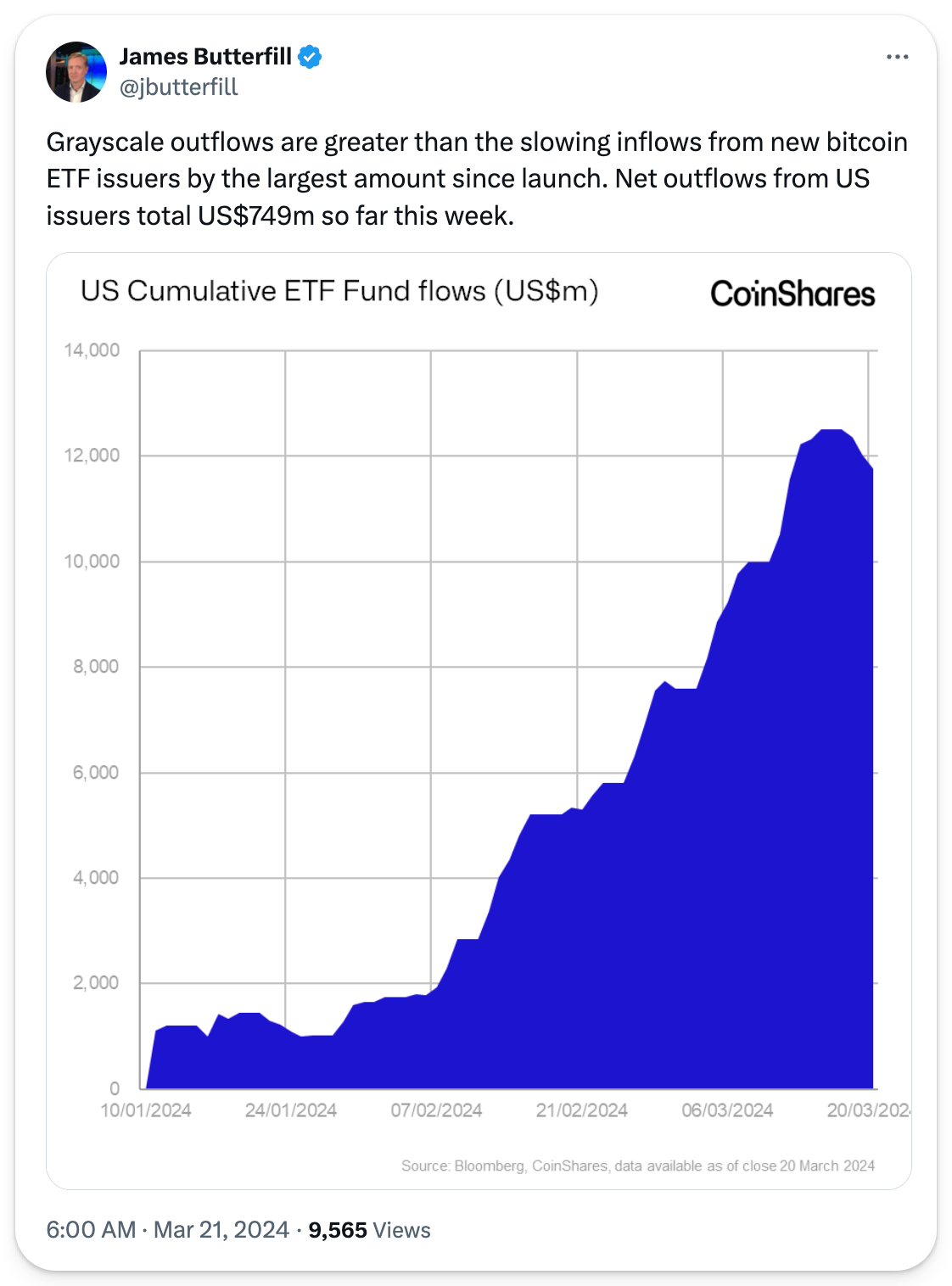

The asset’s price swung between ~$60k and ~$66k. Substantial ETF outflows from Grayscale, who started off the week with $643M of outflows on Monday and continued their selling throughout the week, certainly impacted market movements.

Don’t worry; only ~365K BTC remains for GBTC to sell, down from 619K two months ago. With 28 days left to the BTC halving, anticipations of increased volatility have risen. Yet, the long-term outlook remains optimistic, with predictions of a coming calm.

Ethereum Foundation Under Scrutiny?

Ethereum Foundation Under Scrutiny?

The Ethereum Foundation announced it’s facing voluntary inquiry from an unnamed state authority.

This inquiry comes amid growing pessimism about the approval of ETH ETFs, as the SEC appears reluctant to engage with potential issuers and, according to Fortune, is actually eager to classify ETH as a security! According to expert ETF Analyst Eric Balchunas, the approval odds for the May deadline currently rests at 25%.

BlackRock’s ‘BUIDL’ Fund

BlackRock’s ‘BUIDL’ Fund

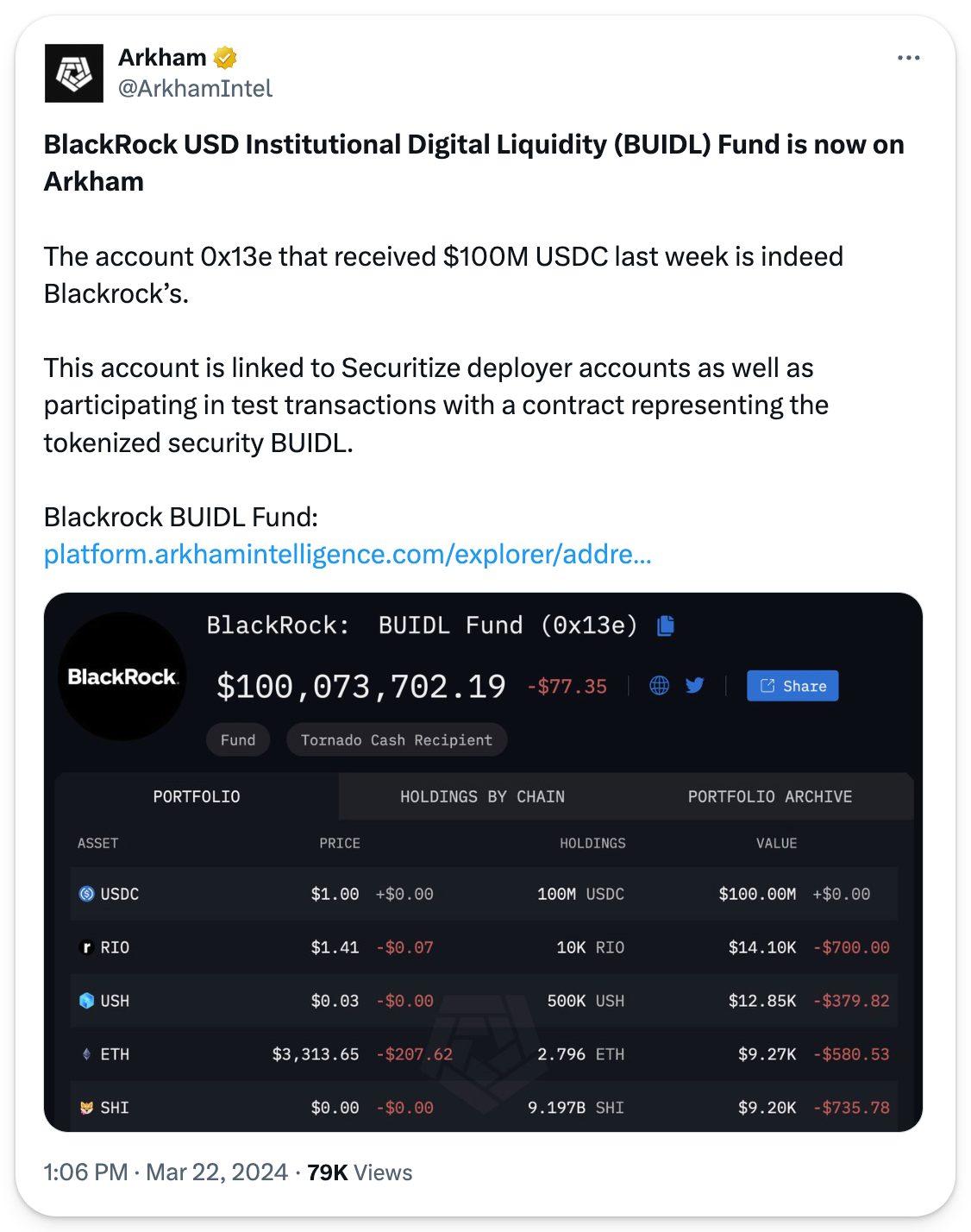

TradFi Titan Blackrock continued its crypto charge by announcing its ‘BUIDL’ fund this week, a tokenized treasury fund onchain.

With a hefty initial investment requirement, BUIDL aims to further merge traditional and digital finance by issuing dividends to investors’ wallets monthly. Several prominent entities, including Coinbase, BNY Mellon, and Price Waterhouse Coopers, were enlisted to support this initiative. Issued via Securitize, a tokenization platform, this strategic move further underscores BlackRock’s commitment to ushering in a new era of digitization in capital markets. Do not expect them to start buying your favorite altcoins.

Outside of Bitcoin and Ethereum, the fund said its clients had very little interest in other tokens.

Base’s Congestion Challenges

Base’s Congestion Challenges

Base season is upon us, sadly bringing with it soaring transaction fees and pending transaction states. Concerns have stirred over the network’s capacity due to heightened activity following the Ethereum Dencun upgrade.

In response, Jesse Pollak took to Twitter, facing the scaling critiques head-on, outlining plans for 1000x’ing Base’s throughput. Continued announcements of L3 launches on Base mix in with this plan, such as Clique’s announcement of an L3 for AI-enhanced gaming built on Base and Stacks an L3 for loyalty programs a few weeks back. Overall, the future remains bright for Base as it builds DeFi and consumer apps to attract all audiences, whether long-time degens or first-time crypto users.

Japanese Pension Fund Eyes Bitcoin

Japanese Pension Fund Eyes Bitcoin

One of the largest pension funds in the world, Japan’s Pension Investment Fund, is exploring investing in Bitcoin, among other ‘illiquid’ assets. With a portfolio of ~$1.54T, the fund’s foray into digital currencies marks another significant moment in accepting Bitcoin as a viable investment option, potentially paving the way for other pension funds to consider Bitcoin.

The timing of this announcement also adds to its significance, as Japan announced they would hike interest rates for the first time in 17 years! (2023 saw Japan reach its highest level of inflation in 40 years, though still way below other countries.) Overall, this combination may signal the strength of Bitcoin’s narrative as an inflation hedge — something even governments are paying attention to.

Still, this is the exploration phase, not the integration phase. Nevertheless, be sure to keep track of this news.

[ad_2]

Read More: www.bankless.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  Sui

Sui  LEO Token

LEO Token  Chainlink

Chainlink  Stellar

Stellar  Avalanche

Avalanche  USDS

USDS  Toncoin

Toncoin  WhiteBIT Coin

WhiteBIT Coin  Shiba Inu

Shiba Inu  Litecoin

Litecoin  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  WETH

WETH  Hedera

Hedera  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Monero

Monero  Polkadot

Polkadot  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Bitget Token

Bitget Token  Pepe

Pepe  Pi Network

Pi Network  Uniswap

Uniswap  Dai

Dai  Aave

Aave  Ethena Staked USDe

Ethena Staked USDe  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Bittensor

Bittensor  Aptos

Aptos  sUSDS

sUSDS  Cronos

Cronos  Internet Computer

Internet Computer  Jito Staked SOL

Jito Staked SOL  NEAR Protocol

NEAR Protocol  Ethereum Classic

Ethereum Classic