Macroeconomics and financial markets

In the US NY stock market on the 13th of the week, the Dow rose $376.66 (1.11%) from the previous day and the Nasdaq rose $173.67 (1.48%), both of which rebounded.

The US consumer price index (CPI), which is an inflation (high price) index, is scheduled to be released at 22:30 Japan time, and the topside is heavy due to concerns about sudden fluctuations in the market depending on the numbers.

connection:What is the CPI (Consumer Price Index) that attracts attention in the virtual currency market | Easy-to-understand explanation

Economists expect the CPI to slow by 6.2% year-on-year this month, but if the CPI is expected to significantly exceed market expectations following the recent U.S. employment statistics, the need for an additional interest rate hike will increase, and the U.S. Treasury bond will rise. It is assumed that the dollar will be bought and stocks and bitcoin will be sold.

Meanwhile, Youwei Yang, chief economist at crypto mining firm BIT Mining Limited, said a drop below the 6% year-on-year level could be seen as bullish. The CPI rose 9.1% year-on-year in June 2010, marking the first increase in 40 years, but has slowed since then.

US Federal Reserve Board (FRB) officials have made a series of hawkish remarks to check the market. Fed Governor Michelle Bowman said the Fed is “committed to taking further action to bring inflation down to our target,” suggesting continued interest rate hikes.

Virtual currency market

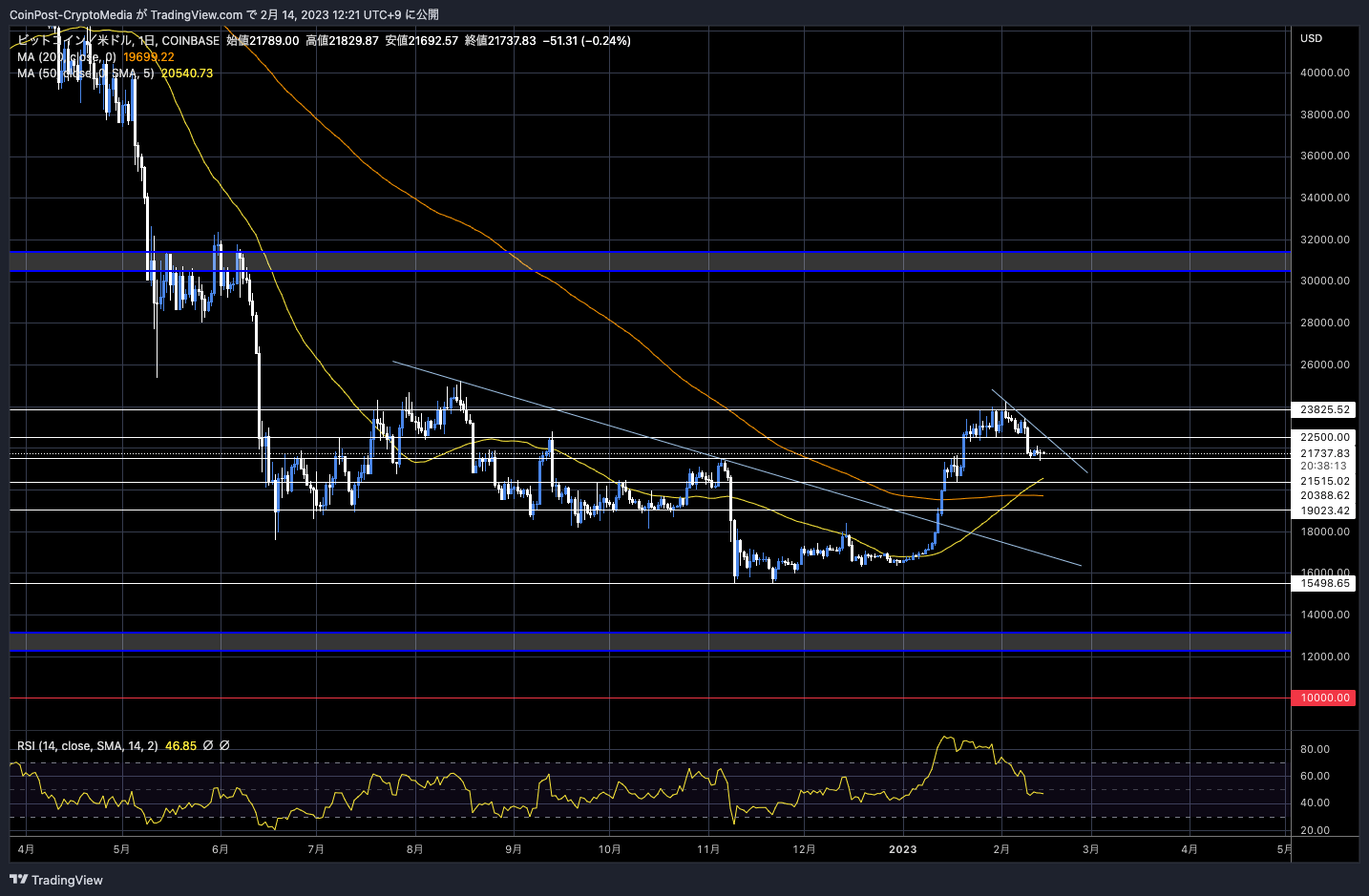

In the crypto asset (virtual currency) market, Bitcoin dropped 0.46% from the previous day to $21,713.

BTC/USD daily

The bitcoin market has been on an upward trend since the beginning of the year, but it turned to a downward trend due to the risk-off in the financial market following the recent U.S. employment statistics and the uncertainty in the virtual currency market.

On the 13th, the New York State Department of Financial Services ordered Paxos, which issues the industry’s third-largest US dollar-linked stablecoin “BUSD,” to suspend new issuance. On the 9th, the cryptocurrency exchange Kraken was sued by the U.S. SEC (Securities and Exchange Commission) for violating securities laws, and the market price fell when it was reported that the staking service for U.S. customers had been suspended. /p>

There are concerns about the impact on other companies such as US coinbase, which provides staking services, and PoS-based currencies such as Ethereum (ETH).

connection:How to view the US SEC’s Kraken indictment and consider the impact on Ethereum staking

The suspension of new issuance of BUSD has caused market turmoil, with Binance, the industry’s largest exchange, withdrawing more than $800 million in less than 24 hours, a figure comparable to that of FTX’s bankruptcy last November.

Dune

Changpong Zhao (CZ), CEO of Binance, said, “Paxos continues to guarantee the issuance and redemption of BUSD, audited by multiple audit firms and assets protected in bank reserves are safe. We will support BUSD for the time being,” he said, stating, “If BUSD is recognized as a “securities” by the court, it will have a significant impact on the development of the US industry.”

He also suggested a review of the main currency pairs traded on Binance.

#BUSDA thread. 1/8

In summary, BUSD is issued and redeemed by Paxos. #SAFU!

— CZ

Binance (@cz_binance) February 13, 2023

On the other hand, Paxos announced that it will stop issuing new BUSD after the 21st of this month and end the partnership with Binance. Paxos, which has been audited by Big Four accounting firms, said it will continue to manage its reserves and will be ready to redeem BUSD until at least February 2024.

Strong opposition to the SEC’s notice of enforcement action (Wells Notice), which states that “Paxos-issued BUSD is a security and should be registered with the SEC in accordance with the Federal Securities Act” and “violated the Investor Protection Act.” He said he was prepared to take legal action if necessary.

Paxos issued the following statement on February 13. Read the full statement here: https://t.co/jbfcBAiCgf pic.twitter.com/T7k80QtKyX

—Paxos (@PaxosGlobal) February 13, 2023

The NYDFS claims that it has authorized oversight Paxos to issue BUSD on the Ethereum (ETH) blockchain, but not Binance-peg BUSD.

Related: NY State Department of Financial Services Explains Why It Ordered to Stop Issuing BUSD Stablecoin

GBTC’s negative divergence widens again

The negative divergence (discount) from the spot price of the investment trust “Bitcoin Trust (GBTC)” of the crypto asset (virtual currency) investment management company Grayscale has expanded to a record low level of -46.9%. The all-time low was -48.62%, recorded in December last year.

ycharts.com

GBTC aims to achieve investment results in which the BTC holding ratio per beneficiary certificate is linked to the Bitcoin market price. In the bull market of 2021, combined with demand for arbitrage trading, demand surged, mainly from institutional investors, and the positive deviation (premium) expanded.

Today, however, institutional investors’ exposure has drastically decreased due to the worsening sentiment in the financial market as a whole and the approval of Bitcoin futures ETFs. Discounts continue.

GBTC is a closed-end product that cannot be redeemed before maturity and cannot be canceled before maturity, so it may deviate from its intrinsic value. Refunds based on the net asset value are allowed for open-ended products, which is said to contribute to more efficient price formation.

Most recently, Digital Currency Group (DCG), the parent company of Genesis Global Capital, which has filed for bankruptcy with more than $3 billion in debt after the FTX bankruptcy, has been forced to sell part of its investment portfolio.

connection:DCG, a major cryptocurrency with liquidity problems, explains points about the impact on the market

Grayscale is a subsidiary of DCG. The Financial Times reported Monday that Genesis has begun selling its holdings, including the Ethereum Trust, to pay back Genesis creditors.

connection:DCG sells part of stake in Grayscale-provided cryptocurrency mutual fund = report

Click here for a list of market reports published in the past

The post Bitcoin investment trust GBTC discount hits record low as uncertainty rises in cryptocurrency market appeared first on Our Bitcoin News.

Read More: bitcoinwarrior.net

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Hyperliquid

Hyperliquid  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Sui

Sui  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Avalanche

Avalanche  Stellar

Stellar  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDS

USDS  WETH

WETH  Wrapped eETH

Wrapped eETH  Litecoin

Litecoin  Hedera

Hedera  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Monero

Monero  Polkadot

Polkadot  WhiteBIT Coin

WhiteBIT Coin  Bitget Token

Bitget Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pepe

Pepe  Pi Network

Pi Network  Uniswap

Uniswap  Aave

Aave  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Bittensor

Bittensor  OKB

OKB  Internet Computer

Internet Computer  Aptos

Aptos  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  NEAR Protocol

NEAR Protocol  Cronos

Cronos  Jito Staked SOL

Jito Staked SOL  Tokenize Xchange

Tokenize Xchange  Ethereum Classic

Ethereum Classic