Macroeconomics and financial markets

In the US NY stock market on the 16th, the Dow closed at $431.20 (1.26%) from the previous day, and the Nasdaq, which is centered on high-tech stocks, closed at $214.76 (1.78%).

The January Producer Price Index (PPI) announced by the U.S. Department of Labor was 6.0% year-on-year, well above market expectations of 5.4%. I will not rule out the possibility of an interest rate hike.” Inflation remains high and the labor market remains strong, suggesting that the slowdown in inflation and the suspension of interest rate hikes may take longer than the market expects.

Cryptocurrency-related stocks such as US largest exchange Coinbase are also falling.

connection:NY Dow and Nasdaq decline due to strong economic indicators | 17th Financial Tankan

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

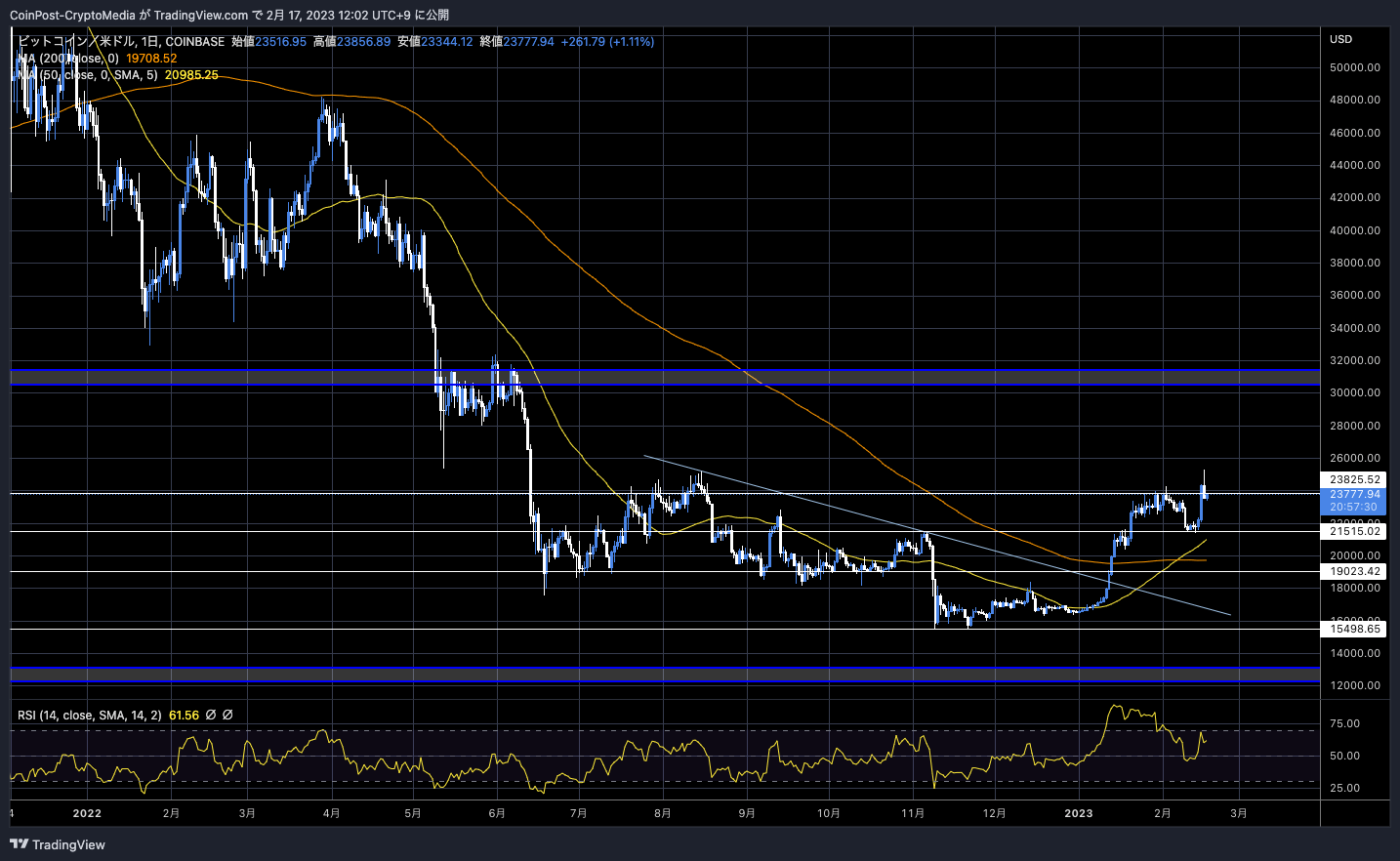

In the crypto asset (virtual currency) market, Bitcoin fell 3.68% from the previous day to $23,782.

BTC/USD daily

Although the stock hit $25,256, surpassing the high of $25,214 in August last year, it fell sharply as the US stock index fell after the release of the PPI announced by the US Department of Labor.

Even if we try to curb inflation at a pace of monetary tightening unprecedented in history, the outlook for adverse effects on the economy is extremely difficult. With the focus on whether the US and European economies will slip into recession, we have also seen the market overreacting to economic indicators such as the CPI and employment data.

Going forward, the US Federal Open Market Committee (FOMC), the announcement of important indicators, and the earnings season of major US companies are expected to lead to volatile developments in which financial markets are shaken up and down.

connection:Bitcoin soars to $ 25,000, the background of the rise

Pantera Capital: Crypto Markets May Have Bottomed and Entered Next Cycle

During yesterday’s soaring phase, two major creditors of the cryptocurrency exchange Mt.Gox, which went bankrupt in 2014 after causing an illegal outflow of cryptocurrencies worth approximately 48 billion yen at that time, It seems that the fact that it was transmitted that he chose to pay with bitcoin was also a tailwind.

Mt.Gox was the largest domestic exchange in the early days of crypto assets (virtual currency), which went bankrupt in February 2014. Former CEO Marc Karpeles was accused of embezzlement and other crimes in the course of business, and was accused of “unauthorized creation and use of private electromagnetic records,” and was sentenced to 2 years and 6 months in prison (4 years suspended). sentenced.

According to an article in the Nihon Keizai Shimbun at the time, 127,000 customers were affected, but most of the users were foreign investors, and the Japanese ratio was 0.8%. After that, in November 2017, in order to maximize the interests of creditors, the bankruptcy proceedings were transferred to the Civil Rehabilitation Law proceedings. In June 2009, a “rehabilitation plan” was submitted after a vote by creditors.

Attorney Nobuaki Kobayashi, who serves as Mt.Gox’s rehabilitation trustee, has sold a portion of the virtual currency he holds on the market several times in the past to use it as a source of dividends. It is said that he currently holds about 140,000 BTC, about 140,000 BCH, and about 68 billion yen, but it was pointed out that the final billed amount may exceed this.

If Bitcoinica and MtGox Investment Funds (MGIF), which account for one-fifth of creditors’ claims, chose to pay in “fiat currency”, they may have been forced to sell more assets by bankruptcy trustees as part of debt consolidation. There was also a view that there was. Bitcoinica is a New Zealand-based crypto asset exchange that was damaged because it was held in an MtGox account, and MGIF is a division of Fortress Investment Group, a US investment company affiliated with SoftBank Group.

According to documents reviewed by CoinDesk, by March 10, 2023, if you choose not to want the option of an “early lump sum payment (up to 90% of the outstanding amount),” which will be paid in September 2023, the It will wait for the entire process of litigation and compensation proceedings to be completed, which could take another five to nine years, the people said.

In addition, domestic exchanges SBI VC Trade and Bitbank have been designated as the Mt.Gox creditor’s proxy recipients with the approval of the Tokyo District Court.

Source: SBI Holdings

On the other hand, Reuters reported on the 16th that some investors reported that “from the end of 2020 to March 21, from the end of 2020 to March 2021, Binance’s CEO Changpong Zhao (CZ) was linked to Binance’s Binance U.S. corporate account. There was a $400 million transfer to the company Merit Peak Ltd.”

A former Silvergate executive told Reuters, “It is against the bank’s compliance rules to move funds out of a corporate account without the approval of the company’s management,” but at this time details such as the reason for the transfer, and The veracity of the leaked reports is unknown.

On the other hand, in response to the recent situation, Binance released a statement to increase transparency in “fund management, security measures and regulatory compliance”.

A rising tide lifts all boats. By following these guidelines, we can make everyone in crypto safer.

We invite the entire ecosystem to join us in this push towards improving security and trust. And provide us any feedback on ways to further improve the initiative.

https://t.co/4E33QrtJfp

— CZ

Binance (@cz_binance) February 16, 2023

In the “Proof of Reserves” framework for checking the balance of audited assets, we will provide the industry’s first verification solution using “zero knowledge proof”.

In response to a Reuters report in June 2022 that reported allegations of money laundering worth billions of dollars, it has accused the press of arbitrary misinformation.

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Bitcoin reached $ 25,000, but it fell with the US index, and the impact of attention headlines appeared first on Our Bitcoin News.

Read More: bitcoinwarrior.net

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Sui

Sui  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Avalanche

Avalanche  Bitcoin Cash

Bitcoin Cash  Toncoin

Toncoin  USDS

USDS  Shiba Inu

Shiba Inu  Hedera

Hedera  WETH

WETH  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Polkadot

Polkadot  Monero

Monero  Bitget Token

Bitget Token  Pi Network

Pi Network  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Dai

Dai  Uniswap

Uniswap  Ethena Staked USDe

Ethena Staked USDe  Bittensor

Bittensor  OKB

OKB  Cronos

Cronos  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aptos

Aptos  NEAR Protocol

NEAR Protocol  Jito Staked SOL

Jito Staked SOL  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  sUSDS

sUSDS