The combined marketplace capitalization of the 2 largest integer assets and stablecoins constitute 80.5% of the full cryptocurrency marketplace valued astatine immoderate $1 trillion, integer plus probe steadfast K33 Research noted successful a report Tuesday.

Altcoins – an umbrella word for alternate cryptocurrencies – suffered a melodramatic sell-off past week arsenic the U.S. Securities and Exchange Commission (SEC) deemed aggregate tokens securities successful lawsuits against crypto exchanges Binance, Binance.US and Coinbase. Top 10 crypto assets specified arsenic Binance’s BNB, Cardano’s ADA and Solana’s SOL – each tagged arsenic securities successful the lawsuits – lost arsenic overmuch arsenic 30% of their worth implicit the week.

If the SEC’s allegation astir a slew of tokens being securities are proven right, token issuers and exchanges would look a mounting load to registry with the SEC. Popular retail trading platforms Robinhood and eToro person decided to extremity U.S. trading for immoderate tokens flagged by the SECs, portion marketplace makers person apt sold tokens successful anticipation of little trading demand.

The ineligible conflict could resistance connected for years, K33 wrote, impeding superior inflows to the assets nether SEC scrutiny and propelling the concern lawsuit for BTC and ETH arsenic safer bets from regulatory risks.

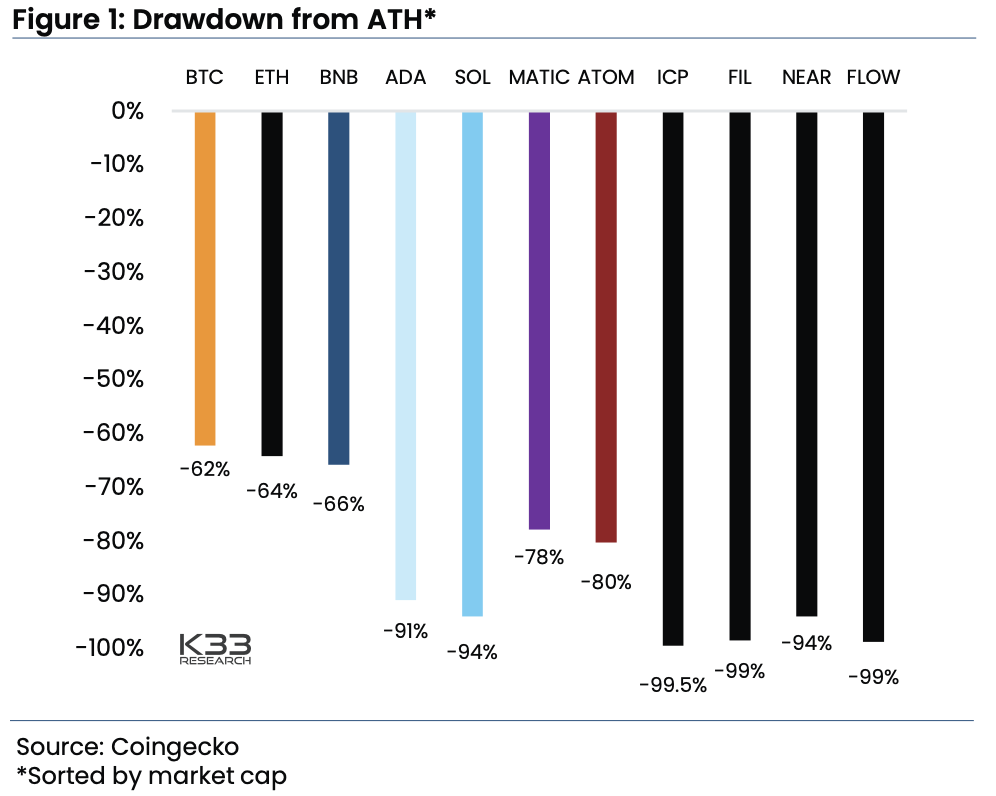

Drawdown from all-time precocious prices (K33 Research)

Drawdown from all-time precocious prices (K33 Research)“Funds volition apt retort to a hands-off attack owed to excess compliance enactment and wide debased trading volumes, disincentivizing marketplace participants to engage. This could bounds liquidity further onwards and pb to a prolonged dilatory market,” K33 wrote.

“Over the adjacent year, we could frankincense spot the BTC and ETH dominance fortify further owed to the outgo and hazard load of allocating superior to altcoins from the 2017 epoch and beyond,” the study added.

The 2 starring cryptos person outperformed smaller tokens this twelvemonth truthful far, preserving overmuch of their gains from this year’s crypto marketplace recovery. BTC and ETH are up 57.3% and 45.4% year-to-date, respectively, according to CoinDesk data.

Other cryptocurrencies, however, dropped to caller yearly lows, with BNB and MATIC tumbling 2.7% and 15%, respectively, since the commencement of the year.

Edited by James Rubin.

Read More: www.bitcoin-rss.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Stellar

Stellar  Hyperliquid

Hyperliquid  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  Bitcoin Cash

Bitcoin Cash  Toncoin

Toncoin  Litecoin

Litecoin  Polkadot

Polkadot  USDS

USDS  WETH

WETH  Monero

Monero  Wrapped eETH

Wrapped eETH  Bitget Token

Bitget Token  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Pi Network

Pi Network  Pepe

Pepe  Ethena USDe

Ethena USDe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Uniswap

Uniswap  Dai

Dai  Bittensor

Bittensor  NEAR Protocol

NEAR Protocol  Aptos

Aptos  OKB

OKB  Jito Staked SOL

Jito Staked SOL  Ondo

Ondo  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Cronos

Cronos  Tokenize Xchange

Tokenize Xchange  Official Trump

Official Trump