The total amount of Bitcoin (BTC) held by exchanges reached its lowest since 2018, while Ethereum (ETH) supply on exchanges has been increasing significantly since June 2022.

The numbers also indicate that investors who buy and hold Bitcoins prefer Coinbase to do so.

Bitcoin

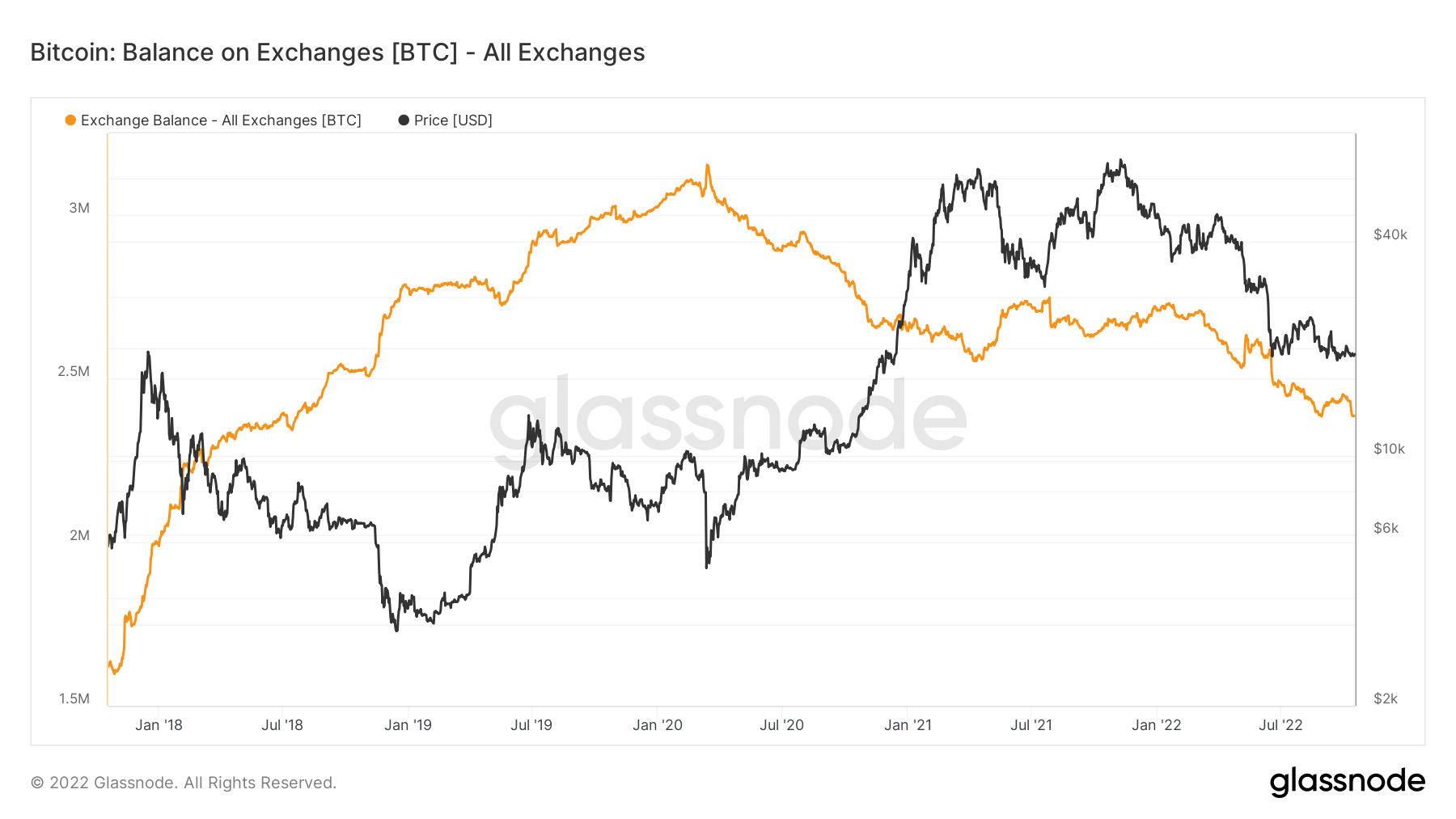

Bitcoin held by exchanges has reached its lowest in four years. Currently, the Bitcoin amount held by exchanges is just under $2,4 million, which is represented by the orange line in the chart below.

Over 300,000 Bitcoins have been removed from the exchanges during the current winter conditions, which indicates a bullish trend among investors. This lowered the supply held by exchanges to its 4-year lowest. The last time the Bitcoin balance on exchanges was around $2,4 million was in late 2018.

The current $2,4 million held within exchanges equate to roughly 12% of all Bitcoin supply in the market.

Ethereum

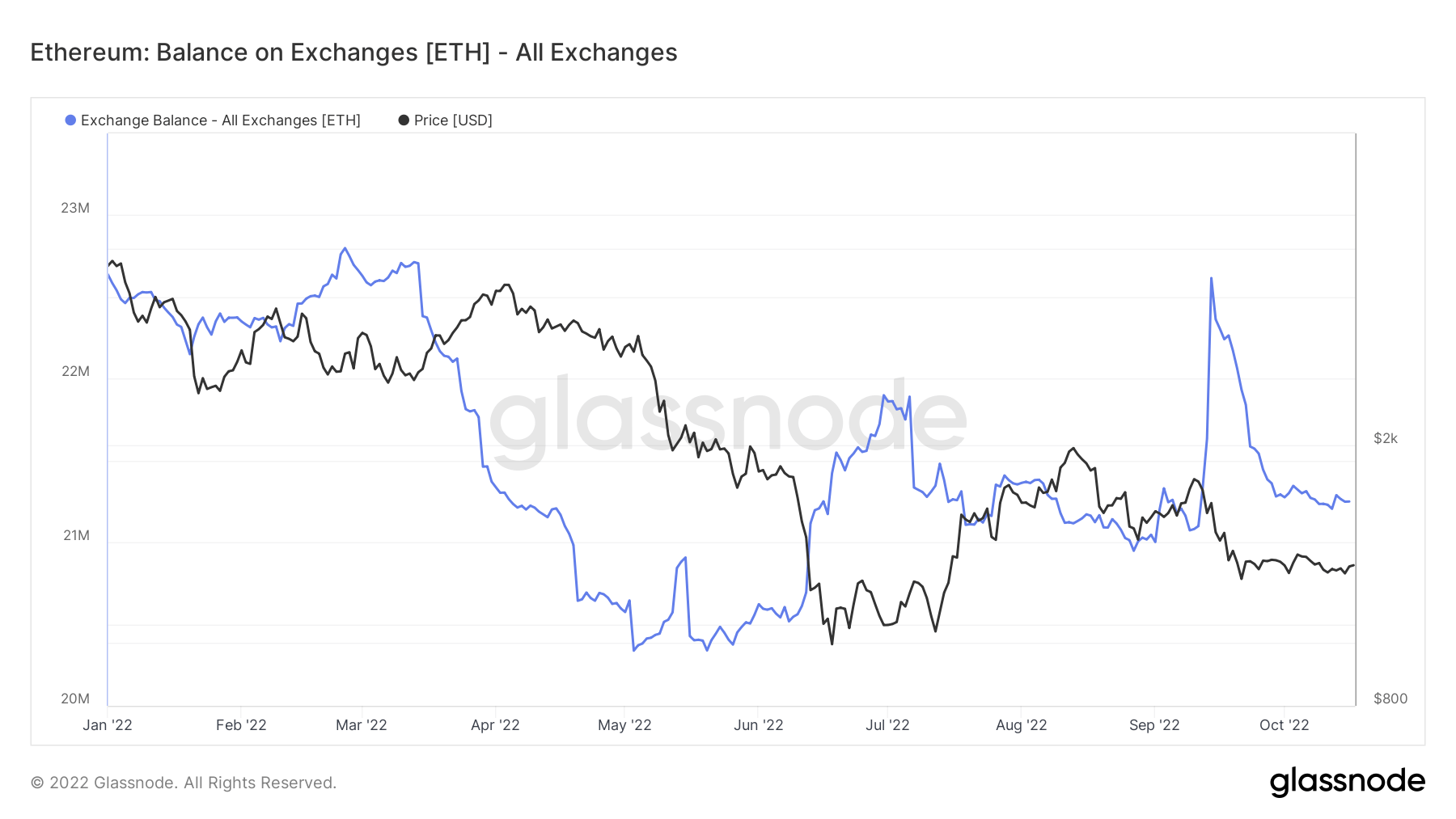

From the beginning of the year until July, Ethereum balances held by exchanges followed the same downward trend as Bitcoin. However, things took a turn in July when exchanges started accumulating Ethereum.

The chart below demonstrates the Ethereum balance held by all exchanges with the blue line and shows a considerable spike recorded after a significant fall.

At the beginning of the year, the total amount of Ethereum held by crypto exchanges was just 22,5 million. Despite the short spike in early March, the Ethereum reserves rapidly fell for the year’s first six months.

Losing nearly 2 million Ethereum in the first half of the year, the total balance held in exchanges fell to just below 20,5 million in June. The downtrend took a turn in June after the Terra-Luna collapse and the Ethereum supply started returning to exchanges.

Today, the Ethereum balance held by exchanges is around 21,2 million, which equates to roughly 18% of the total Ethereum supply in the market.

Coinbase

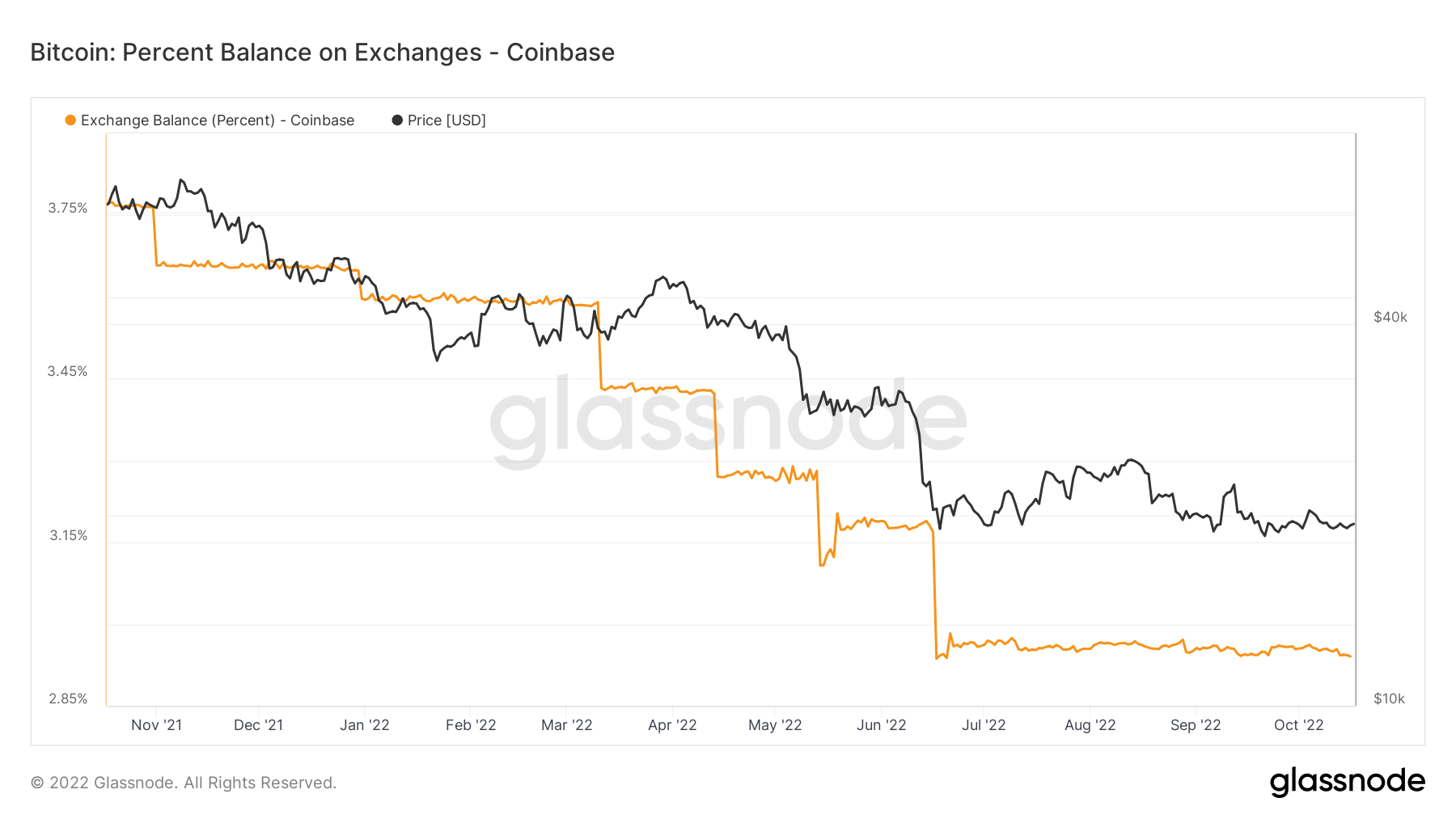

Judging by the number of Bitcoins it lost, Coinbase emerged as the number one exchange platform investors use to buy and hold. According to the chart below, Coinbase has been rapidly losing its Bitcoin balance since May 2022, when the bear market started.

Since the November 2021 bull run, a very small amount of Bitcoins were released back onto the exchange. At the time, Coinbase held almost 4% of the total Bitcoin supply. The exchange lost 1% of total Bitcoin in nearly a year today and now has just under 3% of it.

Coinbase is primarily used by large institutions in the U.S., which are known for their tendency to buy and hold. As is also demonstrated by the chart above, the exchange lost significant amounts of Bitcoin after the bear market hit.

Coinbase had nearly 680,000 Bitcoins at the beginning of the year, and that number had fallen to 560,000 in eight months in August. The exchange lost another 50,000 Bitcoins on Oct. 18, which dropped the total amount held by Coinbase to 525,000.

Read More: cryptoslate.com

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Avalanche

Avalanche  Wrapped stETH

Wrapped stETH  Sui

Sui  Chainlink

Chainlink  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Stellar

Stellar  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Hedera

Hedera  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Uniswap

Uniswap  Pepe

Pepe  Litecoin

Litecoin  Hyperliquid

Hyperliquid  LEO Token

LEO Token  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  Internet Computer

Internet Computer  Ethena USDe

Ethena USDe  USDS

USDS  Aptos

Aptos  Aave

Aave  Render

Render  Mantle

Mantle  Bittensor

Bittensor  POL (ex-MATIC)

POL (ex-MATIC)  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  MANTRA

MANTRA  WhiteBIT Coin

WhiteBIT Coin  Arbitrum

Arbitrum  Virtuals Protocol

Virtuals Protocol  Monero

Monero  Tokenize Xchange

Tokenize Xchange