[ad_1]

Bitcoin (BTC) remains the top target for institutional investors in the past two weeks as the market continues its uphill form this year.

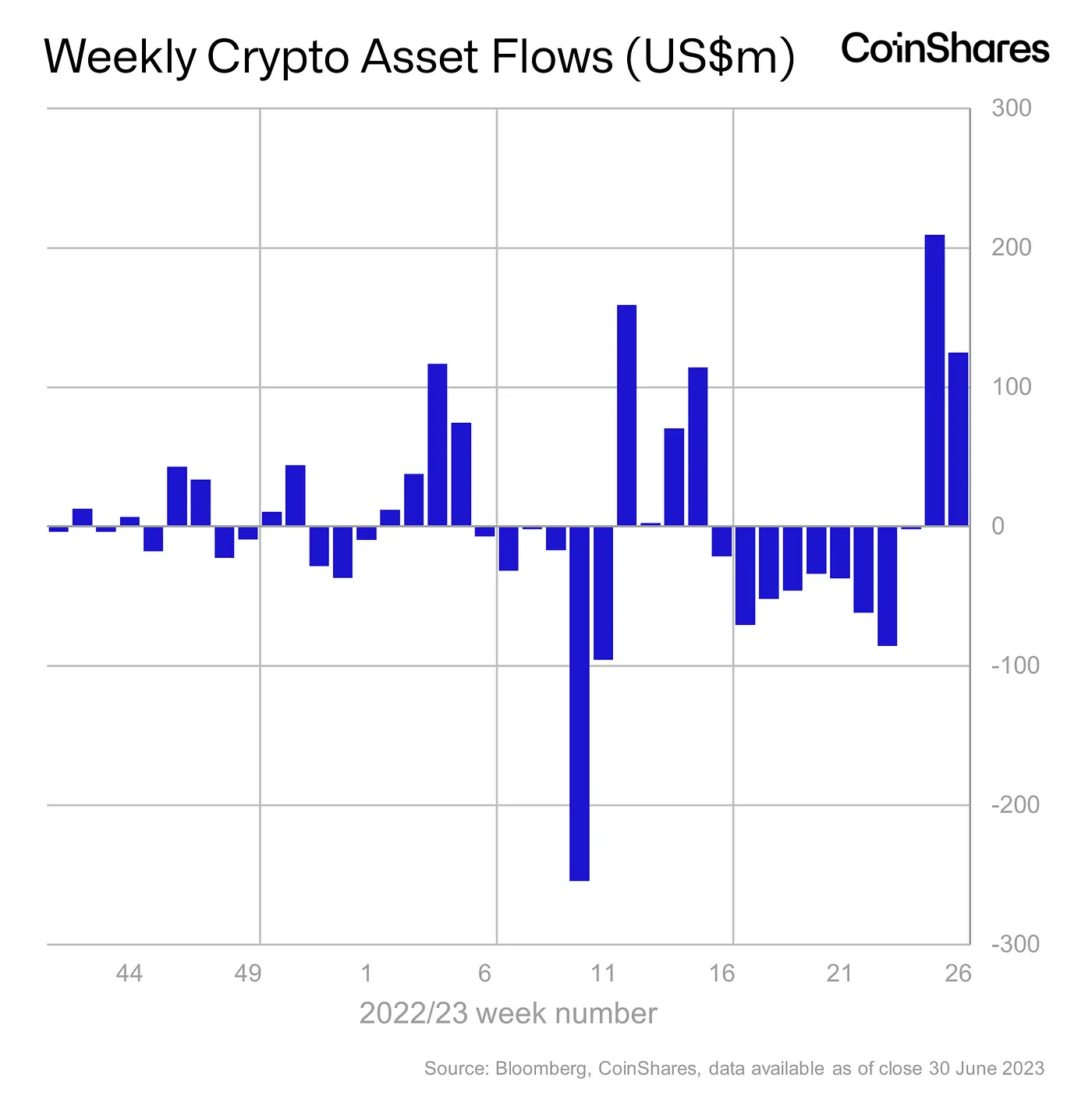

A new report from CoinShares shows Bitcoin’s investment products have attracted $310 million in inflows over 14 days amid skepticism over the approval of the spot BTC ETF by the Securities and Exchange Commission (SEC).

According to the report, BTC leads the pack as it recovers from the previous nine weeks of consecutive outflows.

While this week’s inflows amounted to $123 million, short-BTC investment products recorded $0.9 million in outflows dragging its negative run to the 10th straight week.

Bitcoin dominance can be seen as its share in the last two weeks makes up 98% of the entire market, the second time this year leaving no room for a bearish sentiment with its price trading above $31,000 at press time.

Bitcoin dominance can be seen as its share in the last two weeks makes up 98% of the entire market, the second time this year leaving no room for a bearish sentiment with its price trading above $31,000 at press time.

Ethereum led the altcoin pack inflows of $2.7 million while blockchain equities recorded inflows of $6.8 million, the first time in nine weeks.

Other altcoins like Ripple (XRP), Cardano (ADA), and Polygon (MATIC) recorded similar positive figures with Solana (SOL) posting $0.8 million.

James Butterfill, CoinShares Head of Market Research highlighted that Bitcoin remains the “primary focus” of investors amid high trading activity.

“Bitcoin investment products are now back to a net inflow year-to-date having been in a net outflow position of US$171m just 2 weeks ago.”

On the back of a spot ETF

The reason for Bitcoin’s growing market dominance in recent weeks isn’t far-fetched and fingers can easily be pointed to the frenzy garnered by multiple spot ETF applications sparked off by BlackRock’s initial push.

The price of the leading cryptocurrency has spiked 25.2% since BlackRock made its application last month. WisdomTree, Invesco, and Fidelity also made similar applications.

BTC currently has a market dominance of 51.23% after it reclaimed its 50% market dominance for the first time in two years.

Despite skepticism creeping in following the SEC’s rejection of past spot BTC ETF applications, some observers including analysts at brokerage firm Bernstein opine that the Commission is likely to approve the proposal.

“SEC would rather bring in a regulated bitcoin ETF led by more mainstream Wall Street participants and with surveillance from existing regulated exchanges, than having to deal with a Grayscale OTC product filling the institutional gap.”

Bitcoin’s fear and greed index remains bullish and maintains its stance in the greed zone at 64.

[ad_2]

Read More: cryptonews.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Bitcoin Cash

Bitcoin Cash  Sui

Sui  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Avalanche

Avalanche  Toncoin

Toncoin  USDS

USDS  WhiteBIT Coin

WhiteBIT Coin  Shiba Inu

Shiba Inu  WETH

WETH  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Hedera

Hedera  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Polkadot

Polkadot  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pi Network

Pi Network  Uniswap

Uniswap  Pepe

Pepe  Aave

Aave  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Aptos

Aptos  OKB

OKB  Bittensor

Bittensor  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  NEAR Protocol

NEAR Protocol  Internet Computer

Internet Computer  Jito Staked SOL

Jito Staked SOL  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Ondo

Ondo