This is an opinion editorial by Josef Tětek, the Trezor brand ambassador for SatoshiLabs.

After a three-year hiatus, Bitcoiners once again met at the iconic Baltic Honeybadger event in the Latvian capital of Riga.

Around 800 people attended the conference, so it was a rather small event — by comparison, the Bitcoin 2022 conference in Miami welcomed over 20,000 visitors. However, the saying that “small is beautiful” applied in this case -— compared to the Miami conference, visitors at Honeybadger did not have to worry about endless crowds and queues. But at the same time, it was a conference with global notoriety and one that was held entirely in English, so there was no problem attending hard-hitting talks and later chatting with well-known Bitcoiners like Adam Back, Jimmy Song, Peter Todd, Gigi and many others. Several dozen speakers gave presentations over the two days in two lecture rooms: the main Bitcoin Stage, and the secondary Sats Stage.

The entire conference was filmed and the recordings will be available on the Hodl Hodl YouTube channel (at the time of writing, only the Bitcoin Stage talks have been published).

Free Speech And Free Money

After an opening speech by Max Keidun from Hodl Hodl (the conference organizer), Giacomo Zucco took the floor. Zucco didn’t reveal the title of his talk beforehand, so the audience had no idea what to expect. However, the long-time Bitcoiner, with his characteristic humor peppered with an Italian accent, did not disappoint this time as he revealed the speech title:

But as Zucco readily acknowledged, such a title might offend some, so he decided to make it nicer:

Zucco explained that freedom of speech is a fundamental human right to which we can only make an exception when speech becomes direct aggression, as in the case of ordering a murder or deliberate fraud. He warned of the increasing level of censorship by both governments and corporations; the only practical self-defense is to build and use agorist tools such as the Tor browser.

Zucco then made a segue to money, which also falls under freedom of speech protection (especially in an age where money is overwhelmingly digital in nature) — people have the fundamental right to choose their monetary instrument and use their money as they see fit. However, as with freedom of speech, freedom of money is not guaranteed: again, agorist instruments such as bitcoin and the bitcoin ecosystem need to be built. A quote worth remembering:

“Know-your-customer laws mean that you don’t understand economics. The whole point of money is that you don’t have to know your customer.”

Bitcoin And Islamic Finance

Another talk worth watching is “Bitcoin And Islamic Finance” by Allen Farrington. Farrington is the co-author of “Bitcoin Is Venice,” which in my opinion is one of the very best books written on bitcoin and economics.

The yield is friends we made along the way. Source.

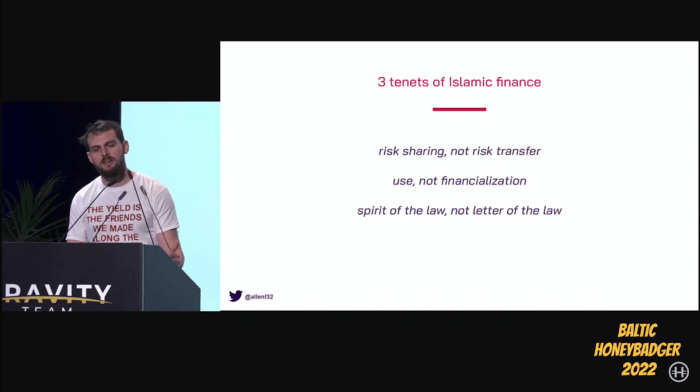

According to Farrington, Islamic finance has become a kind of a Bitcoin meme: we often refer to the concept without properly understanding its tenets. However, we should make the effort to learn more about Islamic finance, because its principles are almost the perfect antithesis of modern fiat money, and are consistent with how the world would likely operate on a bitcoin standard.

The three main tenets of Islamic finance are:

- Risk is shared between trading partners, not transferred

- Collateral is transferred between the parties, not financialised

- The spirit of the law is important, not the letter of the law

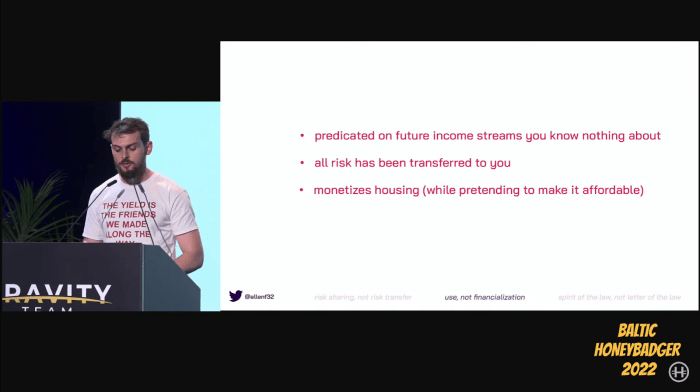

The consequence of these principles is that, for example, it is not possible to accept a loan backed by certain collateral and still have the same collateral available for use by the borrower (as is the case with mortgages).

Read More: bitcoinmagazine.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Avalanche

Avalanche  TRON

TRON  Toncoin

Toncoin  Stellar

Stellar  Wrapped stETH

Wrapped stETH  Shiba Inu

Shiba Inu  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Chainlink

Chainlink  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Sui

Sui  Pepe

Pepe  NEAR Protocol

NEAR Protocol  LEO Token

LEO Token  Uniswap

Uniswap  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Aptos

Aptos  Hedera

Hedera  Internet Computer

Internet Computer  USDS

USDS  Cronos

Cronos  Ethereum Classic

Ethereum Classic  POL (ex-MATIC)

POL (ex-MATIC)  Render

Render  Bittensor

Bittensor  Ethena USDe

Ethena USDe  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Arbitrum

Arbitrum  Filecoin

Filecoin  Celestia

Celestia  Bonk

Bonk  Stacks

Stacks  Dai

Dai  WhiteBIT Coin

WhiteBIT Coin  Cosmos Hub

Cosmos Hub  Immutable

Immutable