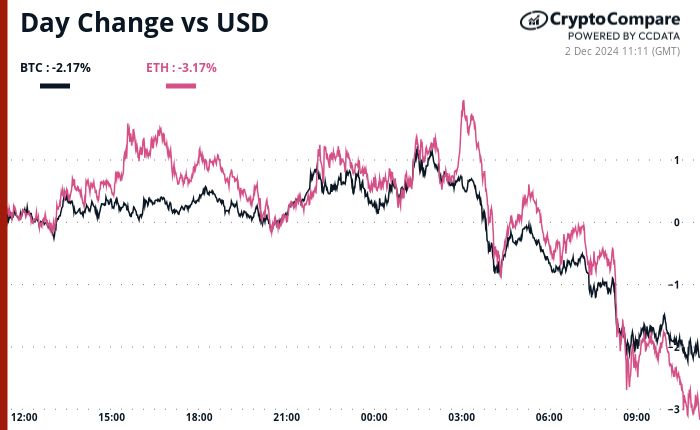

The crypto market is seeing another week in the red with Bitcoin, Ethereum, and larger cryptocurrencies trading to the downside over the past 7 days. The general sentiment in the market turns bearish as the nascent asset class completed a major milestone with “The Merge”.

At the time of writing, Bitcoin and Ethereum record a 15% and 21% loss in the last week. In the crypto top 10 by market cap, the second cryptocurrency shows the worst performance followed by Polkadot (DOT) and Solana (SOL) with around a 15% loss over the same period.

Crypto Market Takes Shelter From Ethereum Fallout

According to data from Arcane Research, the crypto market is moving in tandem with the previous September performance. This month has been historically bad for the nascent asset class and this year the trend will extend.

As seen in the chart below, Arcane Research’s Large, Mid, and Small-cap Indexes have experienced negative performance alongside Bitcoin. The number one cryptocurrency by market cap is moving in red territory, but with better performance than the research firm’s small and large index.

On the latter, only XRP has begun showing bullish momentum with a 14% and 9% profit over the past week and 24 hours, respectively. The fourth cryptocurrency in terms of market cap, without counting stablecoins, seems to be benefiting from a potential agreement between Ripple and the U.S. Securities and Exchange Commission (SEC).

While XRP might save some of the profits for large-cap cryptocurrencies, Ethereum (ETH) is moving in the opposite direction following “The Merge”, the event that completed its transition to Proof-of-Stake (PoS). As expected by many in the crypto market, this event was a “sell the news” milestone.

The negative performance following “The Merge” has pushed the crypto market back to critical support levels. Arcane Research noted:

We saw a slight decline (in the crypto indexes performance following a rally) before the merge as some traders attempted to front-run a potential sell-the-news event. It turned out these traders were right as all indexes continued plummeting after the merge.

Fears Growing In The Crypto Market

As a consequence, traders are swapping their funds into stablecoins, such as Tether (USDT) and USD Coin (USDC) to protect themselves from further downside. This has led to a market share migration from Bitcoin and Ethereum to these digital assets.

As stablecoin’s market cap increases, the fear & greed index crashes into extreme fear levels. Arcane Research noted the following on the recent crypto market crash and its impact on general sentiment and stablecoins:

Over the past seven days, the total crypto market cap declined by 11%. At the same time, the combined market cap of the three largest stablecoins has stayed put, ultimately leading their market dominance to surge.

Read More: bitcoinist.com

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  Dogecoin

Dogecoin  Cardano

Cardano  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Avalanche

Avalanche  TRON

TRON  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Stellar

Stellar  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Polkadot

Polkadot  Hedera

Hedera  Wrapped Bitcoin

Wrapped Bitcoin  Bitcoin Cash

Bitcoin Cash  WETH

WETH  Litecoin

Litecoin  Sui

Sui  NEAR Protocol

NEAR Protocol  Uniswap

Uniswap  Pepe

Pepe  LEO Token

LEO Token  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Internet Computer

Internet Computer  POL (ex-MATIC)

POL (ex-MATIC)  Cronos

Cronos  USDS

USDS  Ethereum Classic

Ethereum Classic  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Ethena USDe

Ethena USDe  Algorand

Algorand  Render

Render  Filecoin

Filecoin  Bittensor

Bittensor  Arbitrum

Arbitrum  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Dai

Dai  Immutable

Immutable  Aave

Aave  Celestia

Celestia