During the Asian session, the price of Bitcoin has remained mostly unchanged, settling in a narrow range of $16,750 to $16,950. Similarly, Ethereum, the second-largest cryptocurrency, failed to hold above $1,260 and fell back into the $1,250 trading range.

Major cryptocurrencies were trading in the red early on January 5, despite the fact that the global crypto market cap increased 1.21% to $820.08 billion on the previous day.

Over the last 24 hours, overall crypto market volume grew by 30.28% to $35.35 billion. DeFi’s total volume is currently $2.19 billion, accounting for 6.18% of the overall crypto market 24-hour volume. The overall volume of all stablecoins is now $32.90 billion, accounting for 93.07% of the total 24-hour volume of the crypto market.

FOMC Minutes Keep Crypto Lower

Minutes from the Federal Reserve’s December meeting, released on Wednesday, show that policymakers there remain dedicated to combating inflation and anticipate that higher interest rates will remain in place until more progress is made.

Policymakers hiked their benchmark interest rate by another half of a percentage point at a meeting and stressed the need to maintain a tight stance as long as inflation remains unacceptably high.

US ADP Non-Farm Employment Change in Focus

Later today, the Automatic Data Processing, Inc. will be publishing a monthly economic indicator. It’s usually published two days before the NFP Report and forecasts the change in nonfarm private sector employment in the United States, excluding the government sector.

In November 2022, private enterprises in the United States produced 127K jobs, the fewest since January 2021 and far below market expectations of 200K. Meanwhile, annual compensation increased by 7.6%.

“According to the data, Fed tightening is having an effect on job creation and wage growth. Furthermore, businesses are no longer in a state of hyper-replacement. Fewer individuals are quitting, and the post-pandemic recovery is becoming more stable “, according to Nela Richardson, ADP’s senior economist.

Stronger non-farm ADP data typically drives a bearish trend in cryptocurrencies, and vice versa.

Bitcoin Price

The current price of bitcoin is $16,846, and the volume of transactions in the last 24 hours has been $14 billion. Bitcoin failed to break above the $16,930 double-top resistance level, and a close below this level is likely to trigger a bearish correction until the $16,775 support zone. On the 4-hour timeframe, an upward channel keeps BTC bullish; thus, closing above $16,775 may cause a pullback in BTC.

On the downside, a break below the $16,775 level today may expose BTC to the $16,450 level. Keep an eye on $16,775 as BTC above this level may exhibit a buying trend.

Ethereum Price

The current price of Ethereum is $1,250, with a $5 billion 24-hour trading volume. The ETH/USD pair has struggled to break above $1,260, and the Doji candle closing below this level indicates a weaker bullish trend. As a result, ETH may fall to $1,245 to complete the 38.2% Fibonacci retracement, with the next support likely to be at $1,230, which marks the 61.8% Fibonacci retracement.

On the higher side, ETH’s immediate resistance stays at $1,270 and a bullish crossover above this could expose ETH toward the $1,295 level.

Alternative Coins with Huge Growth Prospects

Despite the market’s continued bearishness in 2023, a few altcoins are making news.

FightOut (FGHT)

The FightOut (FGHT) platform works in the same way that a personal trainer does, except that the FGHT token is rewarded in advance for exercise time. All activities are tracked and can be employed to improve the statistics of one’s metaverse avatar.

With over $2.6 million already raised, the FGHT presale is doing well. As the sale progresses, the current selling price of 60.06 FGHT for $1 (FGHT can be purchased with ETH or USDT) will rise.

Dash 2 Trade (D2T)

Dash 2 Trade will be an Ethereum-based platform that will provide real-time statistics and social trading data when it launches in early 2023. Trading signals, on-chain analytics, strategy-building tools, and newsfeeds will be among the first features, assisting both new and experienced traders in keeping up with the volatile bitcoin market.

According to new information, the trading intelligence cryptocurrency project’s sell-out presale will be extended with the addition of an over-funding round. The presale reached its fourth and final funding goal of $13,420,000 earlier today and was thus set to close.

To accommodate those who may have missed the initial investment window, the Dash 2 Trade team has decided to hold a 5th stage (or “over-funding round”) of the presale in which an additional 36,000,000 tokens will be sold at a price of $0.0556 in order to raise an additional $2,001,600.

D2T is being over-funded at a price that is 4% higher than its previous price of $0.0533. The current fundraising total for the project is $15,421,600.

C+Charge (CCHG)

C+Charge (CCHG) is a blockchain-based technology designed to compensate electric vehicle owners for charging and driving their vehicles. Its native token, CCHG, is currently on the market. Electric vehicle use has increased significantly in recent years all over the world. The electric vehicle (EV) industry has emerged as a more environmentally friendly alternative to the traditional automobile industry, which has long needed reform.

Thanks to companies like Tesla, Rivian, and others, people can now buy EVs and participate in the green revolution. To demonstrate its scalability, the network has already agreed to add 20% of Turkey’s EV chargers to its network. 1 CCHG is $0.013, and it can be purchased with BNB or USDT. The presale has so far raised $76,365.

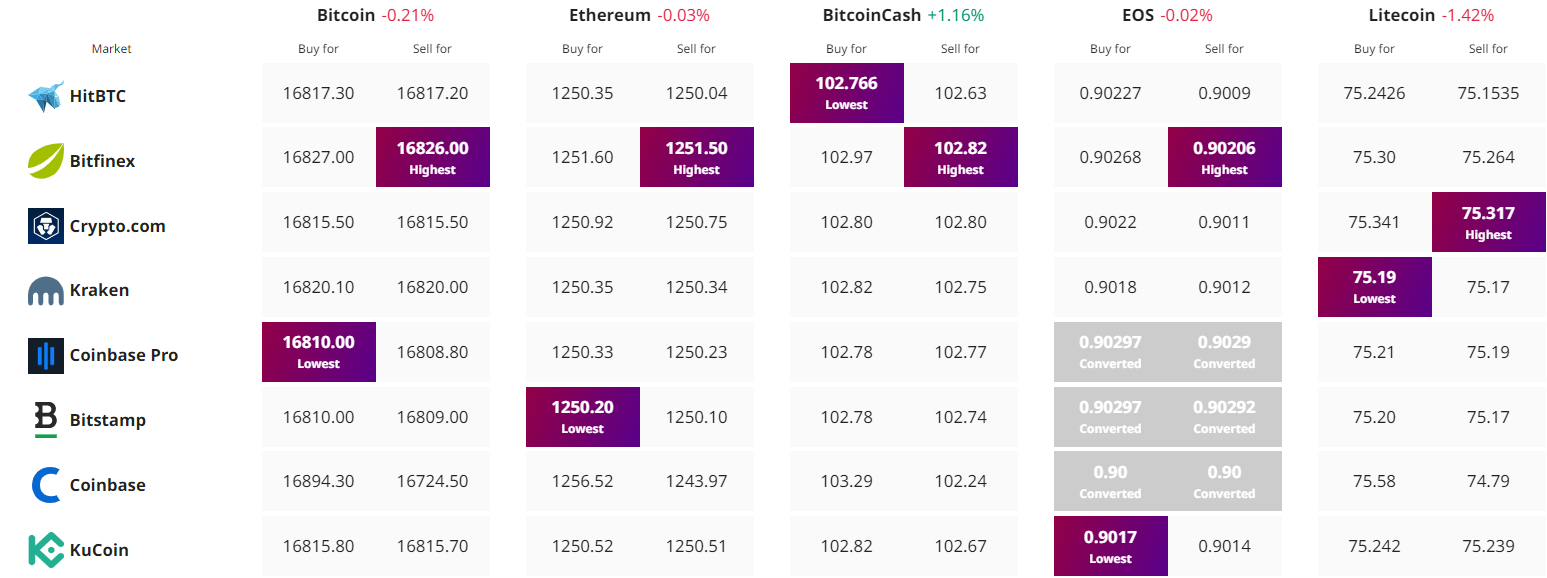

Find The Best Price to Buy/Sell Cryptocurrency

Read More: news.google.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  Bitcoin Cash

Bitcoin Cash  Toncoin

Toncoin  Litecoin

Litecoin  Polkadot

Polkadot  USDS

USDS  WETH

WETH  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Wrapped eETH

Wrapped eETH  Bitget Token

Bitget Token  Pepe

Pepe  Pi Network

Pi Network  Ethena USDe

Ethena USDe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Dai

Dai  Uniswap

Uniswap  Aave

Aave  NEAR Protocol

NEAR Protocol  Aptos

Aptos  OKB

OKB  Jito Staked SOL

Jito Staked SOL  Cronos

Cronos  Ondo

Ondo  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Tokenize Xchange

Tokenize Xchange  Ethereum Classic

Ethereum Classic