Data from Santiment reveals both Bitcoin and Ethereum currently lack the trading volumes to justify their market caps.

Bitcoin And Ethereum NVT Ratios Are Both Bearish Right Now

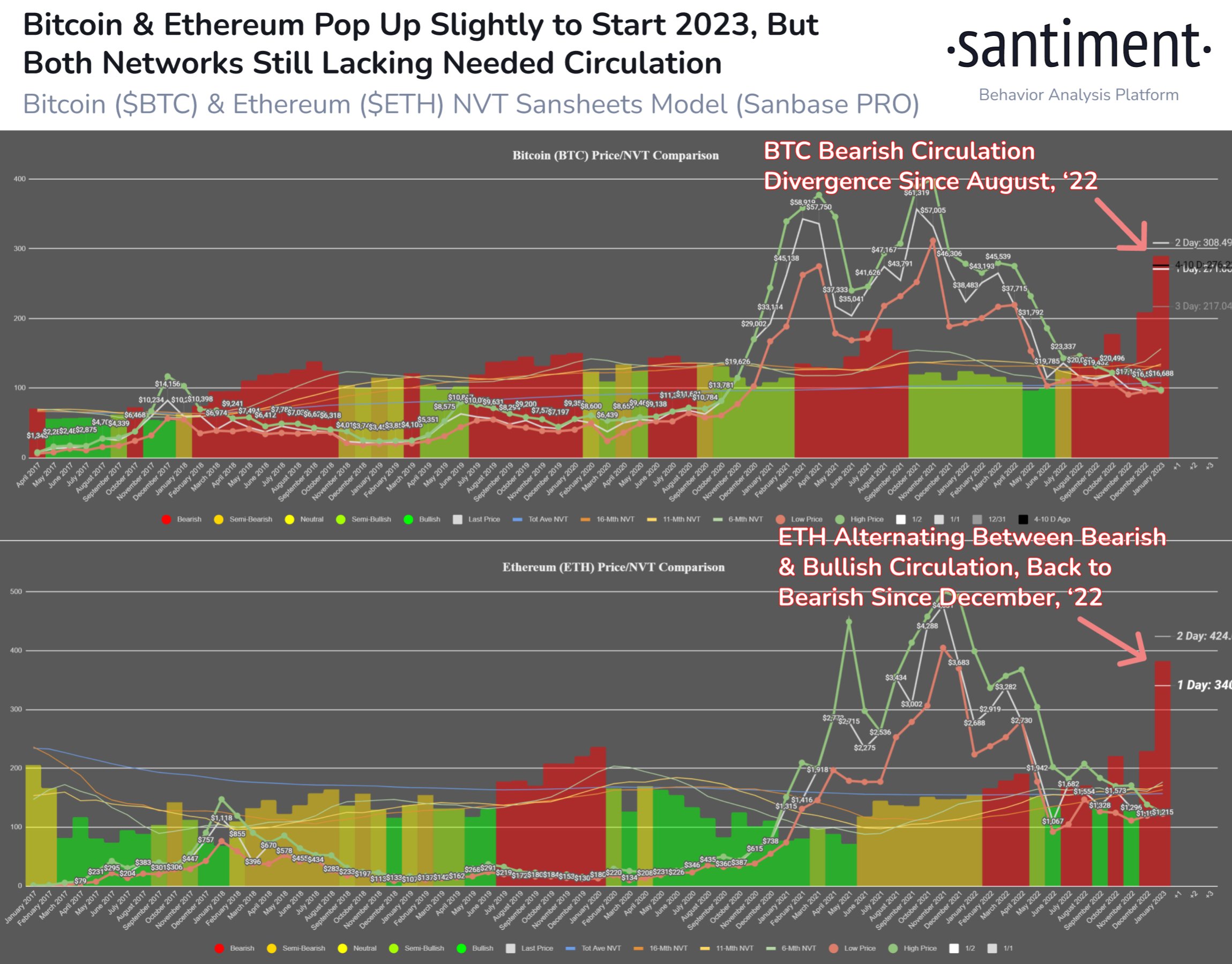

According to the on-chain analytics firm Santiment, both the bitcoin and ethereum networks will need to see a pickup in activity this year. The relevant indicator here is the “Network Value to Transaction” (NVT) ratio, which measures the ratio between the market cap of any crypto and its transaction activity.

Usually, the trading volume is considered as the transaction activity of a coin, but Santiment’s NVT ratio works differently. Instead of dividing the market cap by the volumes, this version of the metric makes use of the “daily circulation,” a measure of the total number of unique coins that have seen some movement in the past day.

The advantage of the circulation indicator is that transactions, where the same coins jump through several wallets, are only counted once towards the measurement, while the normal trading volume metric would have counted them as many times as they were transferred. This helps eliminate duplicate transactions and gives a more accurate idea about the market activity.

Now, what the NVT ratio tells us is how the market cap of Bitcoin or Ethereum currently compares against the activity on the respective networks. High values of the metric suggest the volumes are much lower than the cap right now, and hence the coin may be overvalued at the moment. On the other hand, low values suggest the price may be undervalued.

Now, here is a chart that shows where the NVT ratio has been valuing Bitcoin and Ethereum during the past few years:

The value of the metric seems to have been bearish for both the coins recently | Source: Santiment

As the above graph shows, the NVT ratio has been bearish for Bitcoin since August 2022. This means that in the last few months, the circulation on the BTC network has remained pretty low when compared to the market cap of the crypto.

For Ethereum, the indicator’s value had been switching between bearish and bullish throughout 2022, but the coin seems to have ended the year being overvalued as the circulation was bearish in December.

If the cryptos continue to be overvalued according to the NVT, then a correction may be imminent for them. “The circulation rate of both networks need to pick up in 2023, and this week will be telling as non-holiday days begin,” explains Santiment.

BTC Price

At the time of writing, Bitcoin’s price floats around $16,700, down 1% in the last week.

Looks like BTC has surged in the last couple of days | Source: BTCUSD on TradingView

Featured image from mana5280 on Unsplash.com, charts from TradingView.com, Santiment.net

Read More: news.google.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  LEO Token

LEO Token  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDS

USDS  Hedera

Hedera  Litecoin

Litecoin  WETH

WETH  Wrapped eETH

Wrapped eETH  Polkadot

Polkadot  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Monero

Monero  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Pepe

Pepe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pi Network

Pi Network  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Uniswap

Uniswap  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Bittensor

Bittensor  OKB

OKB  Aptos

Aptos  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  NEAR Protocol

NEAR Protocol  Cronos

Cronos  Jito Staked SOL

Jito Staked SOL  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Ondo

Ondo