Ethereum has been in a descending channel against Bitcoin since August of last year, meaning Bitcoin has been the better investment over this time. However, historical trends show the tides could be changing soon, with Ethereum possibly on the brink of entering an accumulation phase.

Ethereum Price Action

Ethereum is trading at $1600, marking a 22% decrease from its price last August. Bitcoin, on the other hand, is 8% up over the same period.

This is a common trend that happens during bear markets. Coins with larger market capitalizations tend to be more resilient against price decreases as investors become more risk-averse and look to preserve their capital. While Ethereum isn’t short at a market capitalization of $187 billion, it’s still considerably lower than Bitcoin at $525 billion.

During bull markets, coins with lower market capitalization outperform Bitcoin again as investors lean towards assets with greater potential returns.

Ethereum Price Compared Against Bitcoin

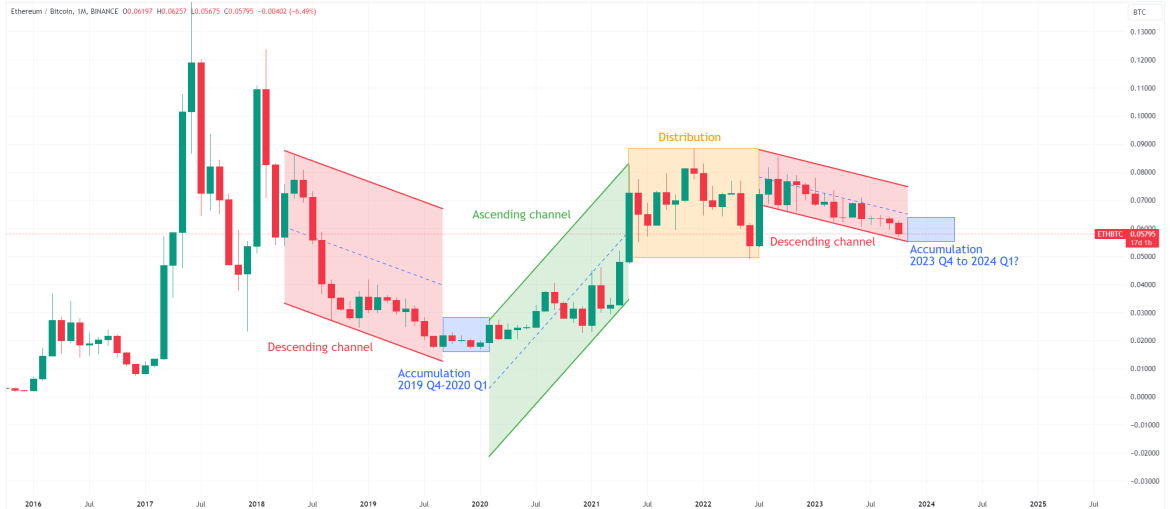

When comparing ETH’s value to BTC, it’s evident that Ethereum has been trading within a descending channel since last August. This pattern, characterized by its lower highs and lower lows, often indicates a bearish trend in the market.

ETH's valuation against BTC over time. Source: ETHBTC on TradingView

The chart above highlights three other distinct phases:

Accumulation phase: During this phase, price tends to stabilize, hinting at an upcoming change in momentum

Ascending channel: Here, the price experiences a significant reversal, often on a parabolic trajectory, characterized by highs and higher lows.

Distribution phase: In the final phase, the price ceases its upward movement. Investors typically use this phase to capitalize on their gains and liquidate their positions.

The accumulation phase is typically the best time for investors to convert their Bitcoin into Ethereum. This phase is marked by price holding on at the bottom and then showing signs of reversal. Ethereum is still forming lower lows against Bitcoin, so it has not entered the accumulation phase yet. However, the last cycle shows that this could be changing soon.

Last Cycle

Reflecting on the last cycle, Ethereum was in a descending channel against Bitcoin for 17 months. The accumulation phase then occurred from September 2019 up until February 2020. Based on the four-year theory, which suggests similar phases in the market occur every four years, this shows that the accumulation phase should also be approaching very soon in this cycle.

Yet, while the last cycle offers valuable insights, it’s important to note that no two cycles are the same. In the current cycle, ETH’s price action has not seen as much of a drop as in the previous cycle, which could be attributed to changing fundamentals and asset maturation.

Final thoughts

While an accumulation phase for Ethereum has not been confirmed yet, there remains the potential for its price to drop even further relative to Bitcoin. However, if the previous cycle is anything to go by, we could enter the accumulation phase soon. This phase typically presents prime buying opportunities for Ethereum.

Investment Disclaimer: The content provided in this article is for informational and educational purposes only. It should not be considered investment advice. Please consult a financial advisor before making any investment decisions. Trading and investing involve substantial financial risk. Past performance is not indicative of future results. No content on this site is a recommendation or solicitation to buy or sell securities or cryptocurrencies.

Featured image from ShutterStock, Charts from TradingView.com

Read More: www.newsbtc.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Sui

Sui  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  LEO Token

LEO Token  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  USDS

USDS  Litecoin

Litecoin  WETH

WETH  Wrapped eETH

Wrapped eETH  Polkadot

Polkadot  Monero

Monero  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Pepe

Pepe  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Pi Network

Pi Network  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Uniswap

Uniswap  Dai

Dai  Ethena Staked USDe

Ethena Staked USDe  Bittensor

Bittensor  OKB

OKB  NEAR Protocol

NEAR Protocol  Aptos

Aptos  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Cronos

Cronos  Jito Staked SOL

Jito Staked SOL  Internet Computer

Internet Computer  Ondo

Ondo  Ethereum Classic

Ethereum Classic