A recent analysis conducted by a prominent crypto and macro researcher, known as “Flow,” has brought attention to concerning trends surrounding tokens listed on Binance, the world’s leading cryptocurrency exchange.

The examination of the past six months’ worth of listings on Binance reveals a troubling pattern: More than 80% of tokens have experienced a decline in value since their initial listing. This discovery prompts serious questions regarding the viability and sustainability of these projects, particularly given the significant valuations they command upon launch.

While a handful of tokens, such as ORDI, JTO, JUP and WIF, have managed to buck the downward trend, they represent exceptions rather than the norm. Conversely, tokens like NFP, PORTAL, AEVO and others have suffered substantial losses, indicating a prevalent issue of overvaluation followed by rapid depreciation.

Flow’s analysis suggests that Binance listings may no longer offer lucrative investment opportunities but rather serve as exit strategies for insiders and venture capitalists.

In essence, it is widely acknowledged that securing a listing on a major exchange represents a significant milestone for any new token, with investors anticipating a boost to their investment. Similarly, it is no secret that these listings often serve as opportunities for holders to capitalize on token growth and cash out their crypto holdings.

However, the question arises: Is there genuine cause for concern beneath this surface drama, or is this simply an accepted consensus among market participants?

Read More: u.today

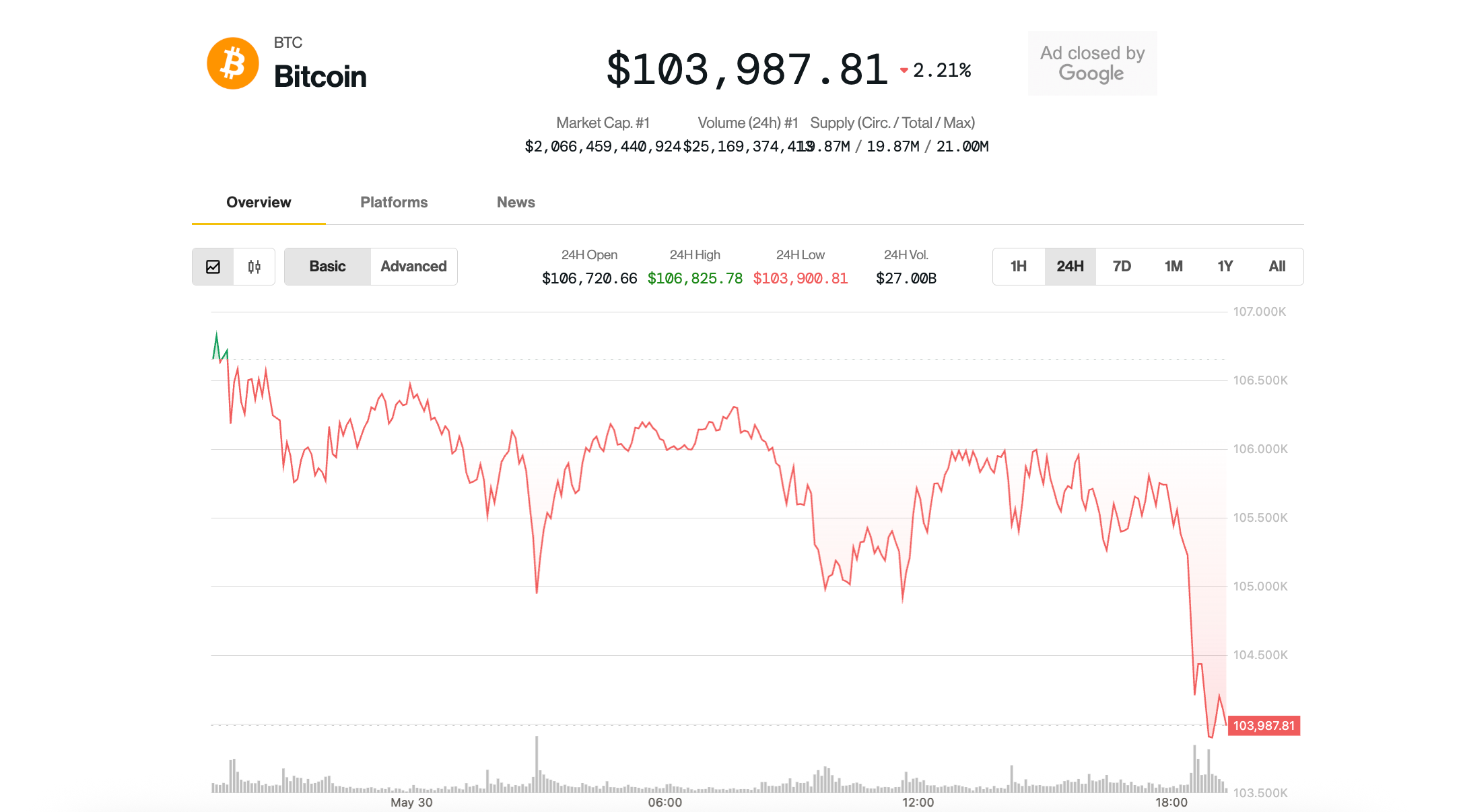

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Bitcoin Cash

Bitcoin Cash  Stellar

Stellar  LEO Token

LEO Token  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDS

USDS  Hedera

Hedera  WETH

WETH  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Polkadot

Polkadot  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Pepe

Pepe  Pi Network

Pi Network  Coinbase Wrapped BTC

Coinbase Wrapped BTC  WhiteBIT Coin

WhiteBIT Coin  Dai

Dai  Aave

Aave  Uniswap

Uniswap  Bittensor

Bittensor  Cronos

Cronos  Ethena Staked USDe

Ethena Staked USDe  OKB

OKB  Aptos

Aptos  NEAR Protocol

NEAR Protocol  Jito Staked SOL

Jito Staked SOL  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Ondo

Ondo  Tokenize Xchange

Tokenize Xchange  Ethereum Classic

Ethereum Classic