[ad_1]

Get the best data-driven crypto insights and analysis every week:

Since its inception in 2009, the world’s first and most prominent cryptocurrency has weathered numerous storms, achieved significant milestones, and fundamentally altered the landscape of finance and technology.

In this week’s special edition of the State of the Network, we reflect on Bitcoin’s remarkable journey as it celebrates its 16th anniversary. As we look back on Bitcoin’s transformative impact and forward to its potential future, we’ll explore key developments, challenges overcome, and the evolving narrative surrounding this groundbreaking digital asset. From its humble beginnings as an obscure whitepaper to its current status as a globally recognized store of value and potential hedge against economic uncertainty, Bitcoin’s story continues to captivate investors, technologists, and policymakers alike. Join us as we delve into the legacy of Satoshi Nakamoto’s creation and its implications for the future of money and decentralized systems.

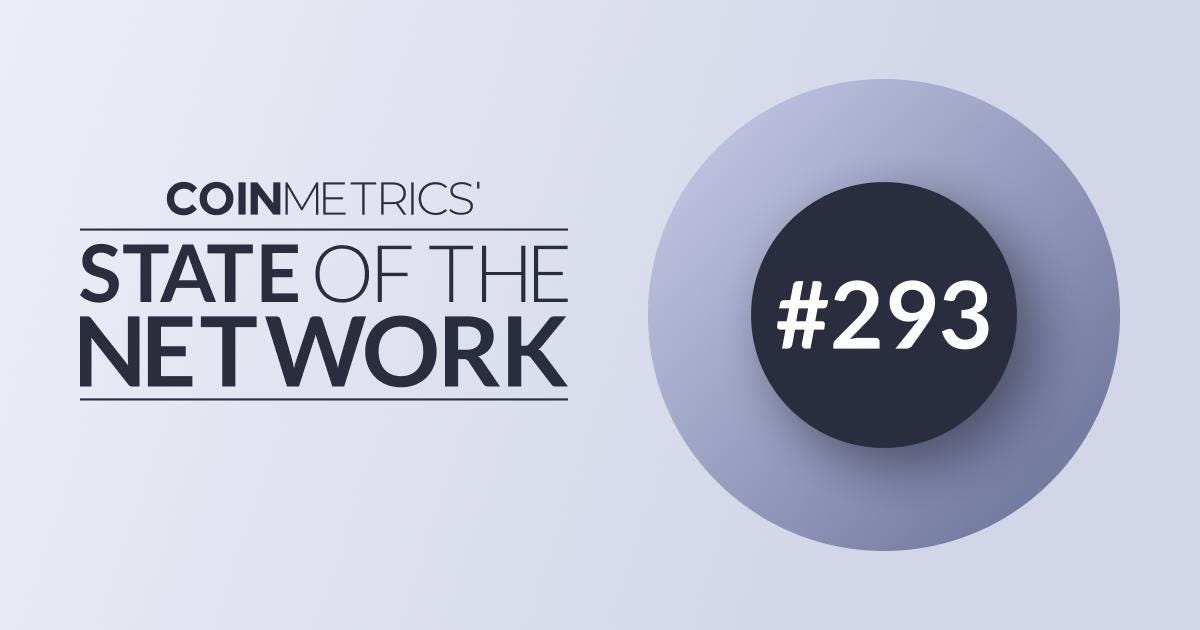

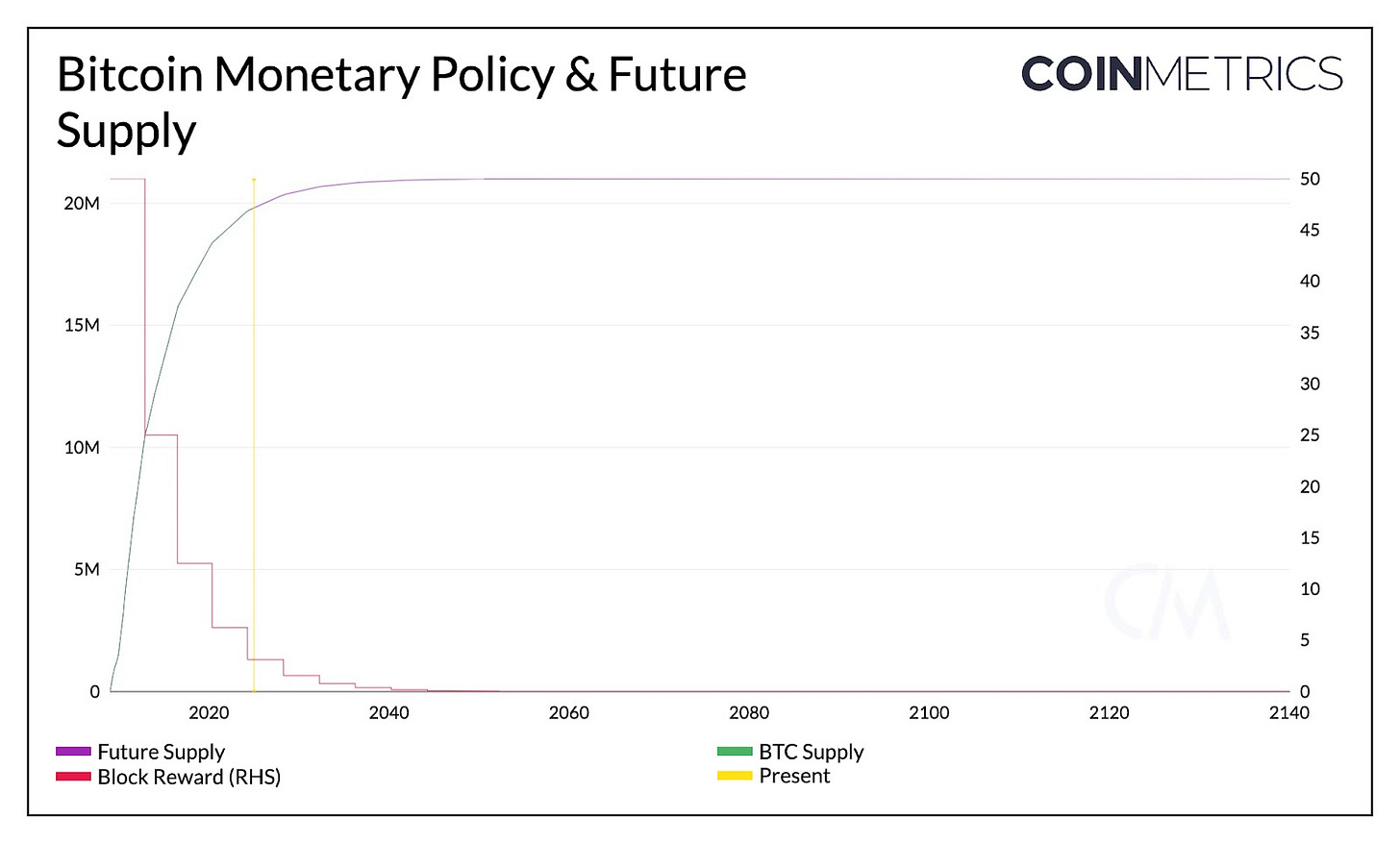

One of Bitcoin’s most revolutionary aspects is that it is a form of money that is devoid of state intervention and has a solidly defined monetary policy. Unlike traditional fiat currencies, which are subject to the whims of central banks and government policies, Bitcoin’s supply and issuance are determined by an algorithm coded into its underlying blockchain technology. This decentralized and transparent approach to monetary policy has been a fundamental driver of Bitcoin’s appeal, as it provides a reliable and predictable framework for the creation and distribution of this digital asset.

Source: Coin Metrics Formula Builder

The absence of state control over Bitcoin’s monetary policy is a direct challenge to the long-standing dominance of centralized financial systems. By offering an alternative to government-issued currencies, Bitcoin empowered individuals and communities to take greater control over their own financial affairs. This paradigm shift has profound implications, as it opens the door to a more equitable and accessible financial landscape, free from the constraints and potential abuses of centralized authorities.

Moreover, Bitcoin’s predetermined issuance schedule, with a fixed maximum supply of 21 million coins, has been widely praised for its ability to resist inflationary pressures that often plague traditional fiat currencies. This scarcity, combined with the decentralized nature of the network, has contributed to Bitcoin’s growing recognition as a store of value and a potential hedge against economic uncertainty.

Source: Coin Metrics Formula Builder

As the world grapples with the ongoing effects of fiat currency debasement and the erosion of purchasing power, Bitcoin’s monetary policy has become an increasingly attractive alternative for those seeking a more stable and predictable financial future. This revolutionary aspect of Bitcoin has been a key driver of its widespread adoption and the growing attention it has garnered from policymakers, investors, and the general public alike.

As Bitcoin has matured as a digital asset, two important economic concepts have come to the forefront: stability and credibility. These factors are often considered in the context of dollarization, the process by which a country or region adopts a foreign currency as its primary medium of exchange.

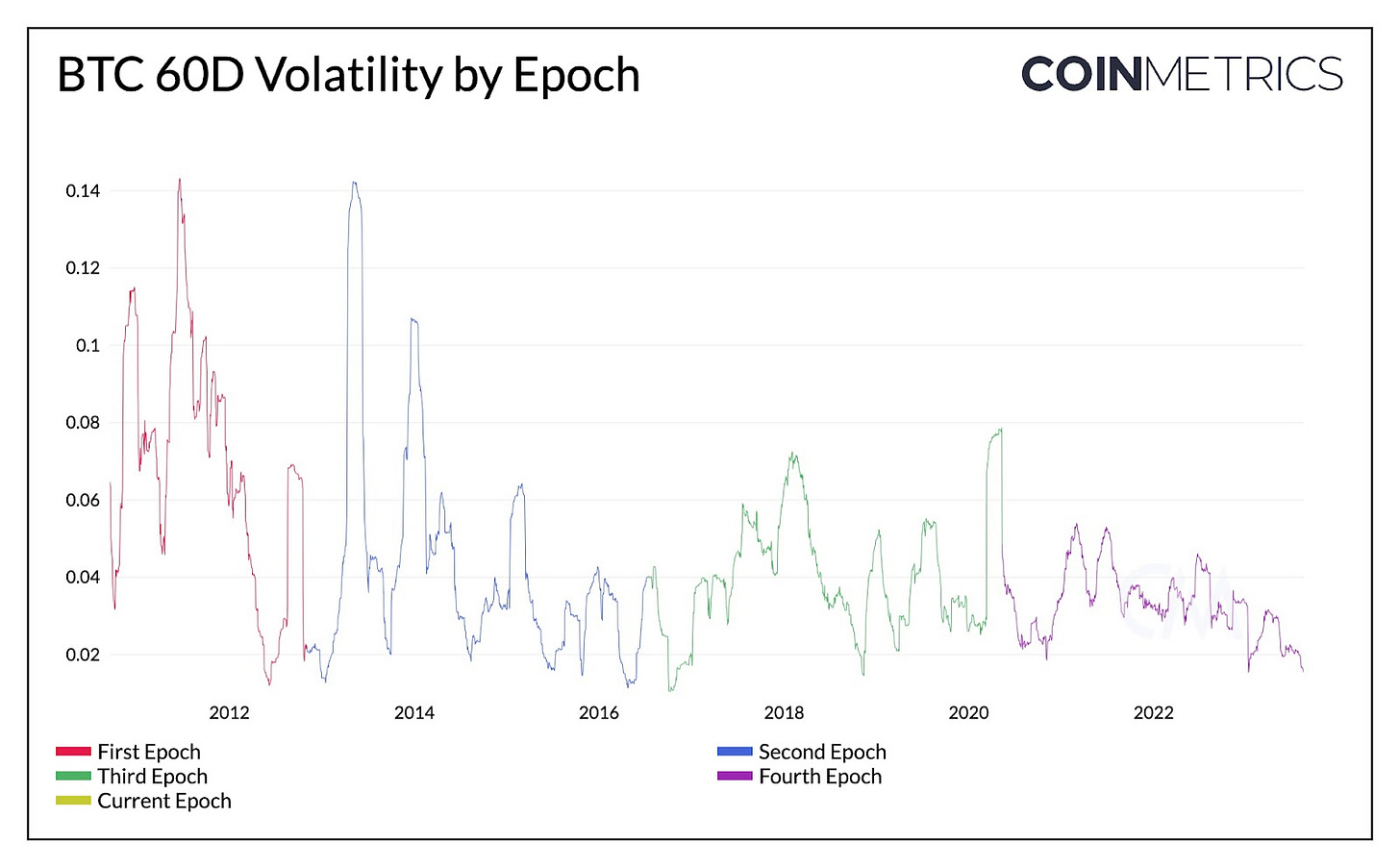

One of the key disadvantages of Bitcoin relative to the world’s leading fiat currencies has been its volatility. Data analysis has shown a steady decline in Bitcoin’s price fluctuations, particularly when compared to its early years. This increased stability has been driven by factors such as the growth of institutional investment, the development of sophisticated trading tools and derivatives, and the overall maturation of the cryptocurrency market. Bitcoin now sits at around 2.6% daily volatility—still far from the world’s best fiat currencies, but surprisingly competitive compared to some other emerging market currencies.

Source: Coin Metrics Market Data Feed

Alongside this growing stability, the rise of stablecoins has further bolstered the credibility of the cryptocurrency ecosystem. Stablecoins are digital assets designed to maintain a stable value, typically pegged to a fiat currency like the U.S. dollar. The combined market capitalization of stablecoins has grown to over $200 billion, reflecting the increasing demand for these more stable digital currencies.

Furthermore, the emergence of Bitcoin exchange-traded funds (ETFs) in the United States has also contributed to the asset’s growing credibility. With over $115 billion in assets under management, these financial instruments have provided institutional investors with a regulated and accessible way to gain exposure to Bitcoin, further legitimizing the cryptocurrency as a viable investment option.

These developments in stability and credibility have significant implications for the potential role of Bitcoin and other cryptocurrencies in the global financial system. As the ecosystem continues to mature and demonstrate its ability to withstand market fluctuations, the prospect of dollarization or the widespread adoption of digital assets as an alternative to traditional fiat currencies becomes increasingly plausible.

As Bitcoin celebrates its 16th anniversary, it is clear that this revolutionary digital asset has profoundly impacted the global financial landscape. From its humble beginnings as an obscure whitepaper, Bitcoin has evolved into a globally recognized store of value and a potential hedge against economic uncertainty.

One of the most transformative aspects of Bitcoin is its decentralized monetary policy, which is devoid of state intervention and defined by a transparent, algorithm-driven framework. This stark contrast to the centralized control of traditional fiat currencies has been a key driver of Bitcoin’s appeal, empowering individuals and communities to take greater control over their financial futures.

The stability and credibility that Bitcoin has demonstrated through its decreasing volatility and the growing adoption of stablecoins and Bitcoin ETFs further solidify its position as a viable alternative to traditional financial systems. These developments have significant implications for the potential role of Bitcoin and other cryptocurrencies in the global economy, as the prospect of dollarization or the widespread adoption of digital assets as a replacement for fiat currencies becomes increasingly plausible.

As we look to the future, the legacy of Satoshi Nakamoto’s creation will undoubtedly continue to shape the evolution of finance, technology, and the very nature of money itself. Bitcoin’s 16th birthday serves as a testament to the resilience, innovation, and transformative power of this groundbreaking digital asset, promising an exciting and unpredictable path ahead.

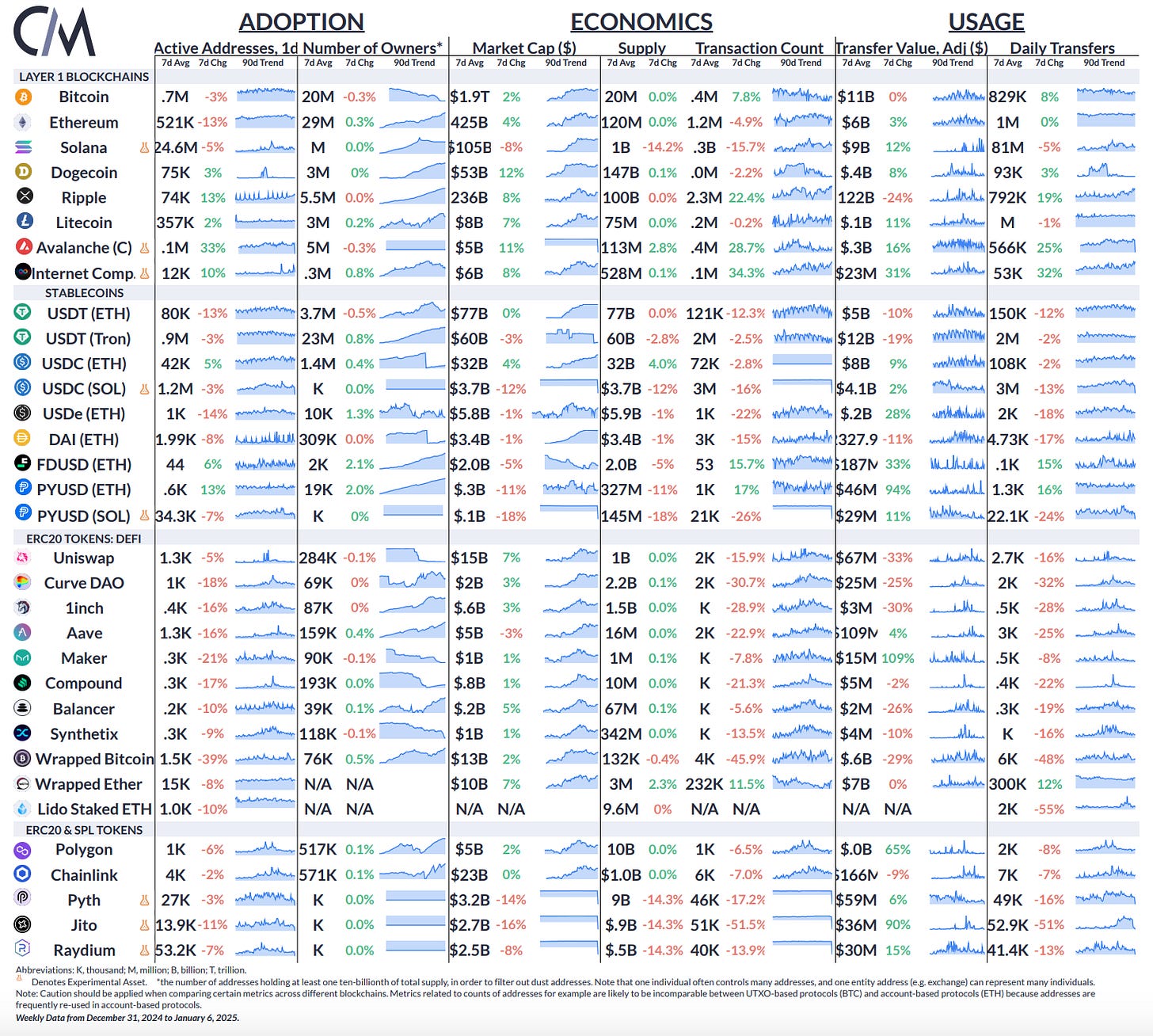

Active addresses fell 3% over the week on Bitcoin, averaging 700K per day. In the stablecoin ecosystem, the free float supply of Tether on Tron fell sharply to 58B while USDC supply rose slightly over the week. At 32B, USDC supply sits well below the 56B all-time-high it reached around July 2022, but recovering quickly.

As always, if you have any feedback or requests please let us know here.

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you’d like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

© 2023 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter.

[ad_2]

Read More: coinmetrics.substack.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  Sui

Sui  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Avalanche

Avalanche  USDS

USDS  Toncoin

Toncoin  WhiteBIT Coin

WhiteBIT Coin  Shiba Inu

Shiba Inu  WETH

WETH  Litecoin

Litecoin  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Wrapped eETH

Wrapped eETH  Hedera

Hedera  Monero

Monero  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Polkadot

Polkadot  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pi Network

Pi Network  Uniswap

Uniswap  Pepe

Pepe  Aave

Aave  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Aptos

Aptos  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Bittensor

Bittensor  Internet Computer

Internet Computer  NEAR Protocol

NEAR Protocol  Jito Staked SOL

Jito Staked SOL  Cronos

Cronos  Ethereum Classic

Ethereum Classic  sUSDS

sUSDS