[ad_1]

Get the best data-driven crypto insights and analysis every week:

By: The Coin Metrics Research Team

In this special edition of the State of the Network, we reflect on a year full of riveting data and crucial events through the lens of our favorite issues from 2024. This year, we covered a diverse range of topics in both breadth and depth, and we remain committed to delivering thoughtful, actionable insights in the year ahead.

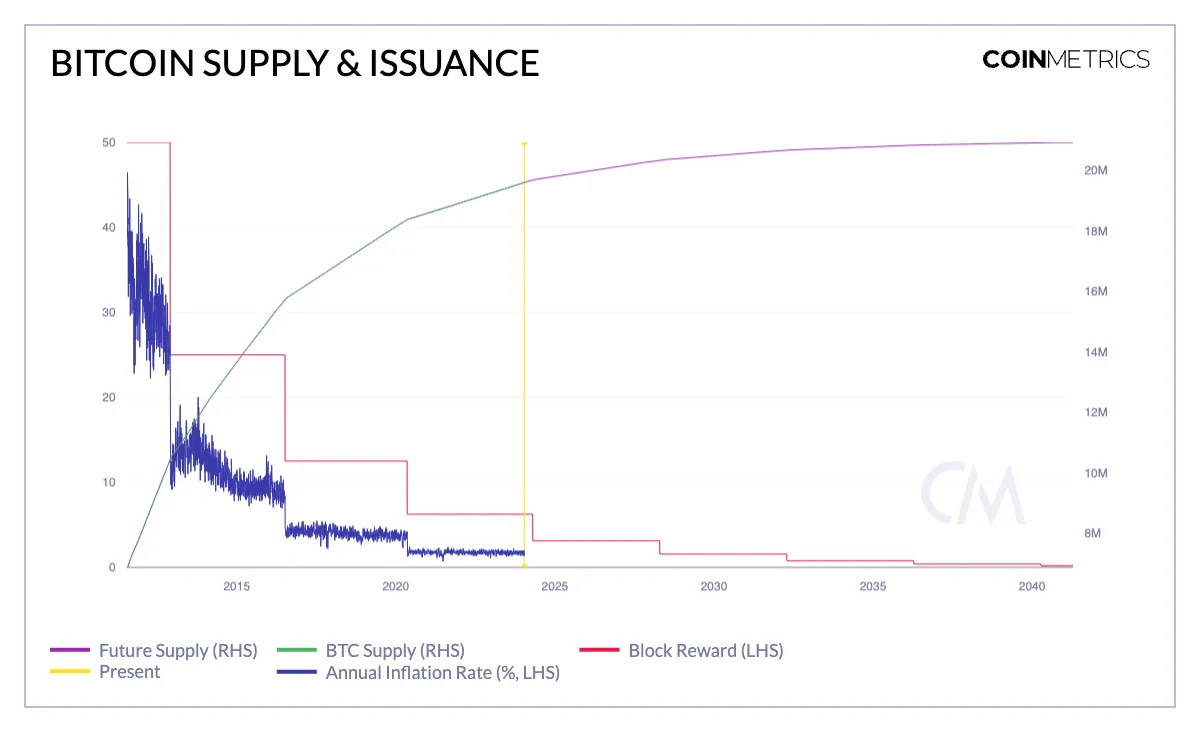

As spot bitcoin ETFs launched in the U.S., we provided a primer on what makes Bitcoin unique, delving into its adoption, economics, supply, usage and market value.

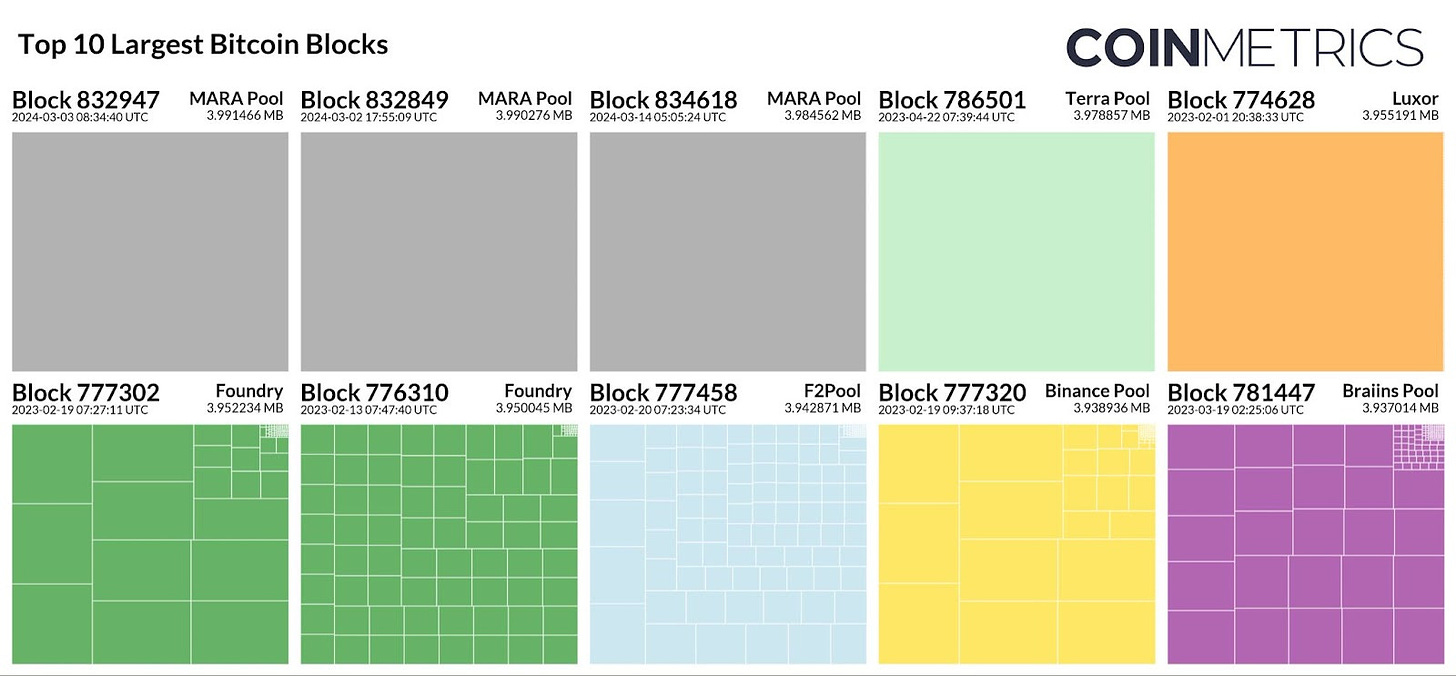

Miners underwent a crucial year with Bitcoin’s 4th halving taking place this year. The Bitcoin ecosystem, miner revenues, adaptability and hardware efficiency was a major topic in our Quarterly Mining Specials.

In Q1, we found that Marathon mined the 3 largest blocks in Bitcoin’s history, with the first two contained a pair of NFTs linked to the “Runestone” project and the third being a audio Inscription from rapper French Montana, etching a MP4 file for his song (“Bag Curious”) into the blockchain.

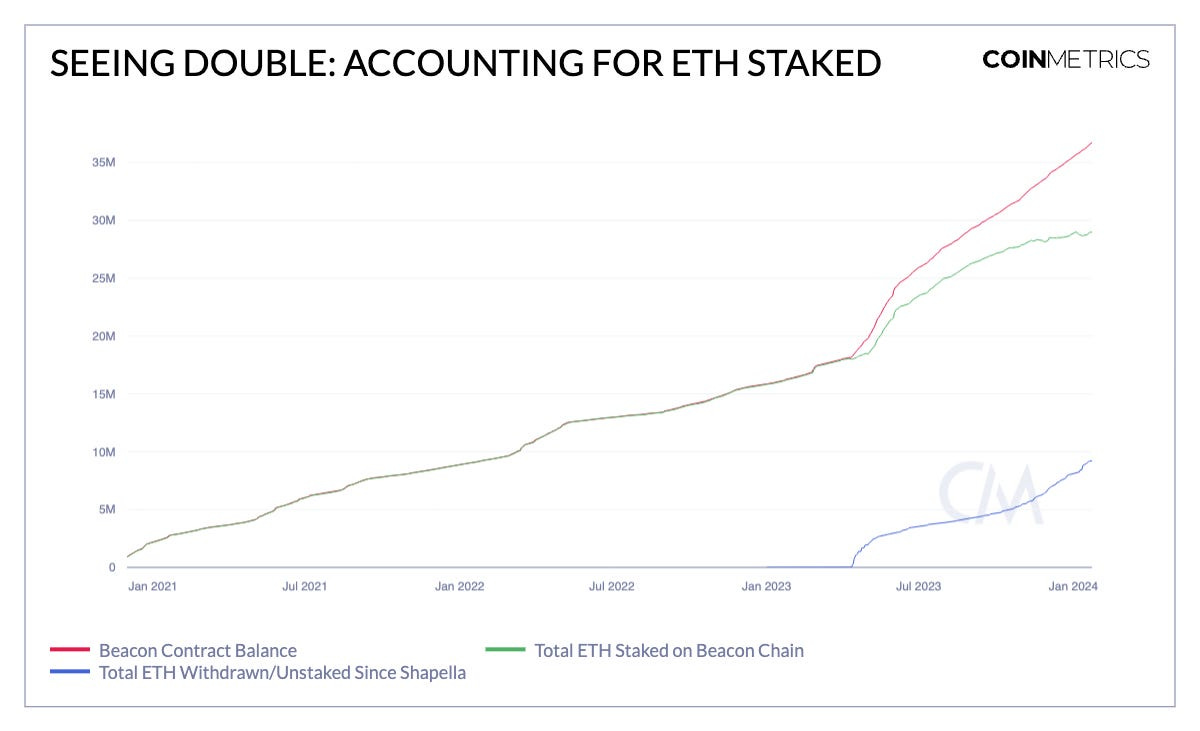

Ethereum’s modular infrastructure, consisting of an Execution Layer and Consensus Layer, presents challenges in accounting for ETH’s total supply. We explored these complexities in SOTN #244, delving into the nuances of tracking ETH supply in a multi-layered system.

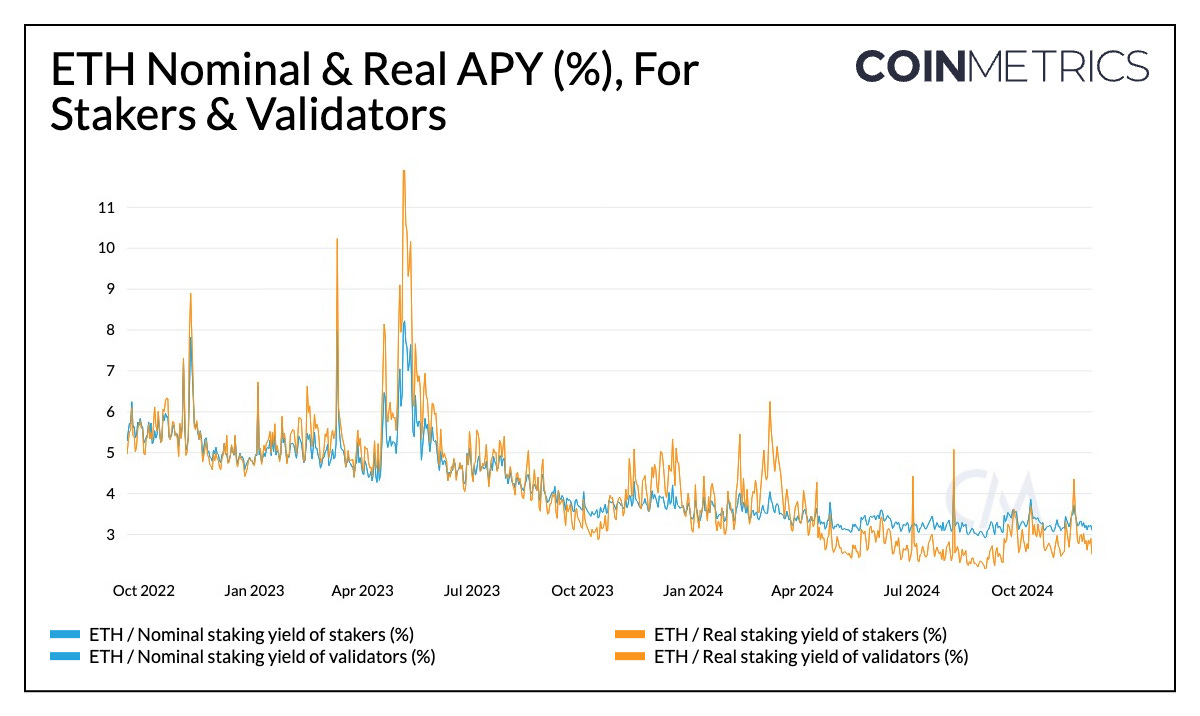

As the largest proof of stake (PoS) blockchain, Ethereum’s staking ecosystem and yield are core facets to network health and potential institutional demand from staked Ether ETFs.

In SOTN #270, we understood the evolution of the Ethereum staking ecosystem, from “The Merge” to “Shapella”, the rise of liquid staking tokens (LSTs) and beyond.

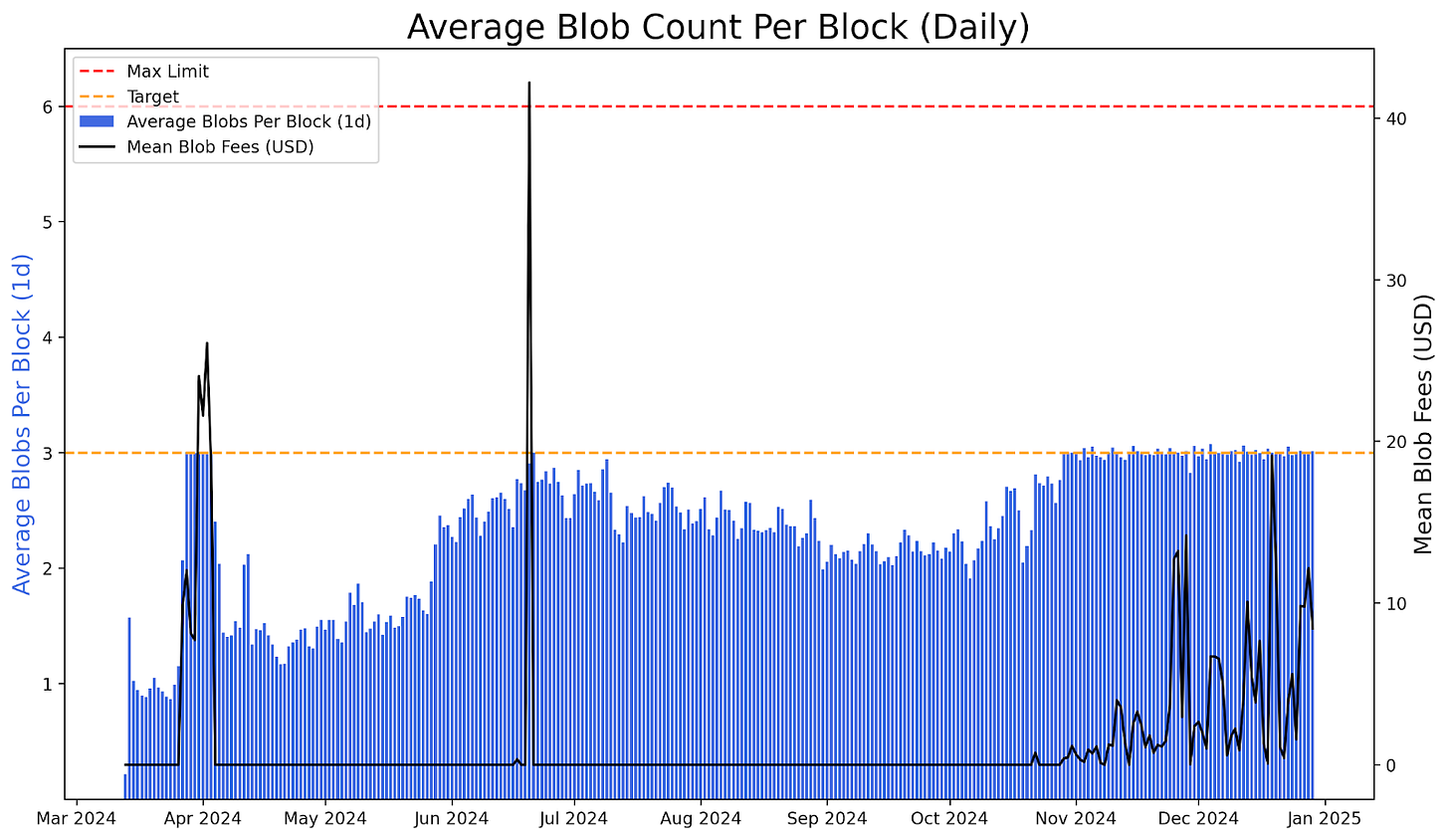

Ethereum’s Dencun upgrade in March 2024 advanced its rollup-centric roadmap, laying the foundation for scalable, cost-efficient transactions. In SOTN #262, we analyzed the impact of EIP-4844 and the role of blob transactions in driving Layer-2 adoption.

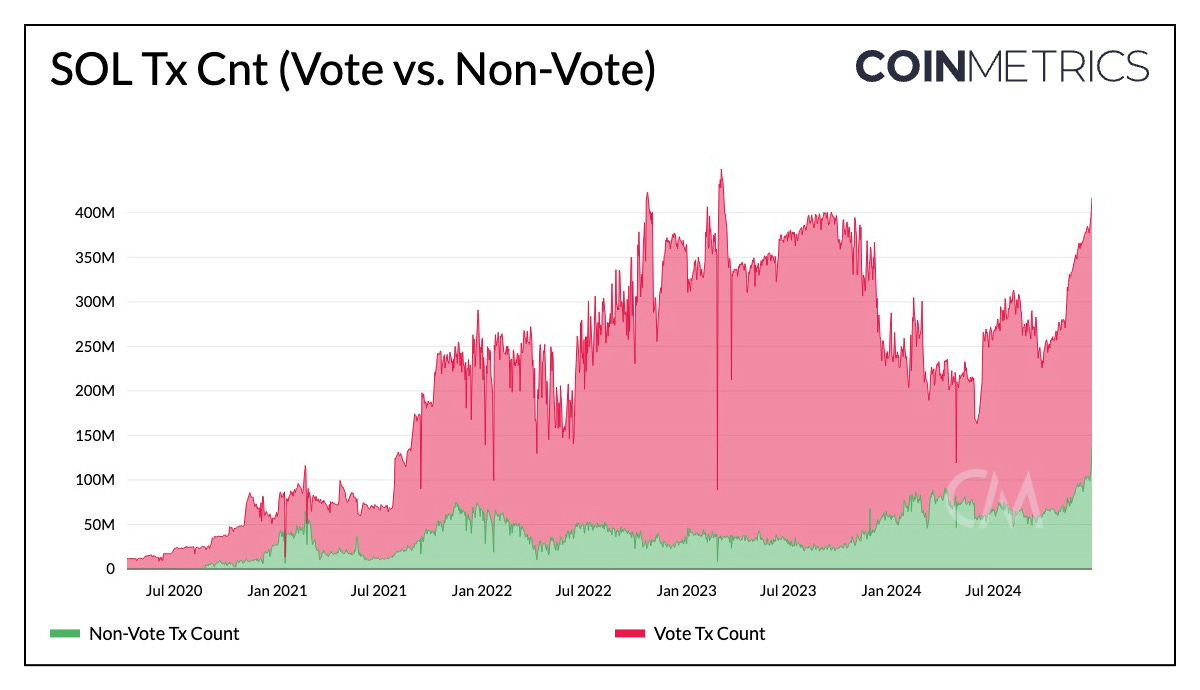

The Solana network had a burgeoning 2024, with a strong market recovery fueling the rise of meme coins and stablecoins.

In SOTN #254, we provided an overview of the Solana network, exploring consensus and staking mechanisms, transactions, user cohorts, and other intricacies as we introduced Solana network data to our suite.

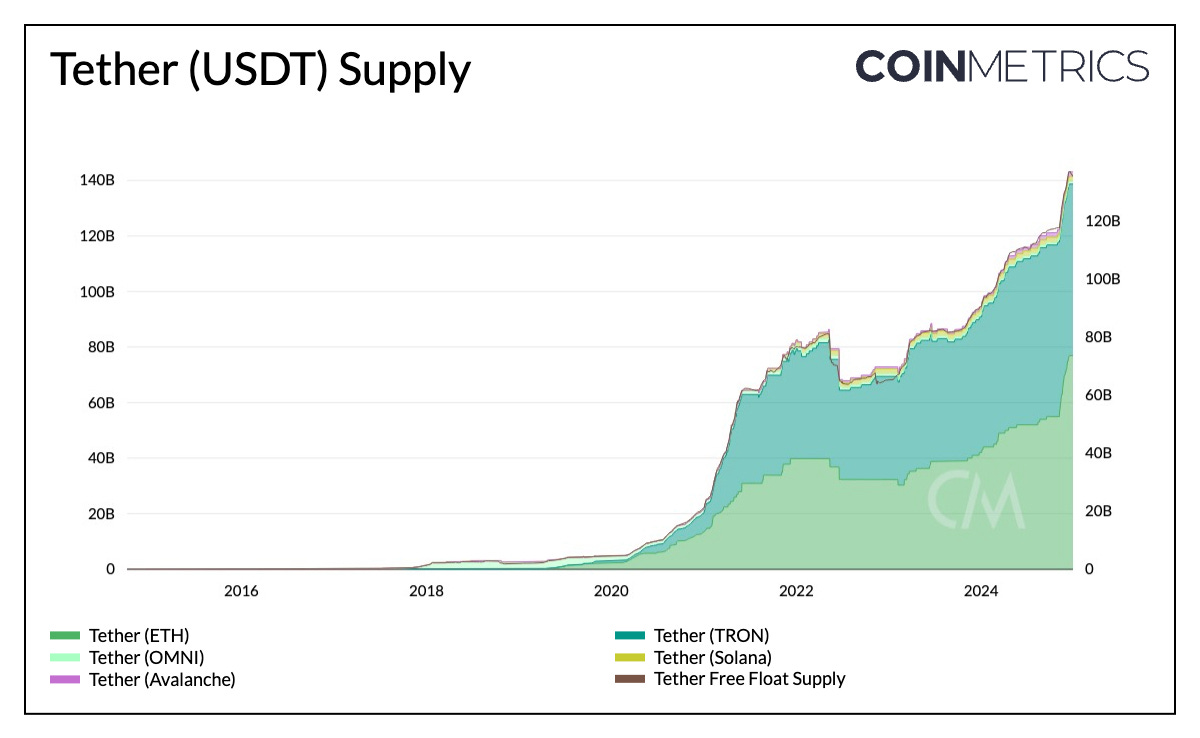

Mirroring their foundational utility for the crypto ecosystem, stablecoins were central to the conversation across digital assets, payments and financial services this year.

In SOTN #243, we zoomed into Tether’s (USDT) dominance in the stablecoin market, breaking down its growth, usage patterns, and nature of its reserves.

Tether’s Ascent: Breaking Down the Dominant Stablecoin’s Growth

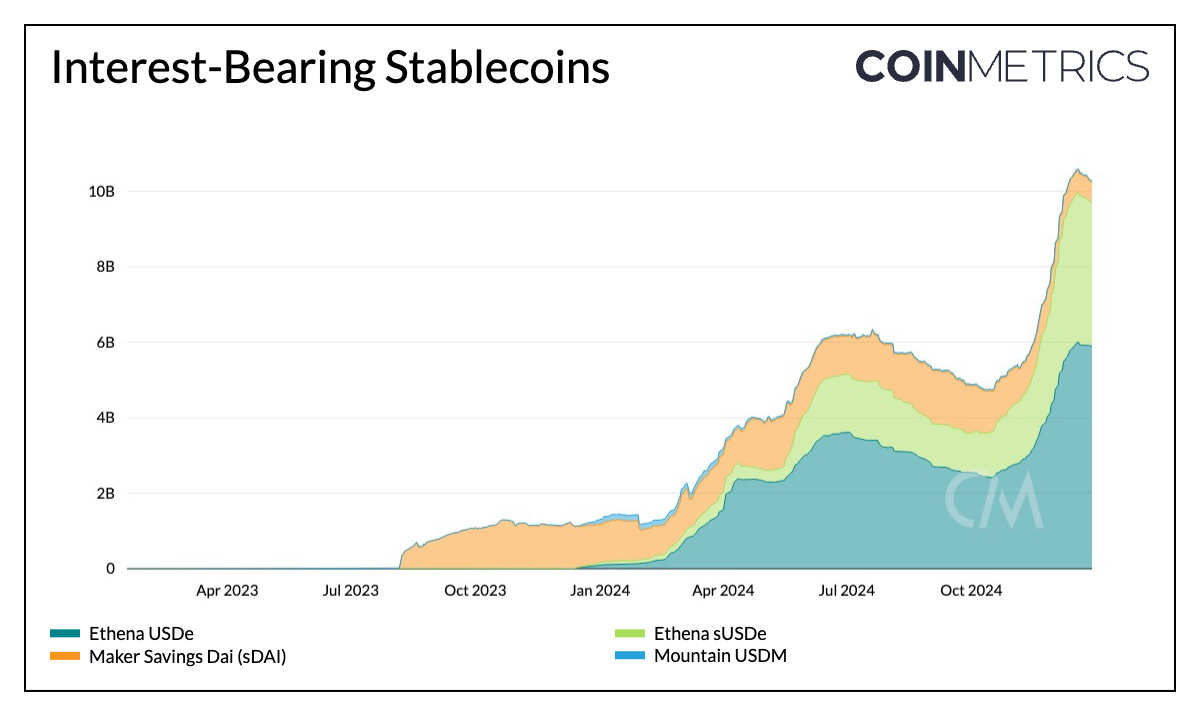

By the end of the year, the aggregate stablecoin supply crossed $210B. The landscape of issuers expanded beyond incumbents like Tether and Circle to payments giants like PayPal, financial institutions like BlackRock & Société Générale and DeFi protocols like Ethena.

In SOTN #274, we revisited the stablecoin ecosystem, exploring diverse approaches to collateralization, peg stability mechanisms, and the emergence of interest-bearing stablecoins.

State of Stablecoins: Sector Expansion & A Changing Interest Rate Environment

As market structure and infrastructure matured in 2024, institutional and sophisticated entities drove a surge in activity within crypto derivatives markets. We provided an accessible introduction to futures, options and other derivatives.

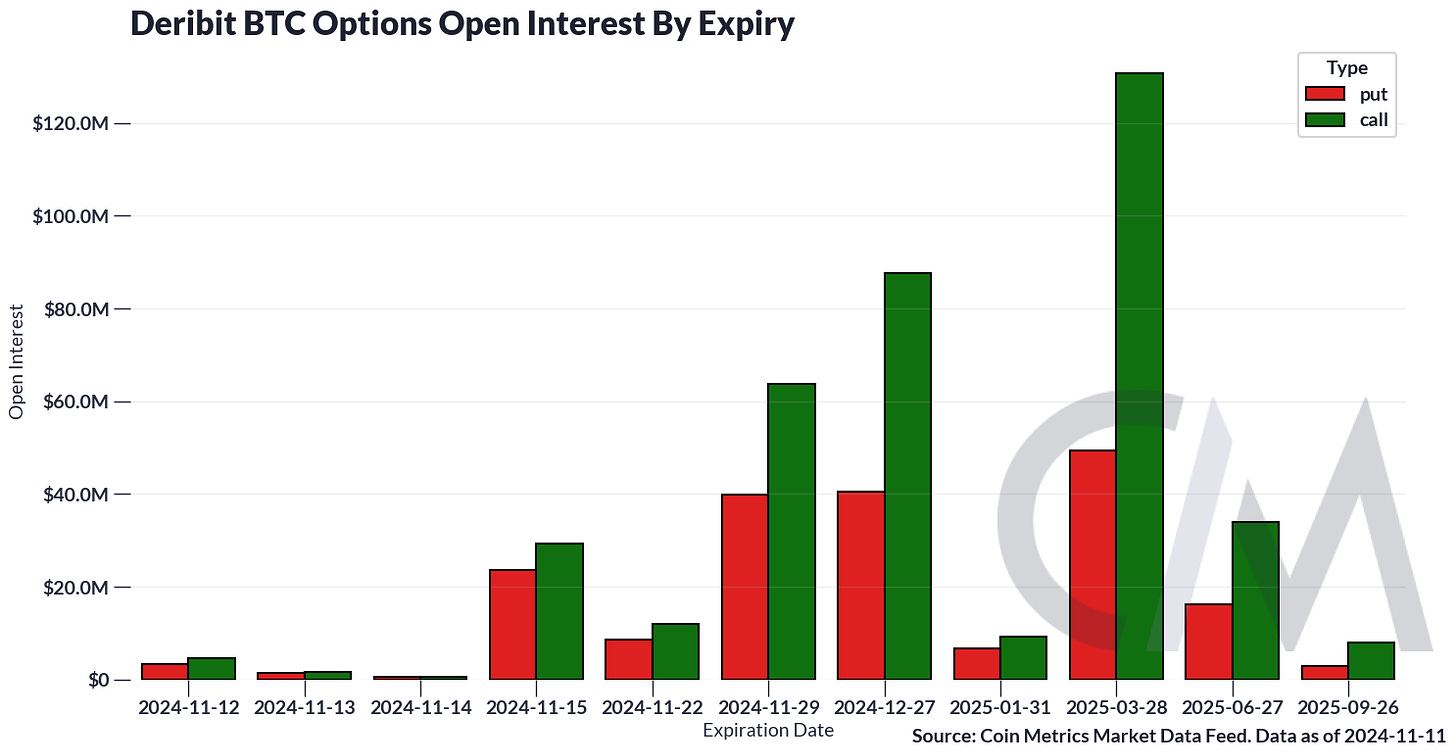

Around the U.S. elections, we analyzed signals from options markets and examined what implied volatility reveals about market movements and sentiment.

The Election Bull Run Through the Perspective of Options Markets

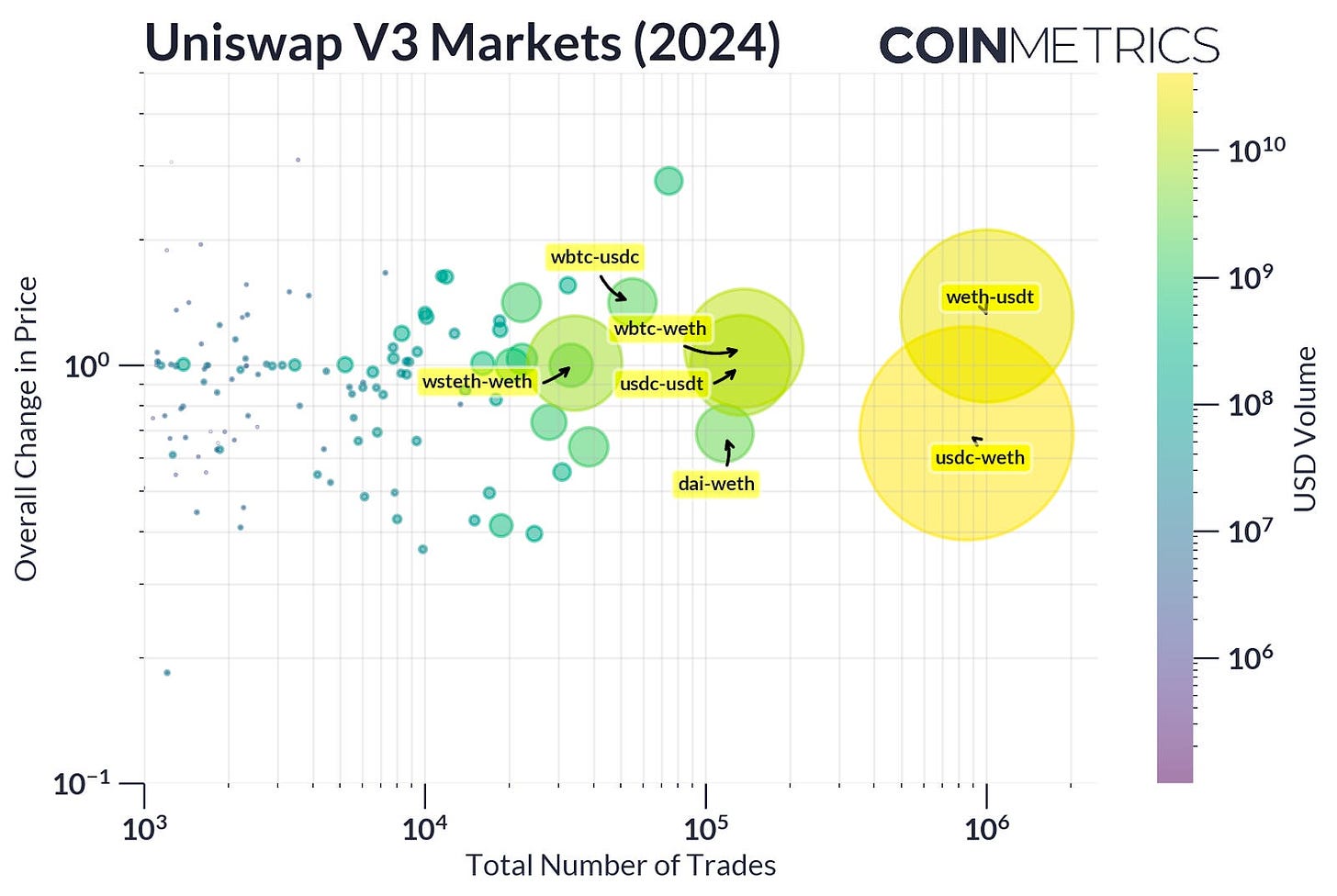

Decentralized exchanges (DEXs) are a cornerstone of the on-chain economy, providing critical infrastructure for trading and liquidity provision.

In SOTN #258, we examined the evolution of DEXs, focusing on automated market makers like Uniswap and Curve Finance, alongside key trends in liquidity and adoption.

Thank you for being part of our journey in 2024. We look forward to bringing you more insights in 2025!

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you’d like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.

© 2023 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter.

[ad_2]

Read More: coinmetrics.substack.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Wrapped stETH

Wrapped stETH  Sui

Sui  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Avalanche

Avalanche  Toncoin

Toncoin  WhiteBIT Coin

WhiteBIT Coin  USDS

USDS  Shiba Inu

Shiba Inu  WETH

WETH  Wrapped eETH

Wrapped eETH  Litecoin

Litecoin  Binance Bridged USDT (BNB Smart Chain)

Binance Bridged USDT (BNB Smart Chain)  Hedera

Hedera  Monero

Monero  Ethena USDe

Ethena USDe  Polkadot

Polkadot  Bitget Token

Bitget Token  Coinbase Wrapped BTC

Coinbase Wrapped BTC  Uniswap

Uniswap  Pepe

Pepe  Pi Network

Pi Network  Aave

Aave  Dai

Dai  Bittensor

Bittensor  Ethena Staked USDe

Ethena Staked USDe  OKB

OKB  BlackRock USD Institutional Digital Liquidity Fund

BlackRock USD Institutional Digital Liquidity Fund  Aptos

Aptos  Cronos

Cronos  Internet Computer

Internet Computer  NEAR Protocol

NEAR Protocol  Jito Staked SOL

Jito Staked SOL  sUSDS

sUSDS  Ethereum Classic

Ethereum Classic