Bitcoin BTC/USD was trading slightly higher during Friday’s 24-hour trading session, lagging the general market, which saw the S&P 500 popping up about 0.6% with many tech stocks rocketing higher following Tesla’s positive earnings print.

The crypto sector had become detached from the general market recently, with Bitcoin, Ethereum ETH/USD and Dogecoin DOGE/USD trading mostly sideways.

The sideways consolidation is healthy and needed because the three cryptos’ relative strength indexes reached overbought territory after massive surges in price, which started in late December. Continued sideways consolidation would help to drop the three cryptos’ RSI levels.

RSI is an indicator technical traders use to measure bullish and bearish price momentum. RSI levels can range between 0 and 100, with levels between 30 and 70 generally considered to be healthy.

- When a stock’s RSI falls below the 30% level, it’s considered to be oversold. When a stock enters oversold territory, it indicates the securities price no longer reflects the asset’s true value, which can signal a reversal to the upside in the cards.

- When a stock’s RSI rises above the 70% area, it is considered to be overbought. When a stock enters overbought territory, it signals the securities price is elevated to its intrinsic value, which can signal a reversal to the downside on the horizon.

RSI is best used when combined with other signals and patterns on a stock chart because stocks can remain in oversold and overbought territory for an extended period of time before reversing.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

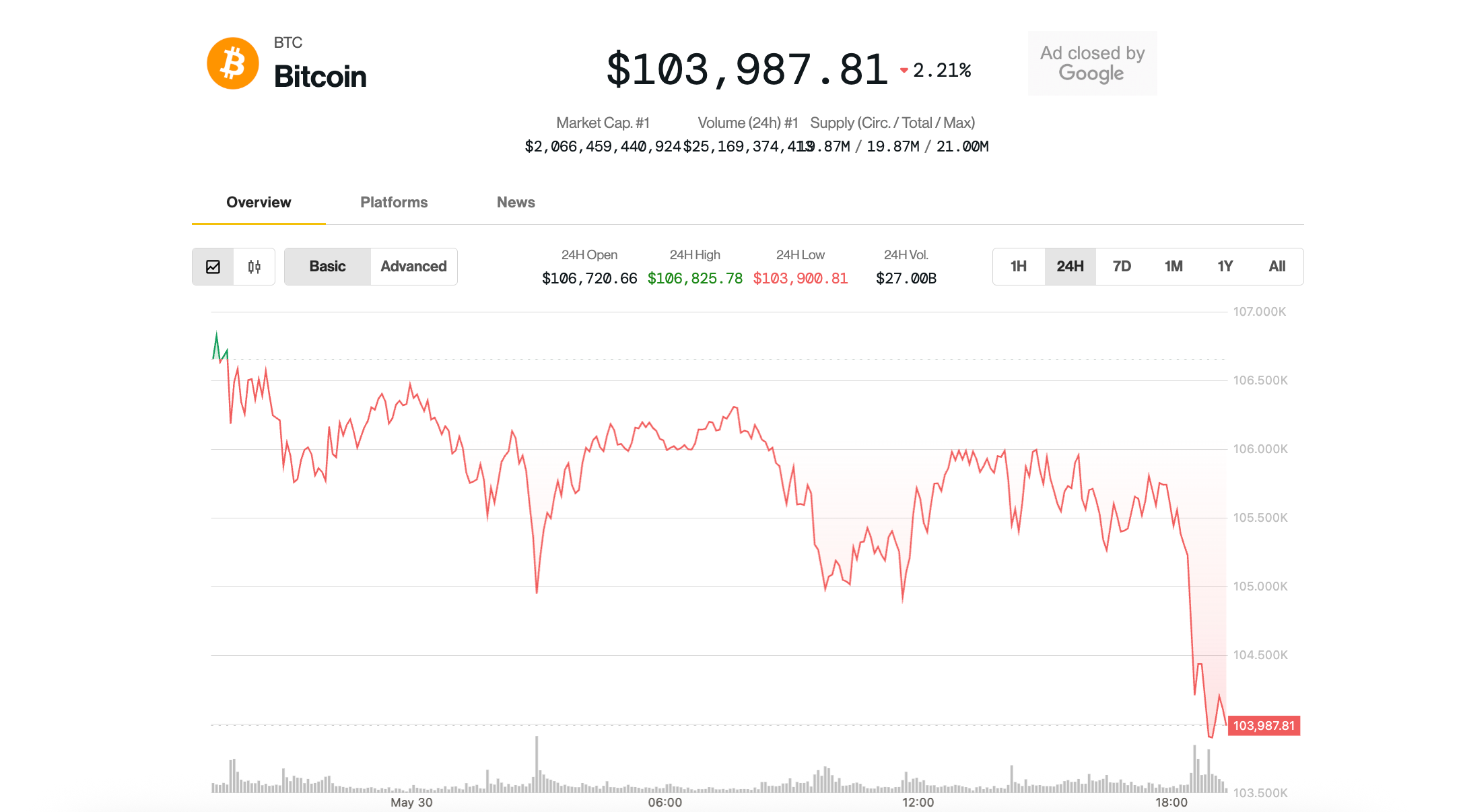

The Bitcoin Chart: Bitcoin has been consolidating between about $22,298 and $23,824 since Jan. 21. On Thursday and Friday, Bitcoin’s consolidation took place in the form of a double inside bar, with all of the price action taking place within Wednesday’s 24-hour trading range.

On Wednesday and Friday, Bitcoin retraced slightly to test the eight-day exponential moving average (EMA) as support and held above the level. The eight-day EMA had been guiding Bitcoin higher Jan. 6 and might continue to act as support.

If Bitcoin closed the trading session near its high-of-day price, the crypto would print a hammer candlestick, which could indicate higher prices will come on Saturday. If that happened, traders would want to see Bitcoin burst up above Wednesday’s high-of-day on higher-than-average volume, which could indicate a longer-term run is on the horizon.

Bearish traders want to see Bitcoin break down from its sideways trading range, which could indicate the current bull cycle has come to an end and a downtrend will occur.

Bitcoin has resistance above at $24,206 and $25,772 and support below at $22,729 and $21,313.

The Ethereum and Dogecoin Charts: Like Bitcoin, Ethereum and Dogecoin had been trading in a sideways pattern and on Thursday and Friday were forming double inside bar patterns. Ethereum’s sideways pattern was taking place between $1,500 and $1,680. Dogecoin had been consolidating between $0.077 and $0.093 since Jan. 13.

Also like Bitcoin, Ethereum and Dogecoin had been mostly holding above the eight-day EMA, which might continue to guide the cryptos higher. For short-term traders, a close under the eight-day EMA could be a solid exit strategy.

Ethereum and Dogecoin bulls want to see the cryptos break up from the horizontal pattern on higher-than-average volume, while bears want to see Ethereum and Dogecoin break bearishly down from the Jan. 18 low-of-days.

Ethereum has resistance above at $1,717.41 and $1,957.24 and support below at $1,564.17 and $1,421.80.

Dogecoin has resistance above at $0.091 and $0.099 and support below at $0.083 and $0.075.

Read Next: Amazon NFTs Could Be Coming Soon: What Could It Mean For The Sector And Investors?

Photo: Shutterstock

Read More: news.google.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Hyperliquid

Hyperliquid  Sui

Sui  Chainlink

Chainlink  Avalanche

Avalanche  Stellar

Stellar  LEO Token

LEO Token  Bitcoin Cash

Bitcoin Cash  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  USDS

USDS  WETH

WETH  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Polkadot

Polkadot  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Pepe

Pepe  Pi Network

Pi Network  WhiteBIT Coin

WhiteBIT Coin  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Dai

Dai  Aave

Aave  Uniswap

Uniswap  Bittensor

Bittensor  OKB

OKB  Aptos

Aptos  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  NEAR Protocol

NEAR Protocol  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Jito Staked SOL

Jito Staked SOL  Tokenize Xchange

Tokenize Xchange  Ondo

Ondo  Ethereum Classic

Ethereum Classic